Accruals and Deferrals

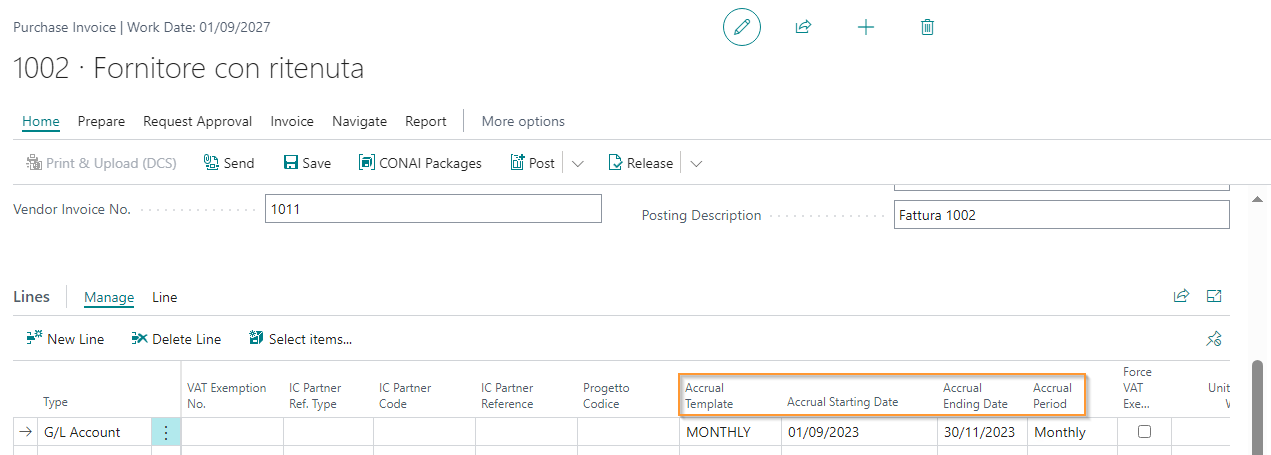

When the fields ‘Template’, ‘Accrual Starting Date’ and ‘Accrual Ending Date’ are filled in on the invoice and/or credit memo line (the ‘Competence Period’ field is automatically filled in), the accruals and/or deferrals are automatically posted upon accounting.

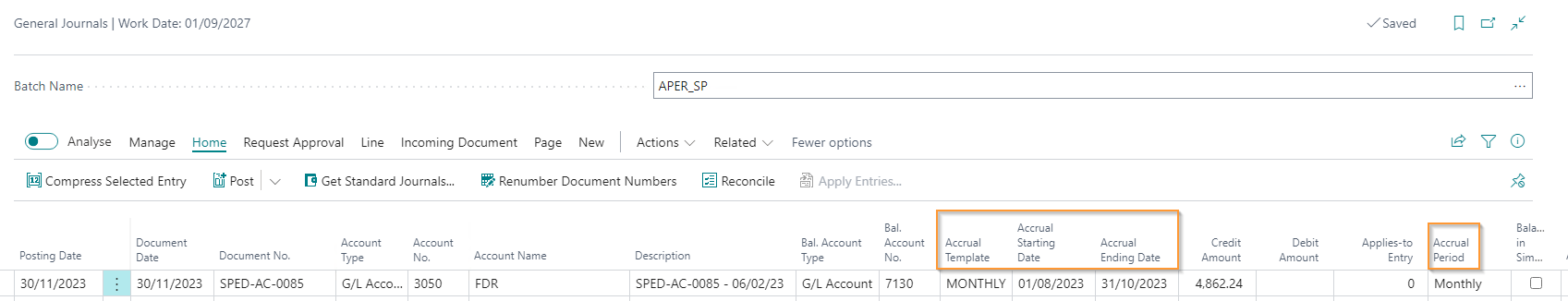

When the fields ‘Template’, ‘Accrual Starting Date’ and ‘Accrual Ending Date’ are filled in on a general journal entry, accrual and/or deferral entries will be generated upon accounting.

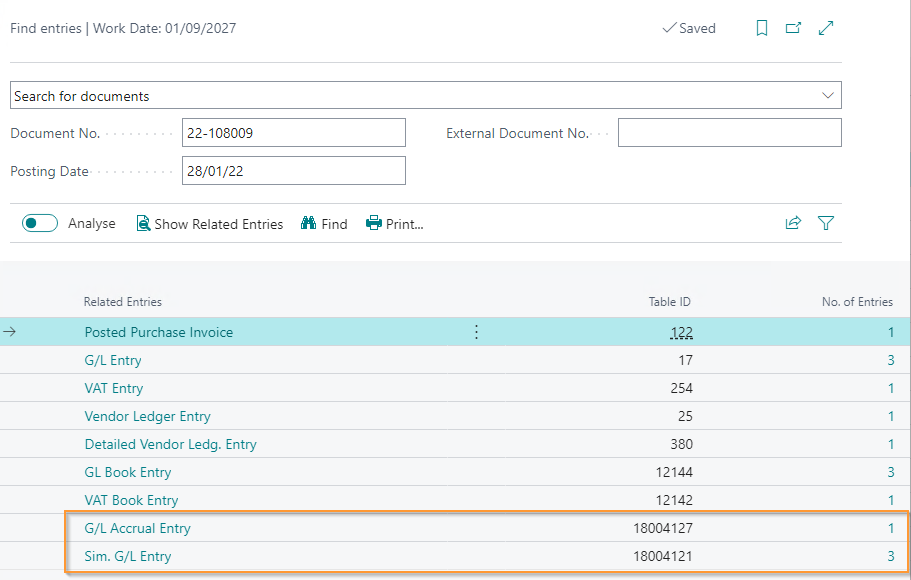

These are the tables that will be moved when a document, invoice or credit memo, is recorded or a G/L entry is accounted for.

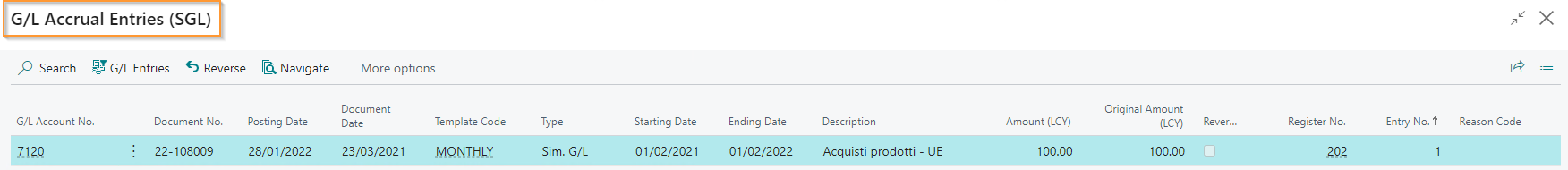

In the ‘Accruals/deferrals Mov.’ view, all information regarding the type of accruals and deferrals template used and the period, any closing date, etc. are reported.

In the simulated G/L entries, there are accounting entries divided by period based on the template used.

_Andrea Giordani.png)

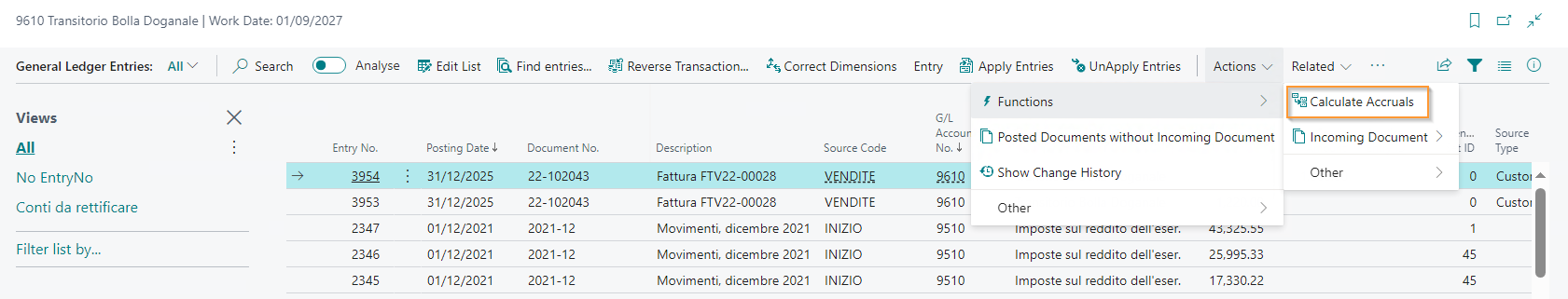

Calculation of ex post competence entries, through G/L entries: in case it has not been done before, it is possible to insert the parameters for the calculation of competence entries by selecting a G/L entry and executing the action “Calculate accruals”.

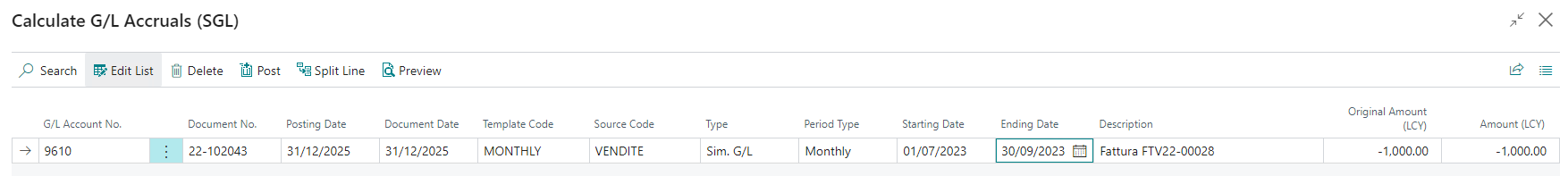

The page action will allow to link an accruals/deferrals template (Model code) or particular conditions for the calculation of accruals and deferrals of an accounting entry. After posting, it will be possible to preview the calculation:

_Andrea Giordani.png)

It is also possible to reverse the previously generated competence entries (through a specific action in the page “Accruals / deferrals entries (SGL)") and generate the entries again.

End of Fiscal Year Accr./Deferrals Closure

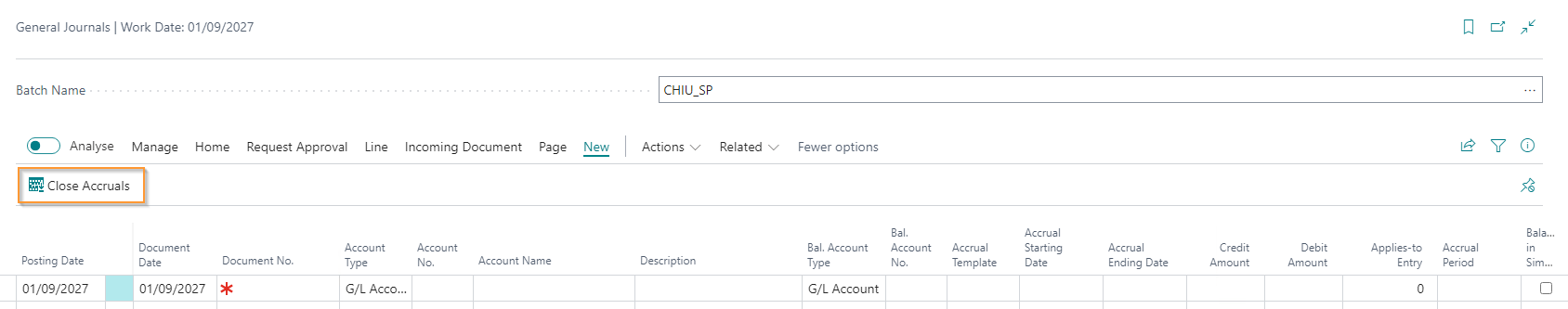

The procedure for closing accruals and deferrals to be used at the end of the fiscal year is carried out directly by General journals using the ‘Accruals/Deferrals Closure’ function (a procedure that CANNOT be used in simulated batches).

End of Fiscal Year Accruals and Deferrals Closure

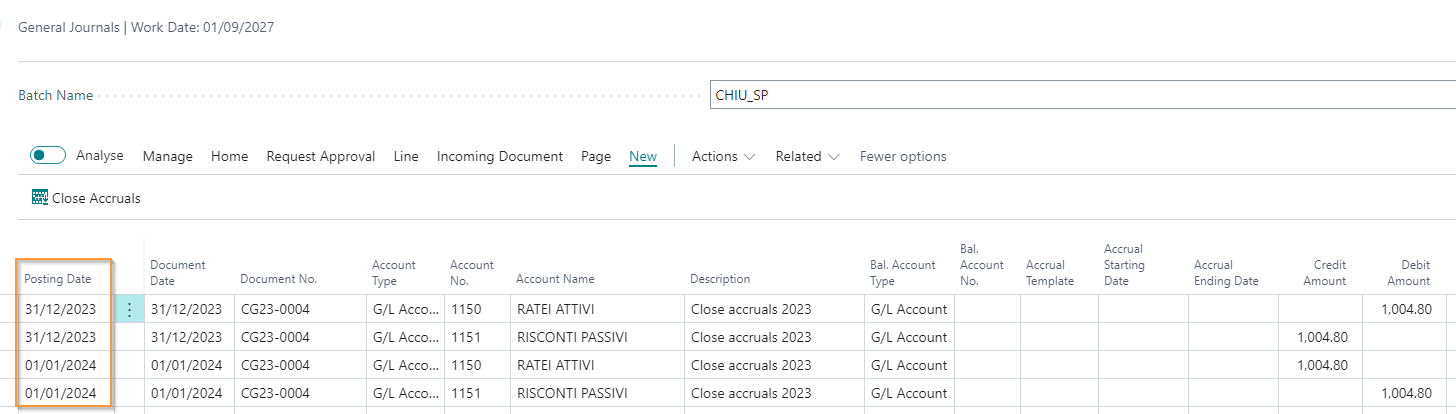

At the end of the procedure, the system creates the lines reporting the end of the fiscal year date and the reversal on the following day

Upon the posting of the entries, equal and opposite entries will also be generated in simulated accounting, since the latter already contains the individual postings created previously (see ‘Simulation Balance’ flag). The ‘Last Closure Date’ will also be valued in the Accruals / Deferrals Entries (SGL) page.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.