Gen. Journal Template and Batch creation

.png)

To establish that one or more G/L (General Ledger Entry) template feed into the simulated accounting, you need to enable the “Simulation” field.

For each template, as per standard practice, you must create the corresponding batches.

Chart Of Accounts

If “Direct Posting” is disabled, it is still possible to use the specific General Ledger account in simulated entries by enabling the “Allow Sim. Posting” option.

.png)

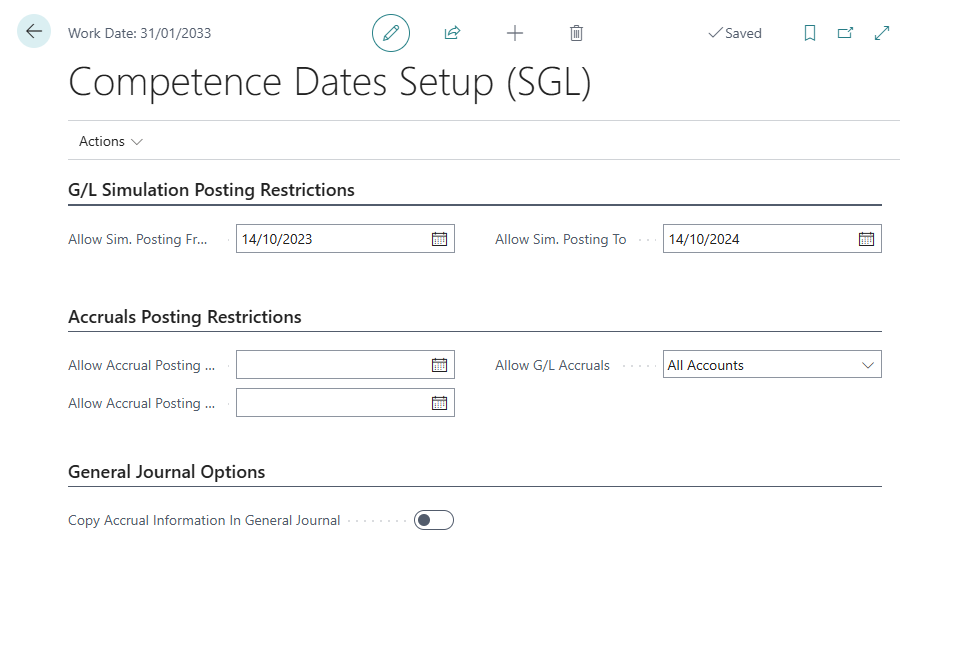

Competence Dates Setup

In this setup, it is possible to define the posting period for simulated entries, specifically related to accruals and deferrals.

- Allow simulated posting from / to These dates allow you to define a period during which you can generate simulated entries, except for those related to accruals and deferrals. Periods outside of this range are not allowed.

- Allow accruals/deferrals posting from / to: These dates allow defining a period within which it is possible to generate accrual/deferral entries generated through the indication of the template and the starting/ending dates of competence, regardless of what is indicated in the fields Allow simulated posting from / to

- Allow G/L Accruals

Specifies which accounts can be accrual. The following values are available:

All Accounts: all accounts can be accrued, without any limitations. This is the default value.Income Statement Accounts: Only income statement accounts can be accrued.Direct Posting Accounts: Only accounts that have been marked as direct posting can be accrued. This means having the field Direct Posting enabled when accruing into the G/L entry and having either Direct Posting or Sim. Posting enabled when accruing into the sim. G/L entry.

- Copy Accrual Information In General Journal: if this is enabled, fields like the accrual template, period and method are copied from the previous line when inserting a new line to the general journal.

Lock accounting period

The generation of entries related to accruals and deferrals within a given period, in addition to being controlled through the fields “Allow accruals/deferrals posting from” and “Allow accruals/deferrals posting to” in the Competence Date Setup (SGL), can also be inhibited by enabling the “Block accruals/deferrals posting” option on the Accounting Periods page.

Furthermore, if the start and end dates of competence for a document line or journal entry partially overlap a closed period and a subsequent open period, the portion of cost related to the closed period will be shifted to the first subsequent open period. This logic can be applied only if the reversal of the cost in simulated accounting does not also fall within the closed period.

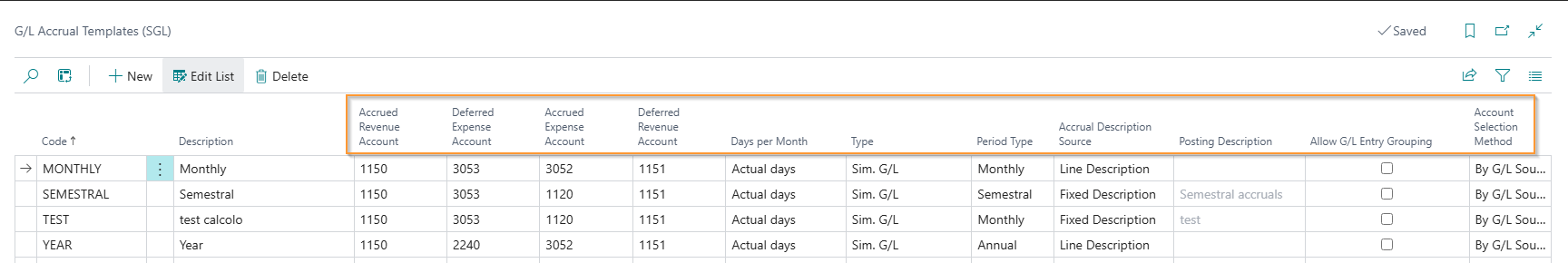

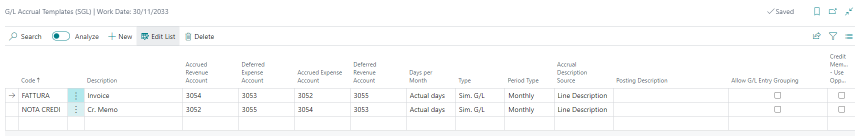

Accruals and deferrals template

This allows to set a series of parameters that determine the logic for generating accrual entries:

| Field | Description |

|---|---|

| Accrued Revenue/Deferred Expense Account - Accrued Expense/Deferred Revenue Account | Accrual and deferral accounts to be used in journals |

| Days per Month | Criterion for allocating the cost/revenue of competence: - 30 days = all months are considered 30 days (Commercial Year) - Actual days = the actual days of each individual month are considered |

| Type | Allows to select the environment for recording accrual entries. - G/L = the entries will be posted in the actual accounting (movement of the G/L Entry and printing in the Journal) - Sim. G/L = the entries will be posted in the simulation environment (Sim. Entries and No printing in the Journal) |

| Period Type | Allows to define the period of competence of the entries generated. Possible values: Monthly, Quarterly, Semi-annual, Annual. |

| Accrual Description Source | Allows to define how to handle the posting description in the accrual and deferral detection. |

| Posting Description | allows you to specify the description to be applied to accrual and deferral entries when the “Accruals/Deferrals Description Source” field is set to “Fixed Description”. |

| Allow G/L Entry Grouping | In case it’s decided to enable the G/L posting, it allows to establish whether to group, as much as possible, the competence entries generated. |

| Account Selection Method | manages the use of accruals and deferrals accounts based on the following options: - By G/L Source Type: based on the transaction’s Source Type — Customer or Vendor — the entry is treated as income or expense, regardless of whether the amount is positive or negative. - By Amount: accrual and deferral accounts are used based on the sign of the transaction amount. It is treated as an expense if positive, or as income if negative. The By Amount logic is always applied to journal entries where the Source Type of the transaction is not specified. |

Customer and vendor posting groups

For each supplier/customer registration category, it is necessary to set the accounts to be used in the procedure for posting entries related to invoices to be received/issued.

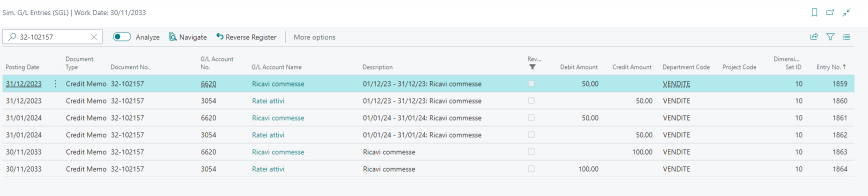

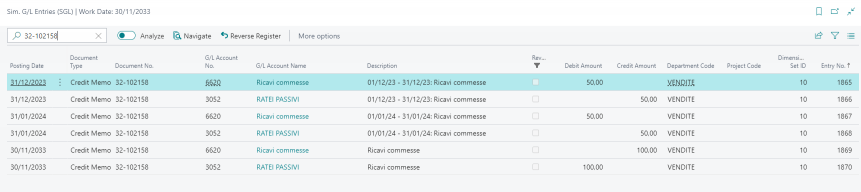

Credit Note Templates Use Cases

Case 1: Invoice and Credit Note Management with a Single Template

Setup:

Journal entries generated from the invoice:

Journal entries generated from the credit memo:

In this case, the credit memo offsets exactly the same accounts as the invoice. Therefore, by posting an incorrect invoice and subsequently an identical credit memo, the system zeroes out the account affected by the A/D template (in the example, the active accrual).

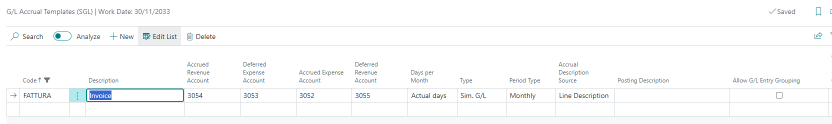

Case 2: Invoice and Credit Memo Management with Different Templates

A/D template setup:

Journal entries generated from the invoice:

Journal entries generated from the credit note:

In this case, the accounting entry is correct but does not exactly reverse the invoice. This method of recording credit memos is used when there is no direct link between the credit memo and the invoice (e.g., year-end bonuses).

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.