Entry Type Balance Analysis (SGL)

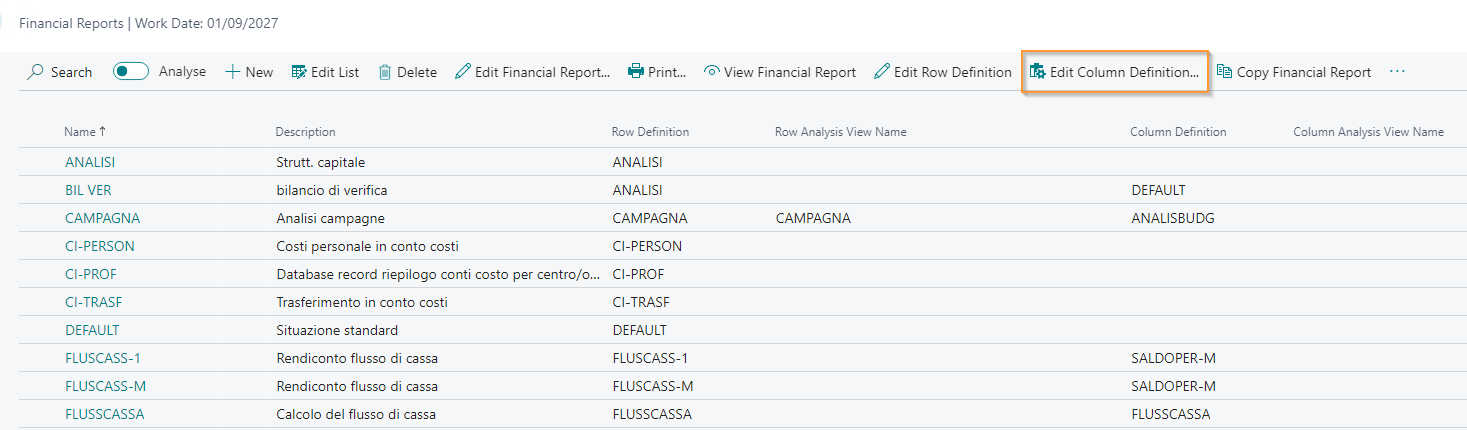

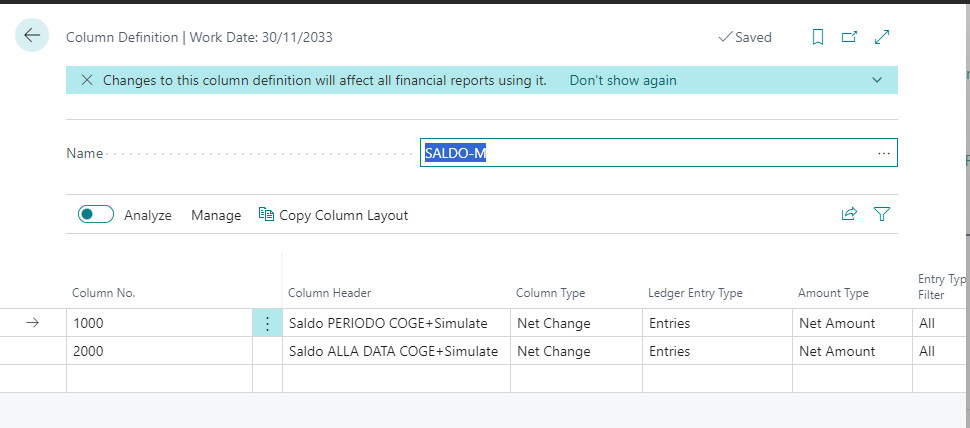

The simulated entries are integrated with the standard BC financial reports. By accessing the column structure, action Modify column leyout, it is possible to establish which types of data must feed the balance:

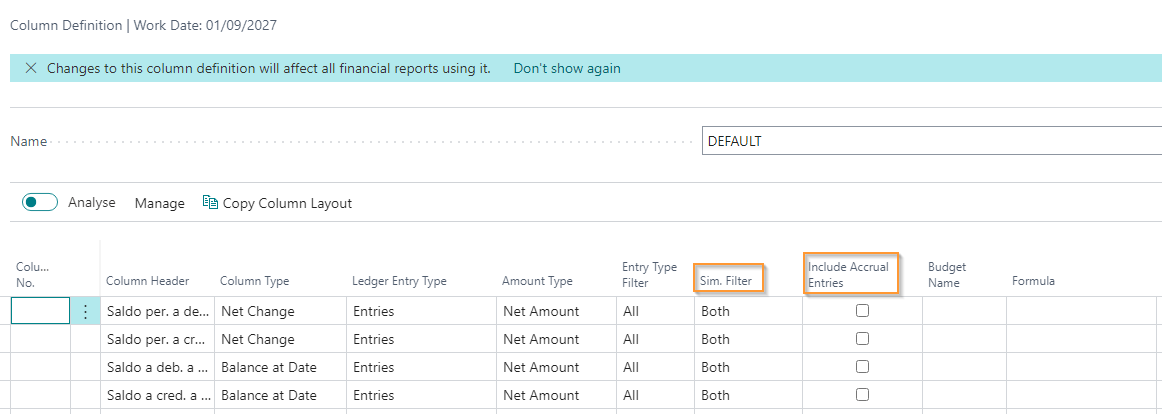

The app integrates two different pieces of information:

- Include accruals/deferrals movements: selected (default) the accrual and deferral movements are considered in the balance

- Sim. filter: option that allows you to determine which balances should be taken into consideration, G/L entries, sim. G/L entries or both

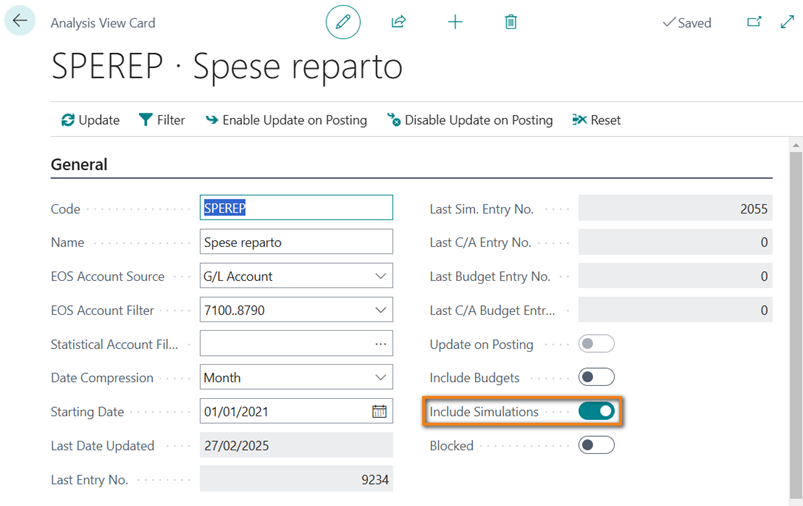

It is also possible to include simulated entries in the data generated through the Analysis View Card:

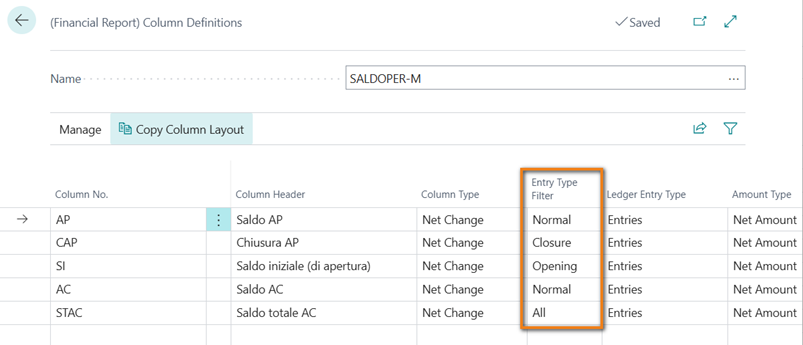

Possibility to include/exclude opening/closure entries in the column balance calculation

The SGL app integrates the “Entry Type Filter” field in the Column Definitions page; the selectable values are:

Normal: all movements for the period are included in the column balance, except for those related to the opening/closure of the fiscal year;

Closure: only the closure entries for the fiscal year are included in the column balance;

Opening: only the opening entries for the fiscal year are included in the column balance;

All: all movements are included in the column balance.

N.B.:

To display the opening balance net of the opening entries in the balance sheet, the following setup must be configured: the “Net Change” option in the “Column Type” field and the “Opening” value in the “Entry Type Filter” field;

The “Entry Type Filter” field does not apply when the financial report is linked to an Analysis View.

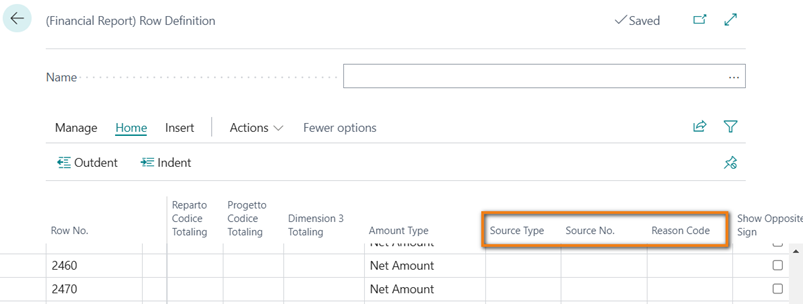

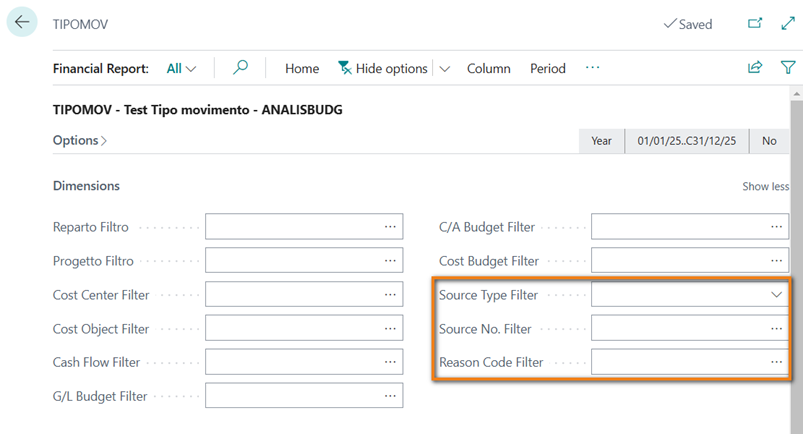

Possibility to set filters on the fields Source Type, Source Nr., and Reason

The SGL app allows you to set filters on the fields Source Type, Source No., and Reason Code in the Row Definition page (rows of the reclassification scheme):

Alternatively, it is possible to apply the same filters directly in the Financial Report page:

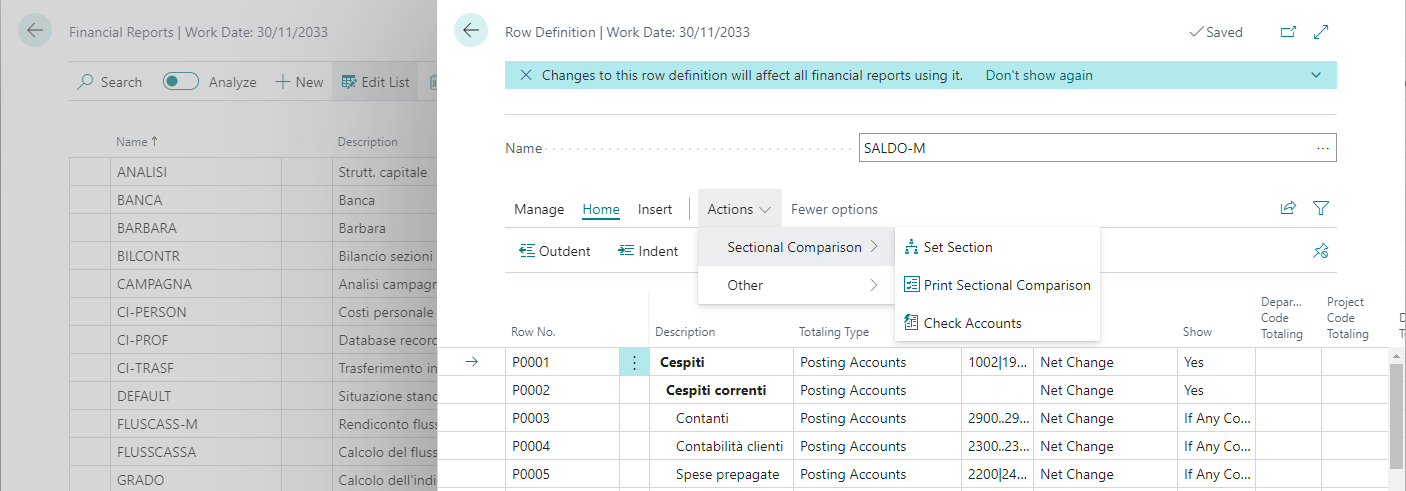

Verify account presence

It is possible to view missing accounts in a specific accounting situation. This action can be performed for accounting situations that deal with reclassifying G/L or Sim. accounts (if you have the EMA app).

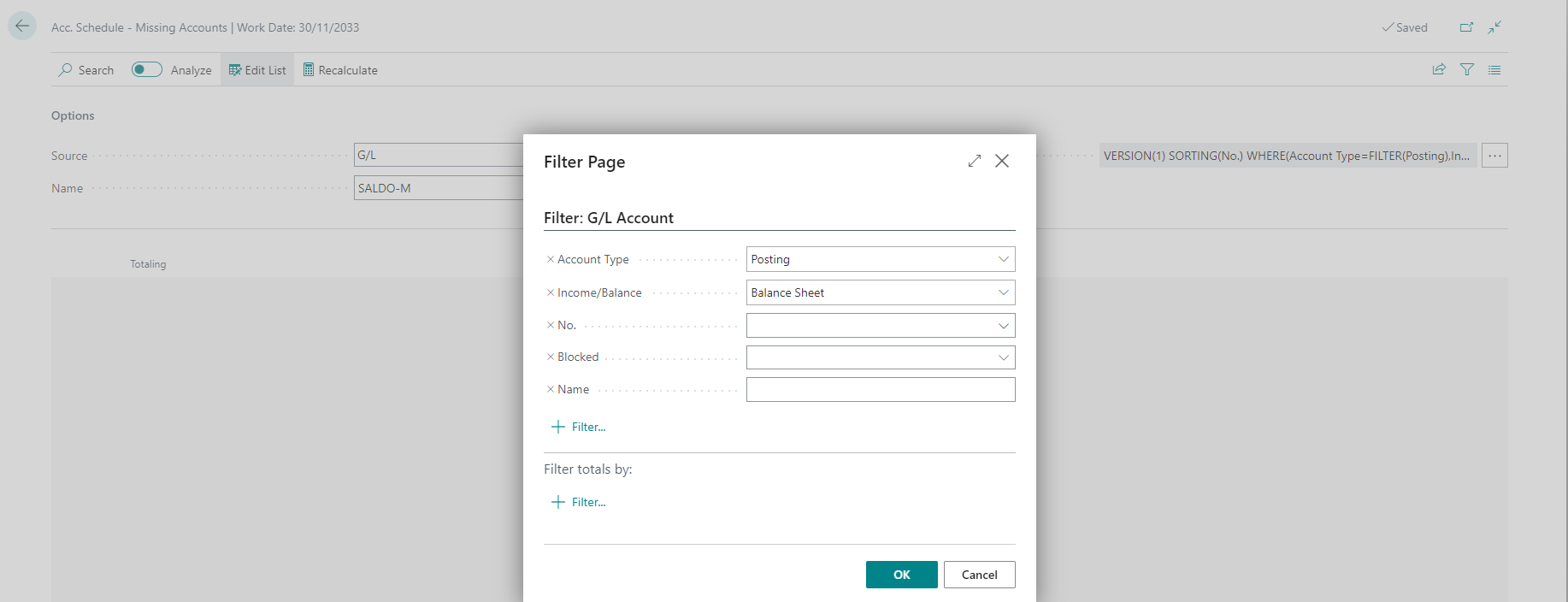

On the “Financial Reports” page, there is an action called “Verify Accounts” through which you can set filters for the accounts to check:

Attention

The purpose of this function is to highlight any potentially missing accounts in the accounting situation. These missing accounts may cause discrepancies between the balance of the Chart of Accounts (Profit and Loss Statement) and that of the accounting situation itself. It is not relevant whether an account is listed in a specific row or in a total/ending total row. In both cases, the account is still included in the reclassification.Using the three dots in the “Filters” field, you can set appropriate filters for various fields in the G/L or Sim. Chart of Accounts (if you have the EMA app):

The “Account Type” is pre-set to “Analytical.”

After setting the filters, the system will provide a list of any missing accounts in the accounting situation.

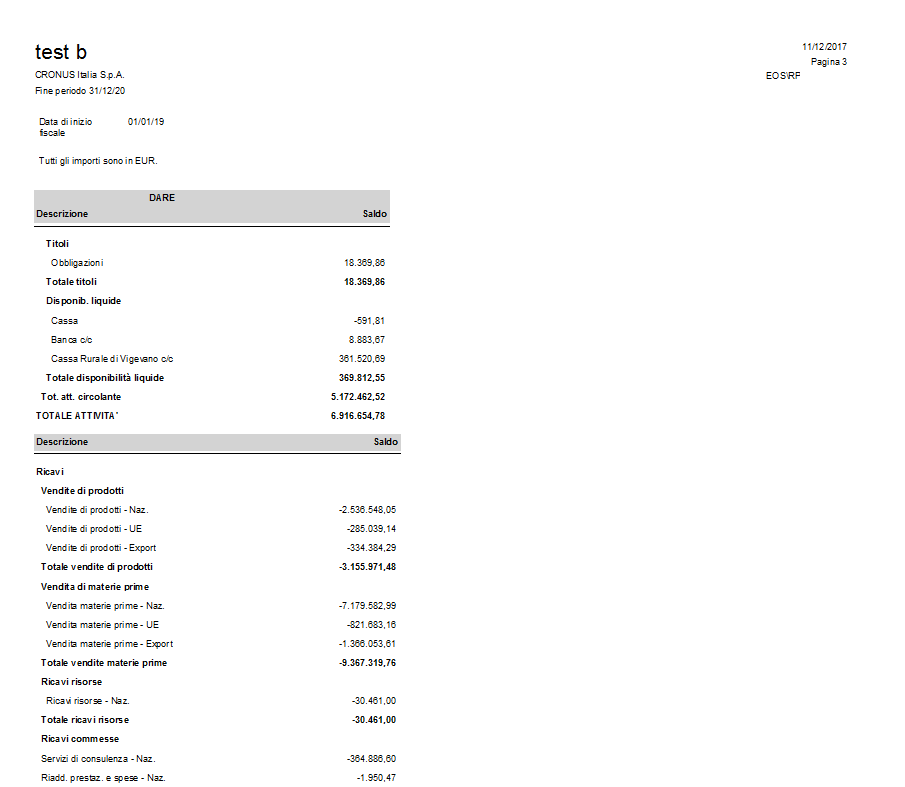

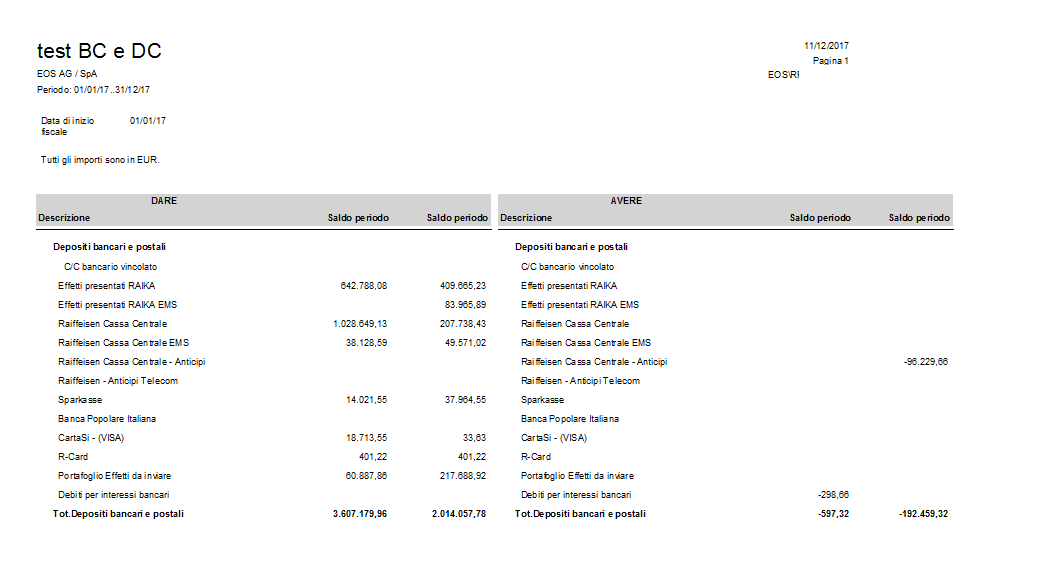

Detailed side-by-side financial statement print

Business Central allows you to print the company’s balance sheet in opposing sections: on the left is the asset and on the right is the liability.

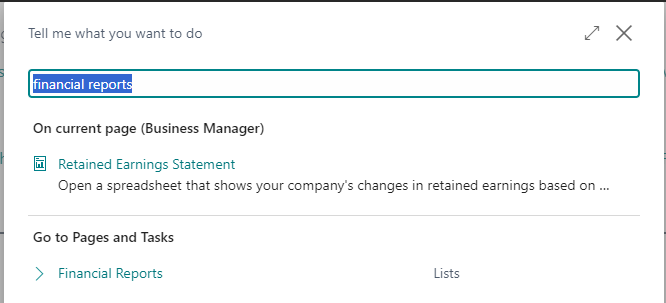

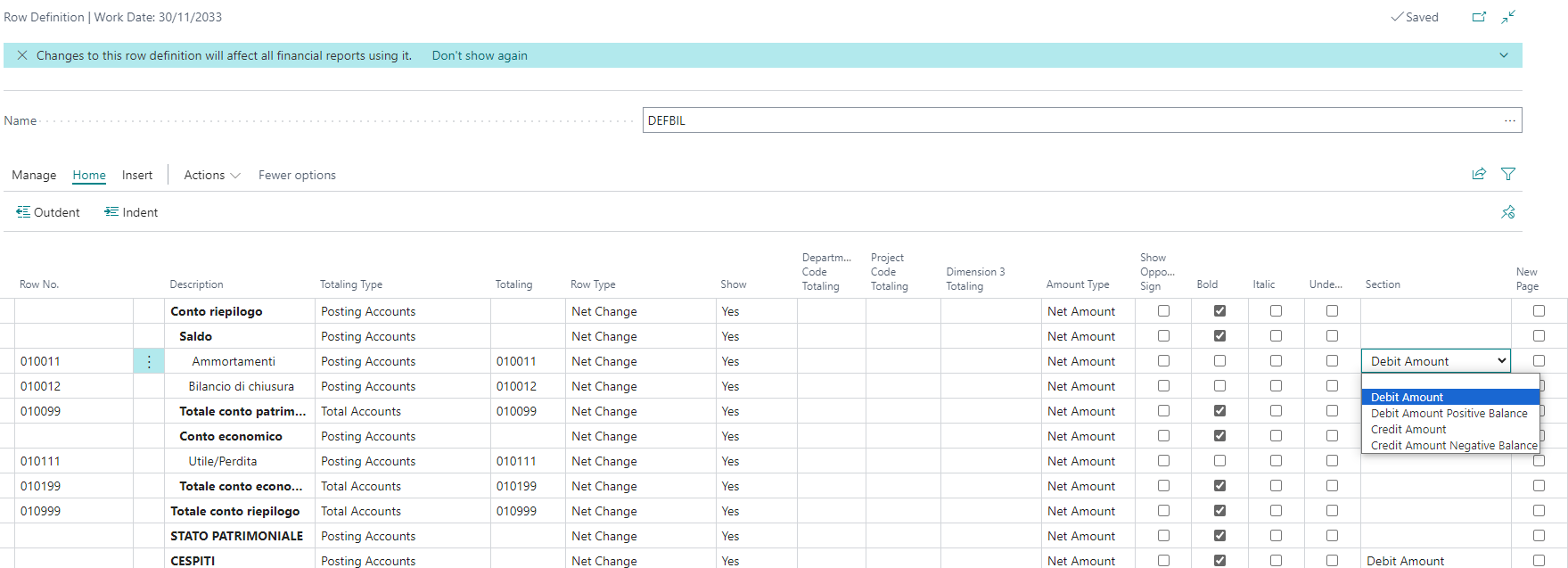

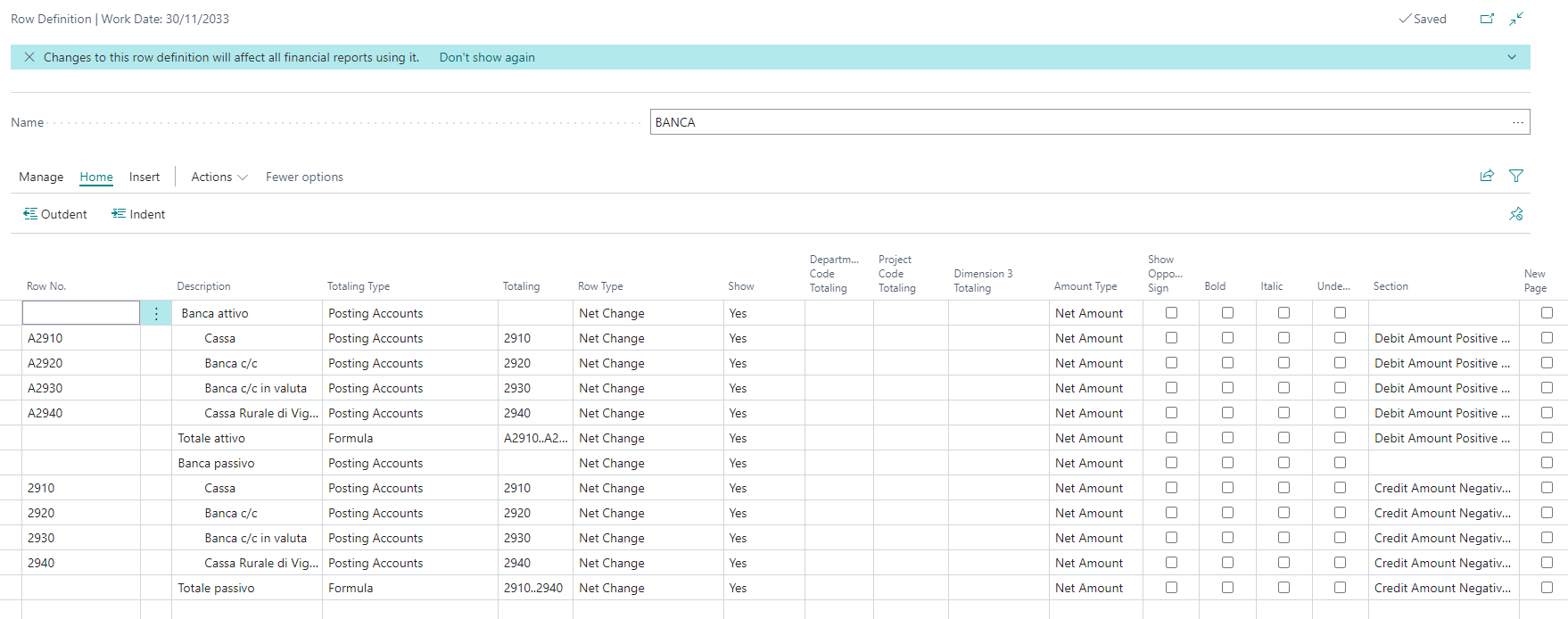

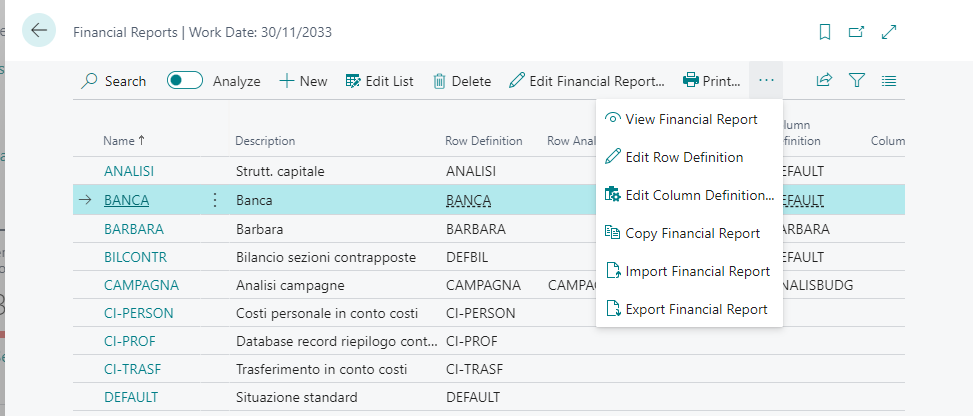

To do this, search for “Financial Reports” and then from the three dots choose Edit row definition:

In the Section field, define whether the account will be printed in the “Debit” or “Credit” section through the following options:

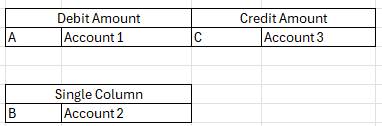

Blank: opposing sections will not be used. The printout will be in a single column, at the bottom of the report

Debit: all selected accounts (assets) will be printed in Debit

Credit: all selected accounts (liabilities) will be printed in Credit

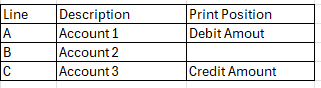

In summary, if we assume to have three account lines:

The printout will be:

There are some accounts (e.g. banks) for which it is not known in advance whether they will be in Debit or Credit. For example, an account may go negative; in that case, in a printout with opposing sections, such an account should be considered in the liabilities. Therefore, the accounting situation will have to provide for replicated accounts (they will be present both in Assets and in Liabilities).

In Section you will have to choose “Debit positive balance” for the Active part and “Debit negative balance” for the Passive part:

In the Total field, a formula will have to be set so that the total active lines and the total passive lines are considered. Be careful to put any letters in the Line Number fields at the beginning and not at the end (e.g. A0110113 and not 0110113A) otherwise the system will not correctly sum these fields in the Total formula.

The system therefore

Debit positive balance: will report the total in the printout, in the Debit part, only if it finds it positive

Debit negative balance: will report the total in the printout, in the Credit part, only if it finds it negative

Column Layout

Open Column Definition Edit:

NOTE

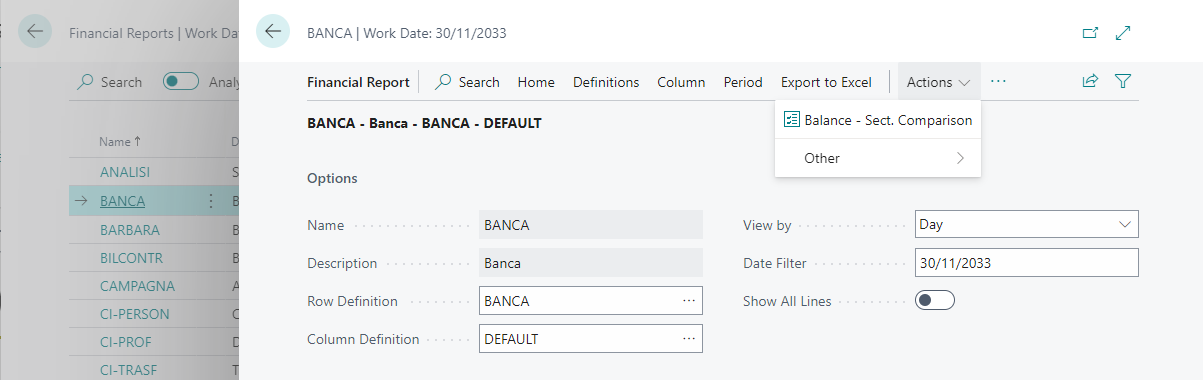

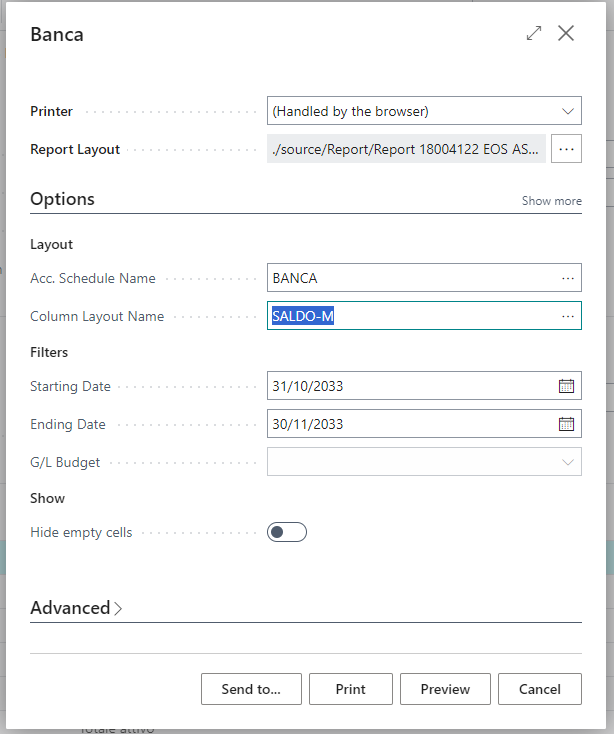

When needing to print two sections, it is possible to define at most two column layouts so that the print is legible. This can be useful, for example, to compare two budgets, the current year’s with the previous year’s.Open a Financial Report tab and press Actions->Balance-Opposing Sections:

In View, you can decide whether to show all rows in the printout or only the valued ones.

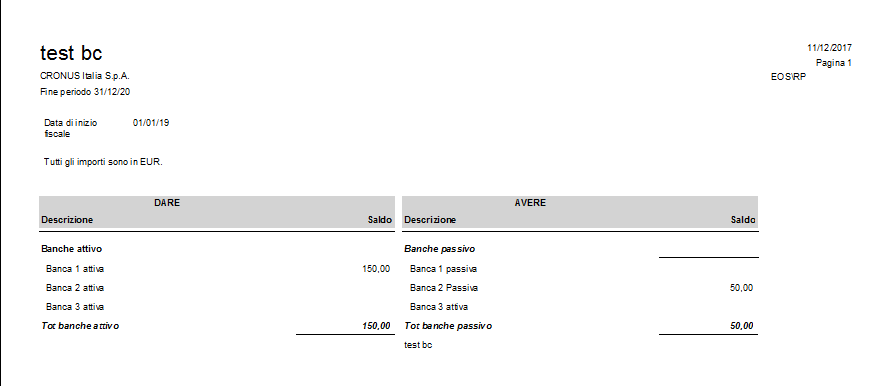

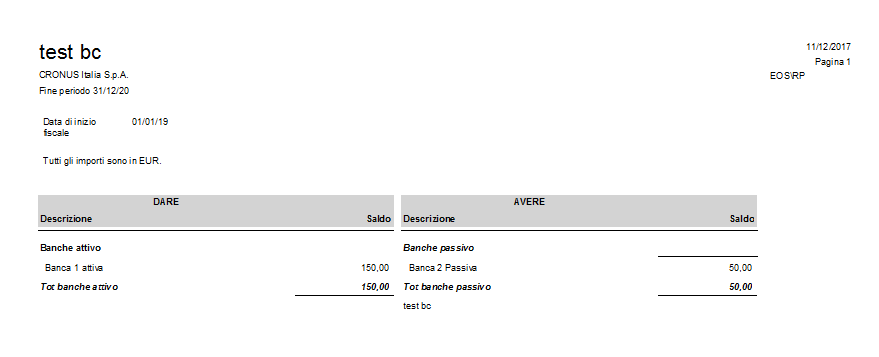

Example of Printing bank accounts with all rows/only valued rows:

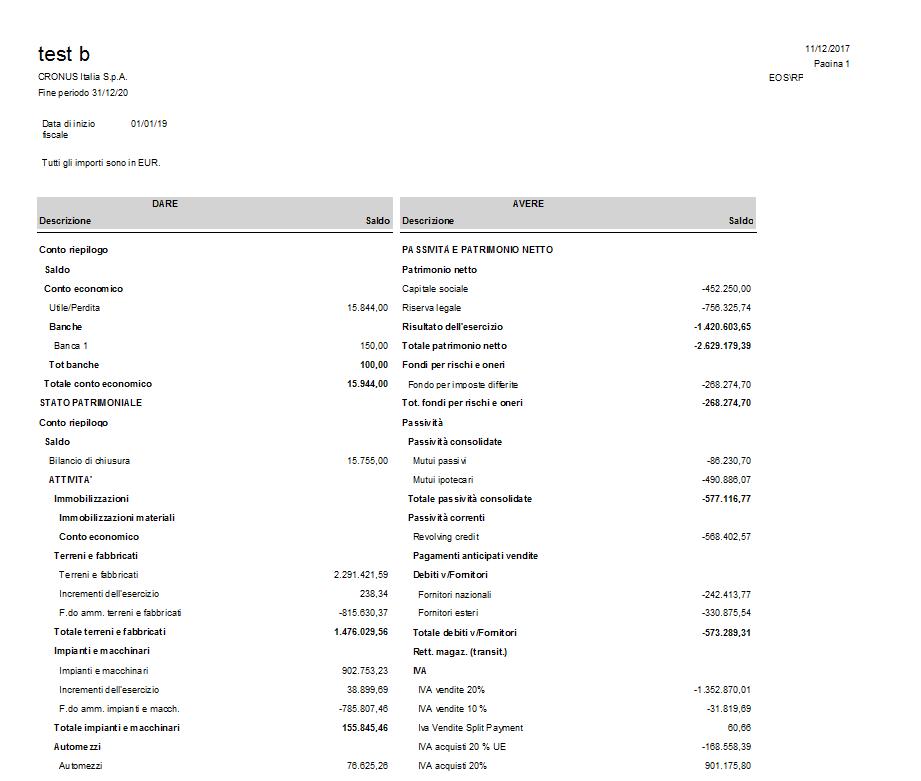

Example of printing only Debit/Credit:

Example of printing with Blank print position (no opposing sections-the rows for which you choose the Blank print position will always be placed at the bottom of the report):

Printing comparison between two balances of different years:

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.