Invoice to Receive / Issue generation (SGL)

This procedure allows the creation of competency entries related to invoices issued or received based on shipments and dispatches (including returns) generated within the system. It calculates the entries for which the corresponding Invoice/Credit Memo document has not been accounted for during the calculation period. The entries’ amount is retrieved from the relevant order line. Additionally, this procedure enables the generation of entries both in simulated ledger (typically during the year) and in general ledger (usually during the year-end closing process).

/68SimulatedGeneralLedger-en.png)

Operating logics

Invoices to Issue / Receive

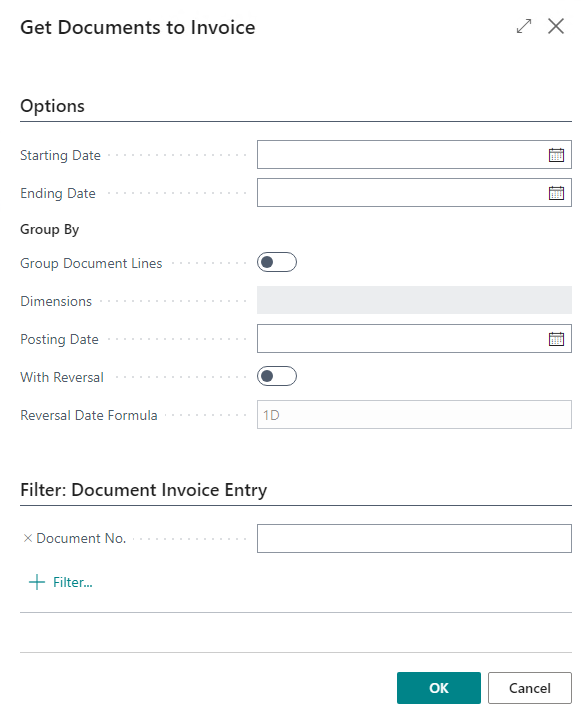

The request page is structured as follows:

- Starting Date: From which registration date should the shipments and deliveries be considered.

- Ending Date: Up to which registration date should the shipments and deliveries be considered.

- Group Document Lines: When selected, it will be possible to determine which dimensions should be subject to potential line splitting.

- Posting Date: The date applied to accounting entries.

- With Reversal: When selected, identical entries but opposite to the issued/received invoices will be suggested.

- Reversal Date Formula: A formula defining the reversal date for the reversal entries.

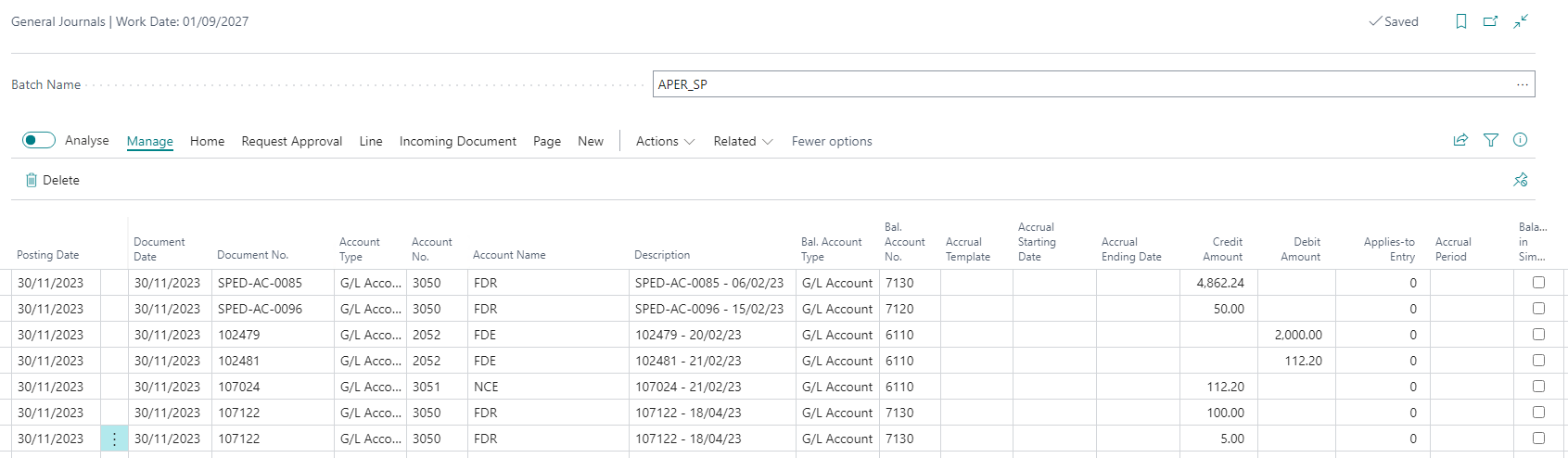

The system generates entries in the batch from which the “Get Invoices to Be Issued” function is executed. In the case of simulated entries, the batches are created on the selected Posting Date and automatically reversed the next day. If they are generated in G/L, the reversal entry is automatically created during the posting of the corresponding invoice (in the next accounting period).

To facilitate navigation, by default, the entries are generated with the same document number as the shipment/delivery from which they originated.

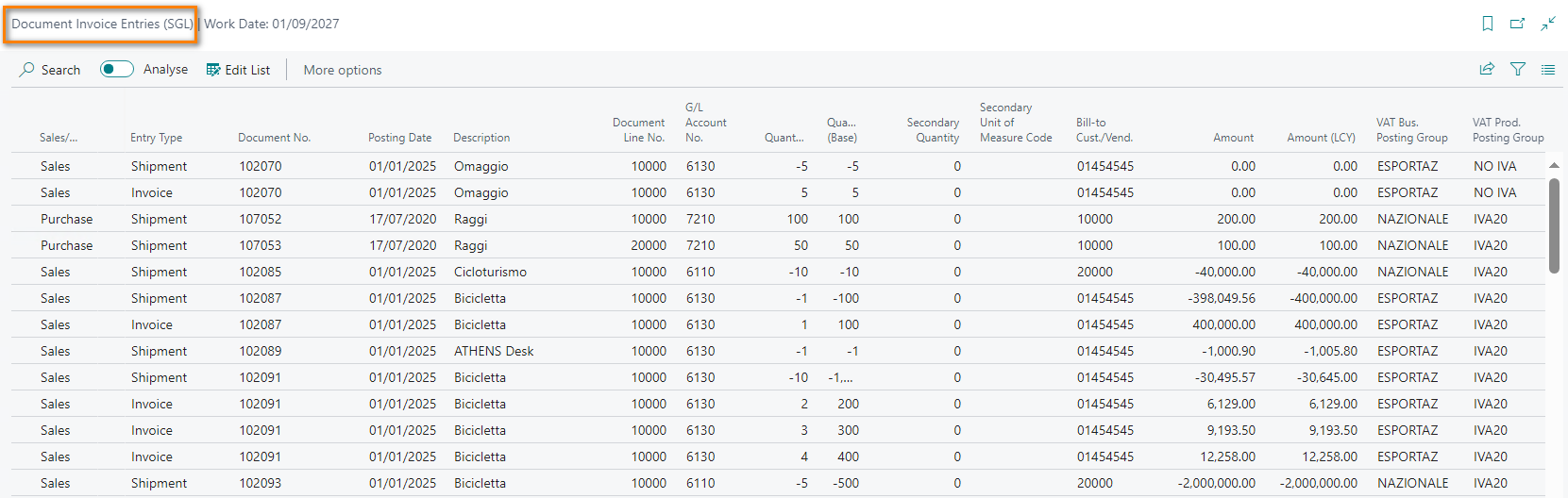

Document invoice entries

All entries related to shipments and/or deliveries are saved within the page “Document invoice entries (SGL).” The view allows you to keep track of all shipments and/or deliveries and their corresponding entries applied to invoices and/or credit memos. Any records with the movement type “Settlement” indicate that the related allocation has been made in G/L (typically at the end of the fiscal year).

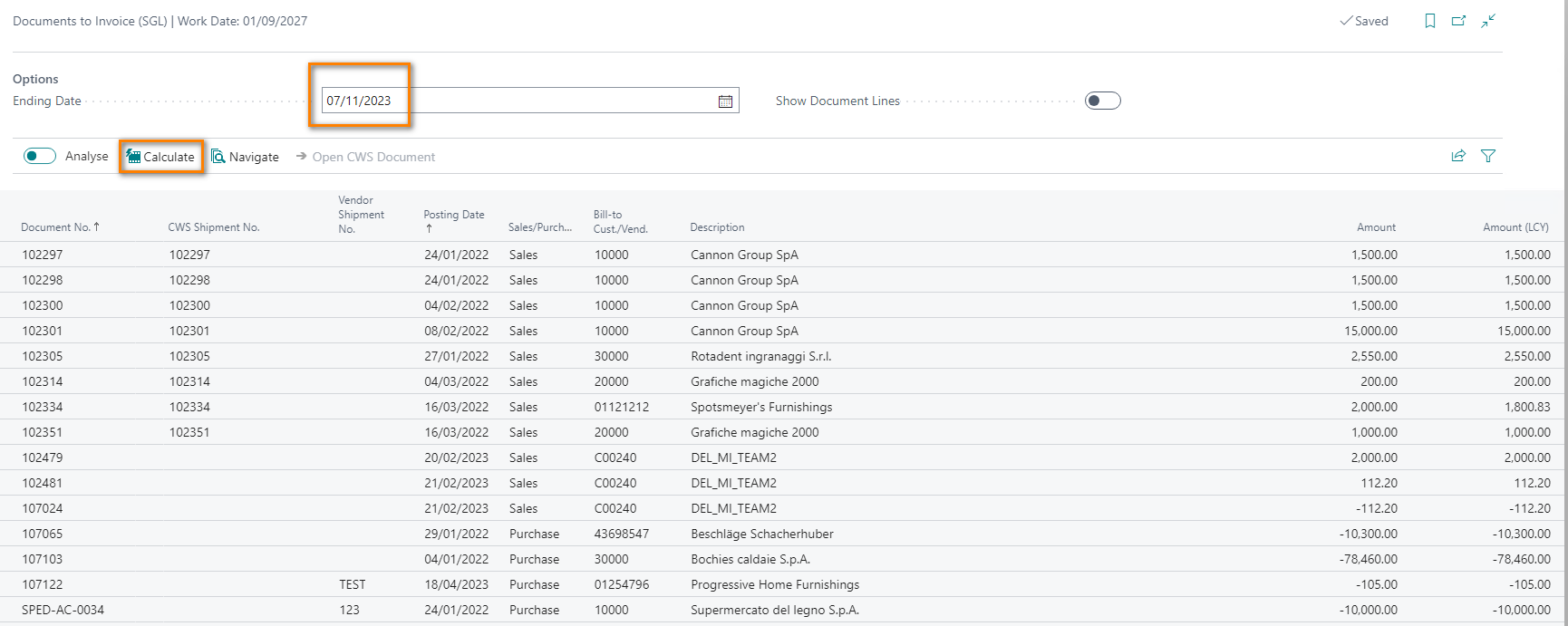

Documents to invoice

The ‘Documents to Invoice (SGL)’ page allows you to identify which documents do not yet have an associated invoice and/or credit memo as of the given date. The extracted data will then be recorded as accounting entries, as previously indicated.

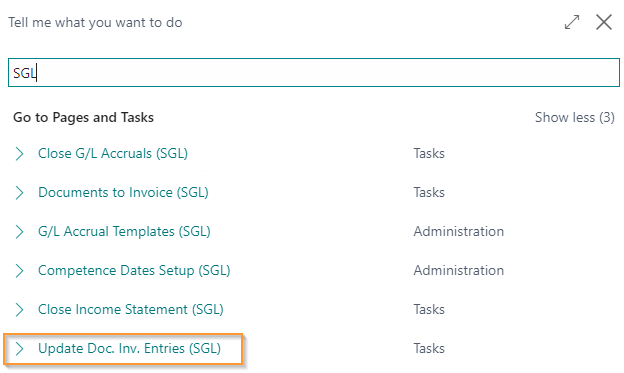

Update doc. to invoice entries

In case the app installation occurs during the current month, it is possible to retrieve a portion of the transaction history by running the “Update Doc. to Invoice Entries (SGL)” report, which will populate the “Invoice Entries to Be Invoiced” table.

_Andrea Giordani.png)

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.