Intrastat Setup (ITR)

The EOS «Advanced Intrastat For Italy (ITR)» app uses some standard setups, integrating them with app-specific setups.

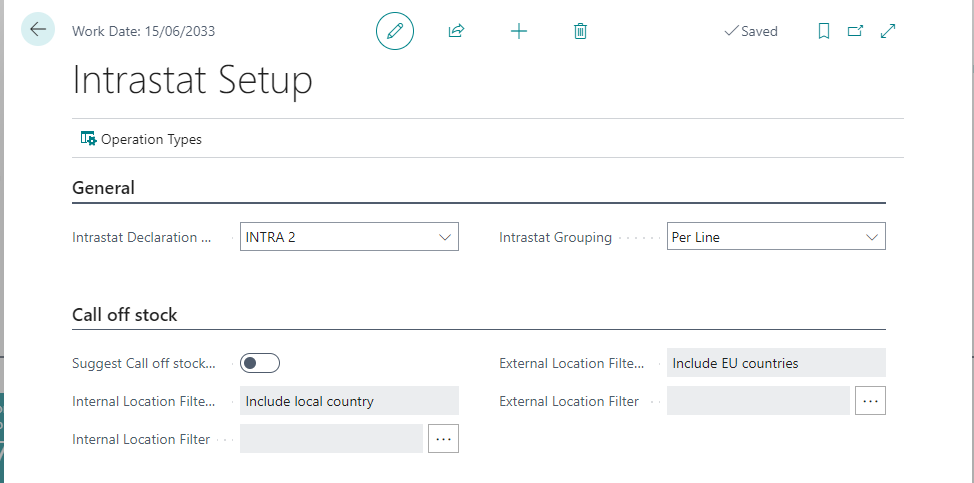

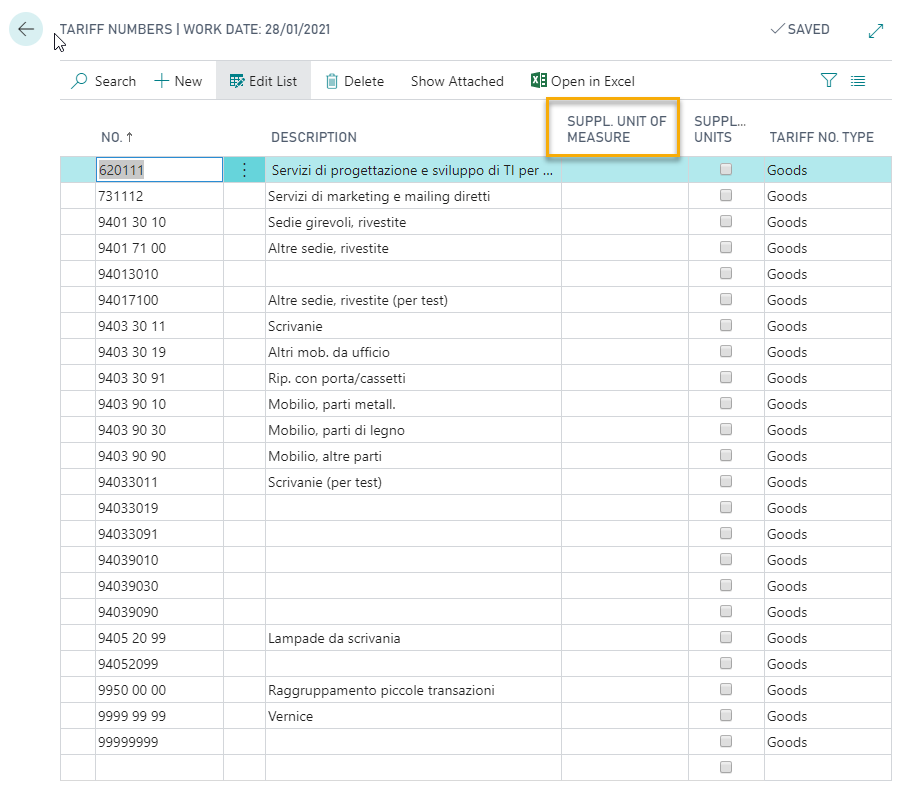

On the Intrastat Setup page, set a numerator and grouping type:

- “Per Line”: each single line is reported in the Intrastat declaration.

- “Per Document”: the lines in the Intrastat Declaration are grouped by nomenclature and by document.

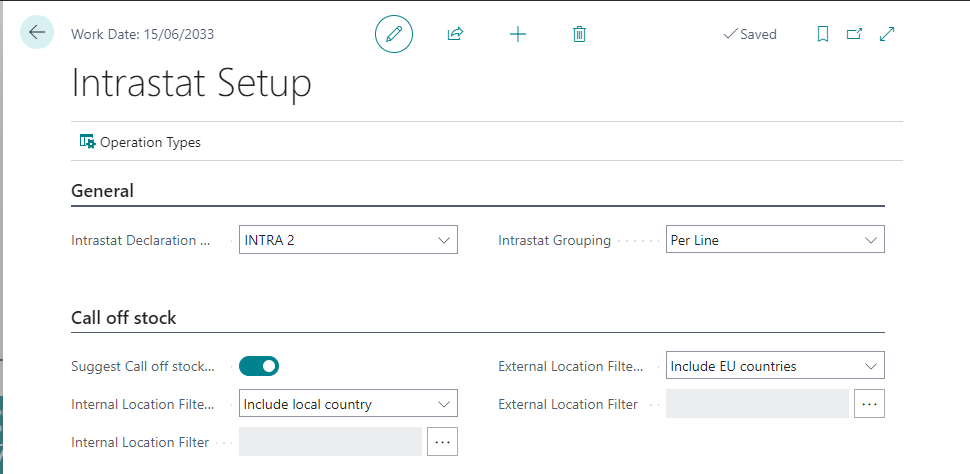

On the Intrastat Setup (ITR) page we can also enable the automatic generation of Call off stock lines; by activating the management, it will be possible to select the type of filter to use for automatic row suggestion

- Internal locations filter type: “Include local country” option: all locations with a country code equal to the one set in the Company information are processed; “Filter” option: only the locations entered in the “Internal locations filter” field are processed.

- External locations filter type: “Include EU countries” option: all locations relating to countries for which the “Code” field is filled in are processed. Intrastat”. “Filter” option: only the locations entered in the “Internal locations filter” field are processed.

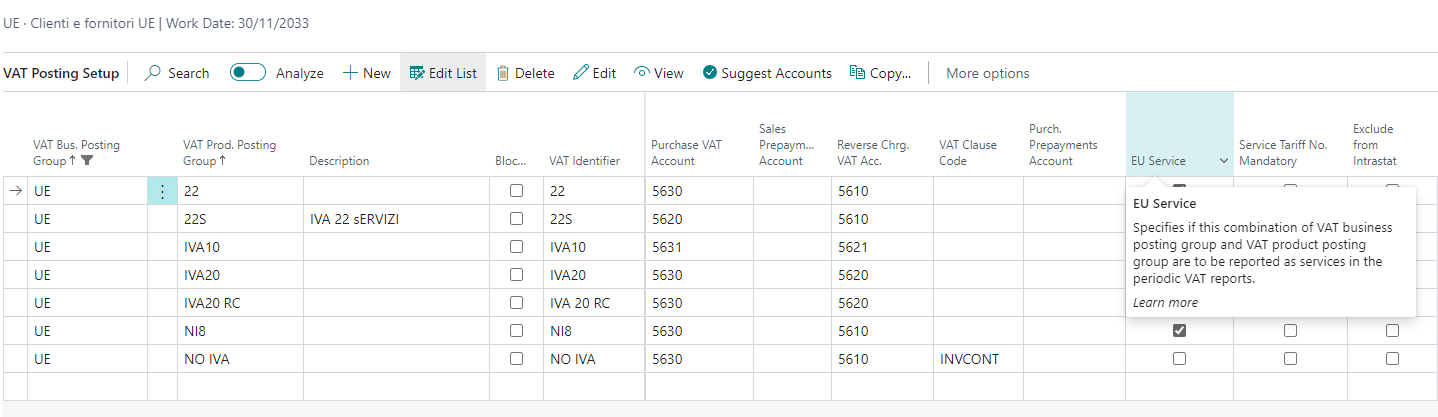

VAT Posting Setup

In the VAT Posting setup, the “EU Service” field determines whether the movement will be charged to the Intra goods or Intra services section; the criterion is the following:

Field not checked => GOODS

Field checked => SERVICES

When you check EU Service, the system also automatically turns on the «Service Tariff No. Mandatory» field, this check must be removed.

There is also the possibility of excluding a particular combination from the intrastat by using the specific “Exclude from Intrastat” flag.

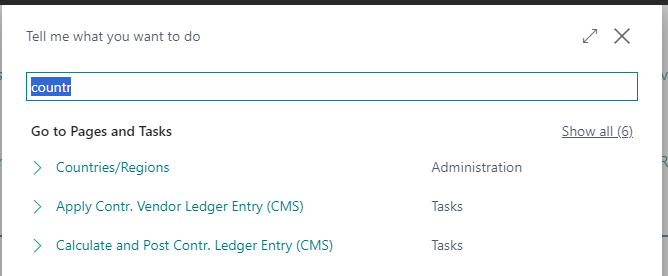

Countries

On the page Countries/Regions you need to set the EU country code (ISO code) and the related Intrastat country code (ISO code) as well as the currency if this is different from the Euro

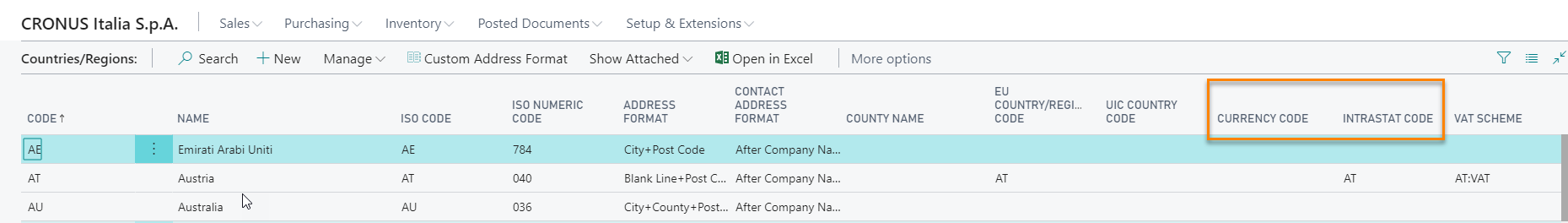

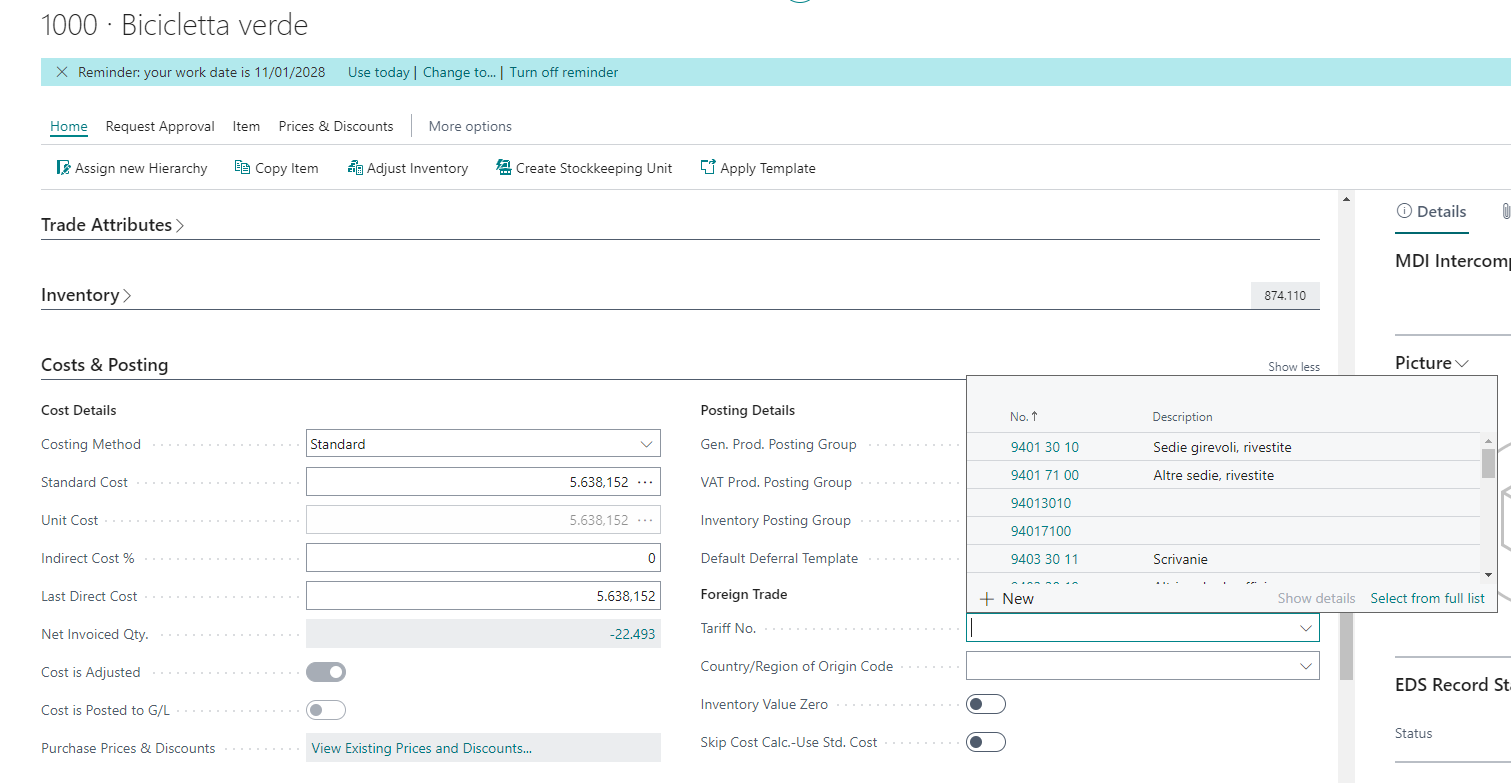

Tariff Numbers

In the Tariff Numbers page you can set the tariff numbers for “Services” and “Goods” to be associated with the item card, which will be automatically used in case of purchase or sale of a product.

In the coding we will insert in the “No.” field the Tariff No. and the related description, the Tariff Type (Goods/Services) and, if the customs tariff requires it, the Suppl. unit of measure and the related flag. The field “Supplementary Unit of Measure” is used to manage the tariff numbers with a different unit of measure from that specified in the document.

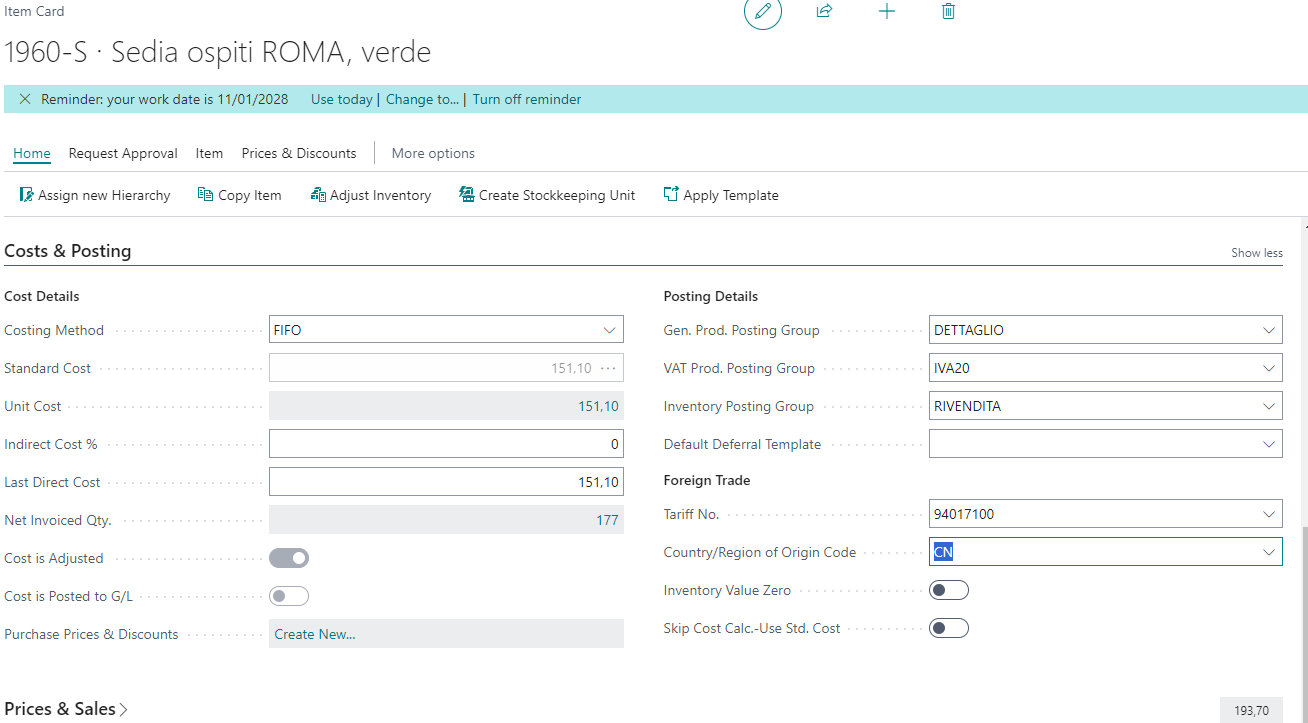

Item card

In the Item card, the Tariff No. field must be filled in

Always on the Item card we can indicate the Country/Region code of origin of the goods with which to fill in the new Intra 1-bis field

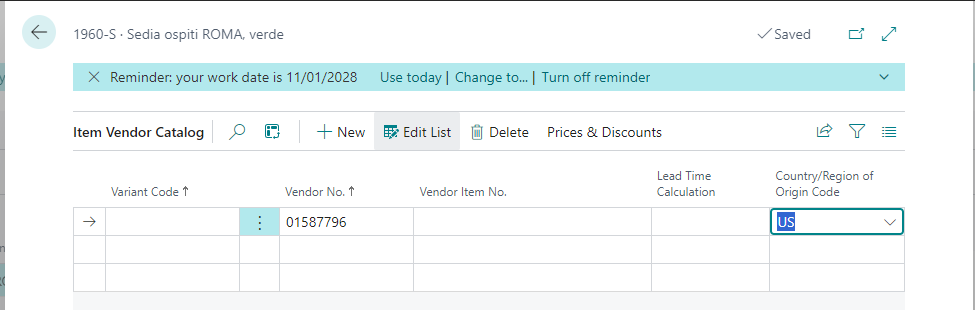

If the origin is different depending on the vendor from which you purchase it, we can indicate the origin in the Item Vendord Catalog card:

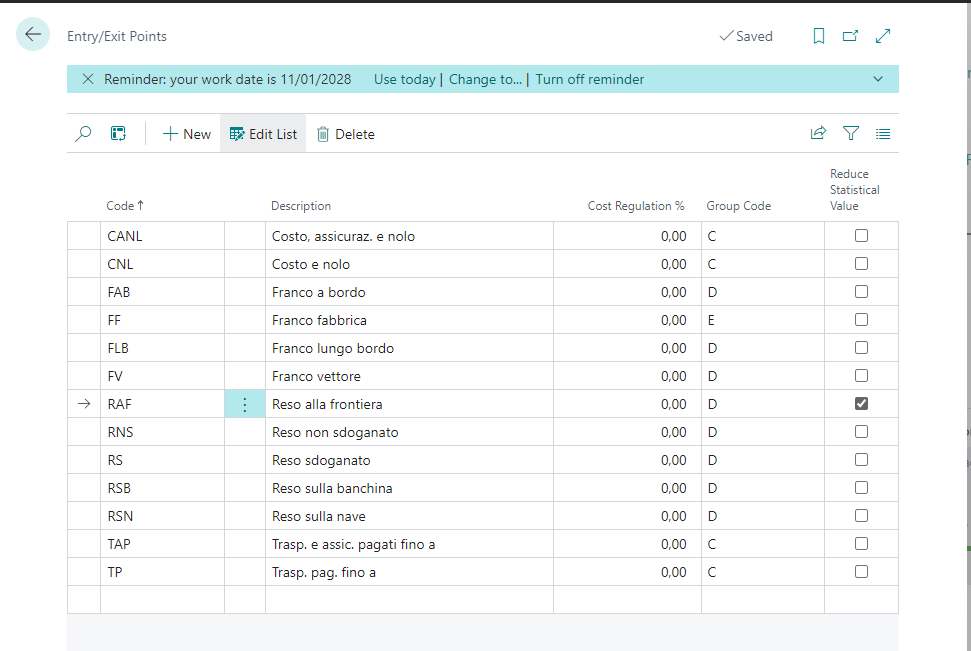

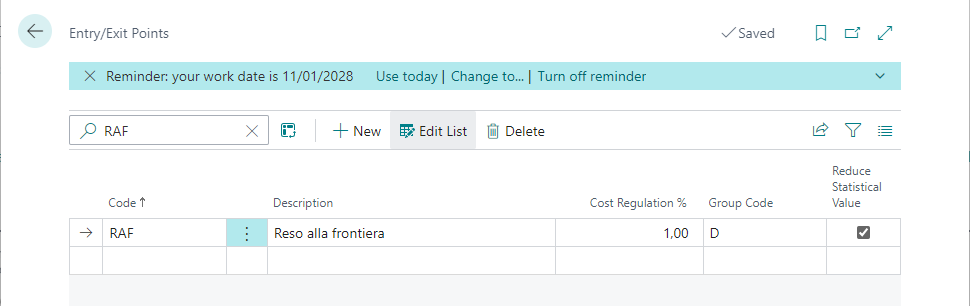

Entry/Exit Points

The delivery conditions must be codified in the «Entry/Exit Points», classifying them according to the coding indicated in table D of the customs instructions.

In the «Entry/Exit Points» card it is also possible to indicate a cost adjustment percentage which will be applied to the statistical value if it is foreseen in the table being compiled (intra-monthly).

The statistical value should be calculated by adding the delivery costs from the place of departure to the Italian border; if this is not possible, using the cost adjustment %, these costs are estimated based on the value of the goods and the percentage indicated. In the case of returns, the costs must be deducted by ticking the relevant column.

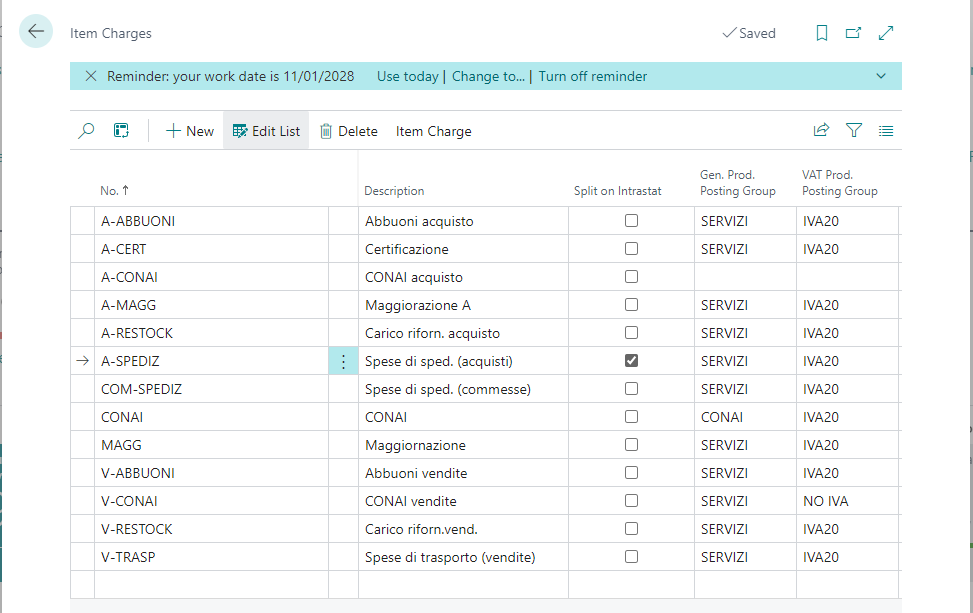

Item Charges

In order to increase the amount declared for Intrastat purposes of any additional costs, it is possible to indicate in the “Item charges” table the breakdown of the value of the charge itself by ticking the appropriate field; this will ensure that in the INTRA declaration the additional amount is re-proportioned among all the lines to which the charge itself refers.

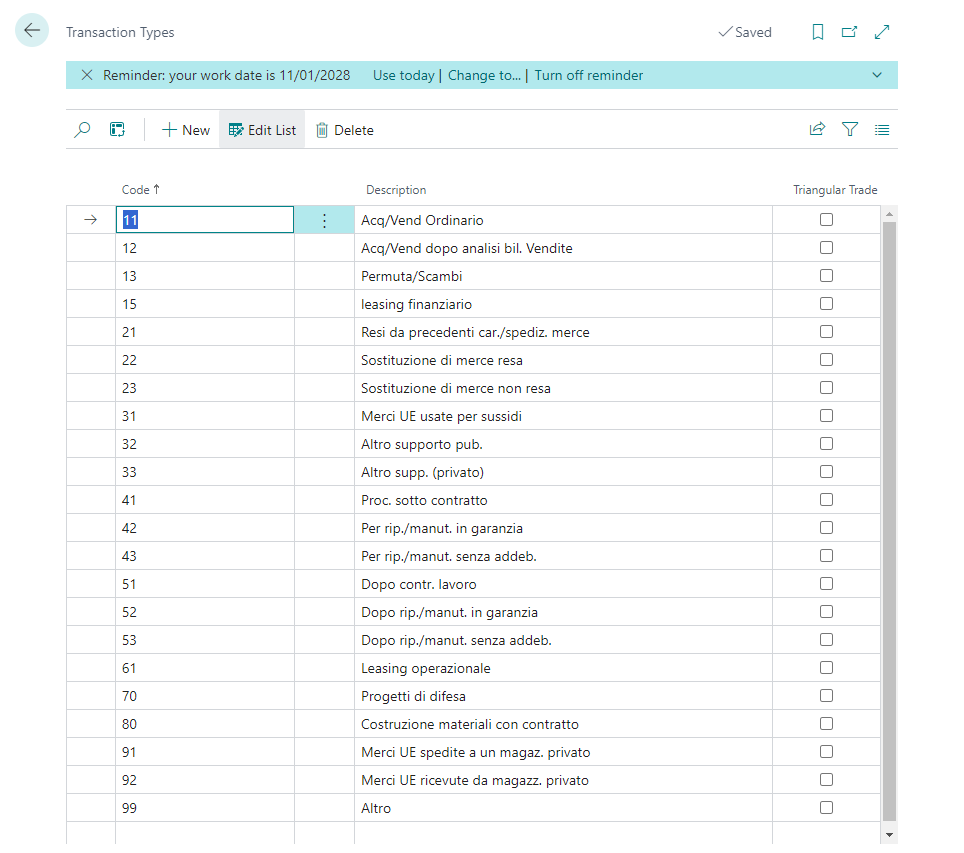

Transaction Types

On the «Transaction Types» page, the values that identify the reasons for which the transfer of goods took place must be codified;

From 2022 it is mandatory to indicate a two-digit code if the value of shipments or arrivals exceeds Euro 20.000.000; this code will be disaggregated into two distinct fields of the intra. If the aforementioned threshold is not exceeded and it is not expected to be exceeded, the single-digit values in use until 2021 can be codified.

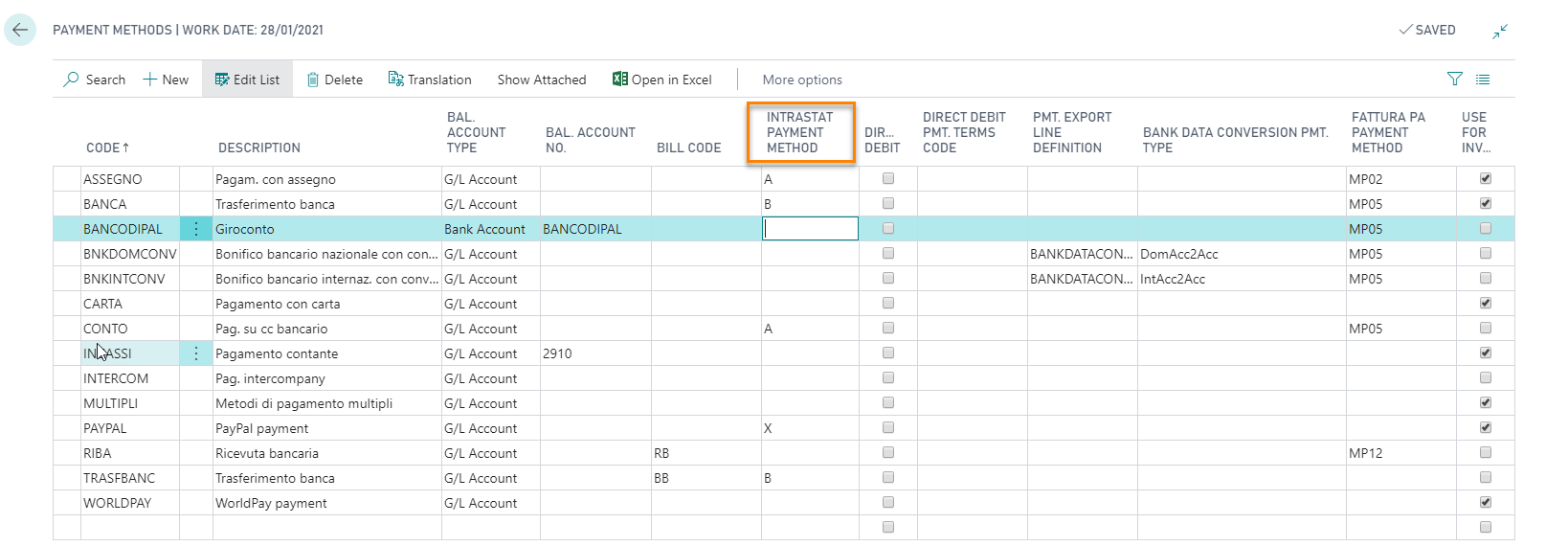

Payment Methods

In the page Payment Methods it is necessary to insert a payment method specific for Intrastat communications:

| Campo | Descrizione |

|---|---|

| A | Bank Transfer: the service is payed by bank transfer. |

| B | Credit: the service rendered is paid by credit in a bank account. |

| X | Other: the service is paid by other methods |

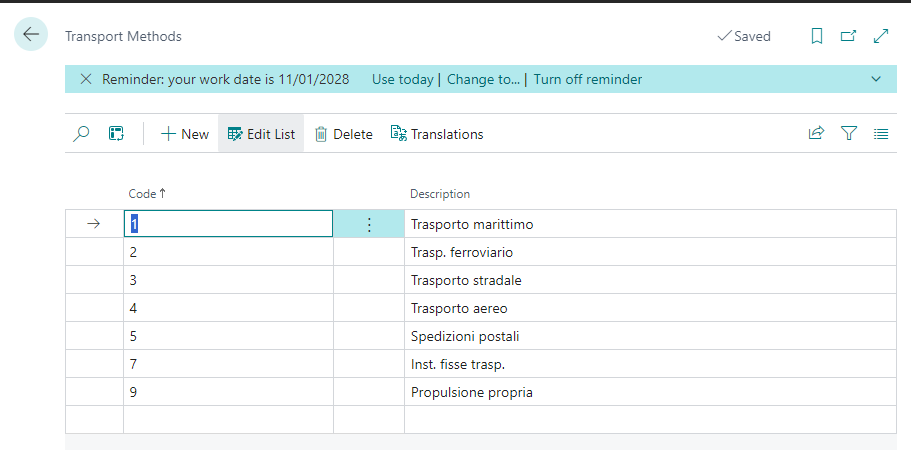

Transport Methods

The following values must be codified in the Transport Methods as required by law:

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.