1. Import Customer Dishonored Riba

The function allows importing the unpaid bills file provided by the bank.

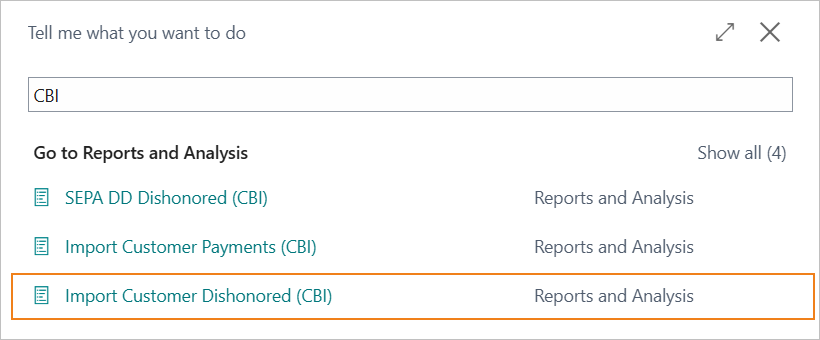

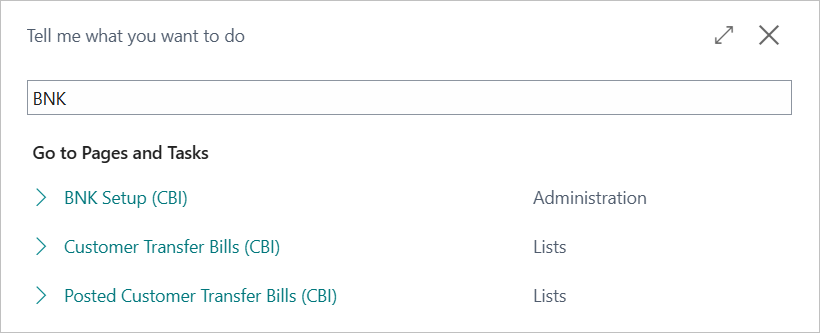

Import Customer Dishonored (CBI) – SUMMARY To access the function press ALT + Q and type “CBI” to search for the functionality.

Select “Import Customer Dishonored (CBI)” to open the following page.

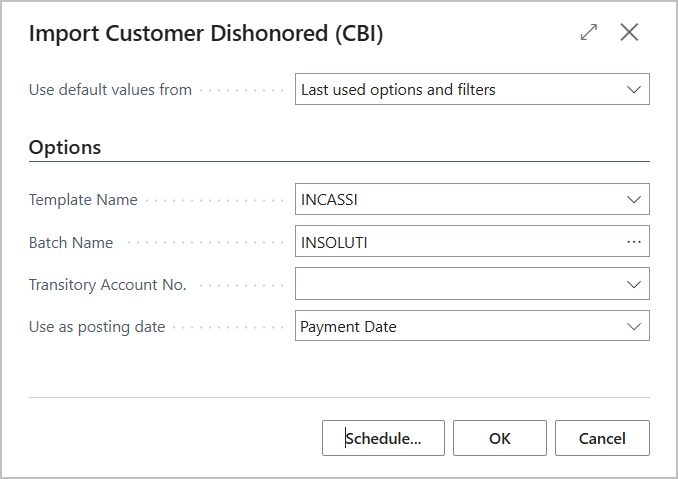

Parameters to be entered:

| Option | Description |

|---|---|

| Template Name | Select the journal to use. |

| Batch Name | Select the batch to use. |

| Transitory Account No. | If using a transitory account, it can be selected. |

| Used as posting date | Define the proposed posting date for accounting entries. Payment Date: proposed posting date will be the due date of the RiBa (pos. 23–28, record 14). Creation Date: posting date will be the creation date in the unpaid file (pos. 14–19, record IB). |

Notes crediting bank account

The bank account must match the ABI, CAB, and account number in the unpaid file. If payments are credited to a different account than the one used for submission, a specific bank account must be created.

Procedure

- The RiBa file is created in Business Central from “Customer Bill Card”.

- Upon maturity, wait for the bank to process the results (usually 1–5 days), then download the unpaid file from Remote Banking.

- Import the unpaid file into Business Central using the “Import Customer Dishonored (CBI)” function and post the accounting entries.

- Run the “Closing Bank Receipts” procedure to apply the invoice with the payment entry.

Closing must occur after posting the unpaid bills, as the unpaid import assumes the related entry is still open. If few unpaid bills exist, you can close them at maturity and manually reopen them before importing.

Accounting Entries

The accounting entries proposed by the system are summarized here.

Unpaid import without transitory account

Depending on whether the S.B.F. account or the regular bank account is debited.

S.B.F account debt.

| Debit | Credit | |

|---|---|---|

| Customer | @ | S.B.F. account |

Ordinary bank account debt

| Debit | Credit | |

|---|---|---|

| Customer | @ | Bank account |

Note:

to automate balance account entry, set a default balance account no. on the batch used for import.

Unpaid import without transitory account

Usually the use of the transitory account is provided in case the treasury is managed with the DocFinance application.

The accounting entries can be summarized as follows.

1. Accounting unpaid debit and bank charges

| Debit | Credit | |

|---|---|---|

| Transitory account | @ | |

| Bank account | ||

| Bank charges |

2. Accounting unpaid by “Customer Unpaid Bills Import (CBI)” procedure

| Debit | Credit | |

|---|---|---|

| Customer | @ | |

| Transitory account |

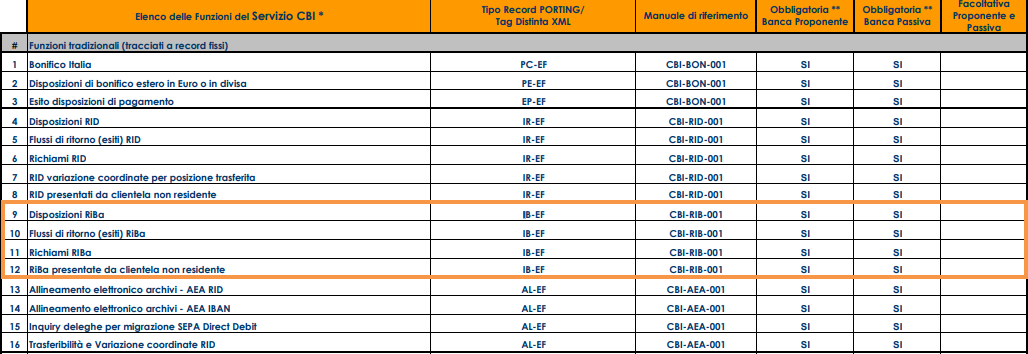

Technical Information

The unpaid file follows CBI (Corporate Banking Interbancario) standards.

The record format is defined by document “CBI-RIB-001 - Ricevute Bancarie (RiBa)", revision 6.03 (25/02/2019).

The function used is “Flusso di ritorno Ri.Ba.".

The file must start with a header record of type “IB”.

Note

Data used includes:

- Payment Date: from record 14, pos. 23–28.

- Creation Date: from header record “IB”, pos. 14–19.

- Reason Code: from record 14, pos. 29–33. Must be “42010” (unpaid bill) to proceed.

Outline summary of CBI services

2. Import Dishonored SDD

The function allows importing the unpaid SDD bills file provided by the bank.

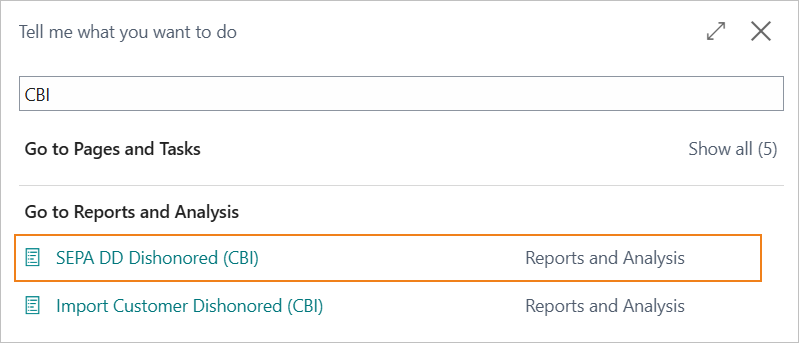

Import Customer Dishonored (CBI) – SUMMARY

To access the function press ALT + Q and type “CBI” to search for the functionality.

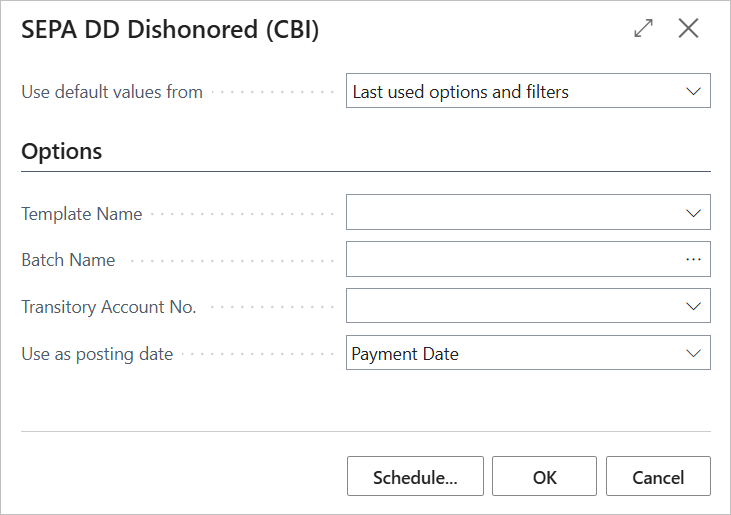

Select “SEPA DD Dishonored (CBI)” to open the following page.

Parameters to be entered:

| Option | Description |

|---|---|

| Template Name | Select the journal to use. |

| Batch Name | Select the batch to use. |

| Transitory Account No. | If using a transitory account, it can be selected. |

| Used as posting date | Define the proposed posting date for accounting entries. Payment Date: proposed posting date will be the due date. Creation Date: posting date will be the creation date in the unpaid file. |

Procedure

- The SDD file is created in Business Central from “Customer Bill Card”.

- Upon maturity, wait for the bank to process the results, then download the SDD unpaid file from Remote Banking.

- Import the unpaid file into Business Central using the “SEPA DD Dishonored (CBI)” function and post the accounting entries.

- Run the “Closing Bank Receipts” procedure to apply the invoice with the payment entry (the procedure is the same as that used for closing bank receipts).

Closing must occur after posting the unpaid bills, as the unpaid import assumes the related entry is still open. If only a few unpaid bills exist, you can close them at maturity and manually reopen them before importing.

Technical Information

Supported Record types:

- CBISDDStsRptLogMsg.00.01.00

- CBIBdySDDStsRpt.00.01.00

3. Import customer payments CBI

The customer payment import feature allows you to import the reporting file made available by the bank.

This functionality is used to import bank transactions, including collections.

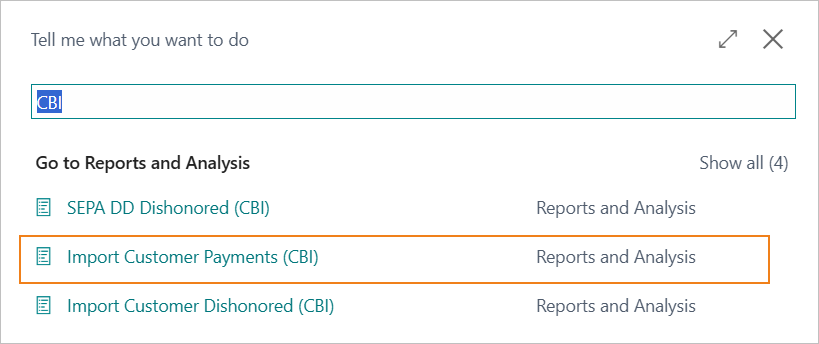

Import Customer Payment (CBI) – SUMMARY

To access the function press ALT + Q and type “CBI” to search for the functionality.

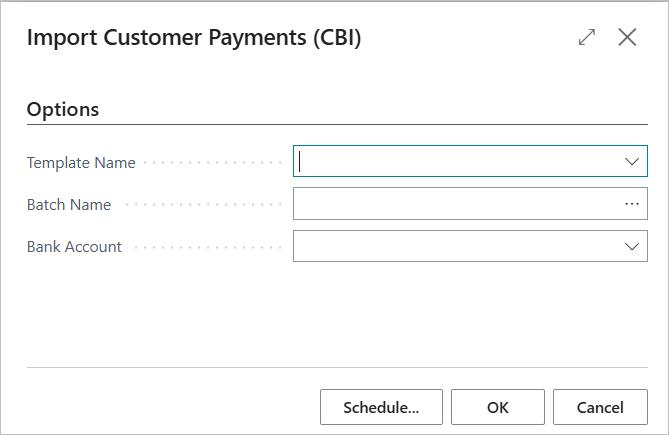

Select “Import Customer Payment (CBI)” to open the following page.

Parameters to be entered.

| Option | Description |

|---|---|

| Template Name | Select the journal to use. |

| Batch Name | Select the batch to use. |

| Bank Account | Specify the bank account number for bank transactions. |

Notes The import function for bank transactions has some limitations.

- Transactions are not filtered by the bank reason for collection type, so all transactions in the reporting file are imported, not just, therefore, collections.

- Transactions are not filtered by bank account, so if there are transactions from multiple bank accounts in the file, they will all be imported to the balance bank account specified on the request page.

- The account number is not populated. Transactions are imported with account type “Customer”, but the Account No. field will not be valorized.

Record type CBI

4. Sepa Direct Debit (SDD) Collections

4.0 Setup

The basic settings for creating SEPA Direct Debit (SDD) collection dispositions are as follows.

4.1 Bank Export/Import Setup

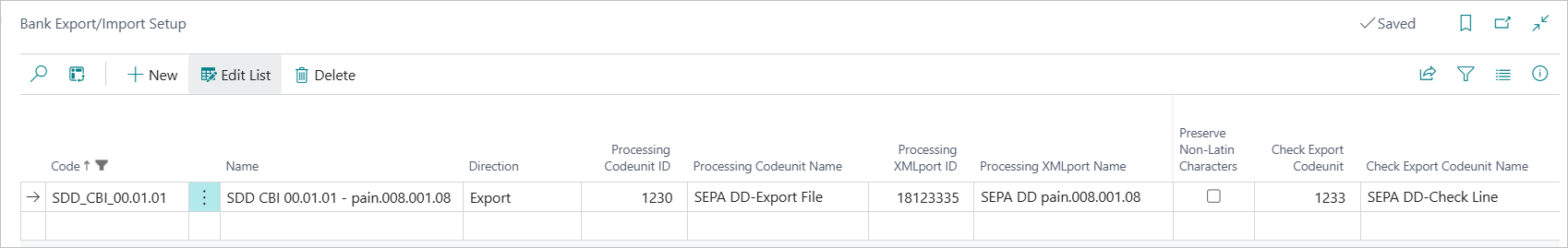

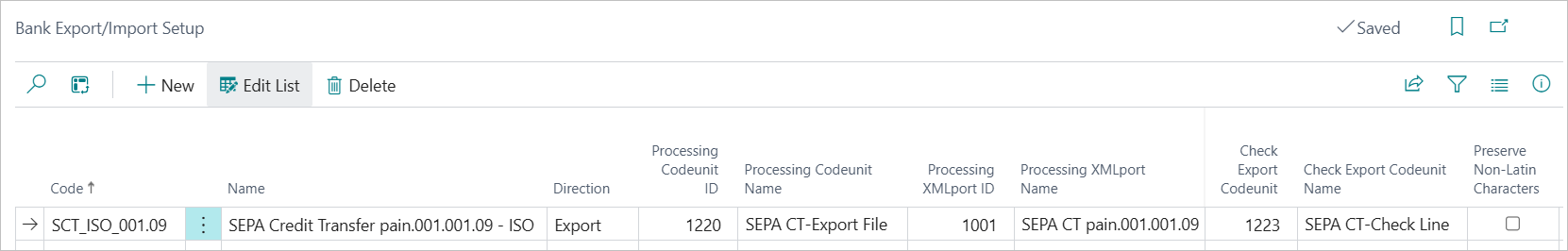

A new export code must be created in the Bank Export/Import Setup with the characteristics highlighted in the image below.

Note: The new XMLport 18123335 - “SEPA DD pain.008.001.08”. has been implemented for data processing.

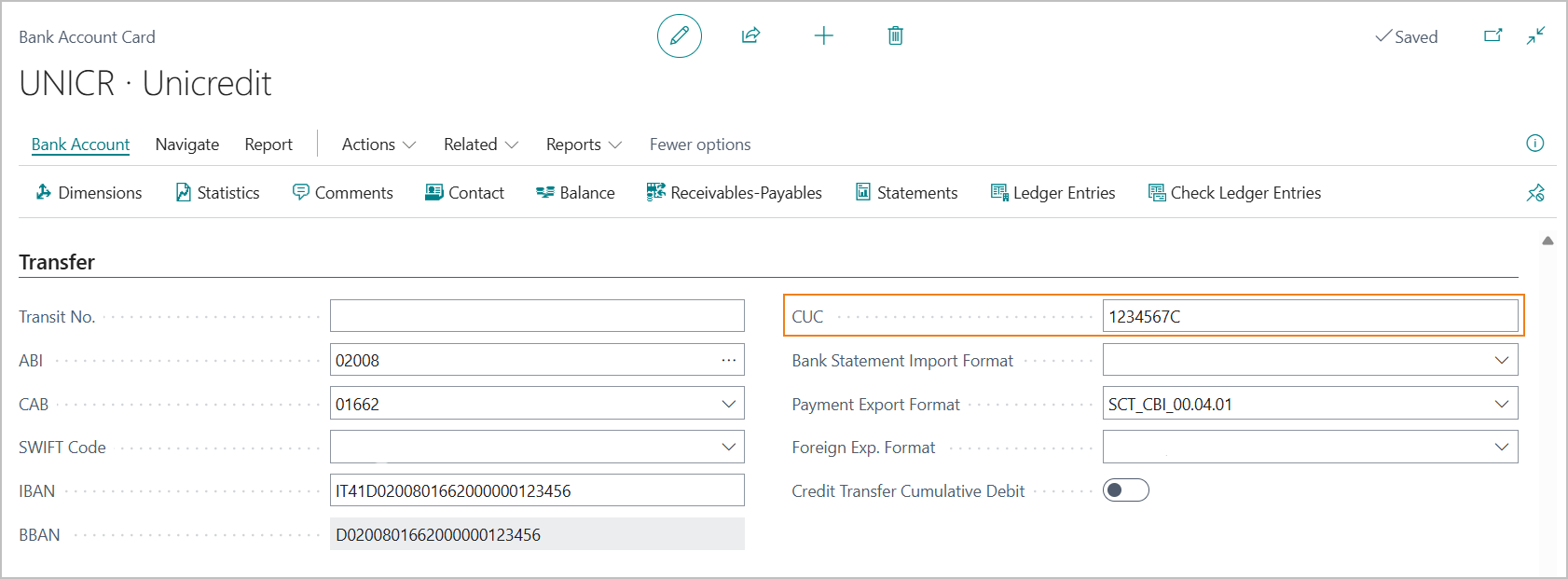

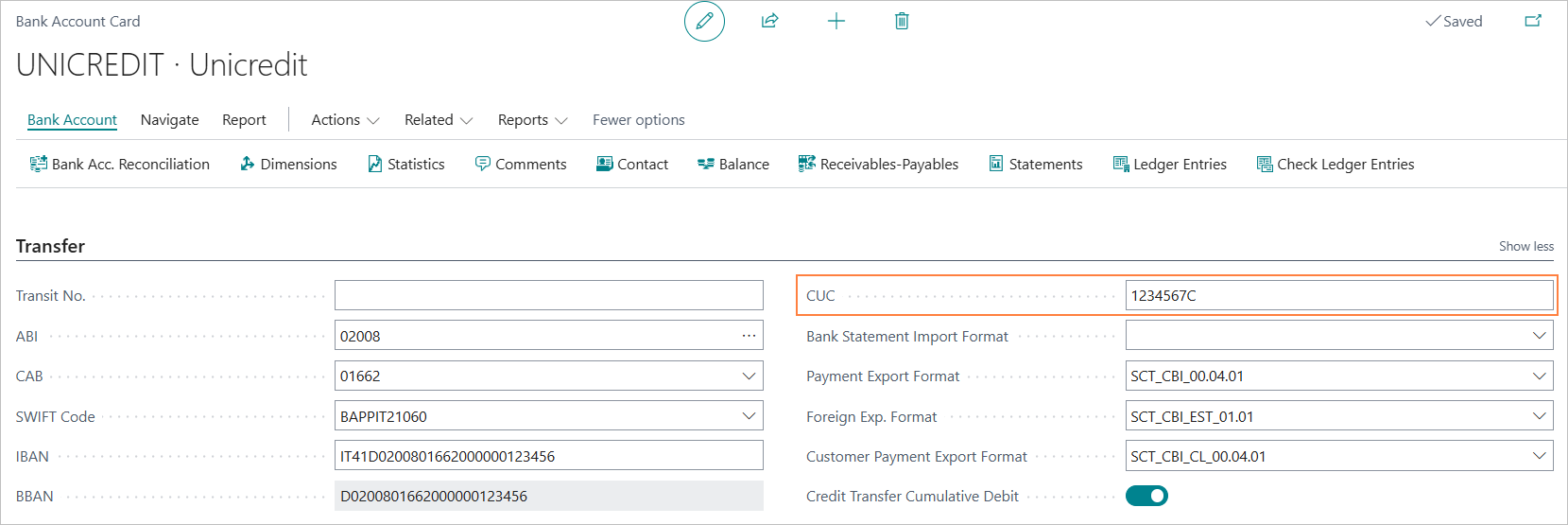

4.2 Bank Account Card Setup

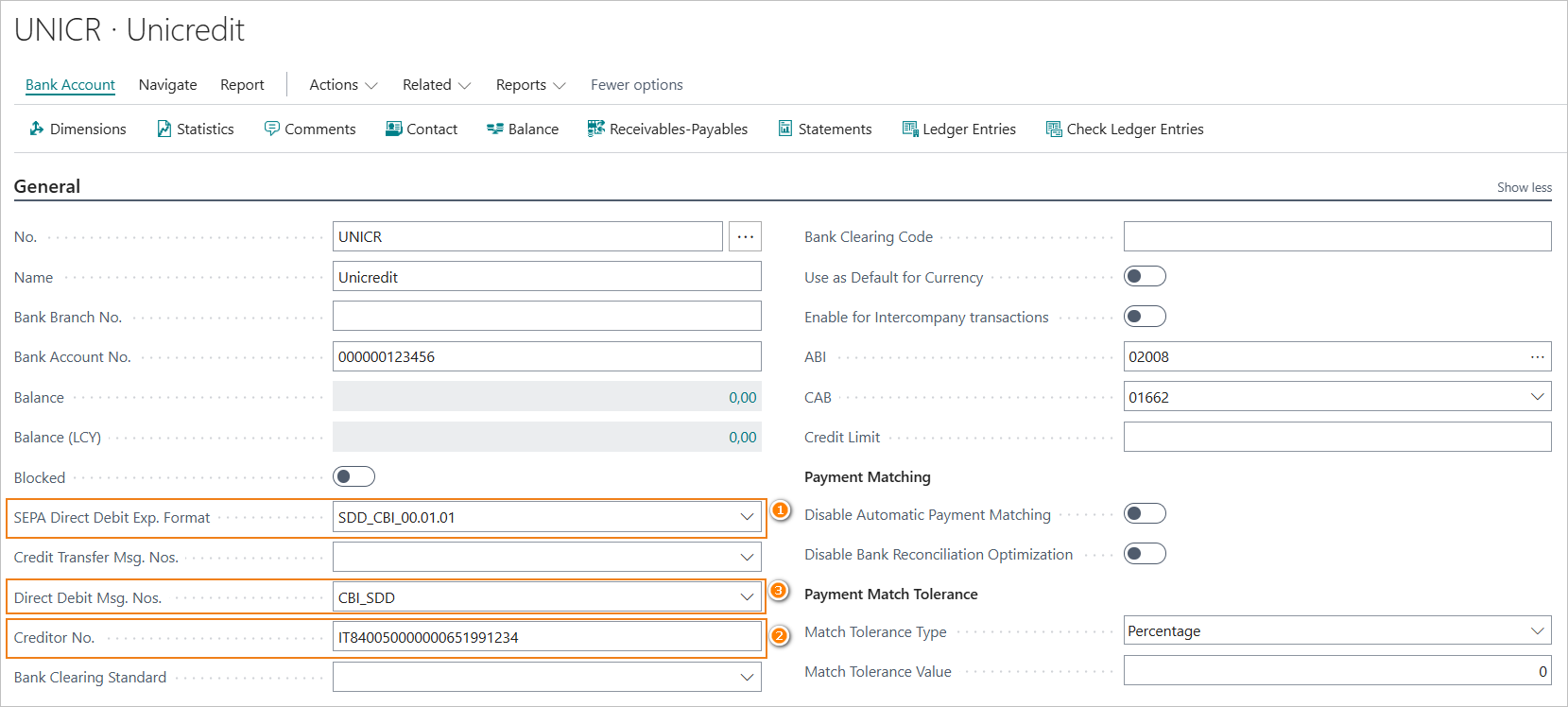

In the “General” tab of the Bank Account card the following parameters should be set.

- SEPA Direct Debit Exp. Format (1): set the correct export code.

- Creditor No. (2): this field must contain the “Creditor Identifier Code”. The Creditor Identifier Code is a unique code that allows the creditor to be identified in the SEPA area. It is important because it is uniquely associated with the SEPA mandate number. It is mandatory information.

- Direct Debit Msg. Nos. (3): enter the No. Series to be assigned to the name of the SDD file that will be created.

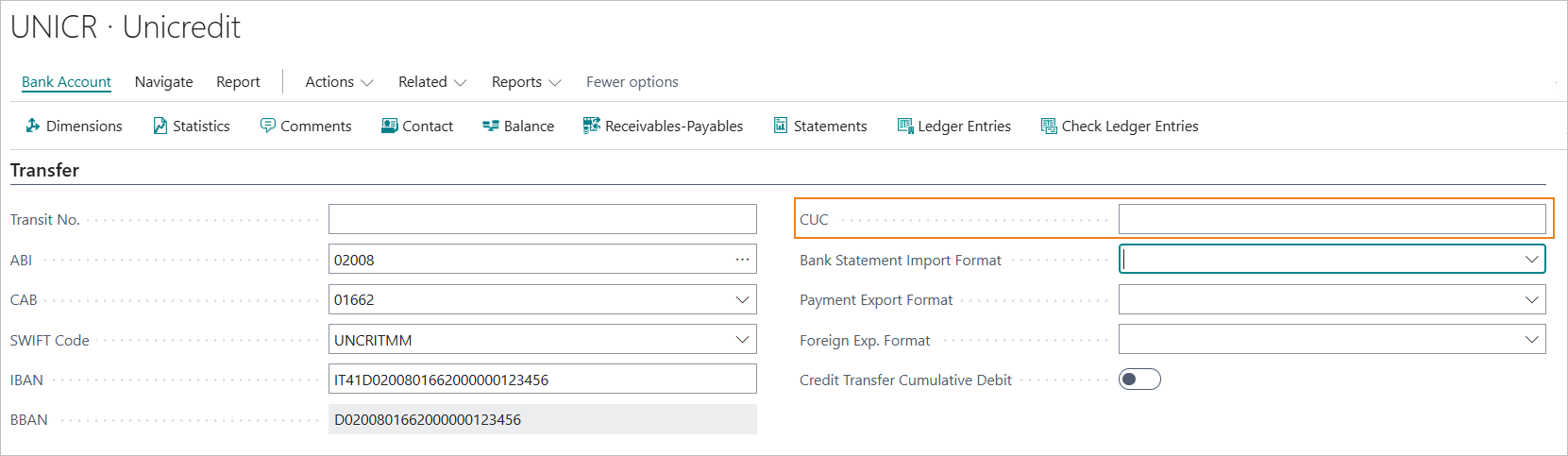

A value must be entered in the “Transfer” tab of the Bank Account card in the “CUC” field. The CUC code (“Codice Univoco CBI”) is mandatory. It is an 8-character alphanumeric code that is assigned by the banking system.

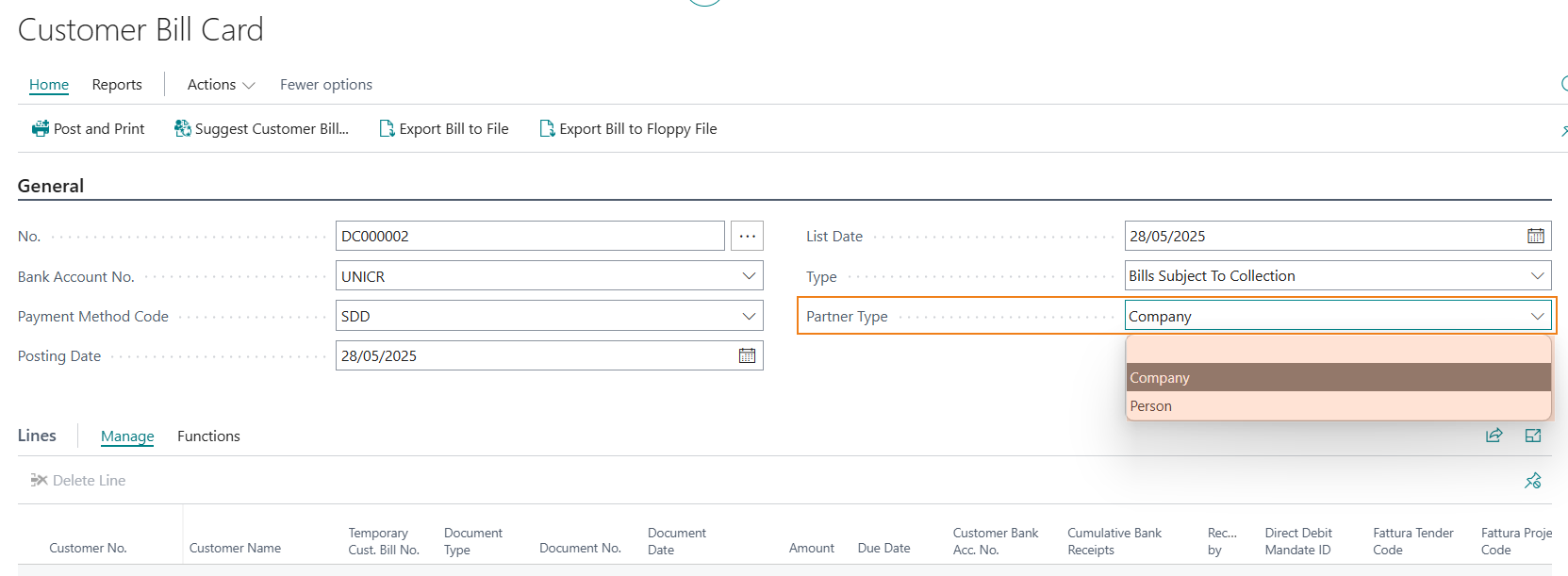

4.5 SDD B2B\Core

The type of SDD (B2B\Core) can be selected via the “Partner Type” field of the Customer Bill card.

“Partner Type “Company”: SDD “B2B”. “Partner Type “Person”: SDD “Core”.

4.6 Creation of the SDD file

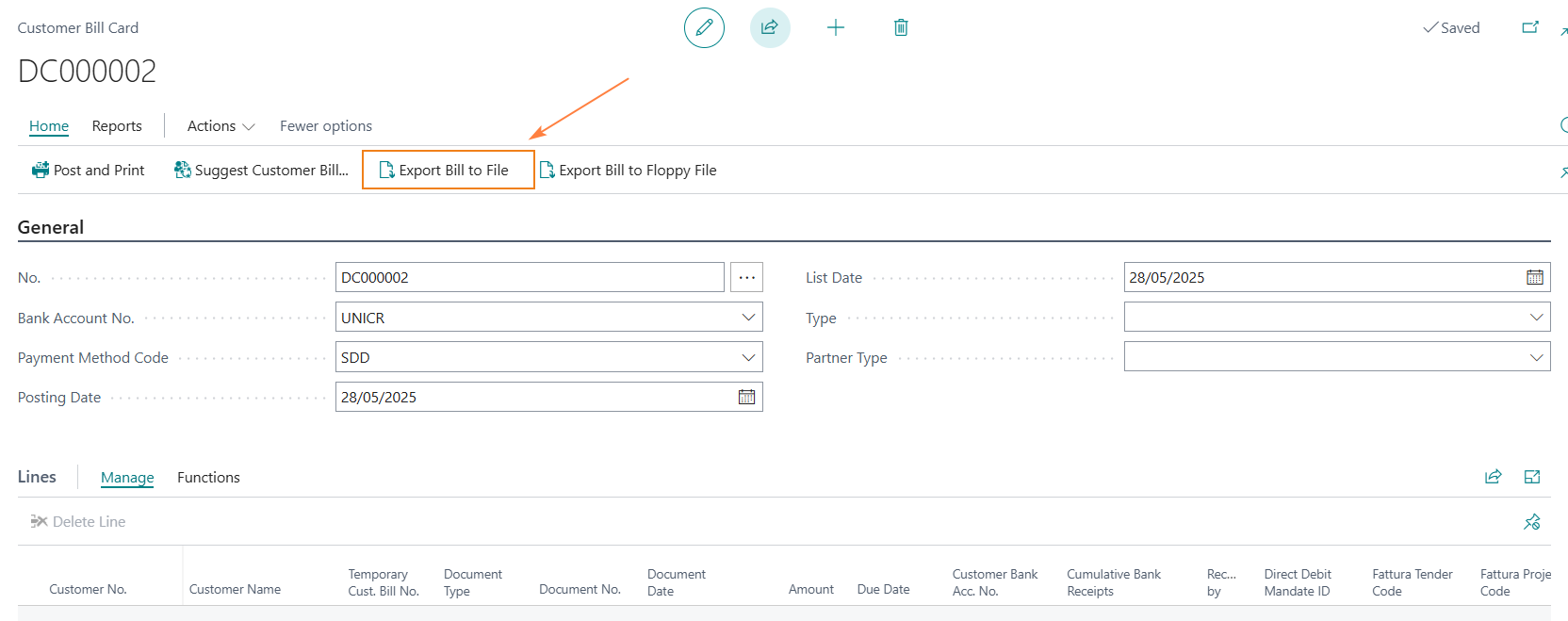

Customer Bill Card

To export the SDD file from the customer bill card, select the “Export Bill to File” action.

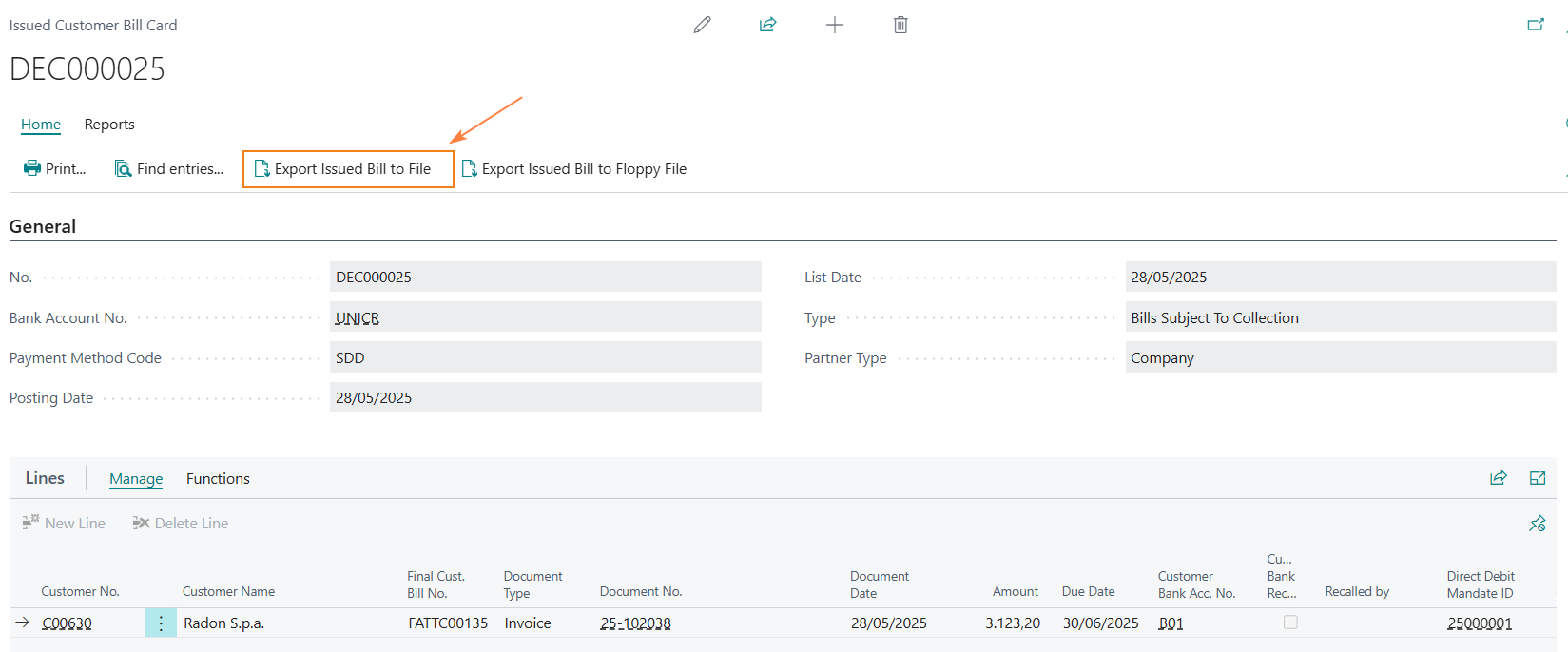

Issued Customer Bill Card

To export the SDD file from the Issued Customer Bill card, select the “Export Issued Bill to File” action.

Technical Information

The SDD file, in Italy, is subject to the standards of the CBI (Interbank Corporate Banking) service, which incorporates the ISO20022 standard layout.

The current format is governed by the technical manual “STIN-MO-001 - Sepa Direct Debit collections,” version 00.01.01 dated 02/11/2023.

Reference ISO20022 path: CustomerDirectDebitInitiation V08 - Pain.008.001.08

5. SEPA Credit Transfers Payment Transaction (SCT) - Vendors Wire Transfer

5.1 Setup

The basic settings for creating SEPA Credit Transfers payments are as follows.

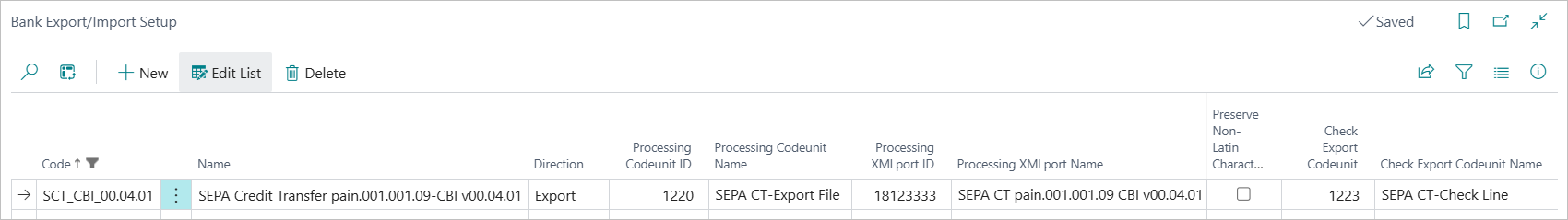

5.1.1 Bank Export/import Setup

A new export format code will need to be created in the Bank export/import setup.

- Processing Codeunit ID: 1220 - “SEPA CT-Export Fil"e.

- Processign XMLport ID: 18123333 - “SEPA CT pain.001.001.09 CBI v00.04.01”.

- Check Export Codeunit: 1223 - “SEPA CT-Check Line”.

**Notes “Check Export Codeunit”**

Regarding the “Check Export Codeunit” to be set, it should be noted that codeunit 12178 of the Italian localization is present in the system. However, this object appears to be updated with a long delay.

It is suggested, therefore, for the control when exporting the file to use codeunit 1223, as it is updated regularly.

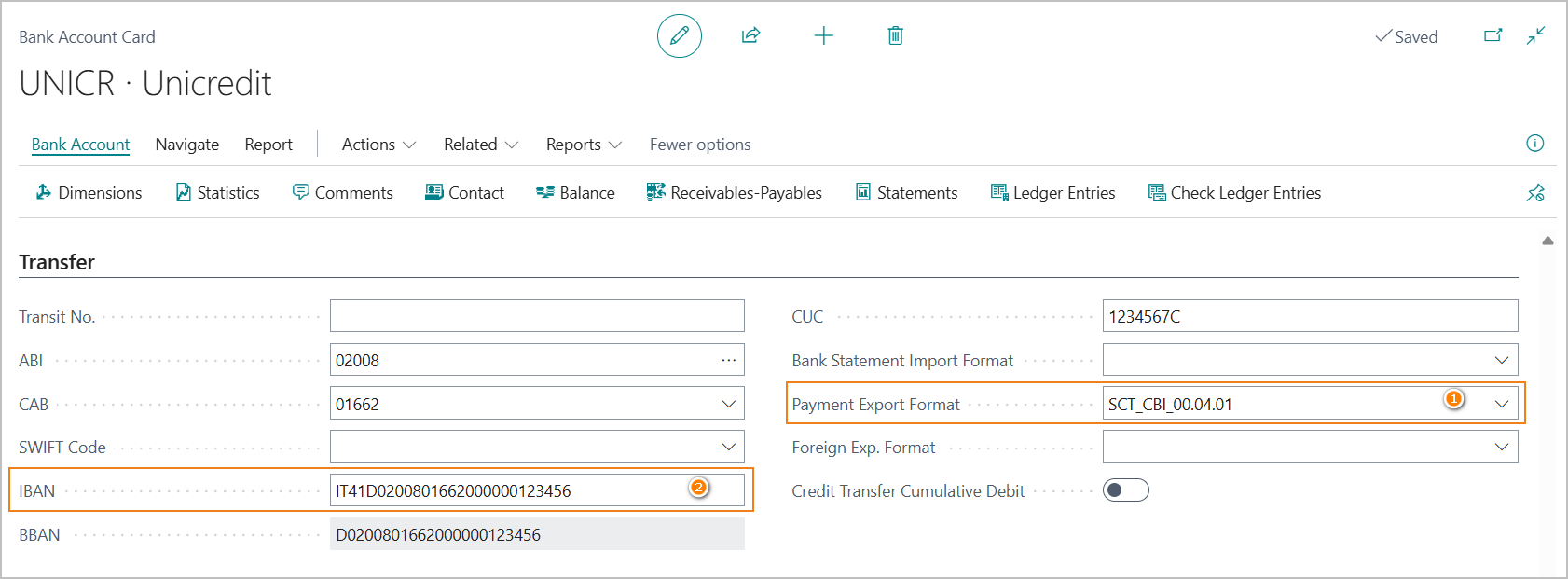

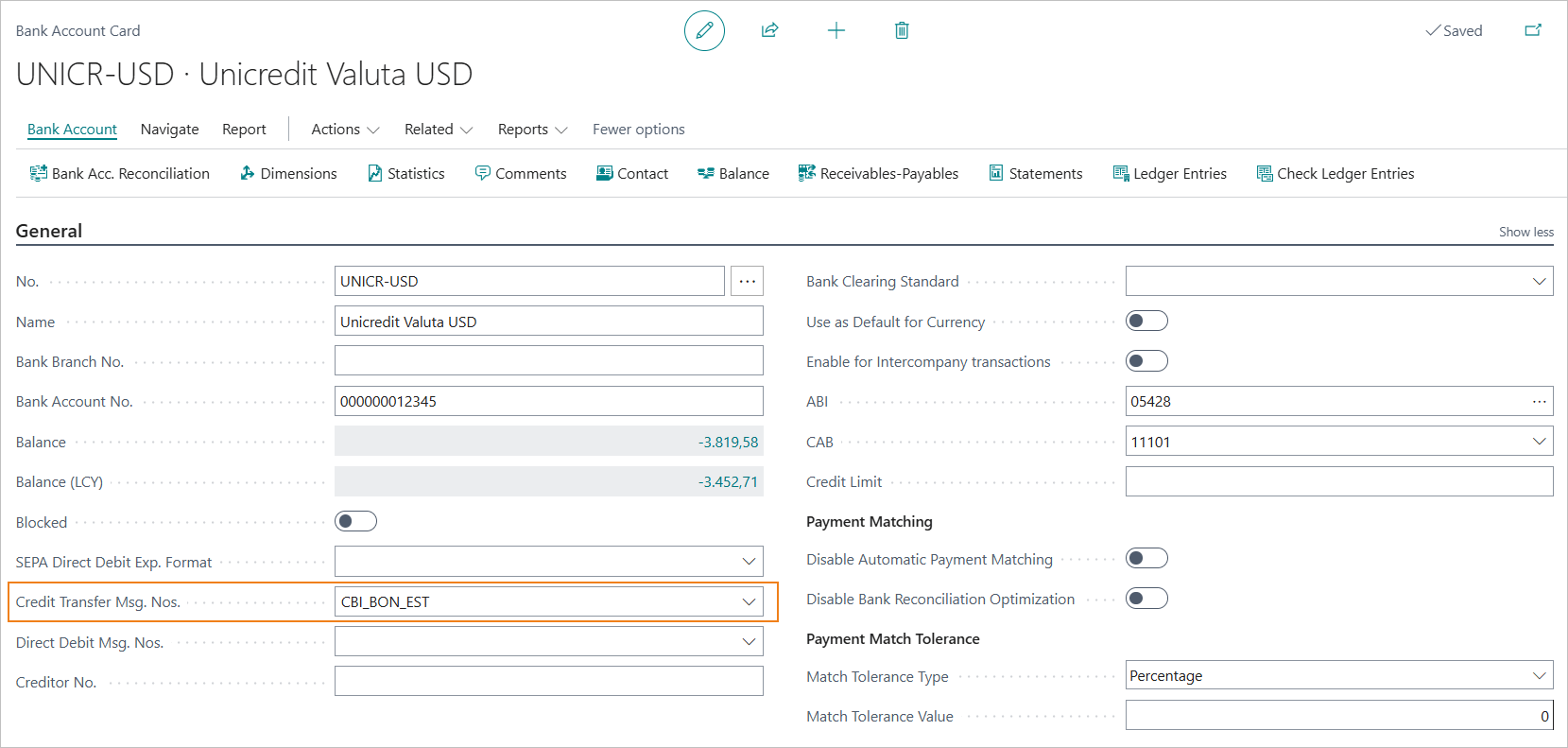

5.1.2 Bank Account Card setup

In the “Transfer” tab of the bank account card the following parameters should be set.

- Payment Export Format (1): set the export format created.

- IBAN (2): IBAN code is mandatory.

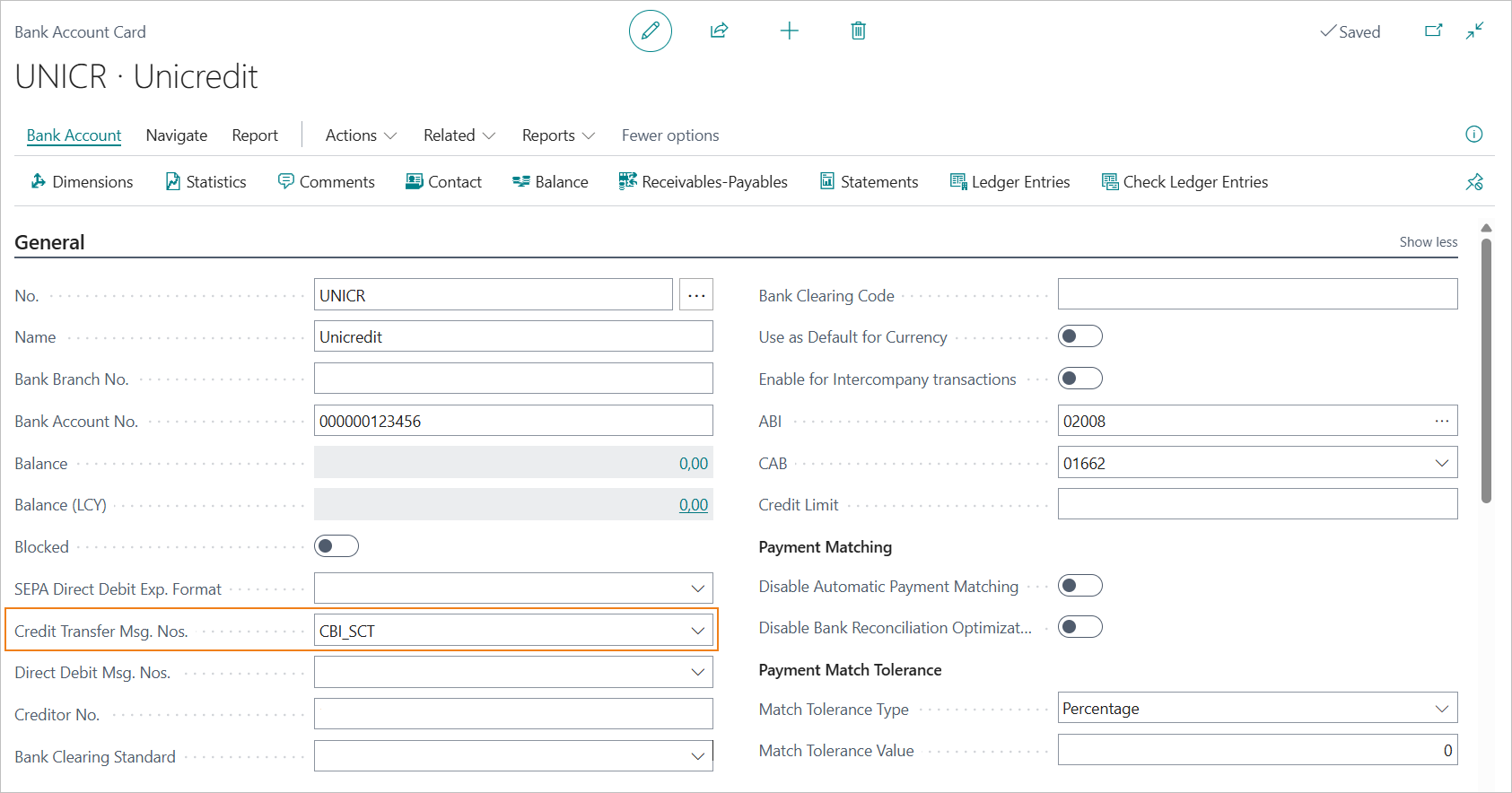

In the “General” tab of the bank account card, the parameter should be set: Credit Transfer Msg. Nos.. Here the Serial No. to be assigned to the name of the SCT file that will be created should be indicated.

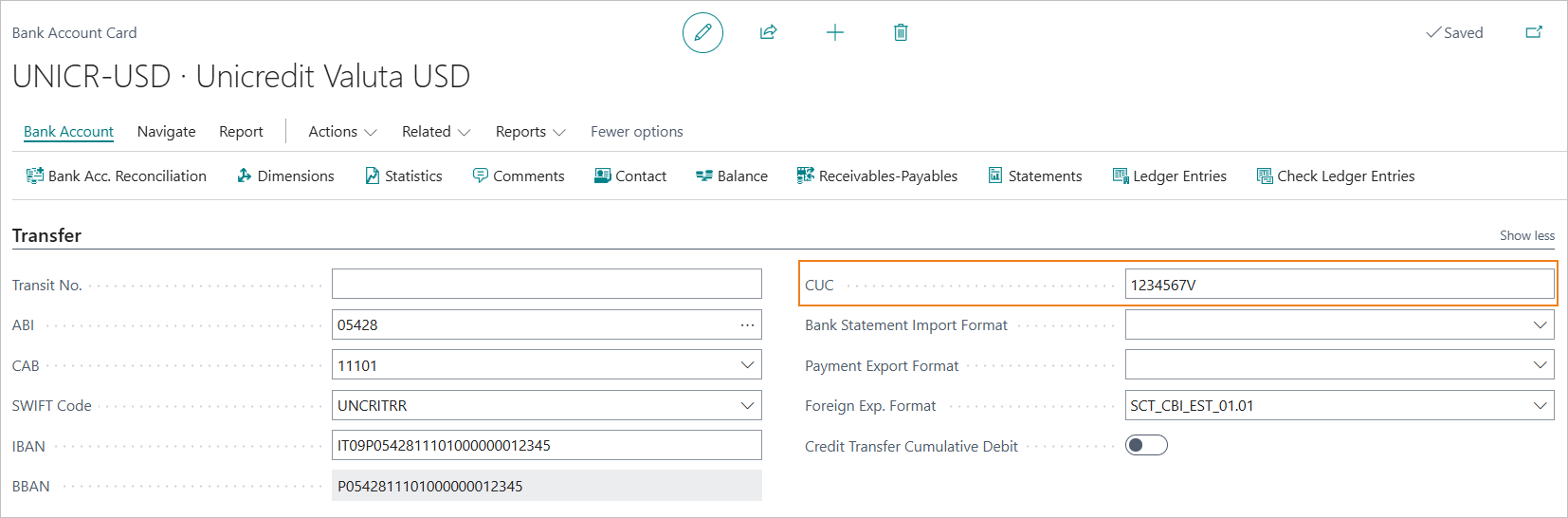

CUC Field

According to CBI standards, the CUC code (CBI Unique Code) is mandatory.

It is an 8-character alphanumeric code that is assigned by the banking system.

However, this data element is not always required by the bank, and to ensure continuity with previous versions, a specific check has not been implemented.

Therefore, it is suggested that the “CUC” field on the bank account card be valorized in order not to risk the discarding of the provision.

5.1.3 Company Information Setup

The VAT number of the company is a mandatory data element in the XML file of transfers. The “VAT Registration No.” field on the “Company Information” tab must be mandatorily filled in.

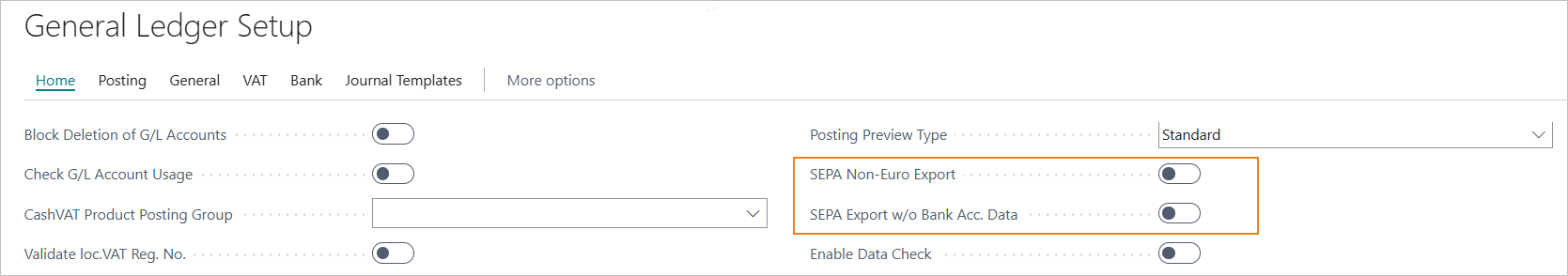

5.1.4 General Ledger Setup

Setting the “Export SEPA Non‑Euro Export” field in the General Ledger Setup

With the 27‑CU1 release of Business Central, Microsoft introduced an update that changes the system behavior when generating the SEPA payment file for vendor transfers.

This update also affects the functionalities of the BNK – Bank Files for Italy (EX005) app.

Specifically, when the “Export SEPA Non‑Euro” field is enabled in the General Ledger Setup, the system automatically sets the “ChrgBr” tag in the SEPA file generated from the Vendor Payment Journal to “SHAR”, which causes the payment instruction to be rejected.

Please note that for SEPA credit transfers, the “ChrgBr” tag must mandatorily be set to “SLEV”.

Therefore, it is recommended not to enable the fields related to SEPA payment file generation in the General Ledger Setup:

- “SEPA Non‑Euro Export”

- “SEPA Export w/o Bank Acc. Data”

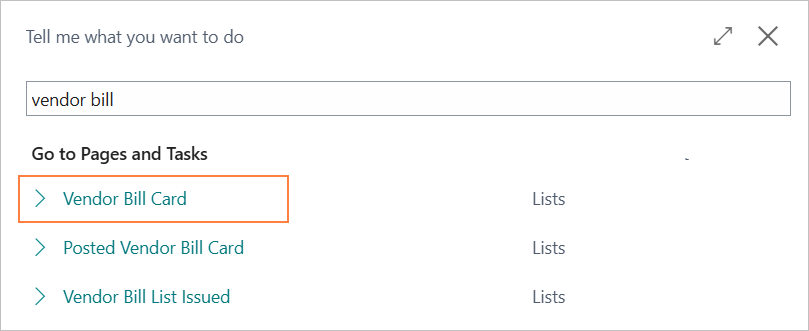

5.1 Vendor Transfer Bill

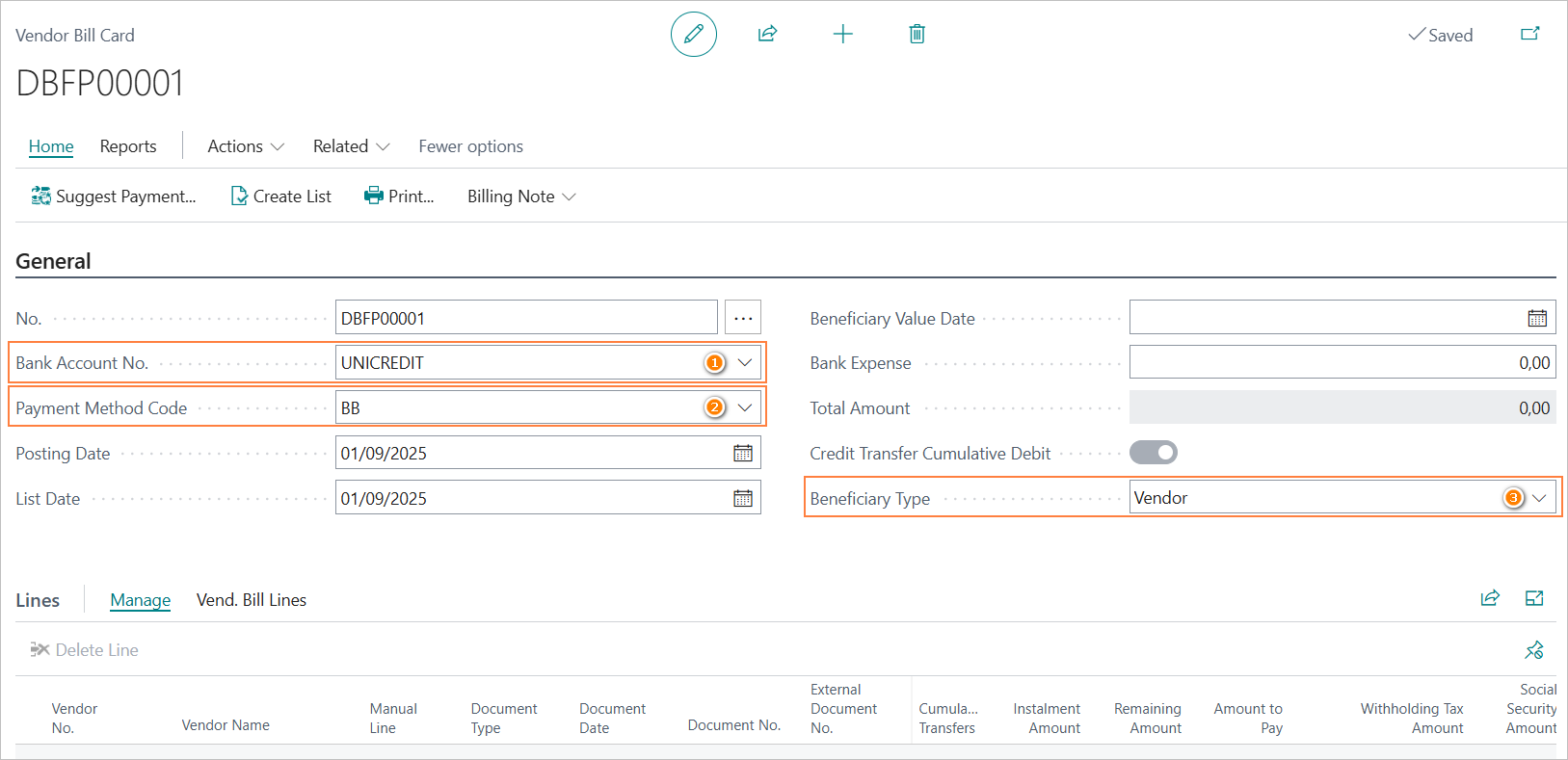

5.2.1 Entering Vendor Transfer Bill

To enter a transfer bill for vendor payments, select the menu item “Vendor Bill Card”.

From the Vendor Bill Card page, you can access the list of draft vendor transfer bills.

Here, you can view all payment instructions that have been entered but not yet posted.

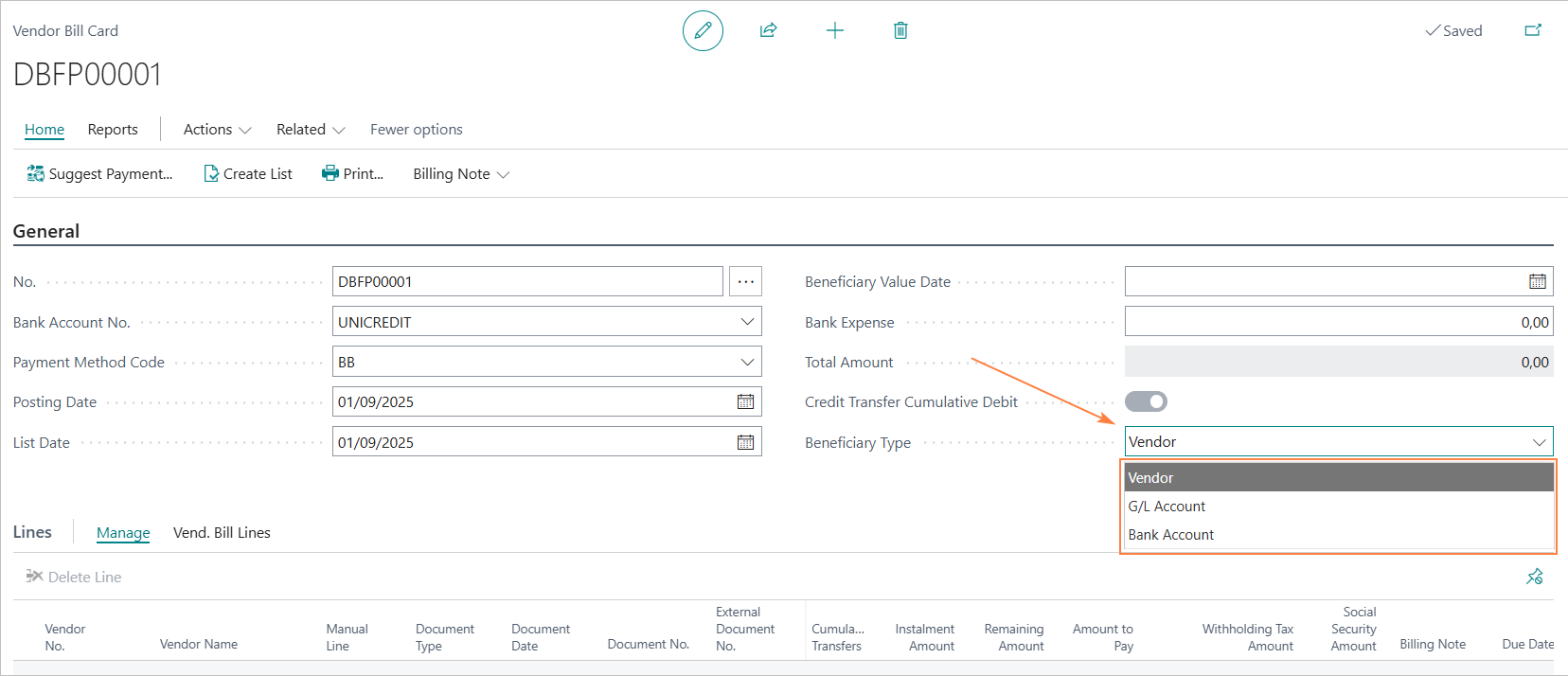

To create a new transfer bill, click the “New” action. In the document, the following fields must be filled in:

- “Bank Account No.” (1): The bank account used to make the payment.

- “Payment Method Code” (2): the payment method associated with the documents to be included in the payment proposal.

- “Beneficiary Type” (3): the beneficiary type (Vendor, G/L Account, Bank Account).

Posting Date and List Date are automatically suggested based on the current work date.

Beneficiary Type

The “Beneficiary Type” field allows you to specify the type of account to be posted as the counterpart.

The available options are as follows.

| Field | Description |

|---|---|

| Vendor | This is the default setting. It enables the payment of vendor invoices or the manual creation of vendor payments. The dispositions result in a posting to the vendor subledger. |

| G/L Account | This option allows you to execute a bank transfer by posting the amount directly to a general ledger account. |

| Bank Account | This option enables you to execute a bank transfer to a different bank account belonging to the company. |

Note

It is not possible to include dispositions with different “Beneficiary Type” values in the same payment proposal.

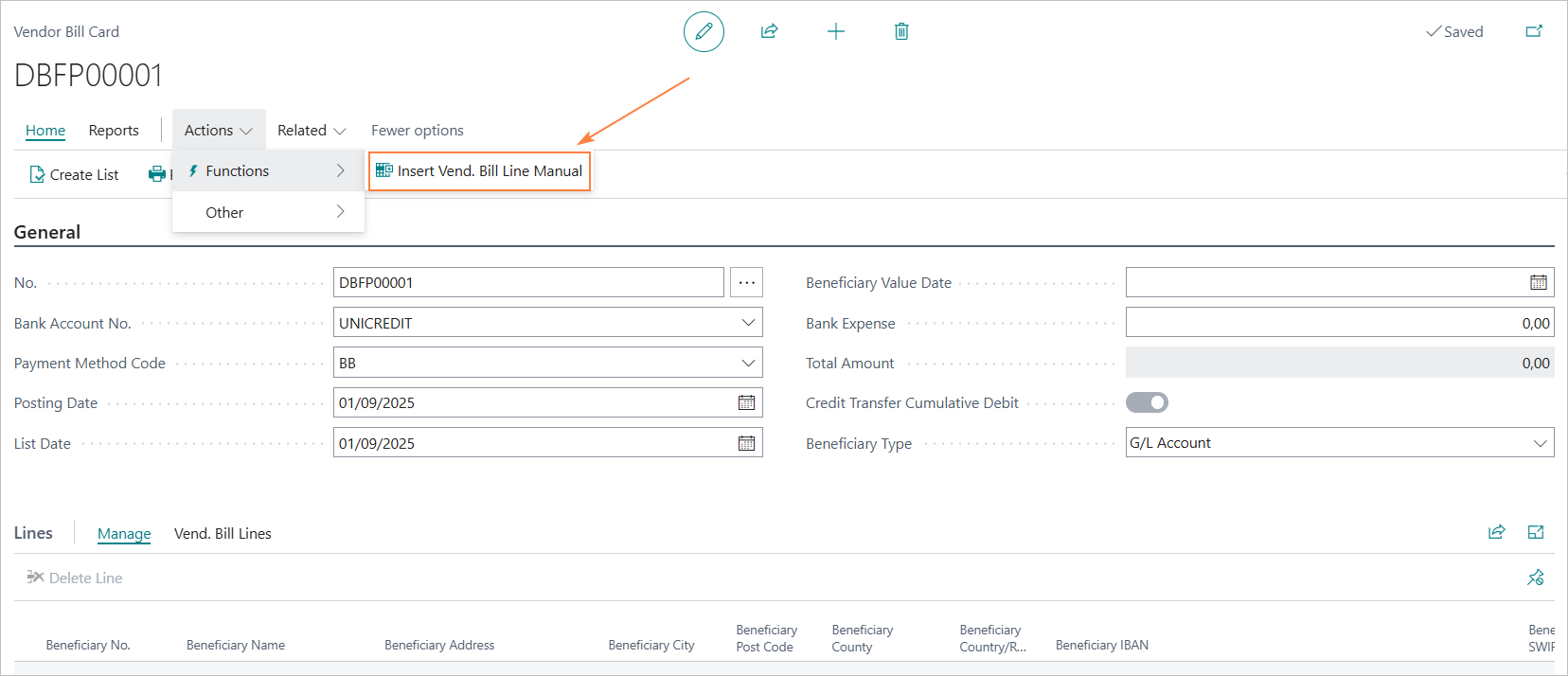

Entering Dispositions

When the “Beneficiary Type” is set to G/L Account or Bank Account, dispositions must be added exclusively via the “Insert Vend. Bill Line Manual” function.

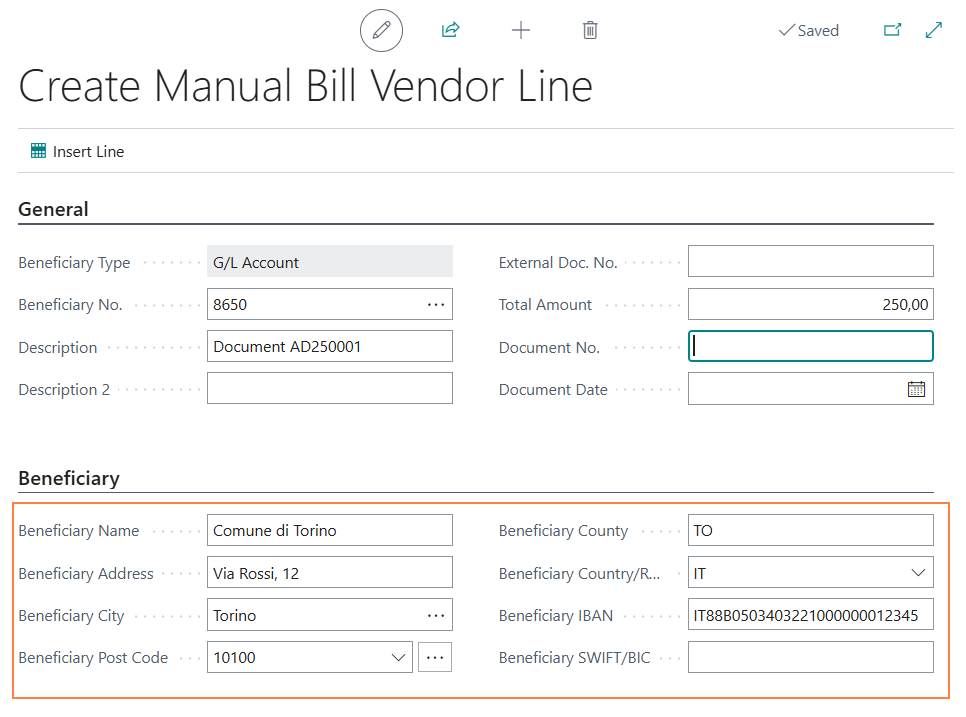

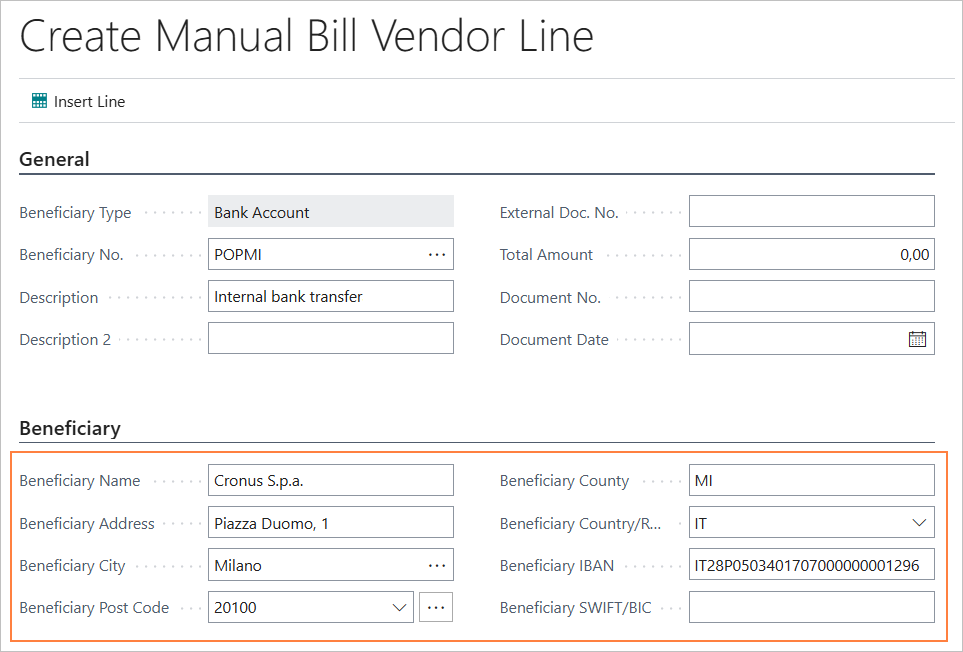

Beneficiary Information

The “Create Manual Bill Vendor Line” page includes a newly added “Beneficiary” section, which enables the entry of beneficiary information necessary for processing the payment instruction.

**Vendor Transfer Bill of type “G/L Account”**

In payment proposals of type “Bank Account”, the beneficiary’s information must be manually entered by the user.

**Vendor Transfer Bill of type “Bank Account”**

In payment proposals of type “Bank Account”, beneficiary details such as name and postal address are retrieved from Company Information, whereas IBAN and SWIFT codes are sourced from the selected bank record.

Note: Transfers of type “Conto C/G” and “C/C bancario” cannot be combined.

5.2.2 Creation of the SCT file (SEPA Credit Transfers)

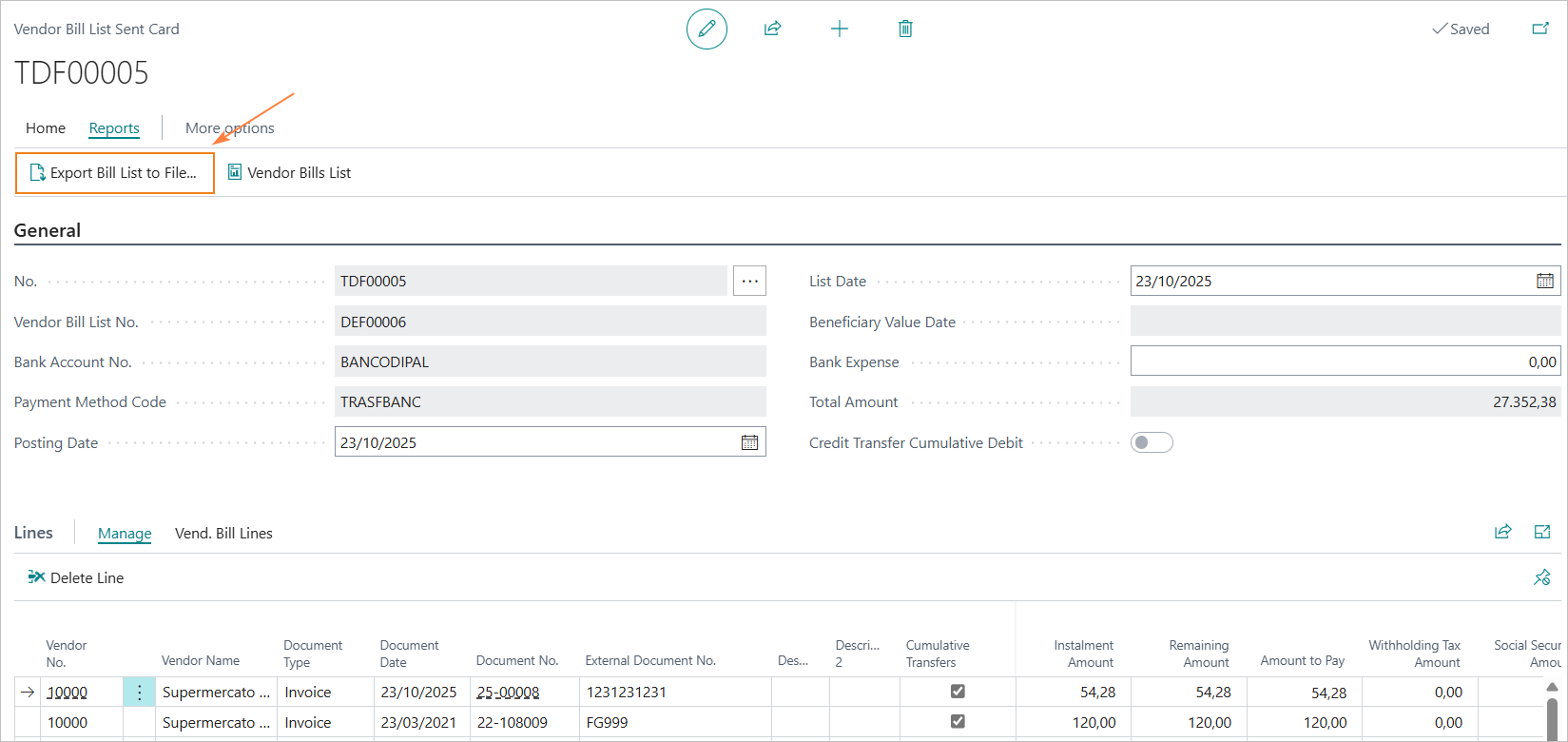

Vendor Bill List Sent Card

To export the SCT file from the Vendor Bill List Sent Card, select the “Export Bill List to File” action.

5.3 Credit Transfer Cumulative Debit

It is possible to define how the bank should report the payments of the bill list on the periodic statement.

The credit transfer cumulative debit reporting request covers the entire bill list and with it, in practice, you are asking the bank to report, on the statement, a single transaction for the total of the bill and not the individual payment.

This mode of reporting is consistent with that used in Business Central in the bank entry, which creates a debit line on the bank account for the total of the bill.

The reporting mode should not be confused with the “cumulative transfers” option, which allows a single transfer to be arranged to pay multiple invoices for the same supplier.

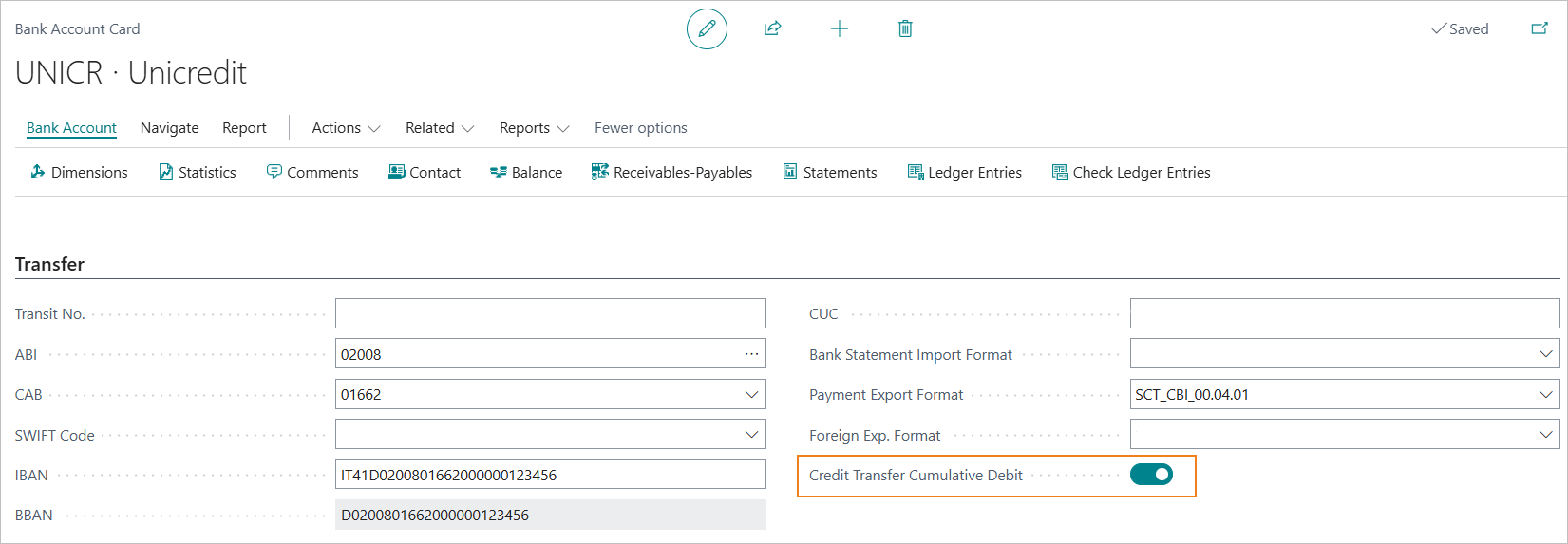

Credit Transfer Cumulative Debit - Bank Account Card

Credit transfer cumulative debit is selectable, on the bank account, via the “Credit Transfer Cumulative Debit” field in the “General” tab.

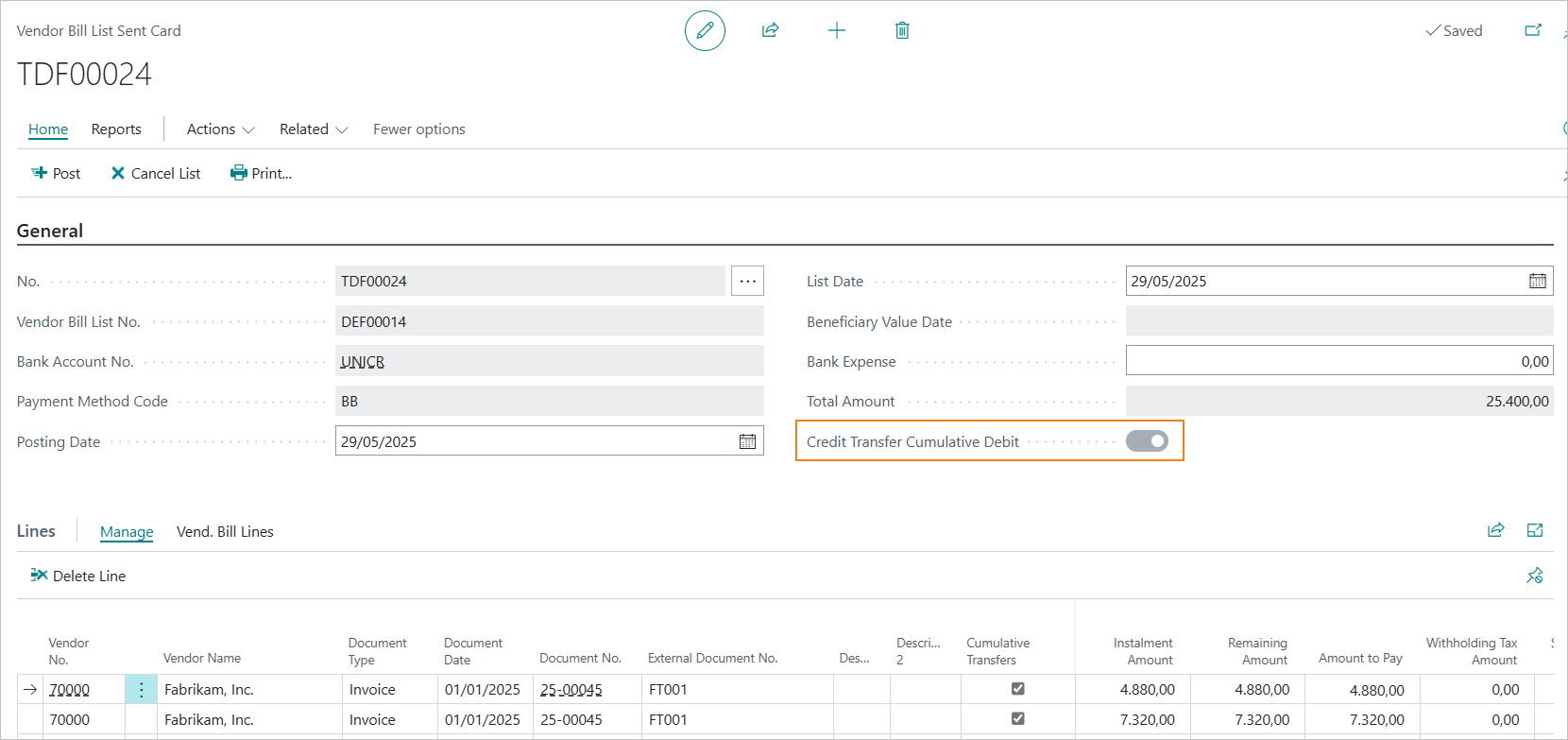

Credit Transfer Cumulative Debit - Vendor Bill List Card

All payments, issued on a given bank, will automatically carry the bank’s “Cumulative Bill Debit” setting.

The information is not editable in the Vendor Bill List and Vendor Bill List Sent Card.

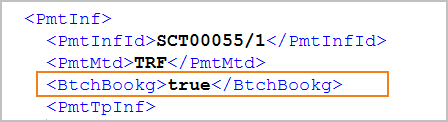

***Tag “BtchBookg”***

The information, in the XML file, is carried via the tag “BtchBookg”.

If “BtchBookg” is true the cumulative bill charge is requested.

Example

5.4 Credit Transfer Cumulative Debit (Beneficiary Different from Supplier)

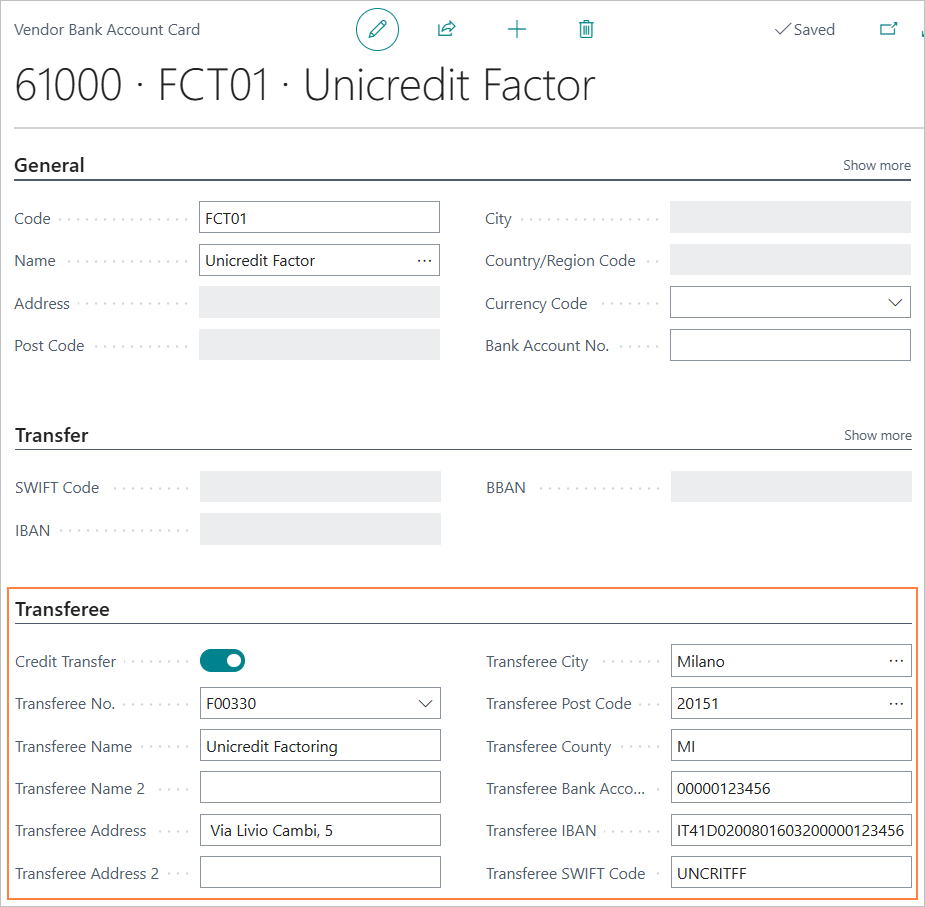

In cases where a supplier has transferred its receivables to a third party, such as a factoring company, it is possible to manage payments correctly by specifying an alternative beneficiary in the vendor’s bank account card.

This functionality allows the payment to be directed to the third party (e.g., the factoring company), while maintaining the correct accounting entry on the supplier’s ledger.

A dedicated “Transferee” section has been added to the vendor bank account card, enabling the entry of beneficiary details different from the supplier for invoice payments.

To activate this functionality, simply fill in the relevant fields for the alternative beneficiary (name, address, IBAN, etc.). These details will then be used in the payment proposals.

This ensures that the payment is executed in favor of the transferee, while the accounting remains correctly posted to the original supplier.

5.5 Technical Information

The SCT file in Italy is subject to the standards of the CBI (Corporate Banking Interbancario) service, which adopts the ISO20022 standard format.

The current version is defined by the technical manual “STIP-MO-001 Payments-v.00.04.01 ENG” version 00.04.01 dated 02/11/2023.

Reference ISO20022 format: CustomerCreditTransferInitiationV03 - pain.001.001.09.

6. XML Cross-Border Credit Transfer

6.0 Setup

The basic settings for creating XML Foreign Transfer payment are, below, reported.

6.1 Bank Export/import Setup

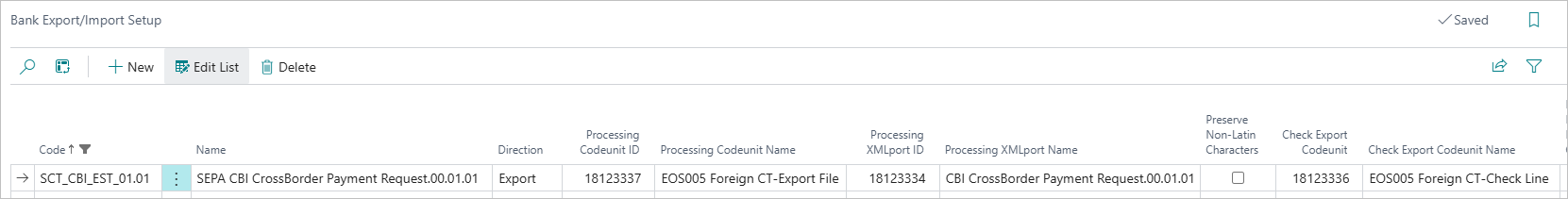

A new export format code will need to be created in the Bank export/import setup.

- Processing Codeunit ID:18123337 - “EOS005 Foreign CT-Export File”.

- Processign XMLport ID: 18123334 - “CBI CrossBorder Payment Request.00.01.01”.

- Check Export Codeunit: 18123336 - “EOS005 Foreign CT-Check Line”.

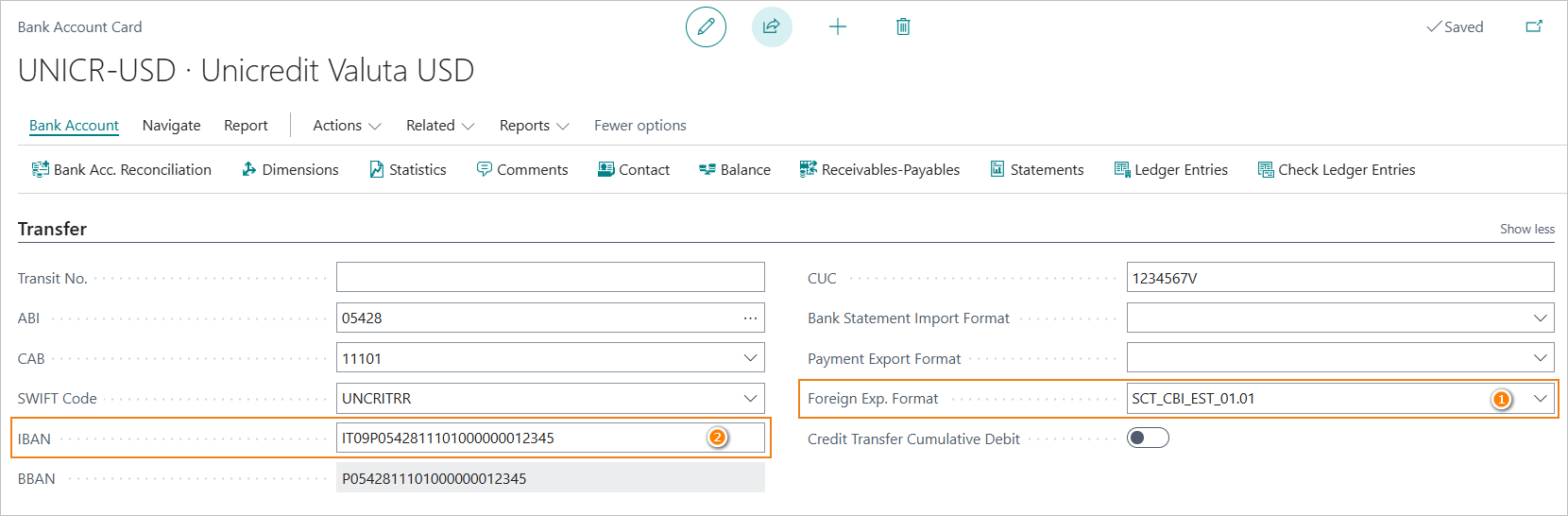

6.2 Bank Account Card setup

In the “Transfer” tab of the bank account card the following parameters should be set.

- Foreign Exp.Format (1): impostare il formato esportazione creato allo scopo.

- IBAN (2): IBAN code is mandatory.

CUC Field

According to CBI standards, the CUC code (CBI Unique Code) is mandatory.

It is an 8-character alphanumeric code that is assigned by the banking system.

However, this data element is not always required by the bank, and to ensure continuity with previous versions, a specific check has not been implemented.

Therefore, it is suggested that the “CUC” field on the bank account card be valorized in order not to risk the discarding of the provision.

In the “General” tab of the bank account card, the parameter should be set: Credit Transfer Msg. Nos.. Here the Serial No. to be assigned to the name of the SCT file that will be created should be indicated.

Note: foreign currency payments

To make transfers in a foreign currency, a bank in the same currency must be set up.

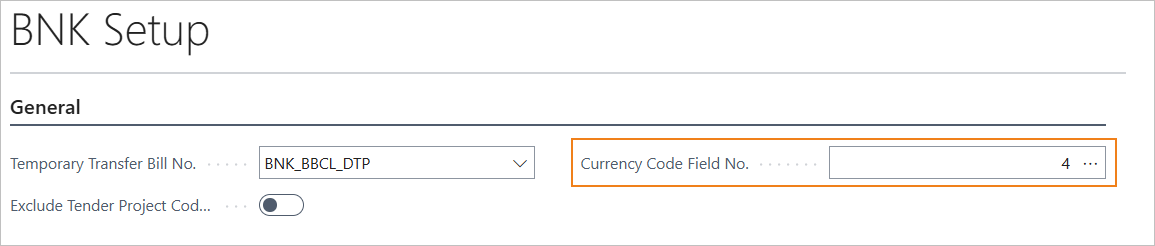

6.3 BNK Setup

In the BNK Setup, the “Currency Code Field No.” allows you to specify which field in the Currencies table should be used to provide the ISO code of the payment currency.

6.4 Company Information Setup

The VAT number of the company is a mandatory data element in the XML file of transfers. The “VAT Registration No.” field on the “Company Information” tab must be mandatorily filled in.

6.5 Information to be included in the provisions on the the vendor bill lines

The following information must be set on the rows of the vendor bill for foreign transfers.

Bank Charges

Specifies which party will bear the charges associated with the transaction.

Takes one of the following values:

- Our Charge (“DEBT”)

- Shared (“SHAR”)

- Beneficiary (“CRED”)

Notes

- The commission type must be the same for the entire bill.

- According to CBI rules, the commission type field mandatorily takes the value “SHAR” if the payee is valorized with IBAN coordinate that contains a Country Code belonging to the European Economic Area.

Reason CVS

May take the following values:

- “INF” (below CVS threshold).

- “SNR” (non-resident party).

- “CVA” (assignment of a single currency code).

- “CDV” (transfer of currency between residents).

CVS Tariff Number

The field must be completed in the case of Reason CVS = “CVA”, in other cases it is optional.

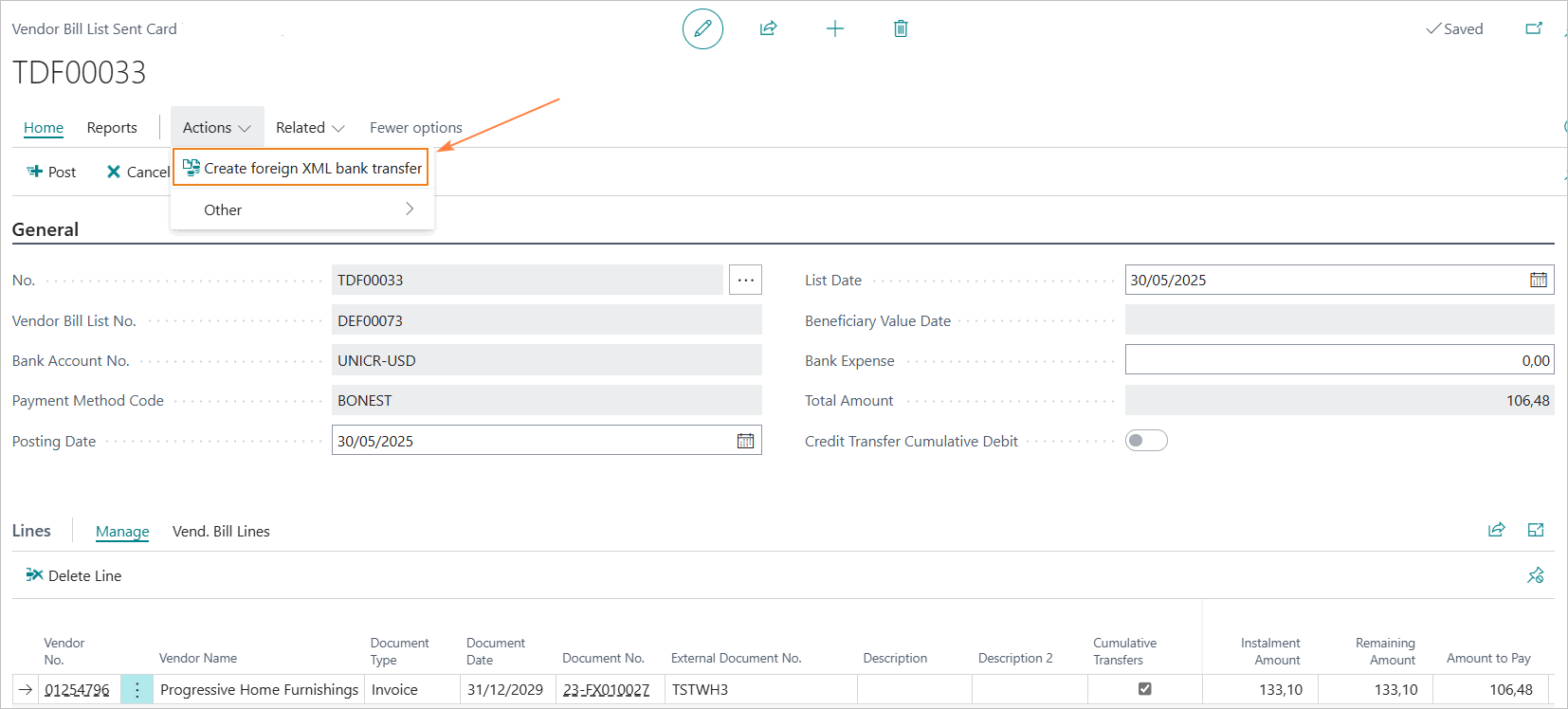

6.6 Creation of the XML foreign transfer payment file

Vendor Bill List Sent Card

To export the XML foreign transfer payment file from the Vendor Bill List Sent Card, select the “Create foreign XML bank transfer” action.

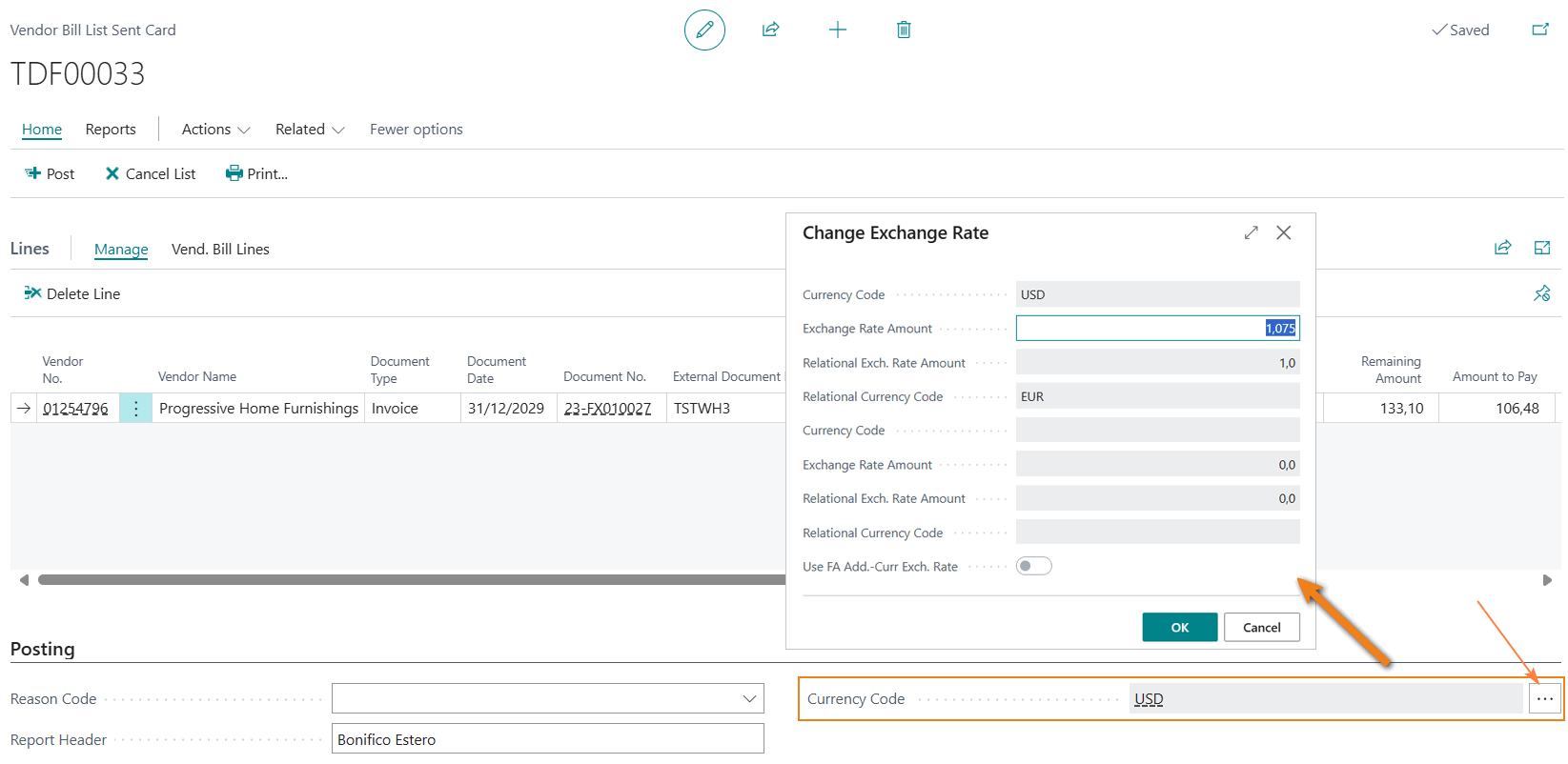

6.7 Currency Management

The ability to define the exchange rate to be used in the Bill List entry has been implemented. The exchange rate is proposed based on the List Date, but can be changed by selecting the assist edit of the Currency Code field.

6.8 Technical Information

The XML Cross-Border Credit Transfer file in Italy is subject to the standards of the CBI (Corporate Banking Interbancario) service, which adopts the ISO20022 standard format.

The current version is defined by the technical manual “STPE-MO-001 Payments-v.00.01.01 ENG” version 00.01.01 dated 02/11/2023.

Reference ISO20022 format: CustomerCreditTransferInitiationV03 - pain.001.001.03

7. SEPA Credit Transfers ISO 20022 (EU)

Setup

If you wish to use the SEPA format based on ISO 20022 specifications instead of the SEPA-CBI format, a different setup must be configured.

This is because the rules defined by CBI (Corporate Banking Interbancario) are not mandatory for all banks operating in Italy. Some foreign banks operating in Italy use the SEPA format based on ISO 20022 specifications as an alternative to the SEPA-CBI format.

Additionally, there may be cases where SEPA payment instructions need to be sent directly to foreign banks that are part of the SEPA network.

Setup importazione\esportazione banca

In the bank import/export setup, a specific export format code must be created with the following parameters.

- Processing Codeunit ID: 1220 - “SEPA CT-Export File”.

- Processing XMLport ID: 1001 - “SEPA CT pain.001.001.09”.

- Check Export Codeunit: 1223 - “SEPA CT-Check Line”.

Note: this configuration is included in the standard product and does not require the use of the BNK app.

Technical Information

Reference ISO20022 format : CustomerCreditTransferInitiationV03 - pain.001.001.09

8. SEPA Credit Transfers - Customers

With the BNK app, it is possible to issue customer refund transactions via SEPA bank transfer. This feature allows you to refund posted credit memos or to enter manual refund transactions.

Bank transfers to customers” - SUMMARY

Press ALT + Q and type “BNK” or “CBI” to search for the different items of the functionality.

8.1 Setup

The basic settings for creating customer refund transactions via SEPA bank transfer are as follows.

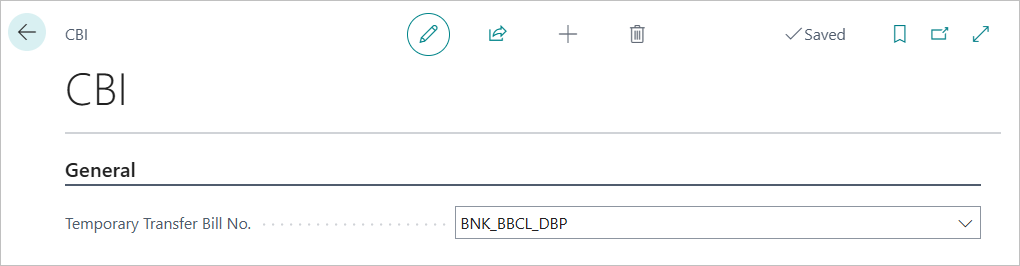

Setup BNK

In the “BNK Setup” page, you will need to enter the serial number related to the provisional customer bank transfer batch.

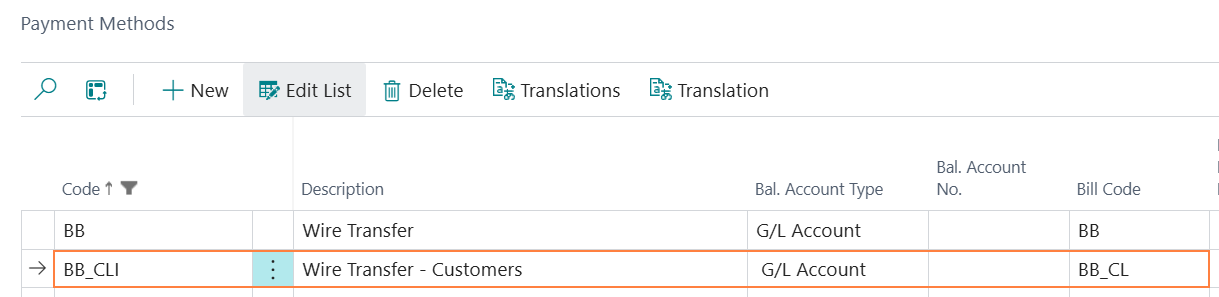

Setup payment method and bill code

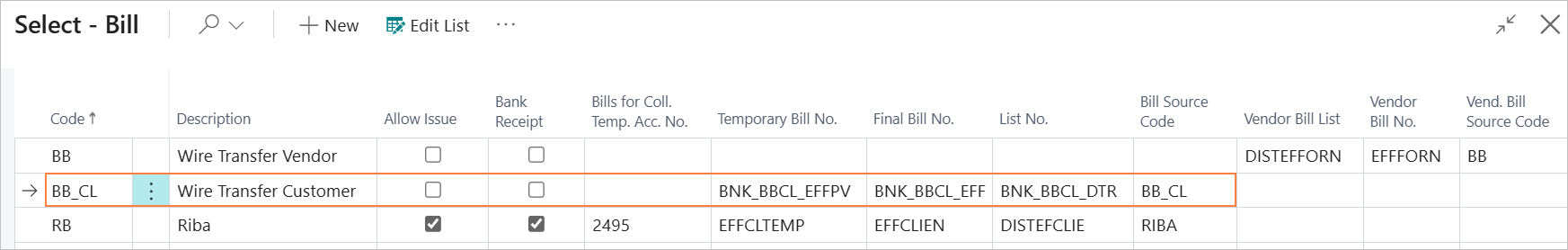

A payment method must be created and linked to a specific bill code.

Payment method example

Bill code example

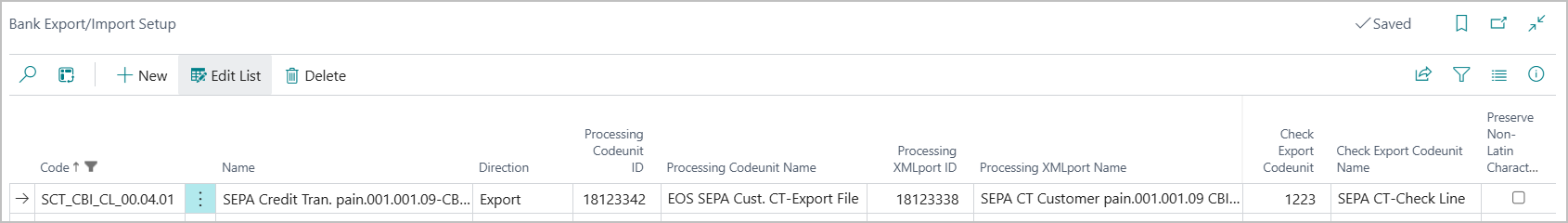

Bank Export/Import Setup

In the bank import/export setup, a specific export format code must be created and associated with the bank accounts.

The parameters to be set are as follows.

- Processing Codeunit ID: 18123342 “EOS SEPA Cust. CT-Export File”.

- Processing XMLport ID: 18123338 “SEPA CT Customer pain.001.001.09 CBI v00.04.01”.

- Check Export Codeunit: 1223 “SEPA CT-Check Line”.

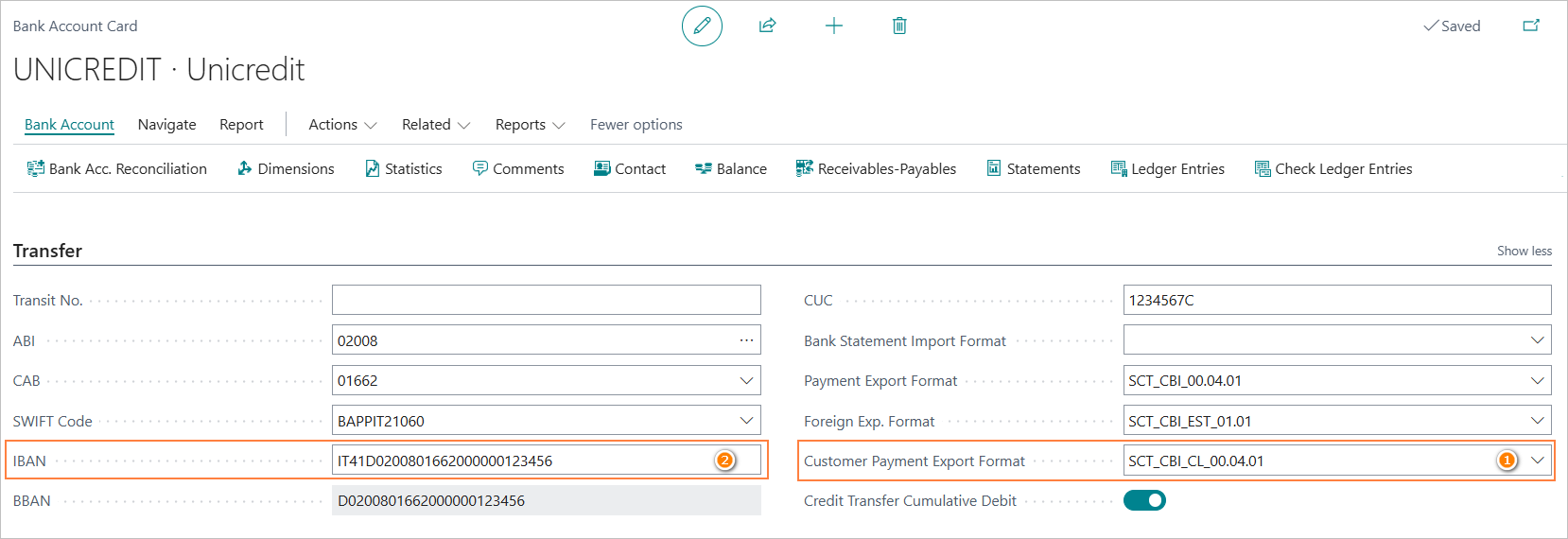

Bank Account Card Setup

In the “Transfer” tab of the bank account card, the following parameters must be set.

- Customer Payment Export Format (1): set the export format created for this purpose.

- IBAN (2): the IBAN code must be entered, as it is required.

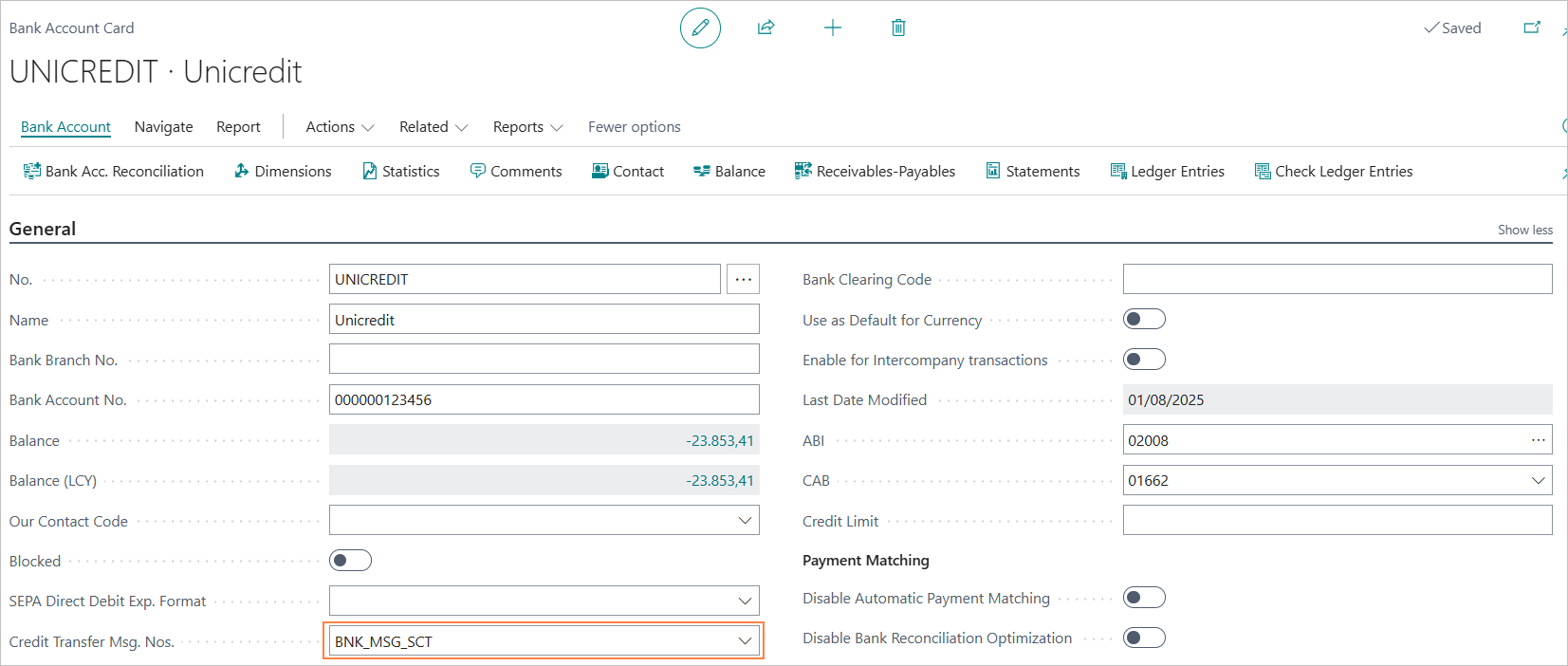

In the “General” tab of the bank account card, the field Credit Transfer Msg. Nos. must be set.

Here, you should specify the serial number to be assigned to the name of the SEPA file that will be created.

Note: The serial number that defines the name of the SEPA file will be the same for both vendor and customer transfers.”

Field CUC - Note

According to CBI regulations, the CUC (Unique CBI Code) is mandatory.

It is an alphanumeric code consisting of 8 characters, assigned by the banking system.

However, this information is not always required by the bank and, in order to maintain compatibility with previous versions, no specific mandatory check has been implemented.

Nevertheless, it is recommended to fill in the ‘CUC’ field on the bank account card to avoid the risk of the payment being rejected.

Company Information Setup

The company’s VAT number is a mandatory field in the XML file for bank transfers.

The ‘VAT Number’ field in the ‘Company Information’ tab must be filled in.

8.2 Entering Customer Transfer Bill and generating the SEPA Transfer File

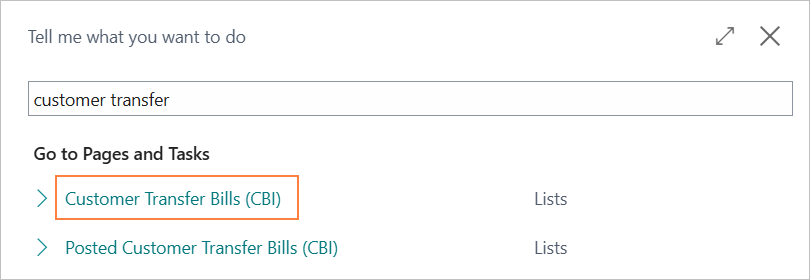

Customer Transfer Bill (CBI) - Entering

To enter a transfer bill for customer payments, select the menu item “Customer Transfer Bill (CBI)".

From the Customer Transfer Bill (CBI) page, you will access the list of draft customer transfer bills.

Here, you can view all payment dispositions that have been entered but not yet posted.

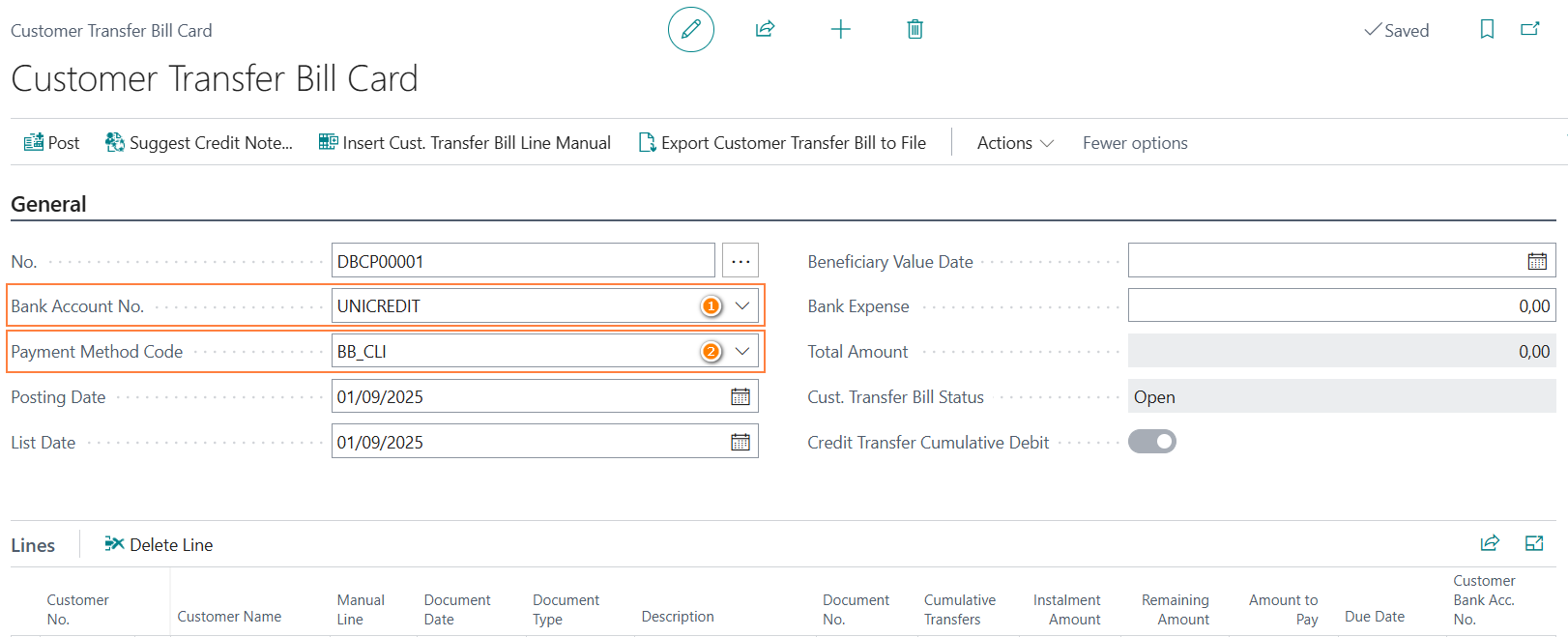

To create a new transfer bill, click the “New” action.

In the document, the following fields must be specified:

- “Bank Account No.” (1): the bank account from which the payment will be made.

- “Payment Method Code” (2): the payment method associated with the documents (credit notes) to be included in the proposal using the “Suggest Credit Note” action. The Posting Date and List Date will be automatically suggested based on the current work date.

Note: The bill will be created with the status “Open”.

To generate the payment file and post the bill, it must first be set to “Released”.

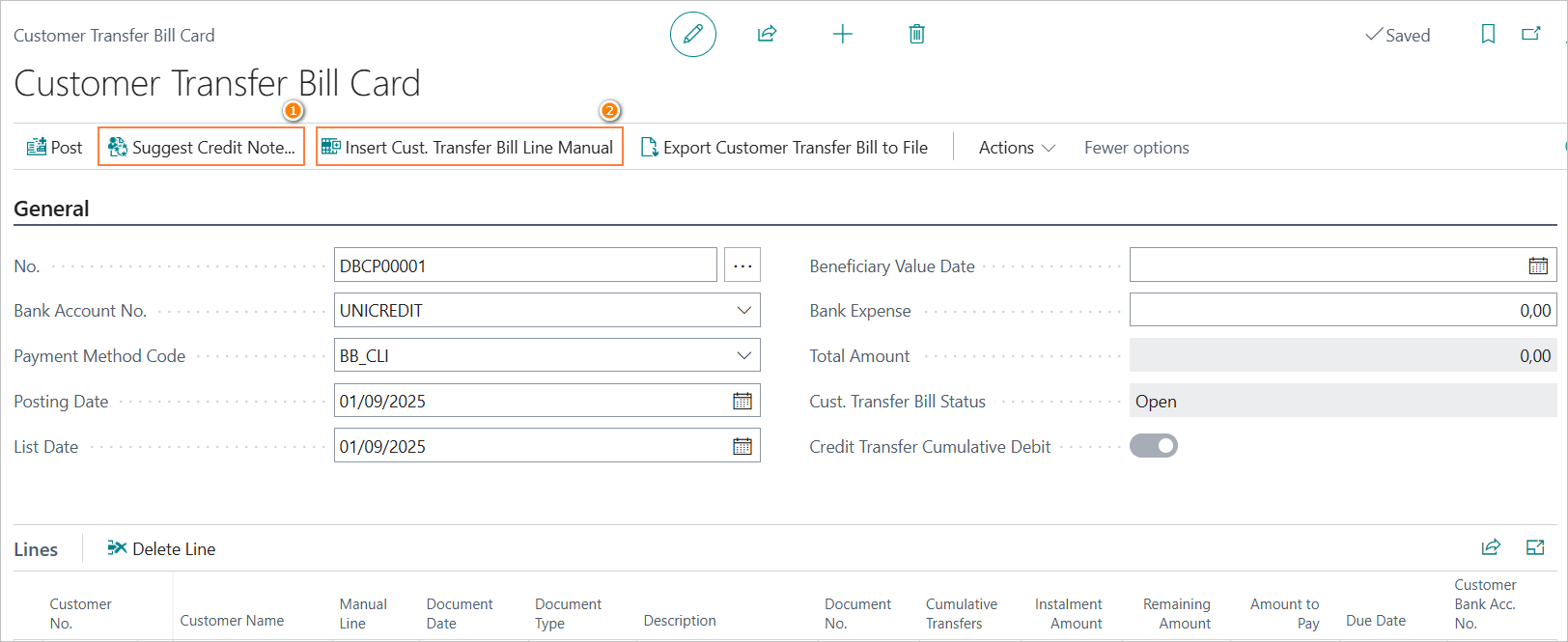

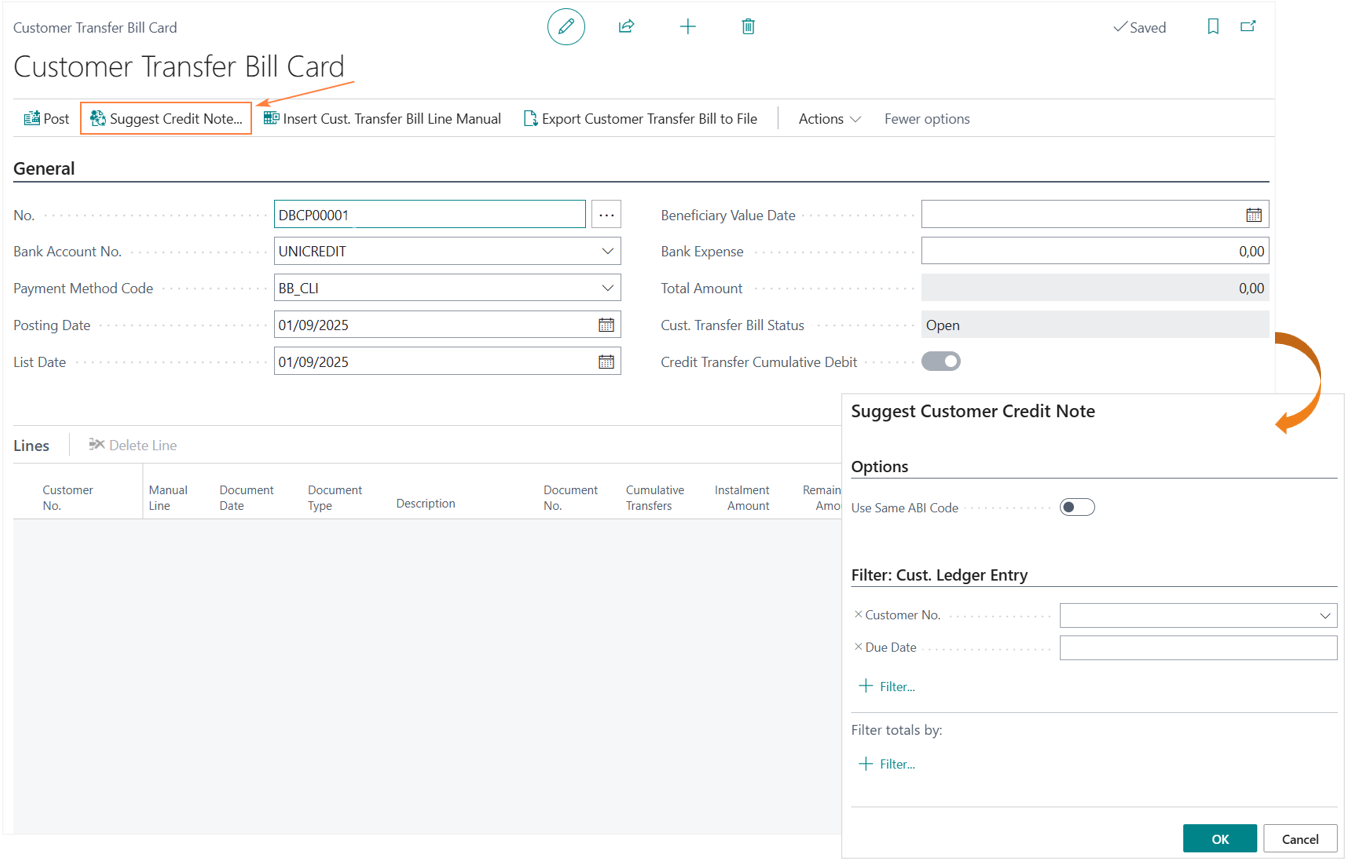

Customer Transfer Bill (CBI) - Entering payment disposals

Payment instructions can be entered using two different functions:

- “Suggest Credit Note” (1)

- “Insert Cust. Transfer Bill Line Manual” (2)

Customer Transfer Bill (CBI) - Suggest Credit Note

The “Suggest Credit Note” function automatically retrieves all credit notes that match the selected payment method and bank account. It is useful for quickly populating the proposal with eligible documents.

Credit notes will be proposed that have:

- the same payment method as that indicated in the statement,

- in Euro currency,

- with the “On Hold” field not filled in.

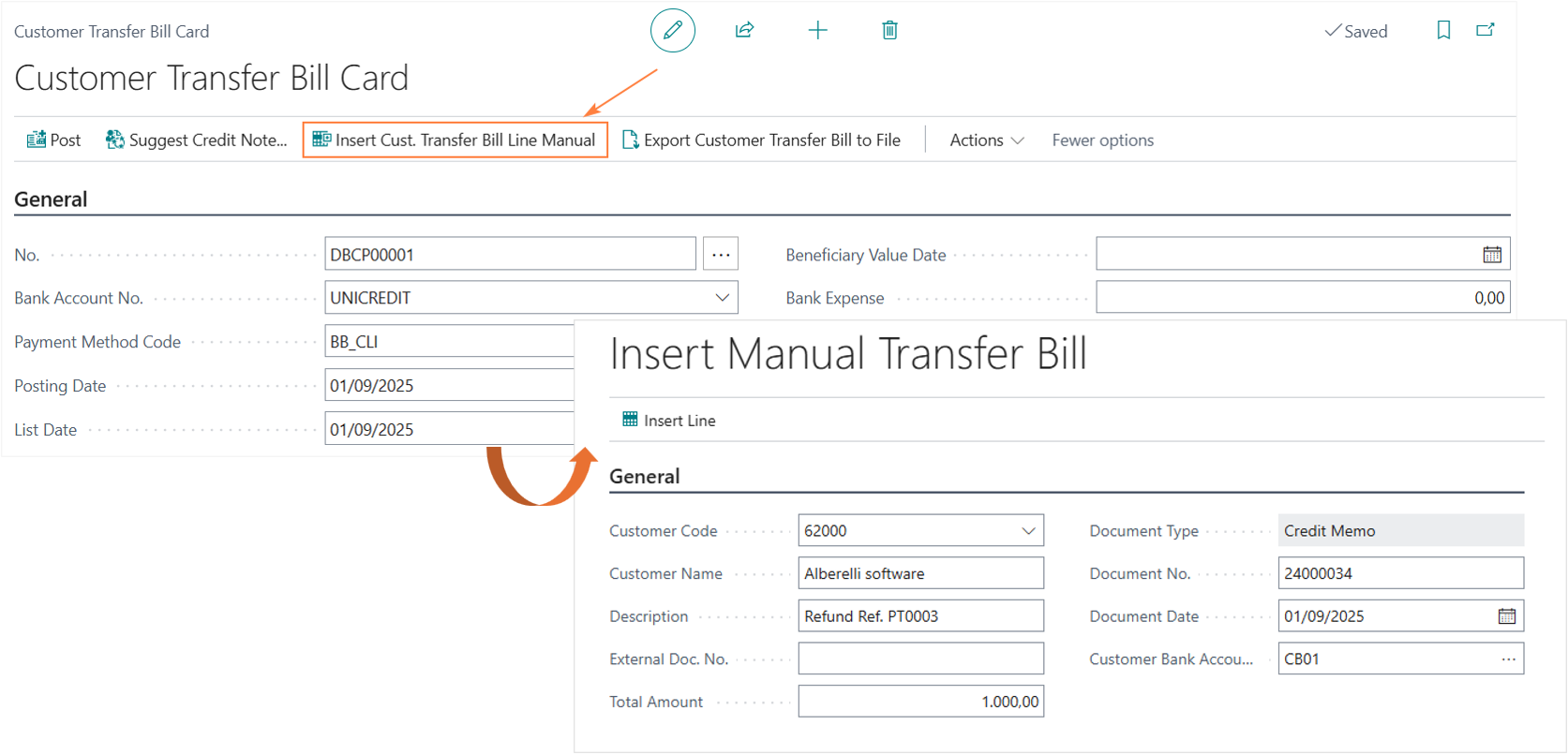

Customer Transfer Bill (CBI) - Insert Cust. Transfer Bill Line Manual

Using the function “Insert Cust. Transfer Bill Line Manual”, you can enter payment instructions that are not linked to previously posted credit memos.

When you select “Insert Cust. Transfer Bill Line Manual”, a page will open where you can manually enter the payment instruction details.

This function is particularly useful for managing manual payments or exceptional cases that require direct input.

The information to be entered is:

- Customer code.

- Description of the transaction (for single, non-cumulative transfers, this information will be included in the transaction).

- Amount in euros.

- Document number: the document number is always included in the payment instruction, even in the case of cumulative transfers.

- Document date: this information is for reference only and is not included in the SEPA file.

- Customer’s bank account number.

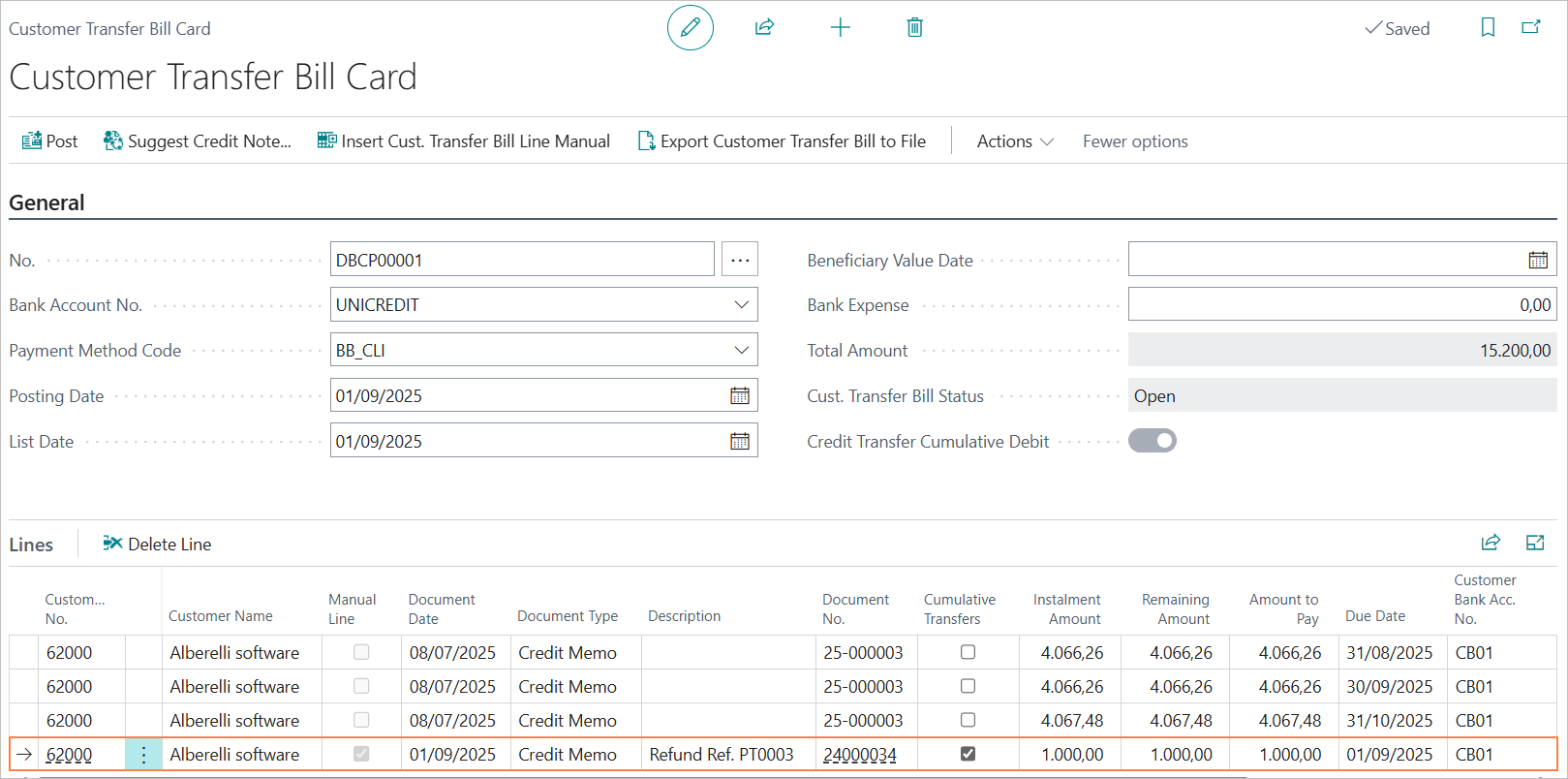

The instruction will be included in the list and highlighted with the attribute “Manual line.”

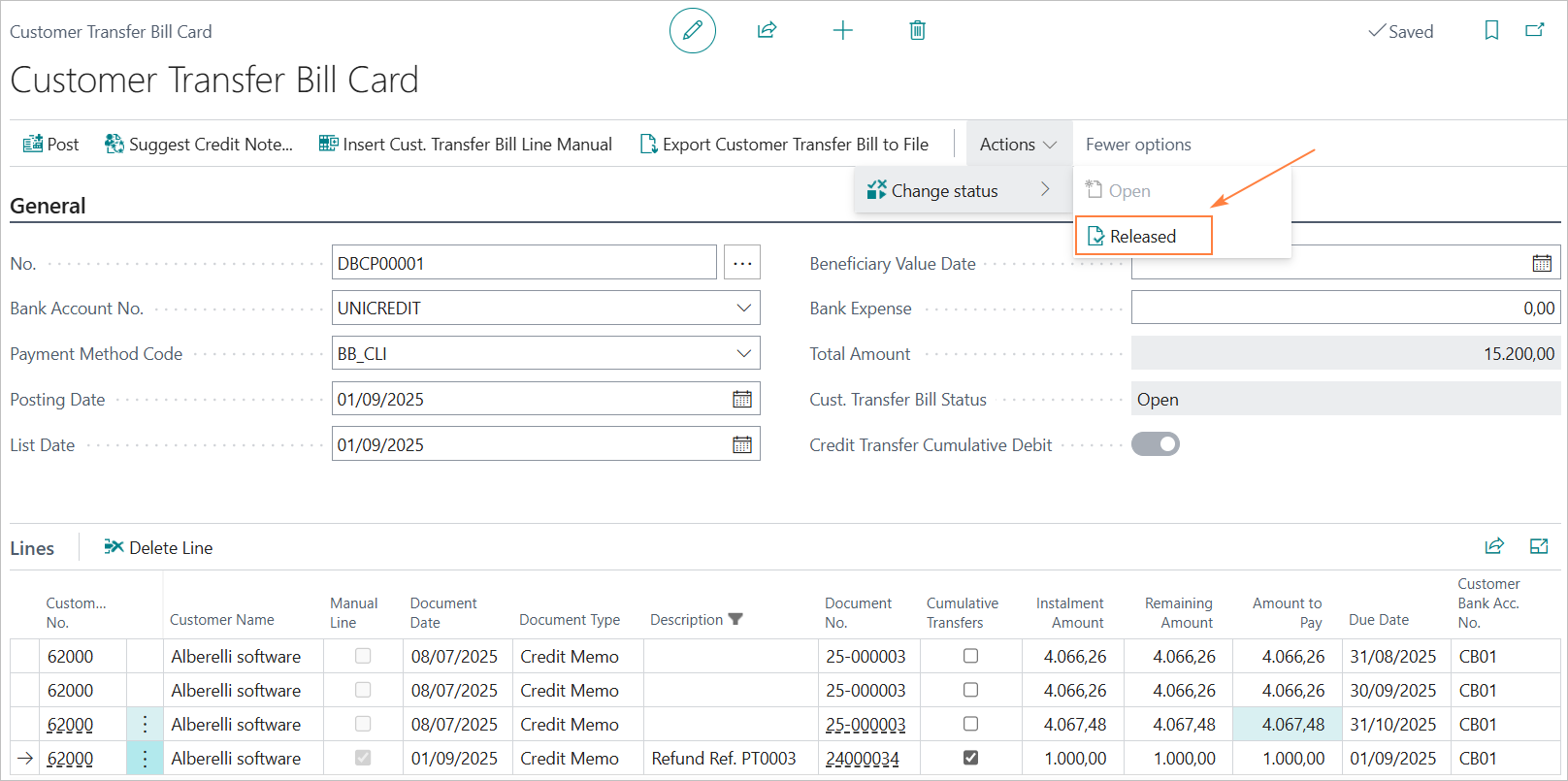

Customer Transfer Bill (CBI) - Release of the bill

To create the payment file and then proceed with posting the bill, you must set its status to “Released.”

You can release the bill by selecting “Change status” - “Released.”

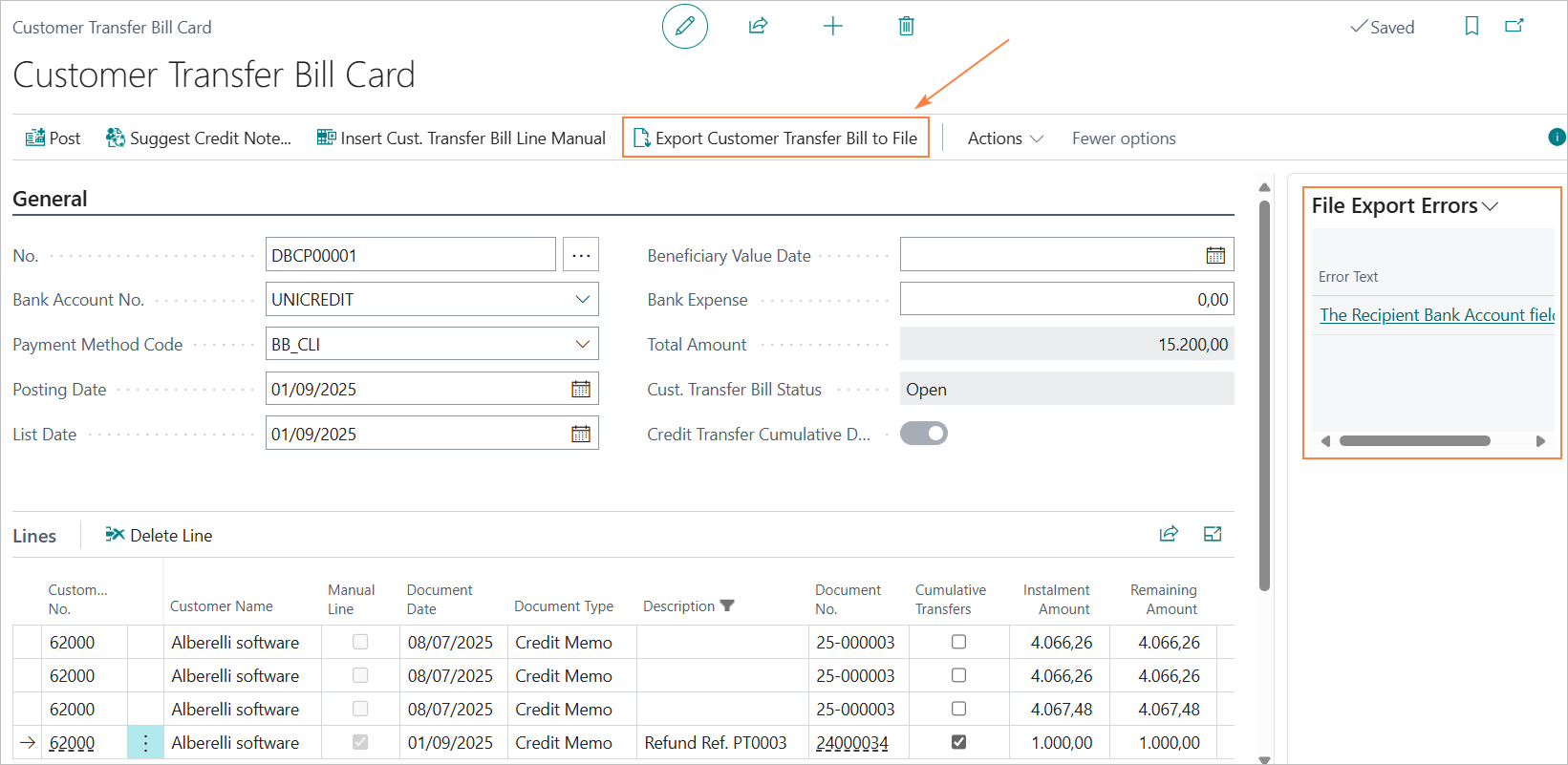

Customer Transfer Bill (CBI) - SEPA file export

To export the SEPA file, select the “Export Customer Transfer Bill to File” action.

Any errors in creating the files are reported in the “File Export Errors” factbox.

Customer Transfer Bill (CBI) - Posting of the bill

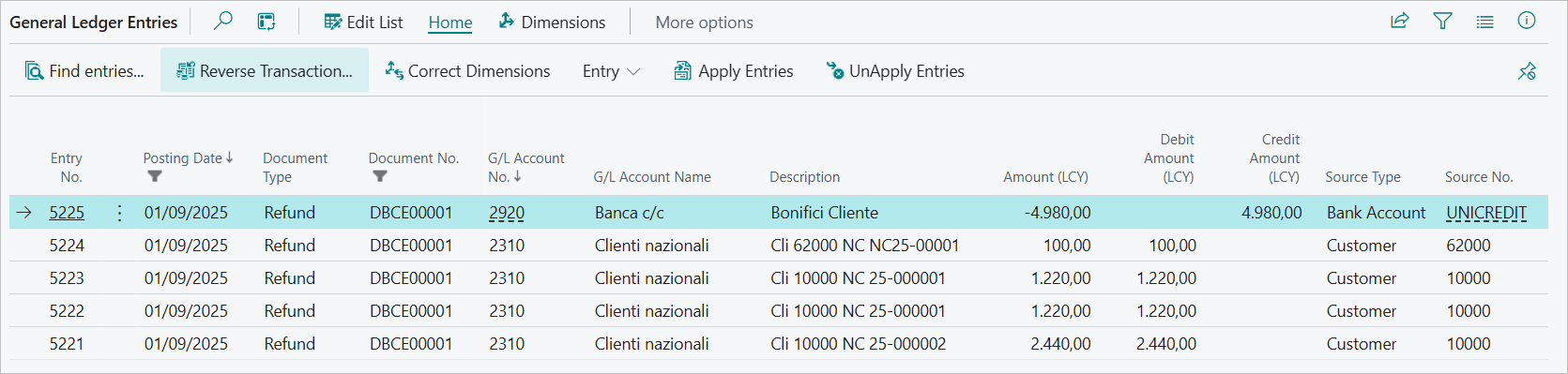

Posting the bill result in the following accounting entry:

Bank C/C @ Customers Credits

The document type for the accounting entry will be “Refund.”

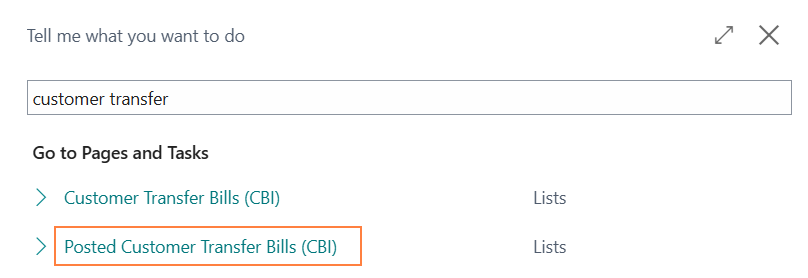

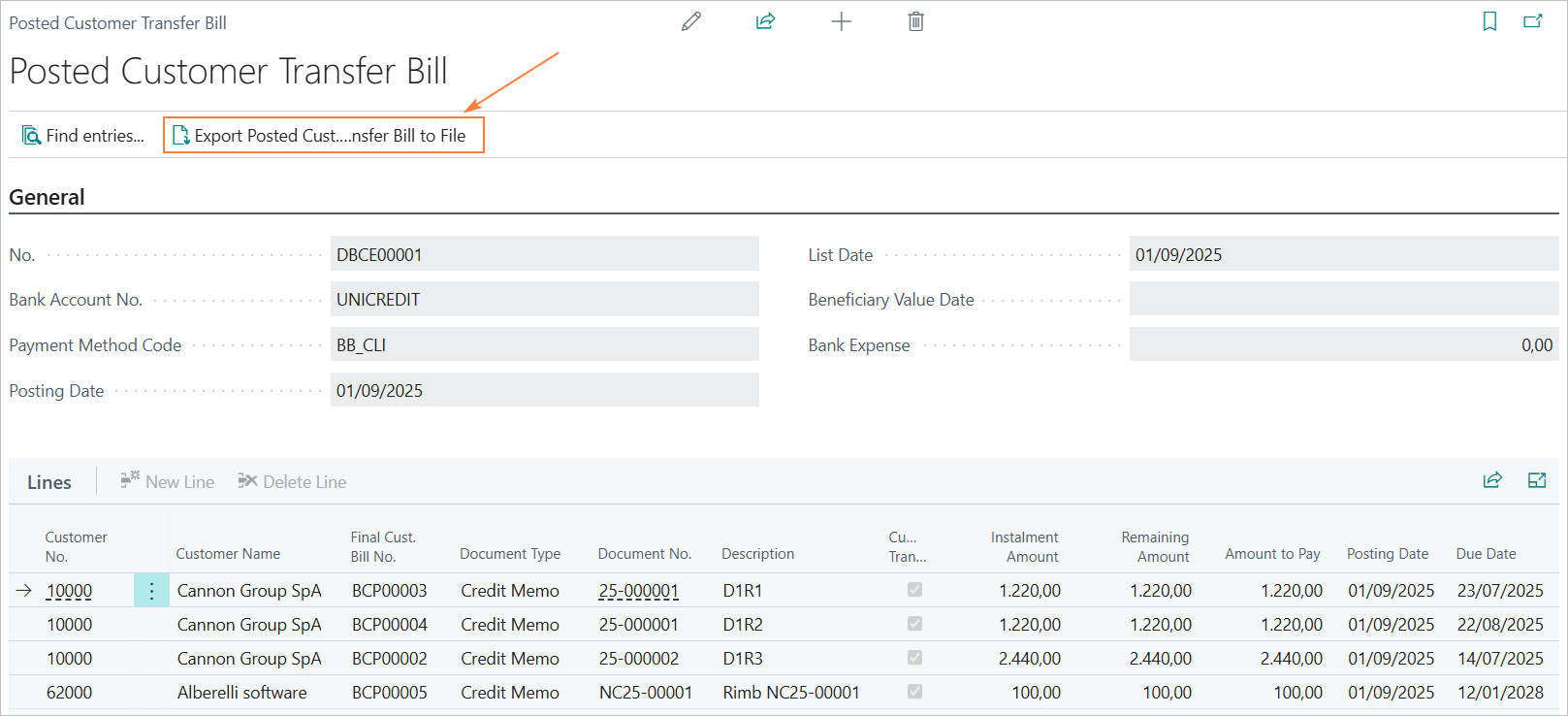

**Posted Customer Transfer Bill (CBI)**

Once the bill is posted, it is archived in the “Posted Customer Transfer Bill” archive.

You can export the SEPA file again from the Posted Customer Transfer Bill using the “Export Posted Customer Transfer Bill to File” action.

8.3 Credit Transfer Cumulative Debit

As with SEPA transfers to vendors, it is possible to define how the bank should report the payments of the bill list on the periodic statement.

The credit transfer cumulative debit reporting request covers the entire bill list and with it, in practice, you are asking the bank to report, on the statement, a single transaction for the total of the bill and not the individual payments.

For more information, please refer to chapter “5.5 Cumulative statement debit.”

8.4 Technical Information

The SCT file in Italy is subject to the standards of the CBI (Corporate Banking Interbancario) service, which adopts the ISO20022 standard format.

The current version is defined by the technical manual “STIP-MO-001 Payments-v.00.04.01 ENG” version 00.04.01 dated 02/11/2023.

Reference ISO20022 format: CustomerCreditTransferInitiationV03 - pain.001.001.09.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.