Discount on Line Document

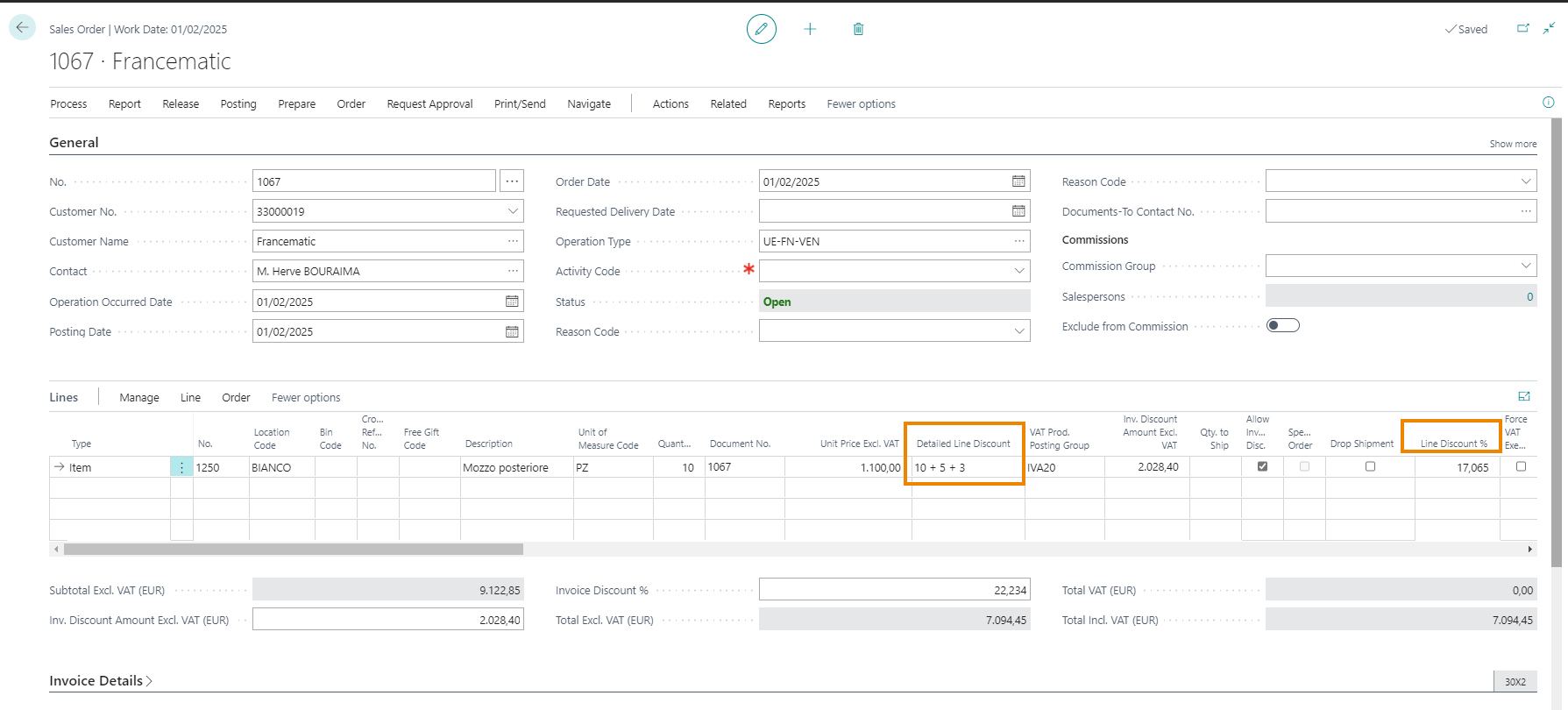

On the document LINES (e.g. Sales order) we insert a line Type=Item for example, a quantity and a unit price:

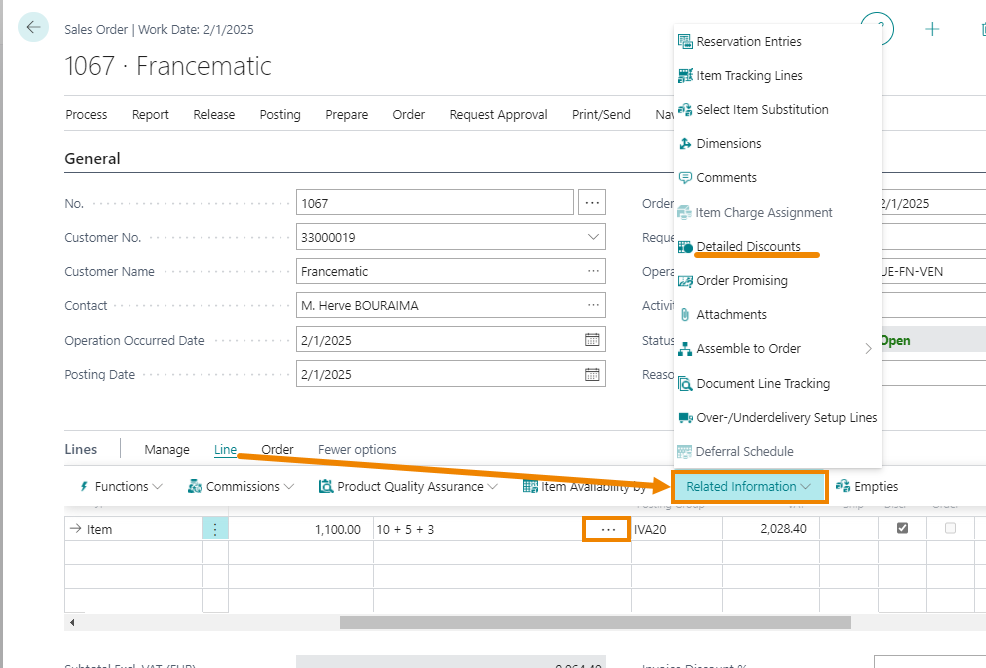

In addition to the standard “Line Discount %” field, the lines include the “Detailed Line Discount” field where multiple discounts can be entered. From Lines-> Related Information-> Detailed Discounts or by clicking the three dots:

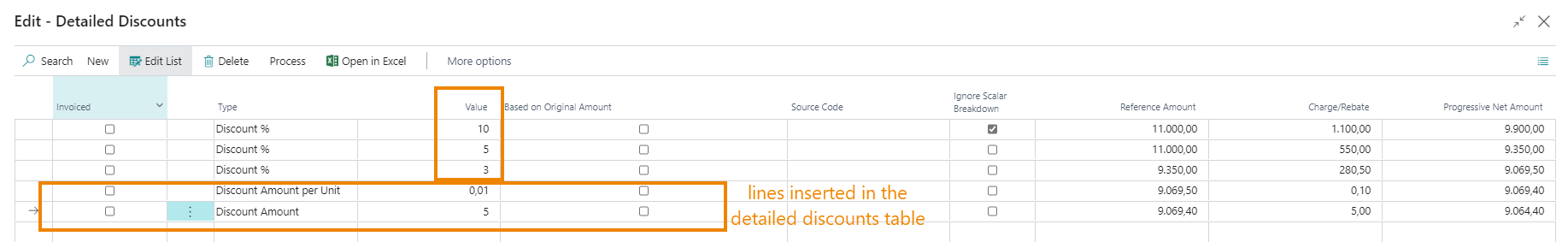

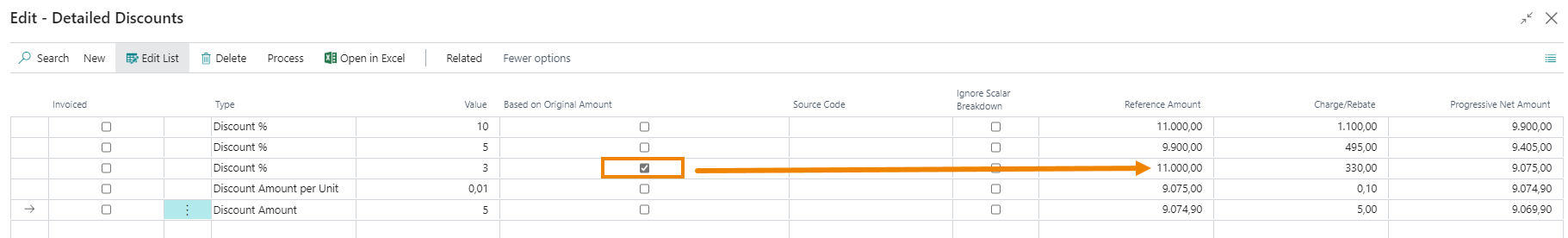

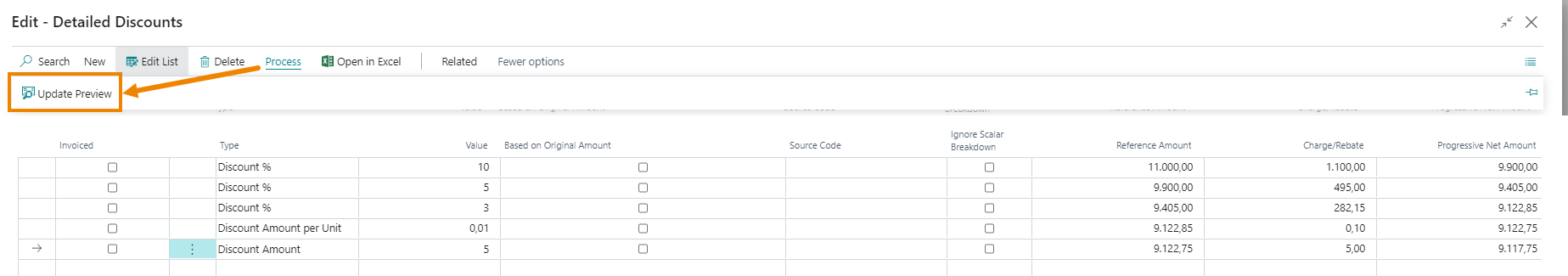

you can access the “Detailed Discounts” table in which you can view the discounts entered. It is also possible to add more discount lines:

the system has splitted the discounts entered in the document line by creating three detail lines. The last two lines were added manually.

| ⚠️ Note |

|---|

| In the detailed discounts table you can specify the discount Type . In the document lines the discount entered is always as a percentage. |

I campi principali sono:

| Field | Description |

|---|---|

| Invoiced | Indicates if this discount line has been invoiced. This only applies to fixed discount amounts. |

| Type | The options are: - Discount %: percentage discount to be applied - Discount Amount: fixed amount to be discounted - Discount Amount per unit: amount that is discounted for each piece of the item - Discount Amount per Net Weight: amount discounted on the net weight of the product |

| Based on Original | Specifies whether the discount for this line is calculated on the non-discounted original document amount. The system otherwise applies the discounts in succession to the resulting amount each time. |

| Process->Update Preview | Allows the system to populate the Reference Amount - Charge/ Rebate - Progressive Net Amount fields to preview the discount amounts. It must be performed at each modification. |

| Origin Code | if entered, indicates the source of the discount entry (e.g. payment terms / shipment methods) |

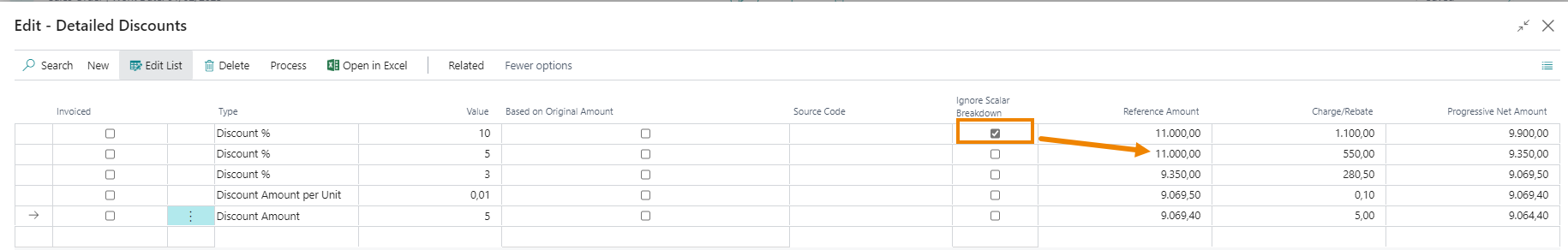

| Ignore Scalar Breakdown | The system, by default, calculates the discounts in scalar way on the amount that gradually decreases as the discounts are added. By enabling this option, the discounts start again from the original amount of the document: |

| Reference Amount | Amount taken as the basis for calculating the discount |

| Charge/Rebate | Amount that is discounted |

| Progressive Net Amount | Net amount of the document with discounts included |

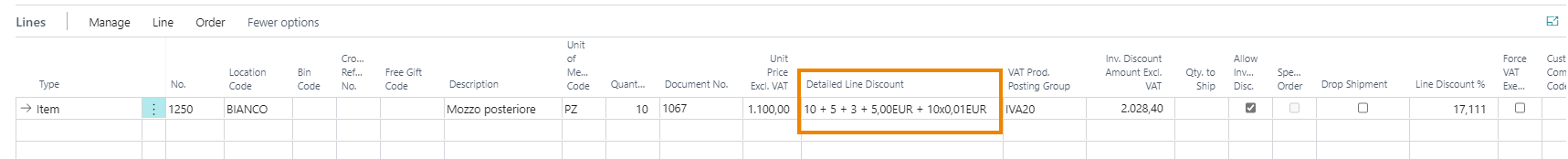

By closing the detail table and returning to the document, the system adds the discounts entered on the detail page:

| ⚠️ Note |

|---|

| The standard field “% discount line” is however populated automatically by the system. |

Discount on Header Document

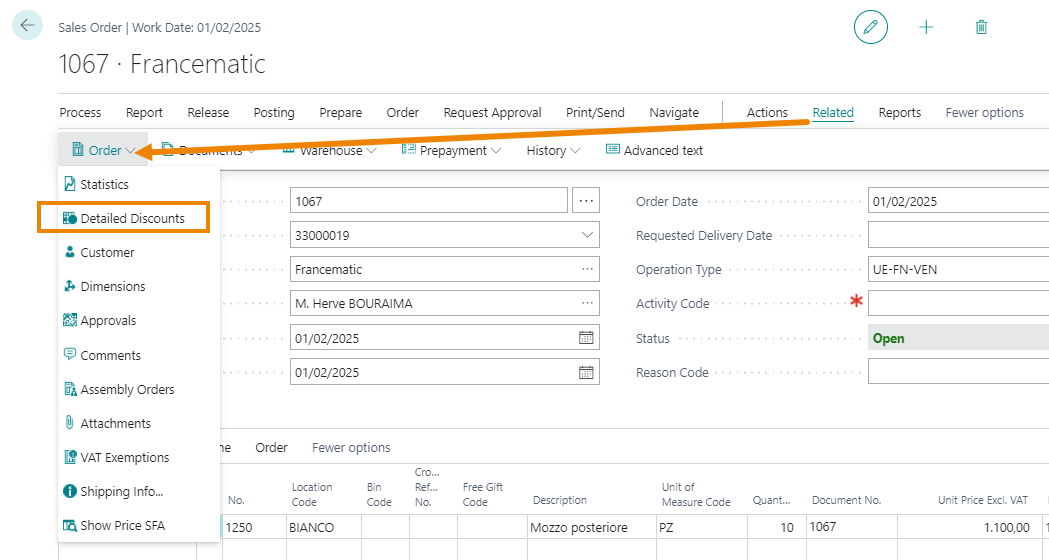

It is also possible to apply document discounts from Related-> Order->Detailed Discounts:

There is a table like the previous one in which to enter the discounts.

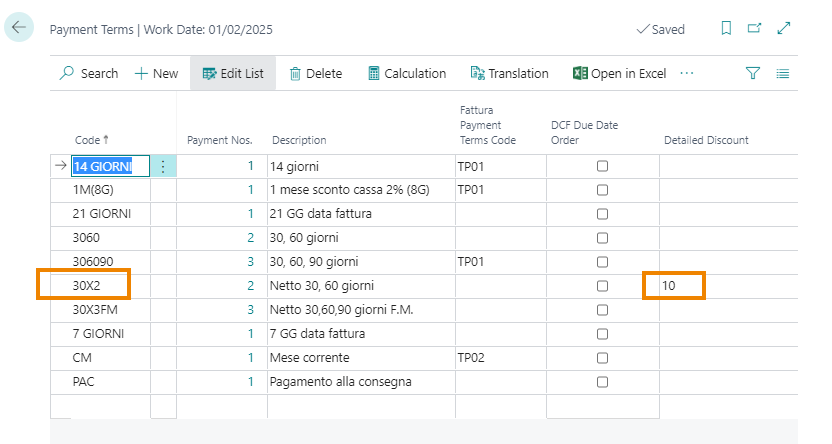

Header discounts can be inherited from:

- Payment terms

- Shipping methods

On both pages there is the “Detailed Discount” field where the discounts are entered.

Price List

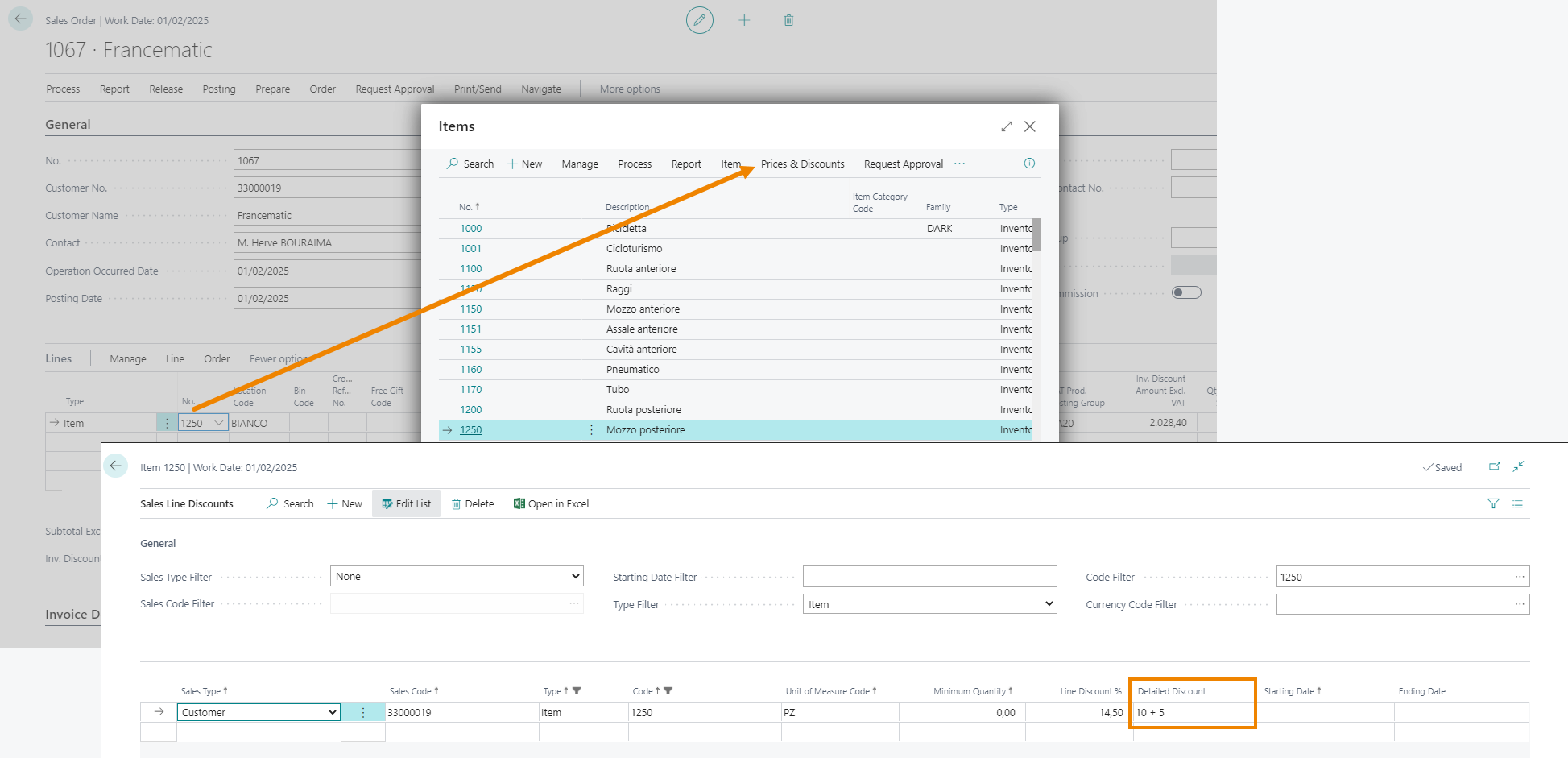

Discounts can also be applied to the price list

From the three dots of the Detailed Discount field you can access the detailed discounts table. In this case, the Process-> Update preview action will not be present as we are in the price list and there is no starting amount on which to apply the discount.

By inserting item 1250 in a purchase / sale document, the system will automatically propose the discount inserted in the price list.

Discounts and Deferred Billing

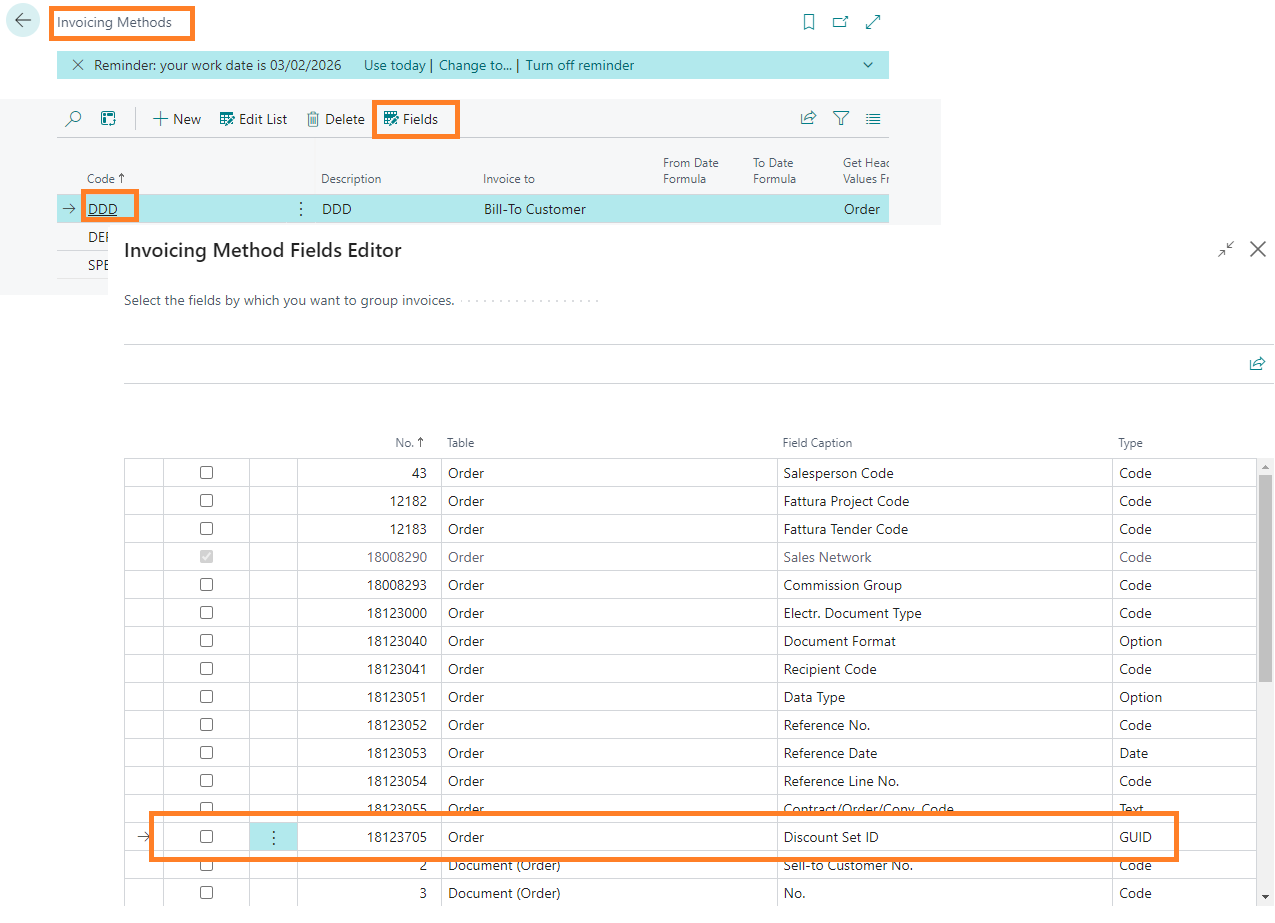

Deferred invoicing, managed by the Extended Combine Shipment (ECS) EX050 app, allows you to indicate how to group documents, who to pay the invoices to, and how often to invoice.

Regarding the cumulative sending of invoices containing header discounts, it is necessary to create a specific invoicing method:

In Fields, the Discount set ID option must be enabled.

This way, when the Invoice report is run. ECS Extended Cumulatives, entering as Invoice Method Code. default the method set in setup previously (e.g. DDD)

| ⚠️ Attention |

|---|

| Discounts are grouped if Discount Type = Discount % and if they have the same value. If header discounts are by Discount Amount, the system generates separate invoices. |

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.