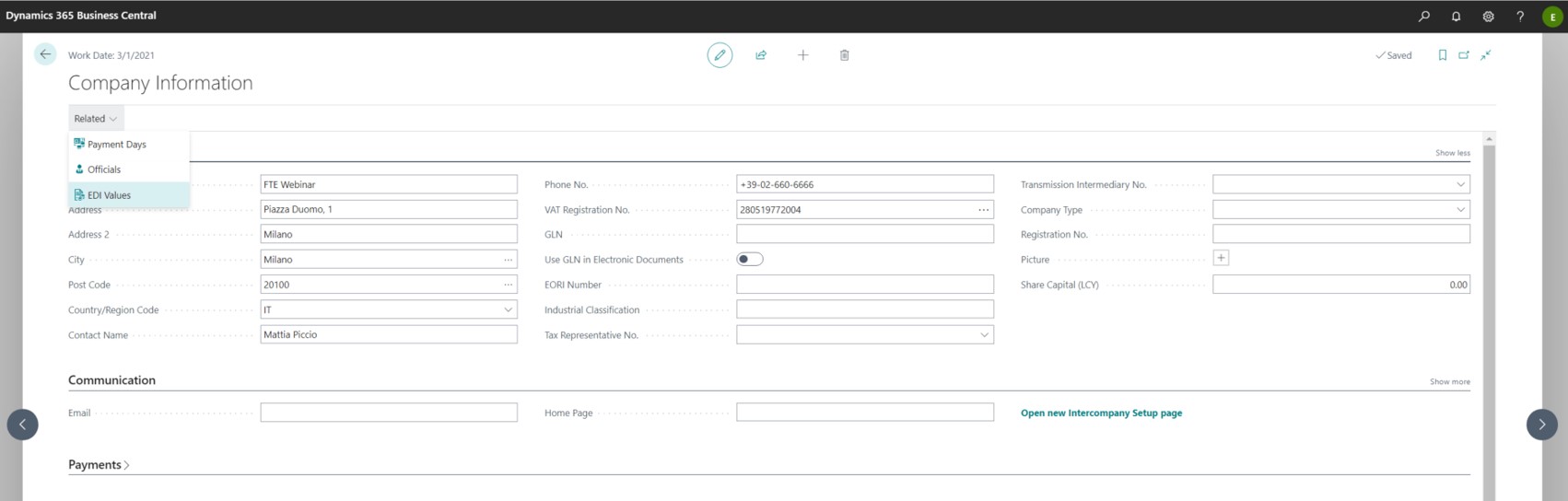

Company Information

Under Company Information set EDI values:

| Field | Description |

|---|---|

| EDI Group Code | Identifies the EDI code of the sender |

| EDI Identifier | Company Identifier Code of the sender |

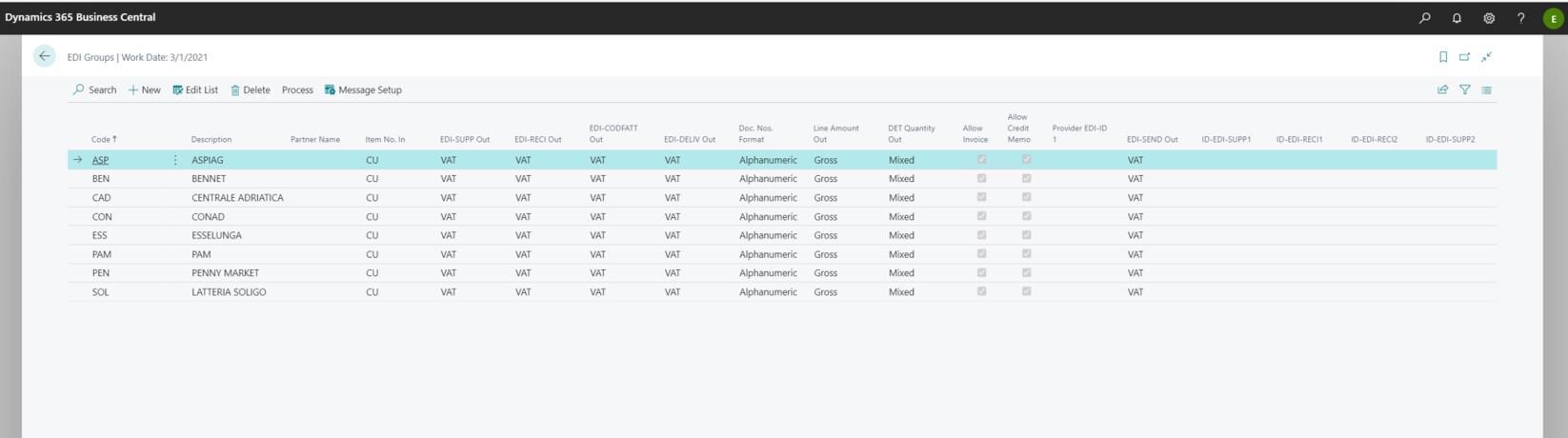

EDI Groups

Under EDI Groups, the groups for which the EDI system is to be activated must be defined. A ‘group’ is a logical grouping, to which a contract corresponds. Thus, it may be a single customer or a group (thus including several companies, e.g. a chain of supermarkets).

- Code: Free field in which to write a number or an abbreviation identifying the customer

- Description. Free field in which you can put a description

- Partner Name Name of the intermediary carrying out the messaging service (e.g. Euritmo, HoGast). This is an optional field.

- Enable Invoices The flag enables the sending of invoices to the customer.

- Enable credit notes: The flag enables the sending of credit notes to the customer

- Doc. No. format: The intermediary has its own standard format, but you can choose to keep it or change it (from numeric to alphanumeric or vice versa)

- EDI-SUPP Out.

This is the field that identifies the sender. If the fields are not filled in, the system takes by default what has been entered in company information

- VAT: Corresponds to the VAT field in company information

- ILN (Geographic Identifier): Corresponds to the ‘EDI Identifier’ field of the company information

- Fixed Company Information: Corresponds to the ‘ID-EDI-MITT1’ field of the Company Information

- EDI-SEND Out. As above, but related to the recipient

- EDI-CODFATT Out.

This is the field that identifies the customer for billing purposes

- VAT: VAT NUMBER

- ILN 14: Corresponds to the ‘EDI Identifier’ field of the customer card

- ILN 91: Corresponds to the ‘EDI Identifier’ field of the customer card

- ILN 92: Corresponds to the ‘EDI Identifier’ field of the customer card

- EDI-DELIV Out: As above, but related to the delivery address

- DET Quantity Out: Indicates what is sent as quantity in the rows (Mixed, KG Only, Pieces, Packages).

- Outgoing Row Amount: Indicates what is sent as an amount in the rows (Gross: without discounts, Net: with discounts deducted)

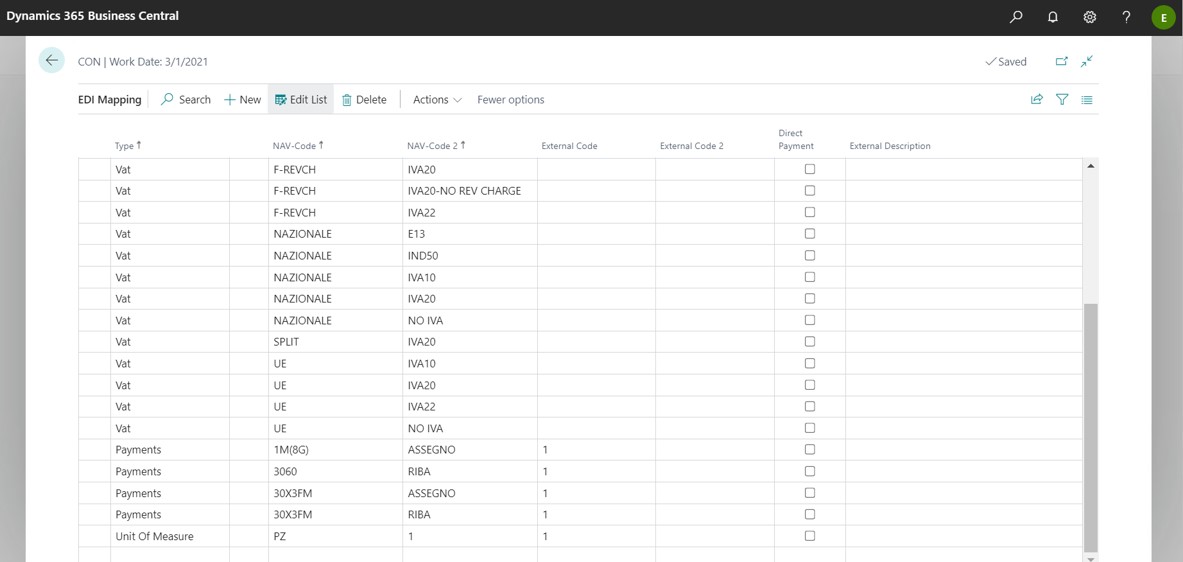

Mapping

From the top menu you can open the EDI Mapping page.

EDI mapping is the process of matching standard Euritmo/HoGast fields to internal codes defined in Business Central.

NB

The codes ‘External’ and ‘External 2’ are codes based on the Euritmo/HoGast standard or provided by the customer.- Type:

- VAT Code: you choose, within BC, between the Group VAT code (Code BC) and the Category reg. art/serv. VAT Code (Code 2 BC)

- Payments: the Conditions (BC Code) and the Payment method (Code 2 BC) are selected

- Unit of measure: select it in the column BC Code (e.g. Can, Day, Gram, Package etc.)

- Return Code: select it in the column BC Code

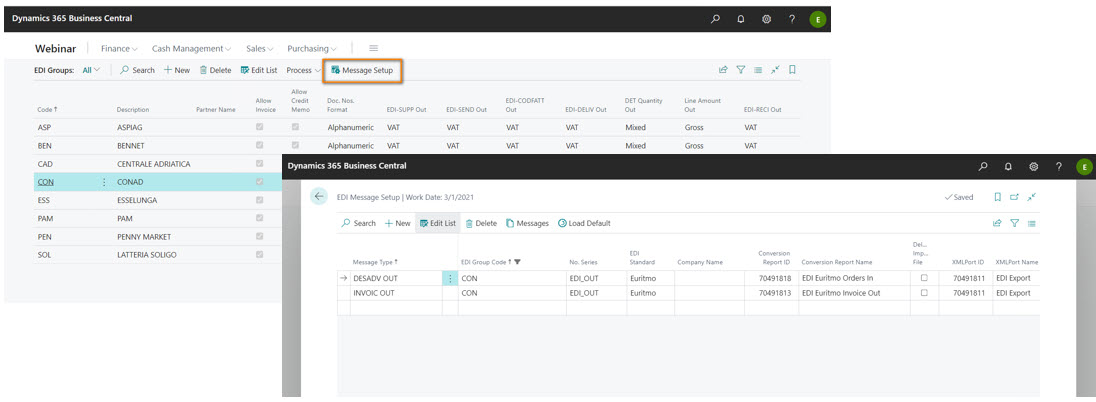

Setup Messaggio EDI

This page defines which message to send to each group and how to send it.

- Message Type (mandatory): Indicates the type of EDI message to be sent or received. This field also determines the direction of the flow (inbound, outbound). INVOICE OUT applies to both Invoices and Credit Notes.

- EDI Group Code (mandatory): Indicates the EDI group for which this setup applies.

- No. Series (mandatory): Each message that is sent or received is assigned a number. This field indicates the number series to be used to generate this number and is therefore mandatory.

- EDI Standard. The ‘EDI Standard’ field is only used inbound, i.e. when importing EDI files. Through this field, the different record types in the file (BGM, DTM, FTX, RFF etc. etc.) are validated. D96 and Euritmo support different record types. If the file is not valid, the system displays an error.

- Company Name You can select the company from the multi-company list.

- Conversion report ID (mandatory) Enter the number of the conversion report. This report is responsible for converting the Business Central document into an EDI message (in the case of outbound) or an EDI message into a Business Central document (in the case of inbound). The EDI app provides a number of standard formats that are already managed. These conversion reports are available open-source at https://github.com/EOS-Solutions/Sample/tree/master/EX074.EDI.

- File Encoding This setting can be used to indicate the encoding of the file to be saved or read.

- Skip existing EDI messages This setting enables to skip documents on exportation that already have an Existing EDI message

- Delete Imported File This setting can be used to indicate that imported files should be deleted after they have been successfully loaded into the system. This setting only applies to inbound.

- XMLport ID This field indicates the XMLport to be used for both reading and writing the EDI message to or from the file-system. If this is not set, EDI uses a default XMLport that writes/reads the file 1:1 as it is in the EDI Message table.

- Export Path (mandatory)

Enter the path where the file is to be saved or read from. This path supports the use of placeholders to define the file name (definition of filename is mandatory) that are replaced with system values. At this time, the following placeholders are supported:

<DOC>: Reference Document No. (Invoice No.)<DATE>: today’s date in the format YYYYMMDD<DATETIME>: today’s date/time in the format YYYYMMDDhhmmss

- Enable Archive Path Enables file archiviation after being imported.

- Archive Path Enter the path where the file is to be saved after being imported if Enable Archive Path is flagged.

- Service Configuration Code (mandatory) Indicates the service configuration to be used to access the filesystem to read or write files.

- Log Level

Allows to configure logging for this message setup.(see /en/docs/apps-tech/8bb96677-5112-4566-b742-12eebbb9a058/enum/enum18122312.html for details)

- None: No logging will be performed for this message setup.

- Failures Only: Only failed operations will be logged.

- All: All operations, including successful ones, are logged.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.

EOS Labs -