Electronic Invoice for Italy - Split Payment

The Split payment is a particular regime which establishes that the VAT debtor is the transferee/customer rather than, as normally happens, the transferor/provider.re.

So, for operations subject to split payment, the transferee/client does not pay the VAT to his transferor/provider considering the fact that it is “paid” directly to the treasury.

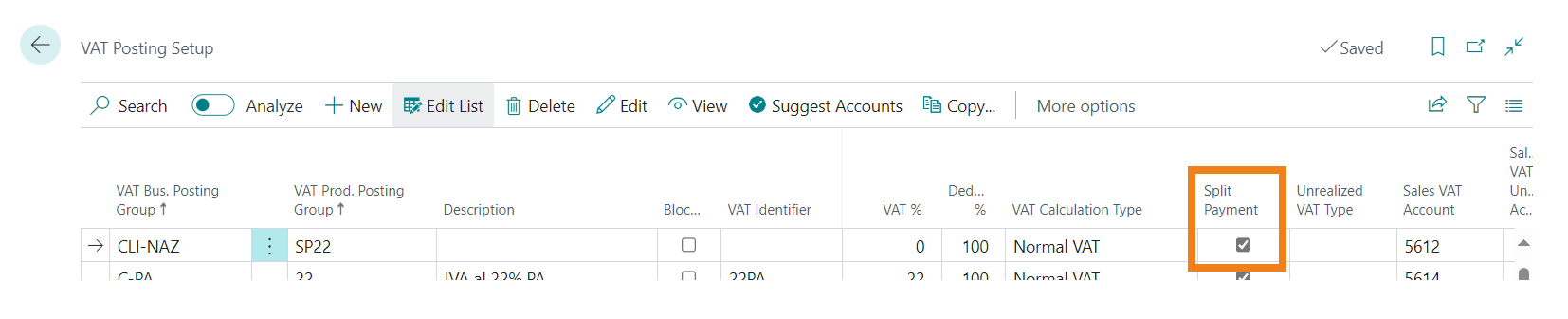

Setup

On the “VAT registration setup” page, you need to create the appropriate records with the “Split Payment” flag set to Yes:

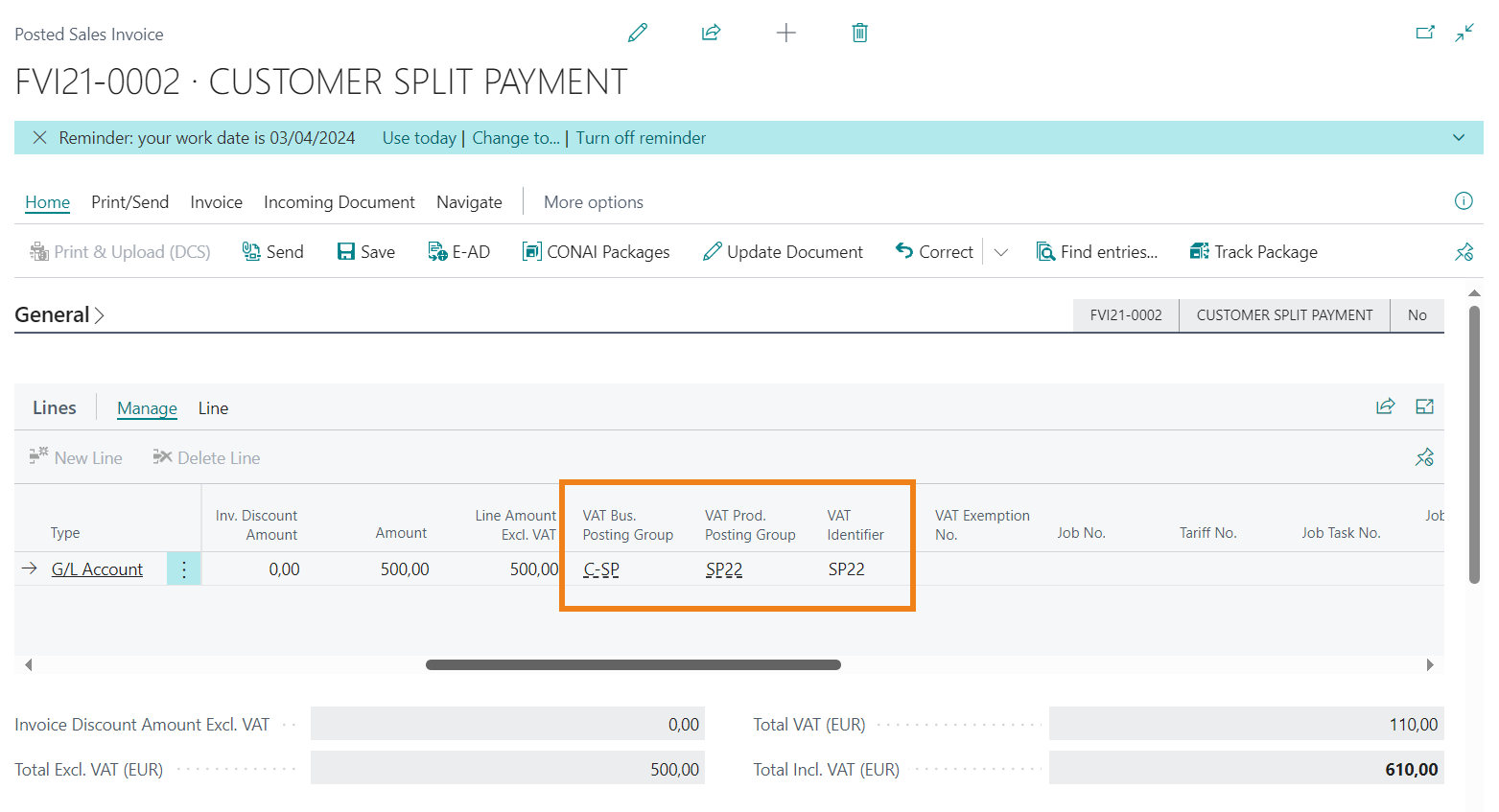

How to operate

By posting the sales document with the defined setup combination, the system automatically takes care of generating the VAT transfer, VAT which will be paid to the Treasury directly by the customer (transferee/customer):

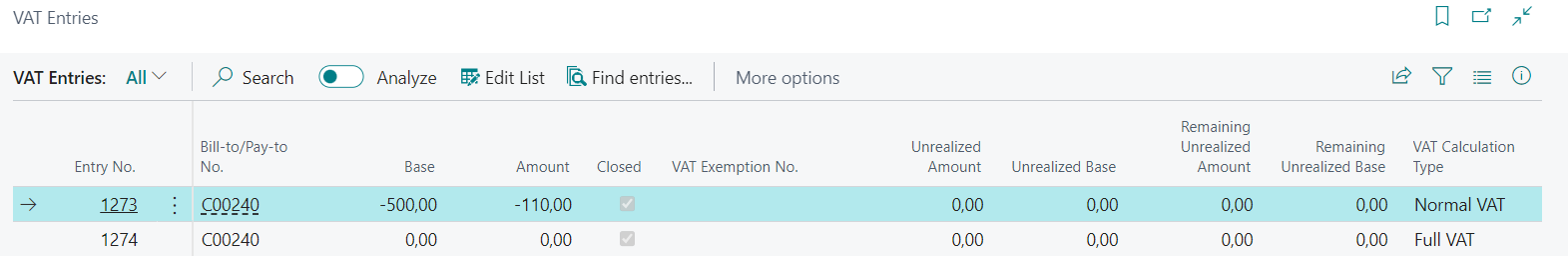

Generated VAT entries

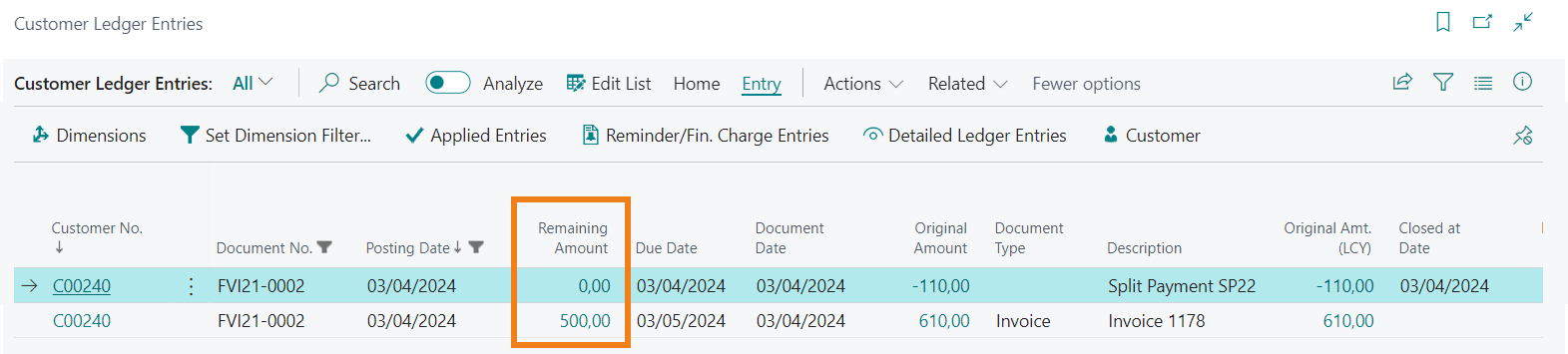

Generated customer ledger entries

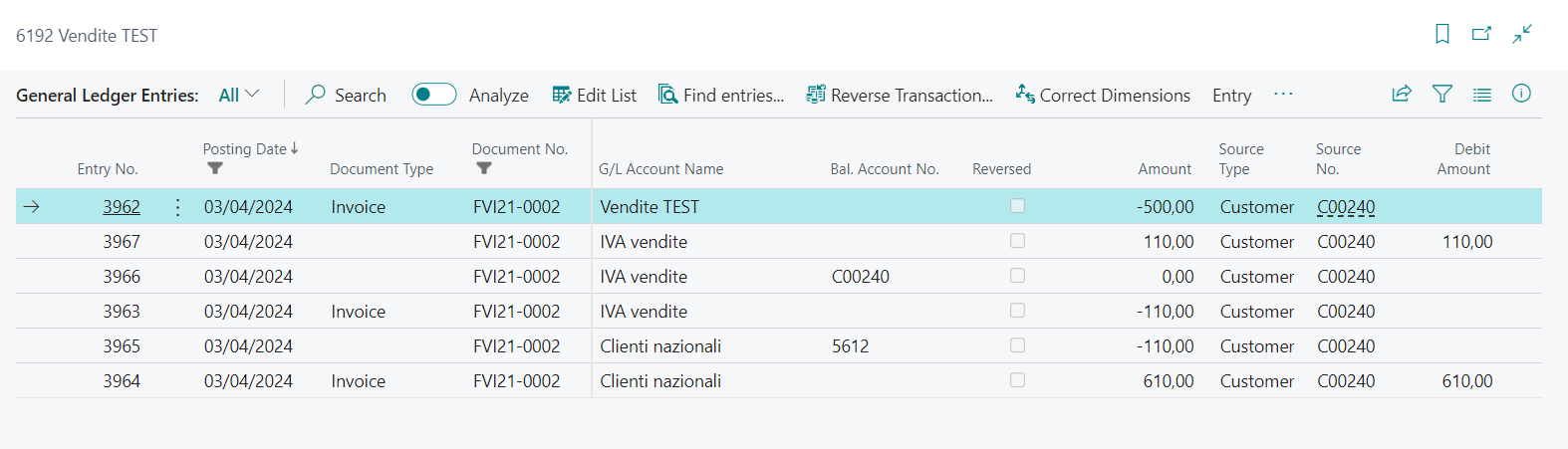

Genereted G/L entries

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.