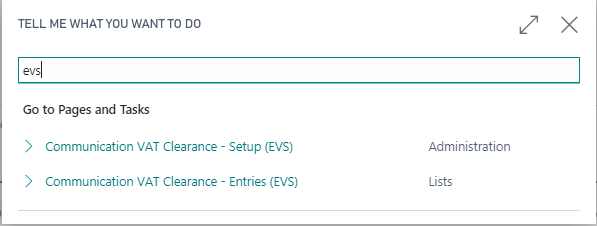

EX018 Electronic VAT Settlement for Italy (EVS)

Quick Guide

| 1 | Fill in the setup with the Company information |

| 2 | Setup specific VAT setup to be summarized in VP fields or not, if necessary |

| 3 | Make the system calculate VAT amounts |

| 4 | Save and check the XML file |

Electronic VAT Settlement For Italy (EVS)

The App allows you to manage the completion and the submission, to tax Authority, of the document for the periodic VAT settlement for Companies that operate in Italy.

Regulation on the Communication of data of invoices issued and received was amended by Law Decree dated 16 October 2017, no. 148, annexed to Budget Law 2018 (“Tax Decree”), by Budget Law 2018 (Law dated 27 December 2017, no. 205) and by the Act of the Director of the Revenue Agency of 5 February 2018 no. 29190/2018.

Pursuant to art. 21 of Law Decree no. 78/2010, on a quarterly basis, VAT taxable persons must transmit electronically, to the Tax Agency, the data of invoices and credit notes issued, as well as of Customs bills.

Such data must be contained in an XML file created following the technical requirements fixed by the Revenue Agency.

Subscriptions

Some features of this app require a subscription.

The subscription can be activated from Subscription control panel page or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard.

In details:

- FULL VERSION: it’s possibile to buy a full version that will last for 12 months, following the wizard and accessing to the EOS AppStore

- FREE-DEMO-TRIAL version: it’s automatically activated at first request and give full access to all features. This trial expires after 20 days from the activation

See https://www.eos-solutions.app/ website for more information.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.