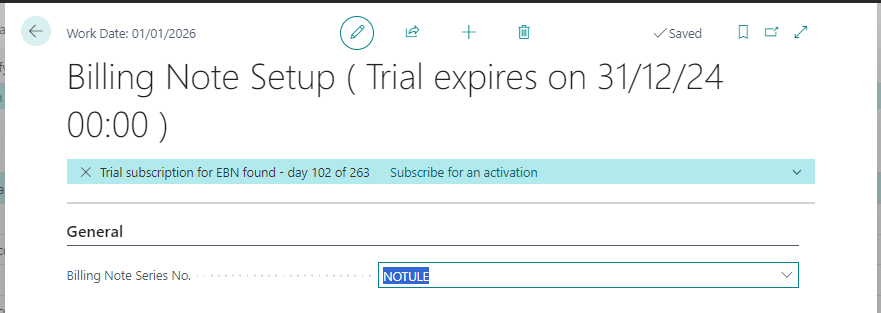

Setup (EBN)

The setup consists of a single field, relating to the Serial No., to be set to manage the numbering of the billing notes.

Billing Notes (EBN)

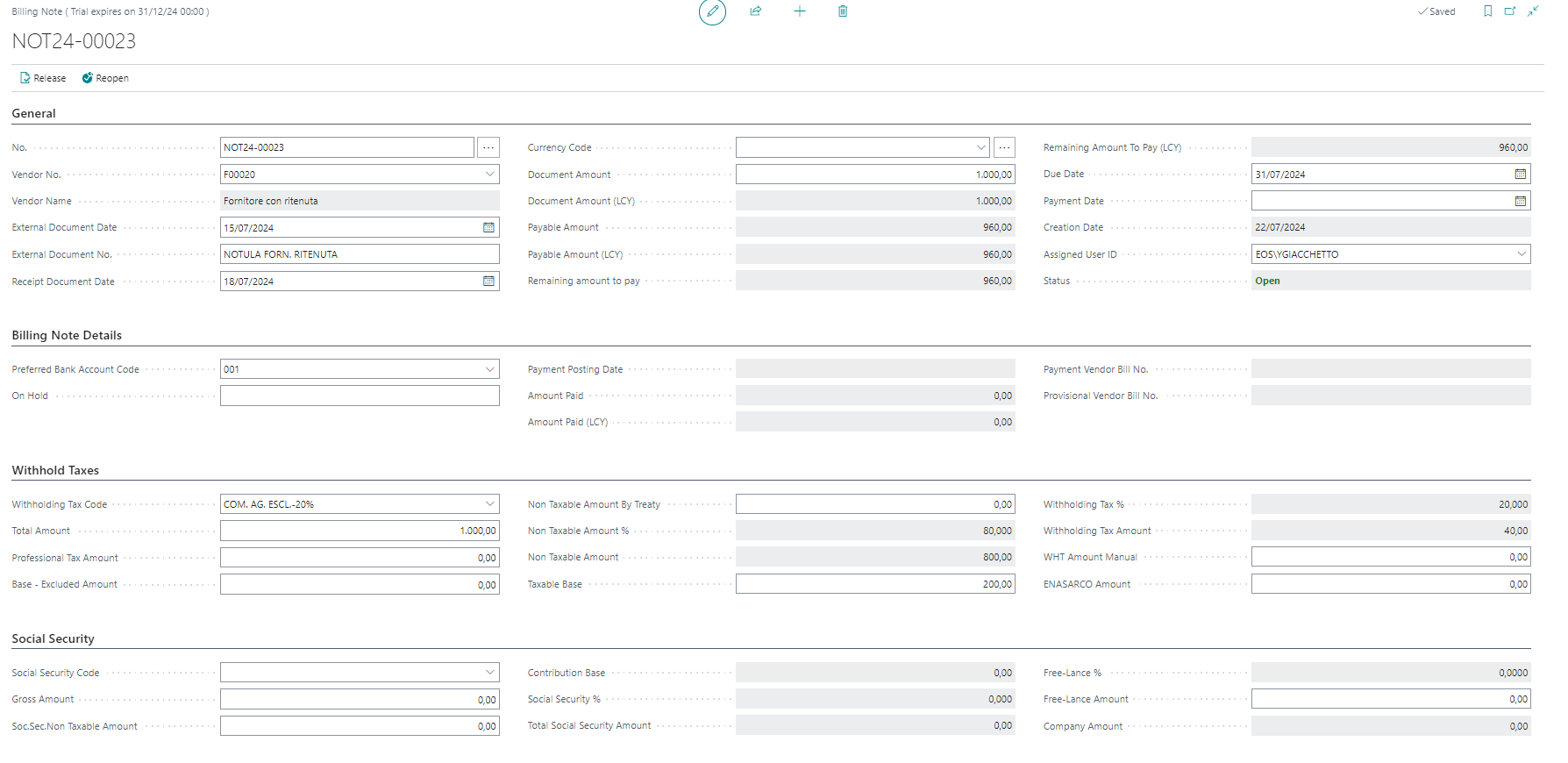

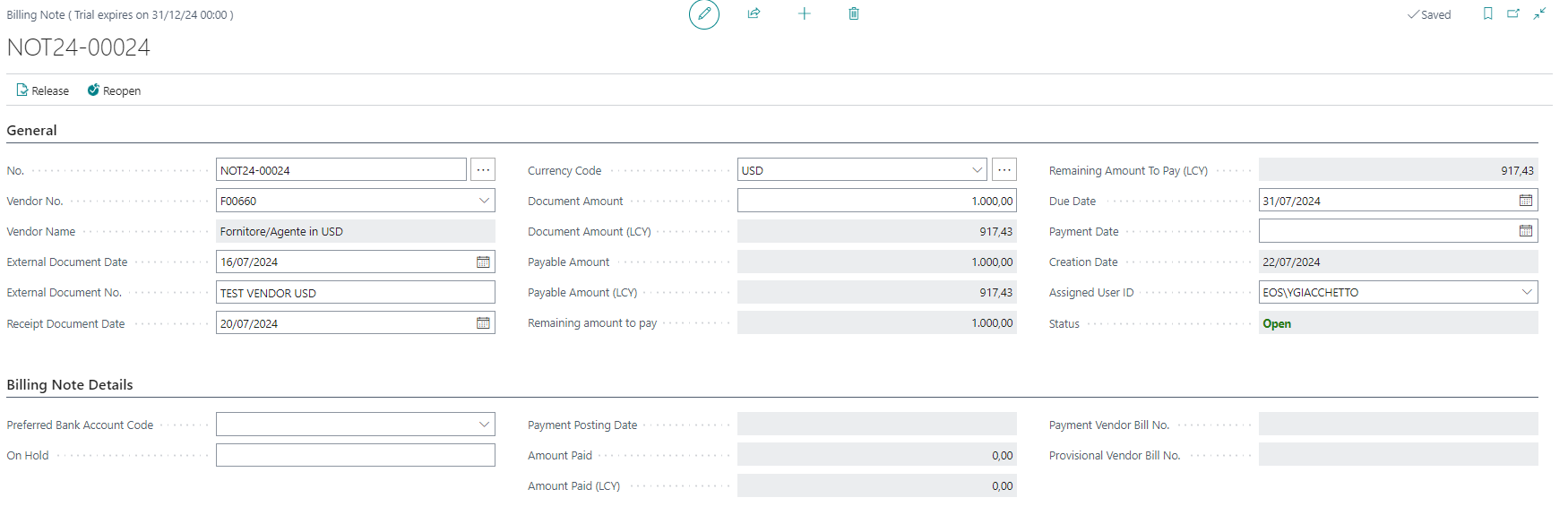

The Billing note page is made up of four groups: General, Billing Note Details, Withholding Taxes, Social Security. In the General group, the fundamental data for the definition of the Billing note are entered: Vendor, the Vendor reference, the various dates and the amount. In the case of Billing notes in currency, it is necessary to specify the relative code and the amounts (LCY) will be modified accordingly.

The Billign Note Details, the preferred bank code of the vendor is specified, inherited from the master data, the “On Hold” code can be managed with the same function as the standard field, the payment data (both partial and complete) and the relative protocols of the documents with which they were registered are reported.

The Withholdings and INPS groups follow the standard fields and are managed in the same way. The amounts will contribute to the value of the “Payable amount” field present in the General group These groups are optional and can only be managed for invoices that do not have the Currency Code field filled in

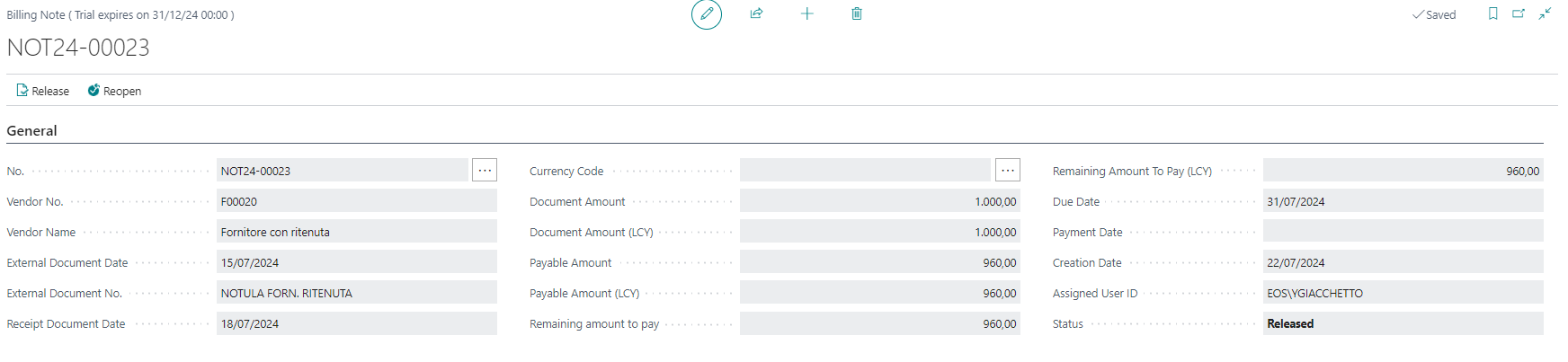

To be paid, or added as a line in a vendor bill list or in a payment journal batch, the Billing Note must be released using the appropriate function which will carry out checks on the mandatory fields to be filled in.

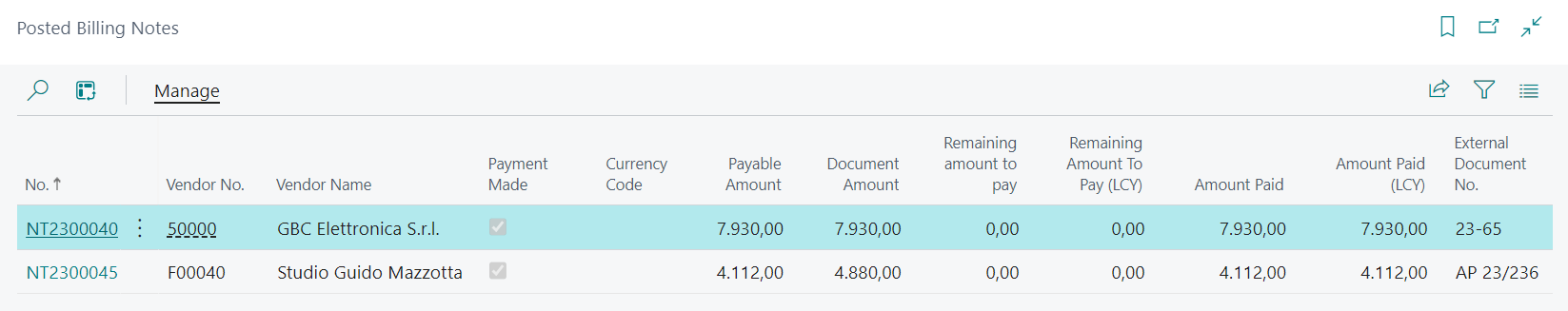

Posted Billing Notes (EBN)

A Billing note is displayed in the Posted Billing Note page when it is fully paid.

Posted Billing Note have the “Payment Made” flag set to True and the reference to the last “Payment Vendor Bill No.”

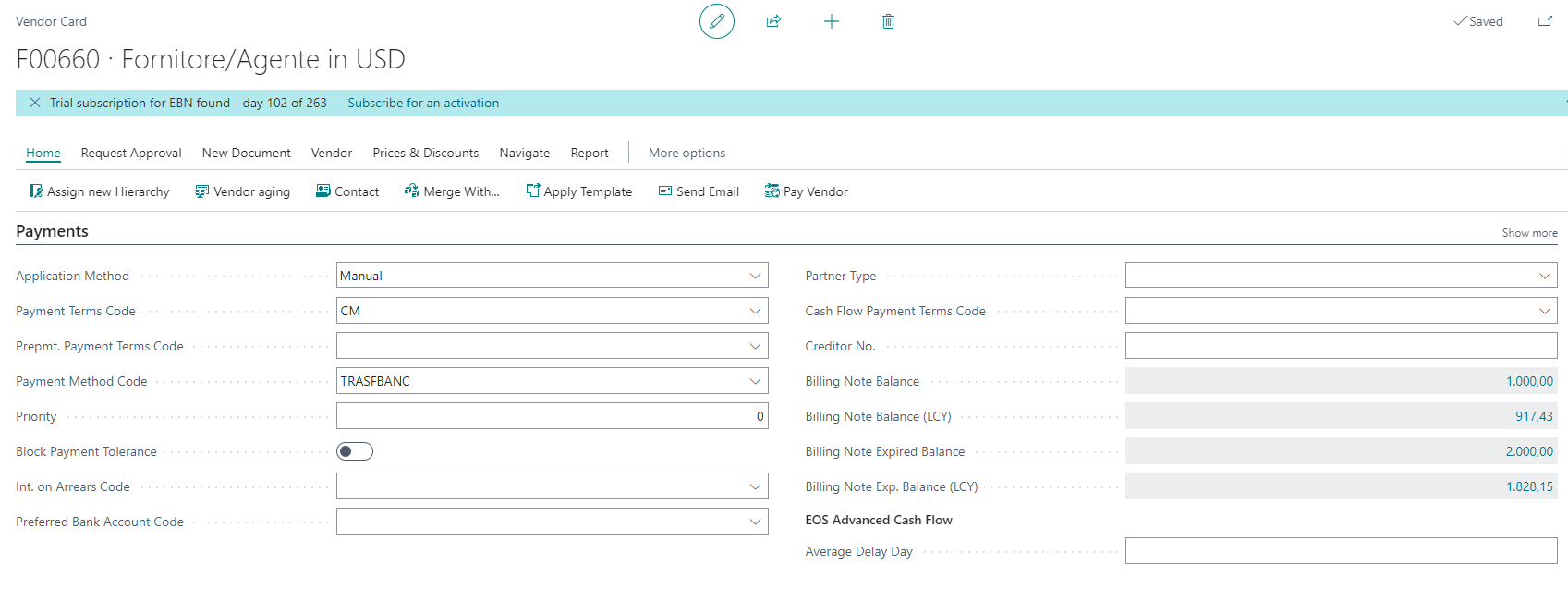

Billing Notes informations in vendor card

In Vendor Card there are four fields in the Payments group: these fields report the Balance of Billing Notes.

Both Currency balances and expired Billing note balances are managed, the latter filtered on the “Due Date” field

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.