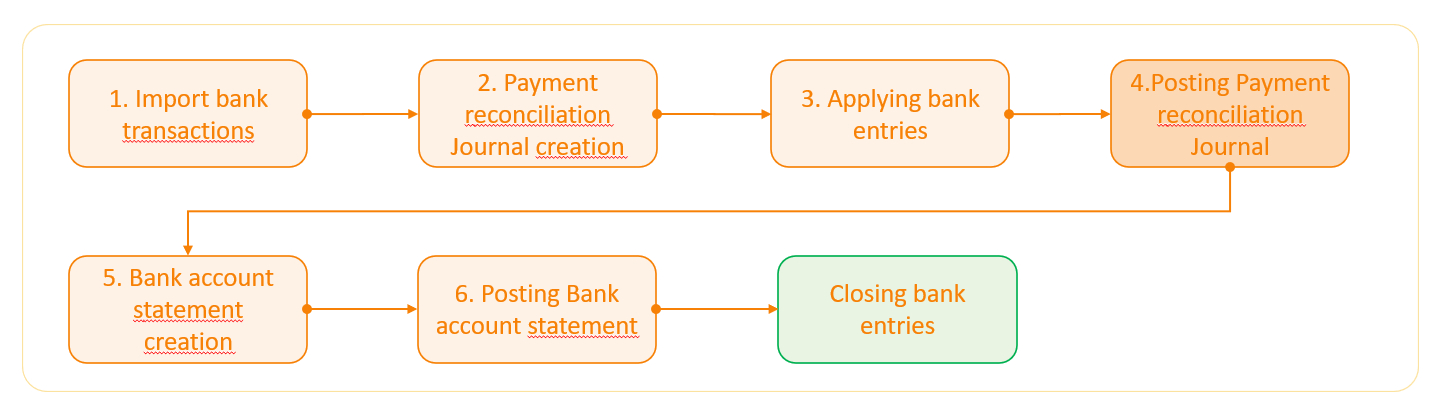

Operational Flow

- The basic assumption is that bank transactions are acquired and processed entirely via electronic flow.

- All transactions must be processed and, in general, no manual entries must be made (with the exception of the registration of Customer Lists Riba\SDD, Unpaid Bills, Supplier Lists).

- The bank movements in BC will therefore be the mirror copy of the bank transactions. Any reversals\corrections on bank transactions will still be processed and accounted for.

Main Scenarios

The main usage scenarios are the following and presuppose a specific setup.

| Scenario 1 | Scenario 2 |

|---|---|

| Use of temporary accounts as counterpart of collections/payments | Direct registration with settlement of customer\supplier\bank items |

| In the Bank Statement (Payment reconciliation record) the temporary account will be automatically proposed based on the CBI reason. The automatic recognition function of customer\supplier\bank items will not be used. The movement on the temporary account will be closed with the settlement of the item. The temporary account can be managed as a bank current account. | The connection to customer\supplier\bank items must be made from the Bank Statement (Payment reconciliation registration). The automatic recognition function of customer\supplier\bank items can be used. |

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.

EOS Labs -