1. Import bank movements and balances

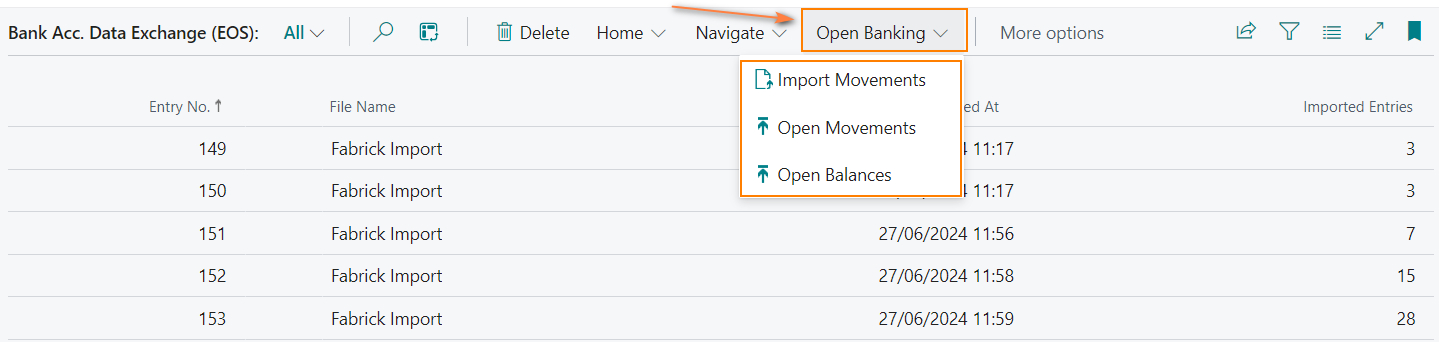

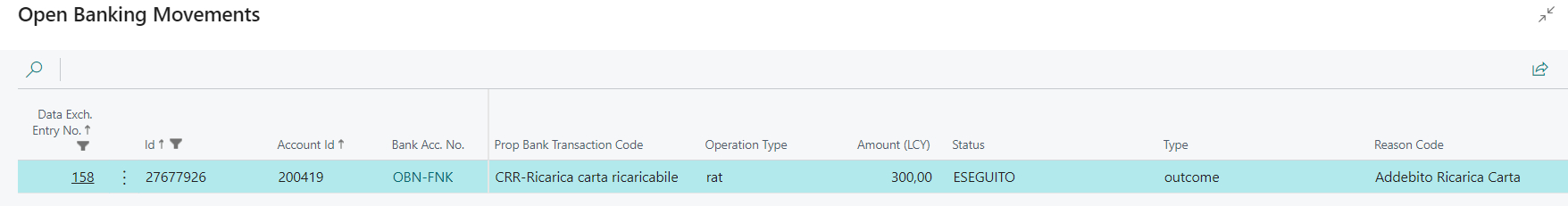

You can download and view bank transactions and bank balances from the «Bank Account Data Exchange (EOS)» page. From the «Open Banking» menu item you can select the desired actions.

Import movements: downloads accounting transactions and balance information. Bank movements: allows you to view downloaded movements. Balances: displays information on downloaded balances.

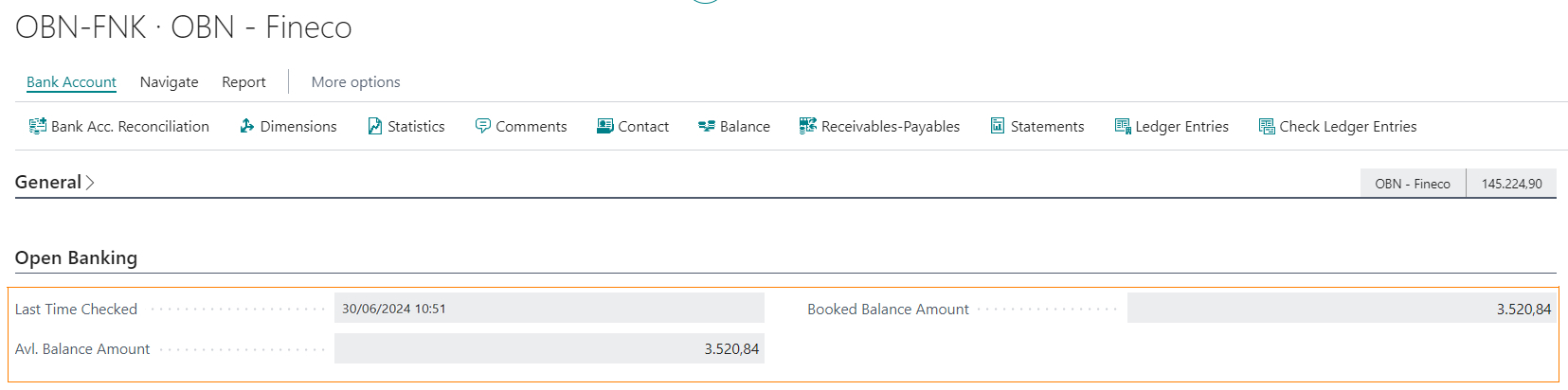

Once the bank movements have been imported, you can view the «Accounting balance» and the «Available balance» on the Bank Account tab.

2. Creating a bank statement

Using the “Create bank statement” action, it is then possible to create the bank statement (the “Payment reconciliation records” table containing the downloaded transactions.

![]()

![]()

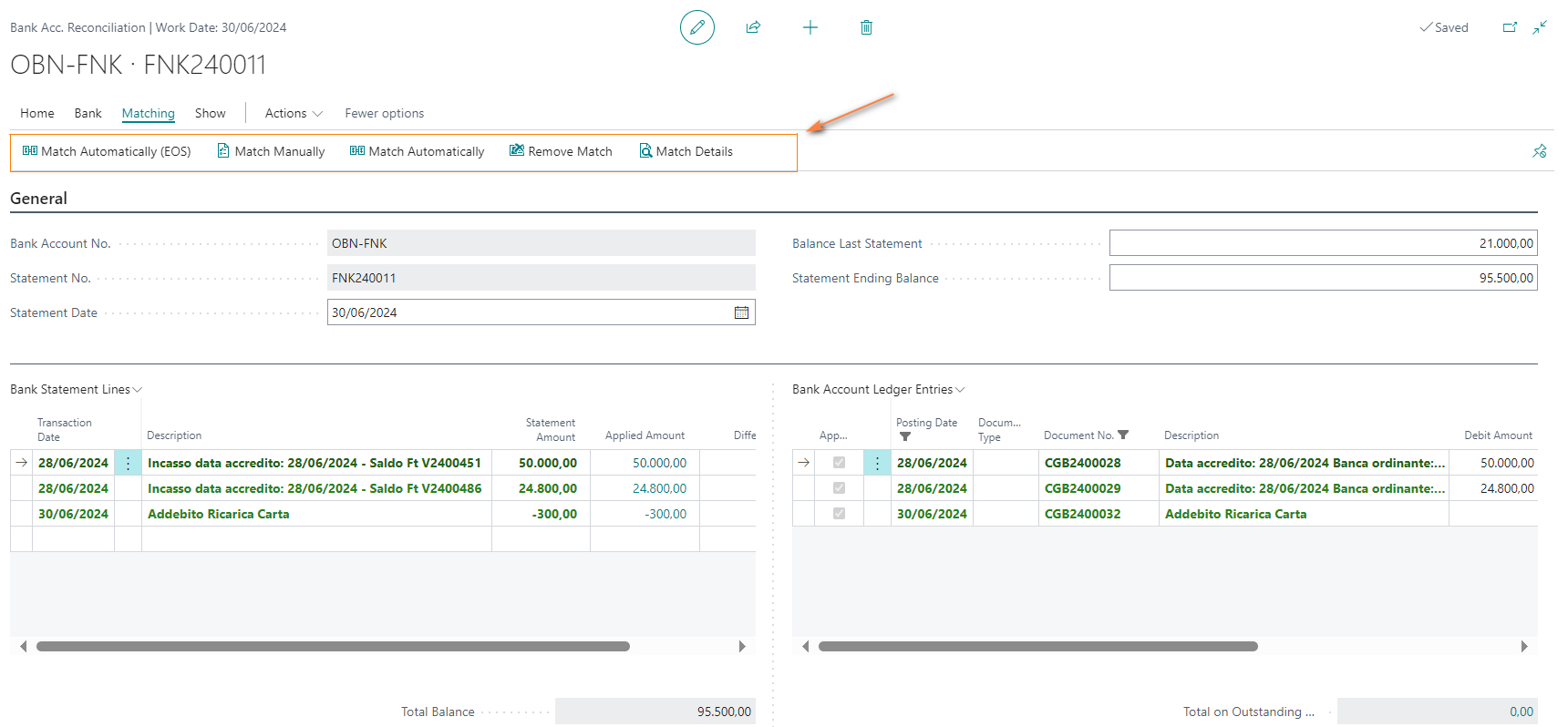

The “Payment reconciliation record” page has been integrated with specific actions and with all the information present on the bank transaction.

![]()

3. Apply Bank transactions

In the payment reconciliation registration form, it is possible to perform the recognition of movements through the connection procedure «Connect automatically (EOS).

![]()

The main types of operations that can be managed by the automatic connection are the following.

- Automatic proposal of CoGe account relating to financial charges\income.

- Bank to bank transfer.

- Automatic proposal of transit account (cash pooling, against transit recognition of collections\payments).

- Connection to bank movements already accounted for (e.g. payments via list).

- Connection of Collections\payments with item account settlement

- Management of differences with accounting on specific accounts.

4. Post Bank statement

- It is possible to record the payment reconciliation registration statement only if all the movements have been “linked”.

- For each bank movement, the system performs a double-entry registration with the recognized account as a counterpart, assigning the specific Series No. defined in the bank C/C card, in the “Bank transaction registration No.” field. (This is unlike the standard functionality that assigns the same document no. to the entire statement even if the movements have different dates).

- If the movement is associated with a bank movement already accounted for, the system does not perform further transactions, but “reconciles” the movement without making any entries.

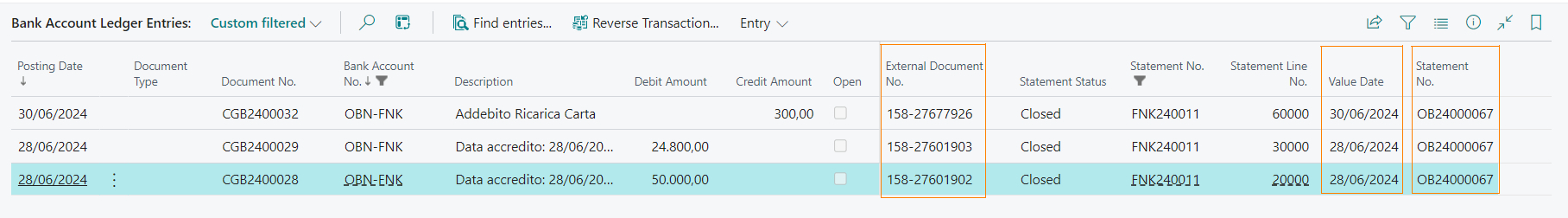

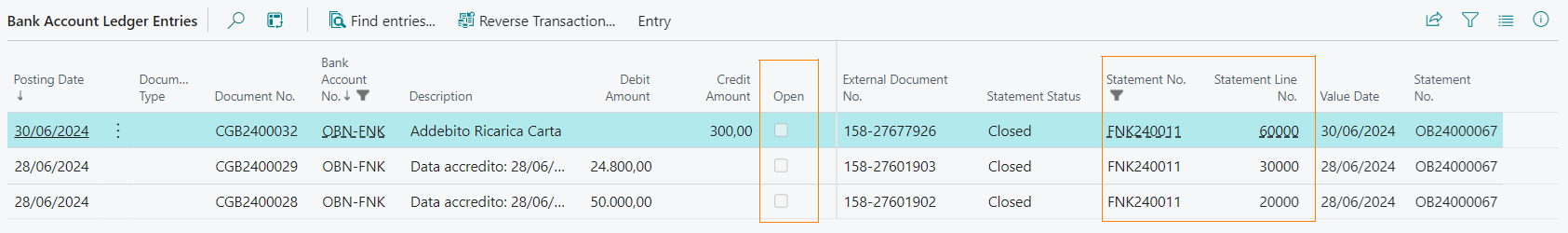

Information on bank accounting movements

The OBN App integrates the information present on bank accounting movements. In fact, the “Value date”, “Payment reconciliation statement No.” and the reference to the single bank transaction referenced in the “External document No.” field have been implemented.

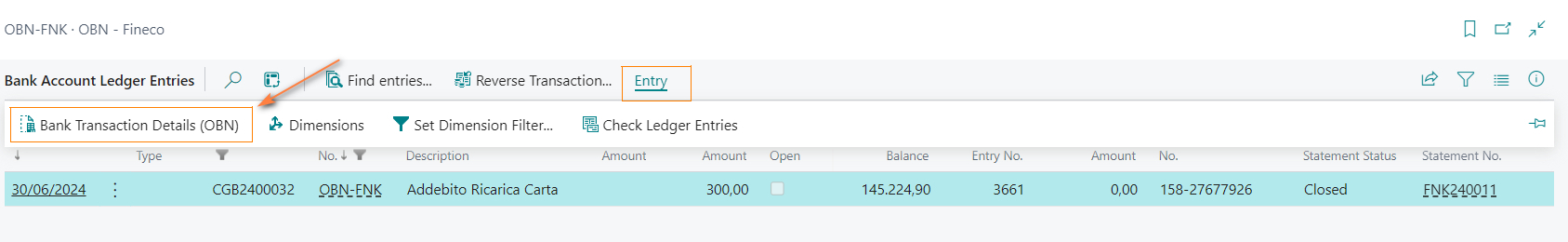

Bank transaction details (OBN)

From the bank C/C movements or from the G/L movements it is always possible to trace all the information of the bank transaction.

This allows the reconciliation and matching of the entries in the case of using transitory accounts for the recognition of collections and/or payments.

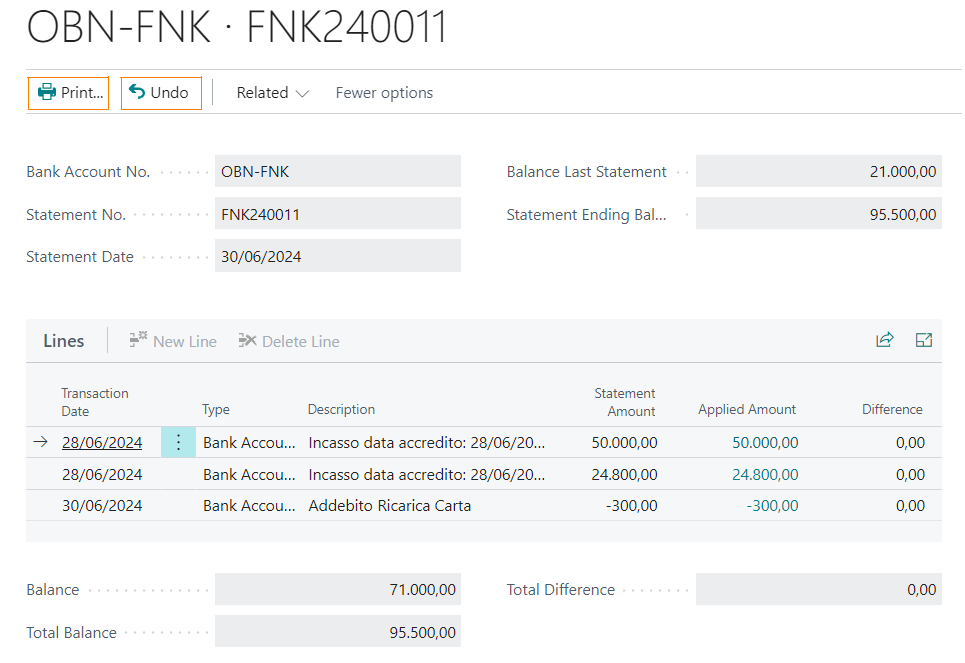

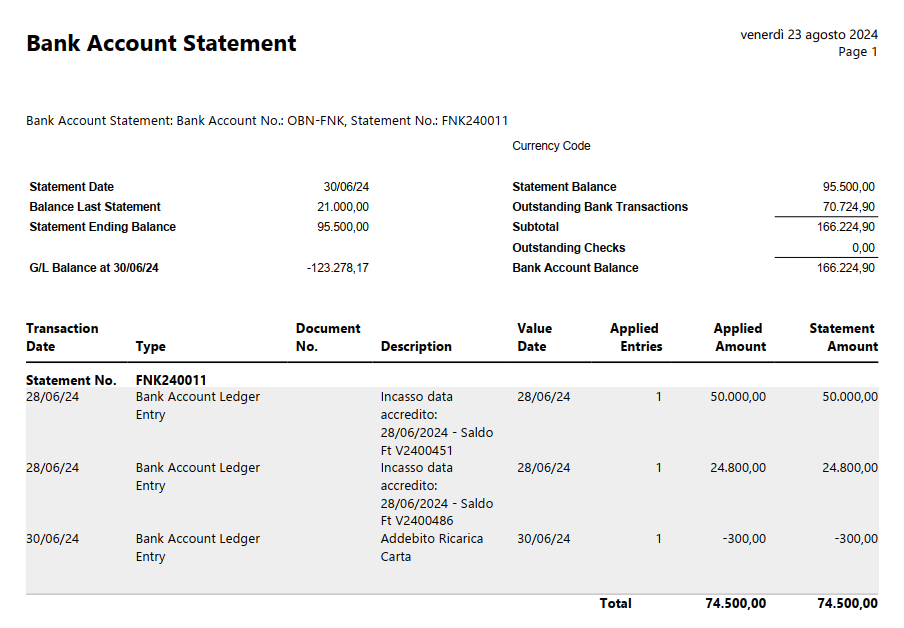

5. Bank Account Reconciliation

Using the “Bank Account Reconciliation” function, you can periodically reconcile your bank statement with the recorded bank movements.

You can access the “Bank Account Reconciliation” directly from the Bank Account tab.

![]()

![]()

The possibility of suggesting statement lines from the recorded Payment Reconciliation statements using the Eos “Suggest Lines (EOS)” function has been provided.

![]()

![]()

During the suggestion phase, the system will automatically connect with the bank movements present in the system; however, it is possible to intervene with the standard connection\disconnection functions.

6. Post E\C

The recording of the Statement of Account “closes” the bank movements (the reference to the recorded E/C is always present on the bank movements).

The recording of the statement of account can be cancelled. The recorded E/C can be printed using standard BC printing.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.