Setup VAT Management for Italy (VMI)

Setup VMI

| 1 | Manage VAT exemption |

| 2 | Preview and check VAT Plafond overruns |

| 3 | Print accurate reports for multiple VAT registers |

| 4 | Calculate and post VAT settlement |

| 5 | VAT amount in case of reverse charge |

| 6 | Calculate and manage the VAT amount pro rata non-deductible |

| 7 | Calculate the VAT interest in the case of quarterly VAT settlements |

| 8 | Check the VAT data posted both by registration date and by operation execution date |

| 9 | Execute Split Payment procedure |

The VAT Management for Italy app for Microsoft Dynamics 365 Business Central allows you to manage VAT exemption (D.I.) at document line level, preview and check VAT Plafond overruns. With The VAT Management for Italy app you can also print accurate reports for multiple VAT registers and execute VAT settlement.

VAT Management for Italy - SUMMARY

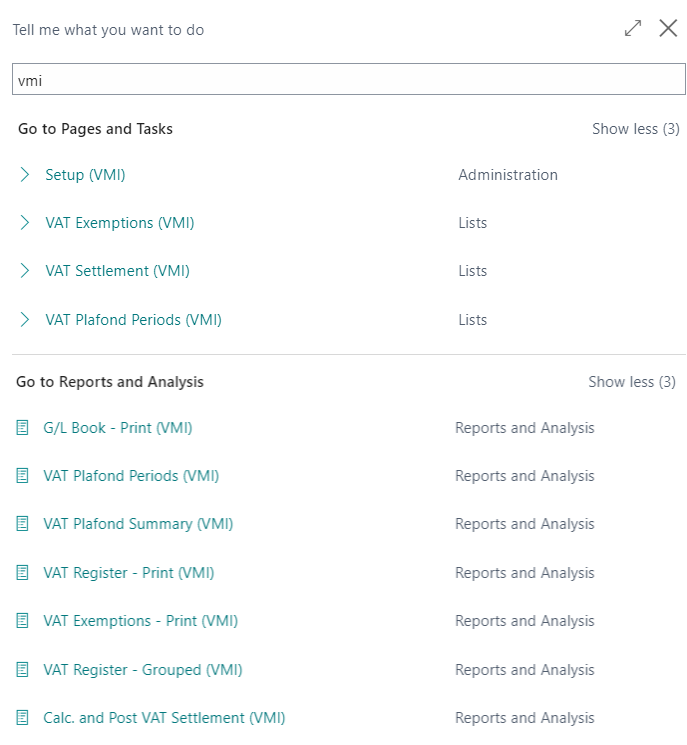

For a summary of the functionalities involved, press ALT + Q and type “VMI”:

Some features of this app require a subscription.

The subscription can be activated from Subscription control panel page or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard.

In details:

See https://www.eos-solutions.app/ website for more information.

Setup VMI

Manage VAT exemption

Preview and check VAT Plafond overruns

Print accurate reports for multiple VAT registers

Calculate and post VAT settlement

VAT amount in case of reverse charge

Calculate and manage the VAT amount pro rata non-deductible

Calculate the VAT interest in the case of quarterly VAT settlements

Check the VAT data posted both by registration date and by operation execution date

Execute Split Payment procedure

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.