VAT Amount Detail in case of Reverse Charge

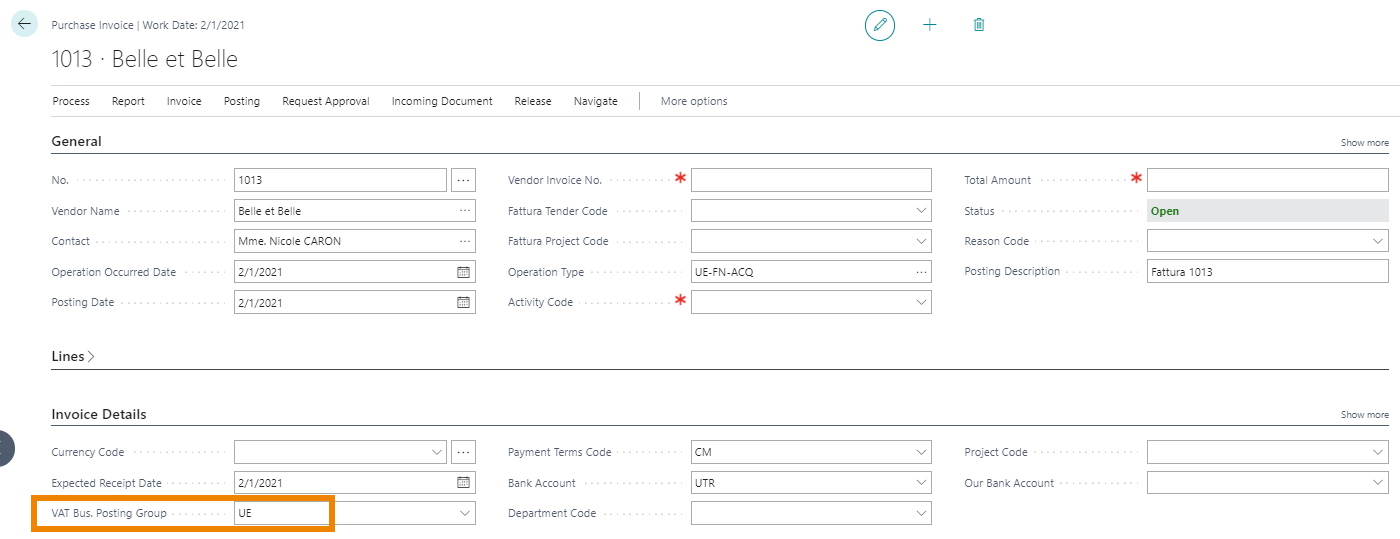

If we register a purchase invoice for a vendor with Reverse Charge

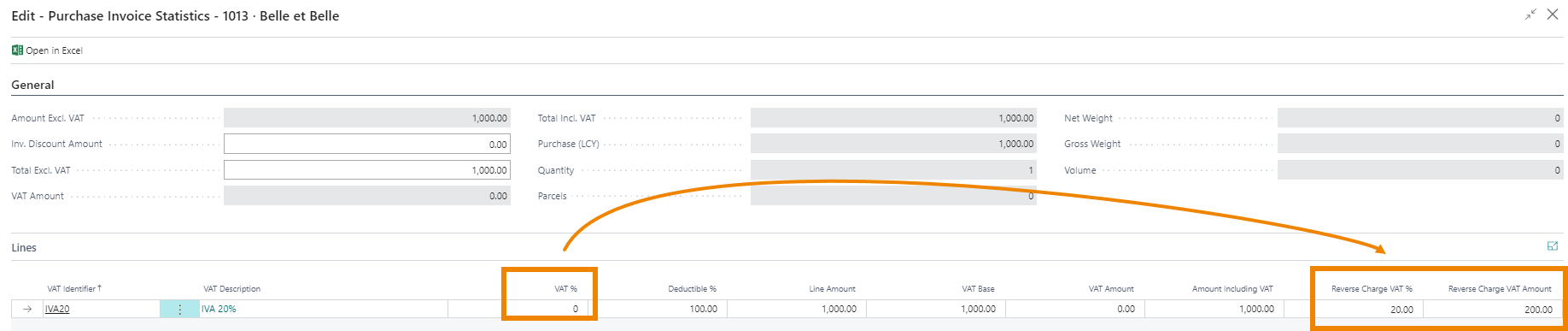

from Invoice->Statistics we see the VAT detail

The VAT % is zero because the system automatically posted vat purchased and sold of the same amount, but with a reverse sign. In the “Reverse Charge VAT Amount” and “Reverse Charge VAT %” fields, the system shows us details about the VAT percentage and the amount.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.

EOS Labs -