VAT number check

The check action is on pages:

- Customers

- Vendors

- Contacts

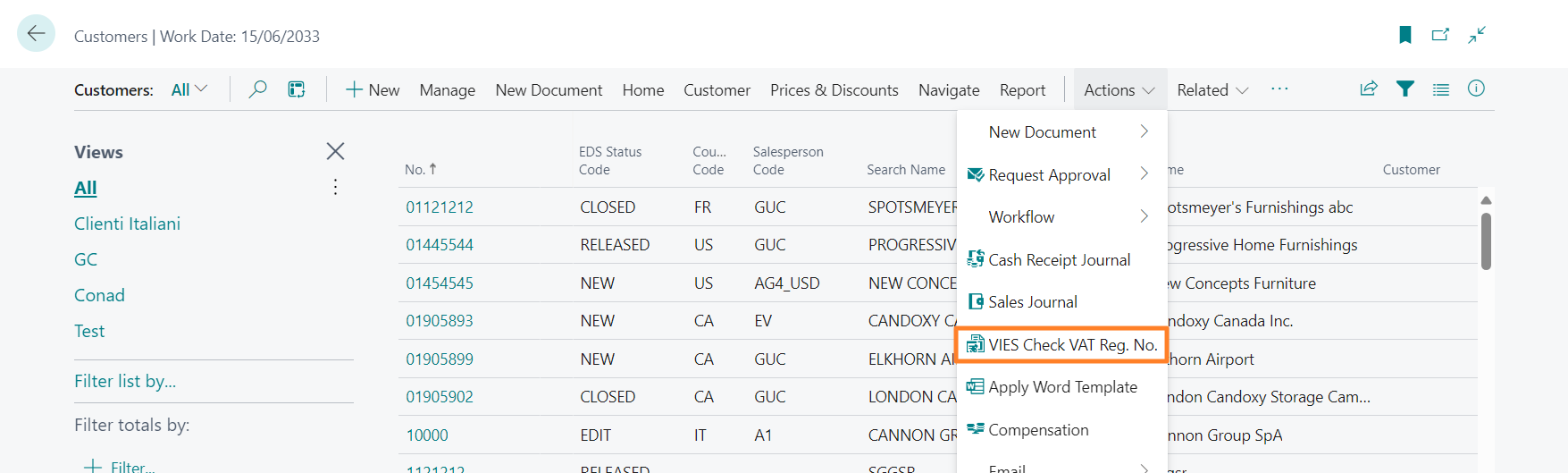

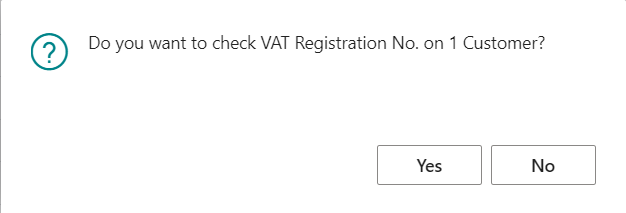

From ‘Actions’->VIES Check VAT Reg. No. the check can be executed: -single> selecting a line in Customers/Vendors/Contacts lists or executing action from within of the specific card. -massive> selecting more lines in Customers/Vendors/Contacts lists.

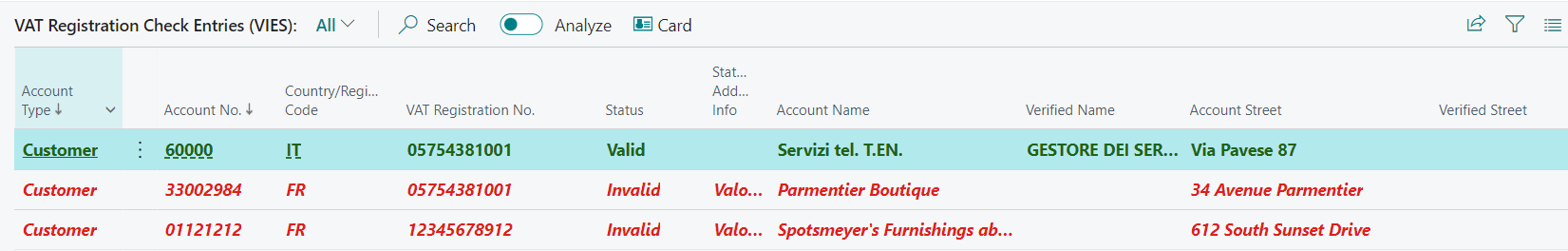

VAT Registration Check Entries

In VAT Registration Check Entries is possible to verify entries.

| Field | Description |

|---|---|

| Account Type | Specificy account type |

| Account No. | Specifica account number |

| Country/Region Code | Corresponds to field Code in table Countries |

| VAT Registration No. | VAT number on Customer/Vendor/Contact card. |

| Status | Options are: Non verified, Valid, Not valid |

| Account Name | Name on card |

| Verified Name | Name returned from check |

| Account street | Address on card |

| Verified street | Address returned from check |

| Account Postcode | Postcode on card |

| Verified Postcode | Postcode returned from check |

| Account City | City on card |

| Verified City | City returned from check |

| Verified Date | Check date |

| User ID | User who executed check |

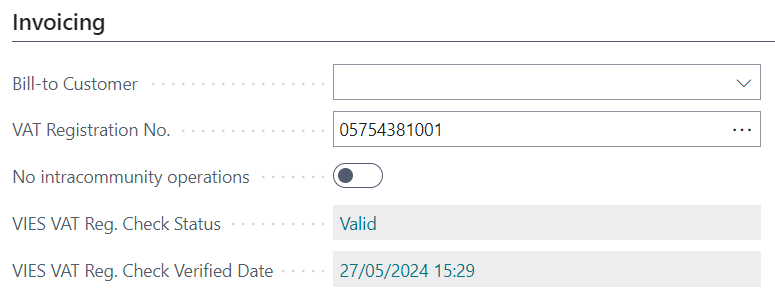

Checking from Customer/Vendor/Contact card, the standard log is also generated. On card there are two flowfields:

Clicking, will be possible to visualize the notification status.

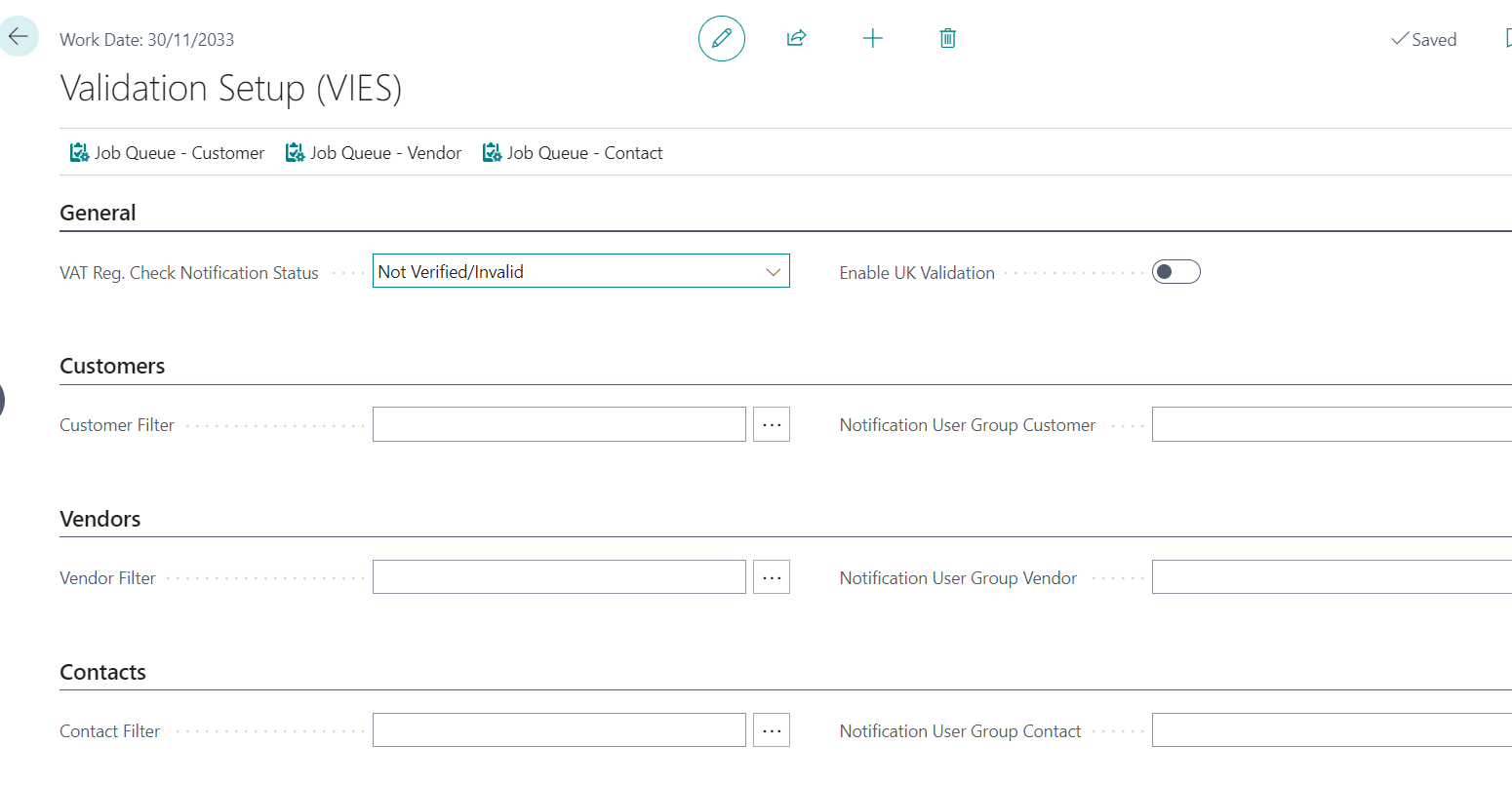

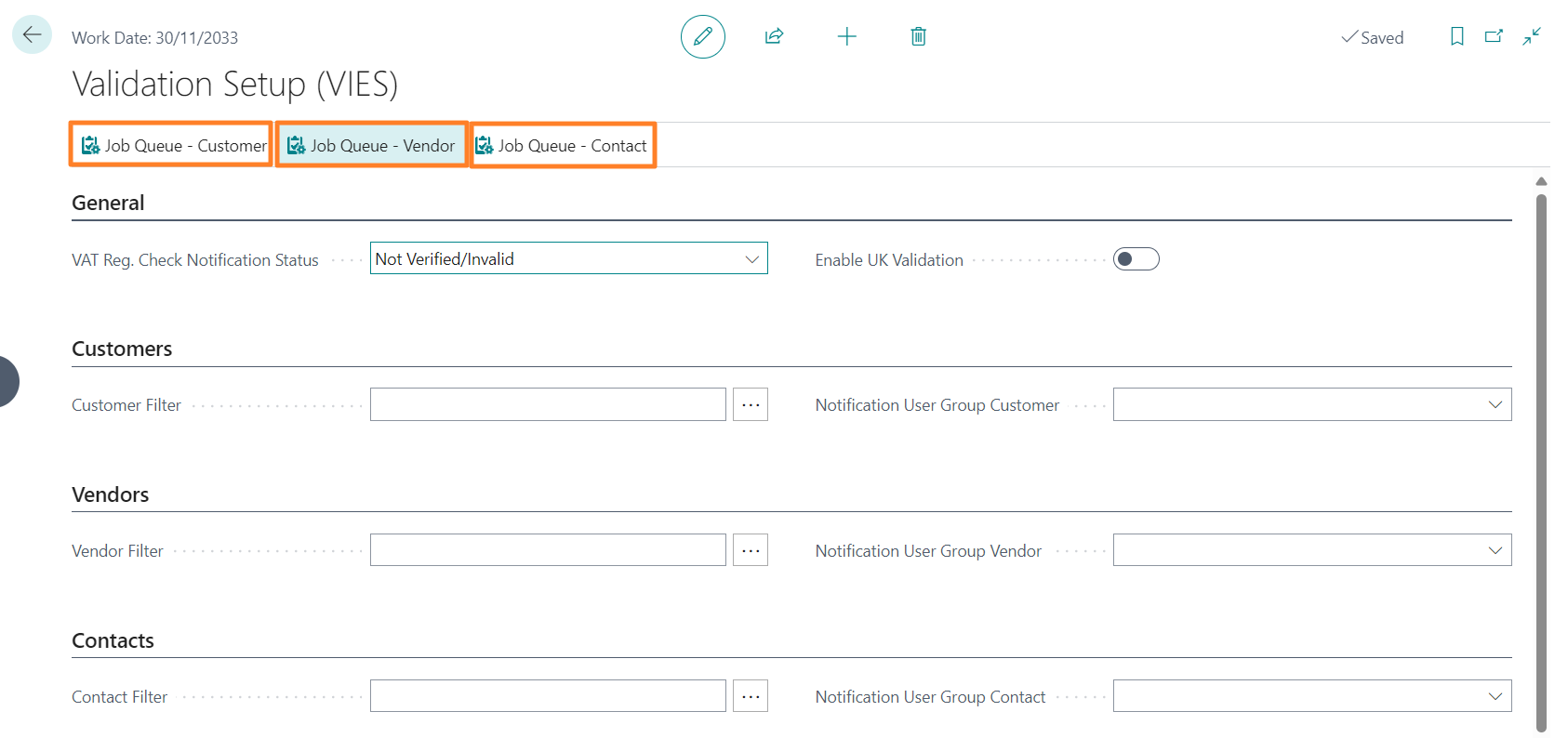

Validation setup

In Validation Setup it’s possible to set the check status of the VAT number to notify, in addition to filters for Customers/Vendors/Contacts and related notification users groups.

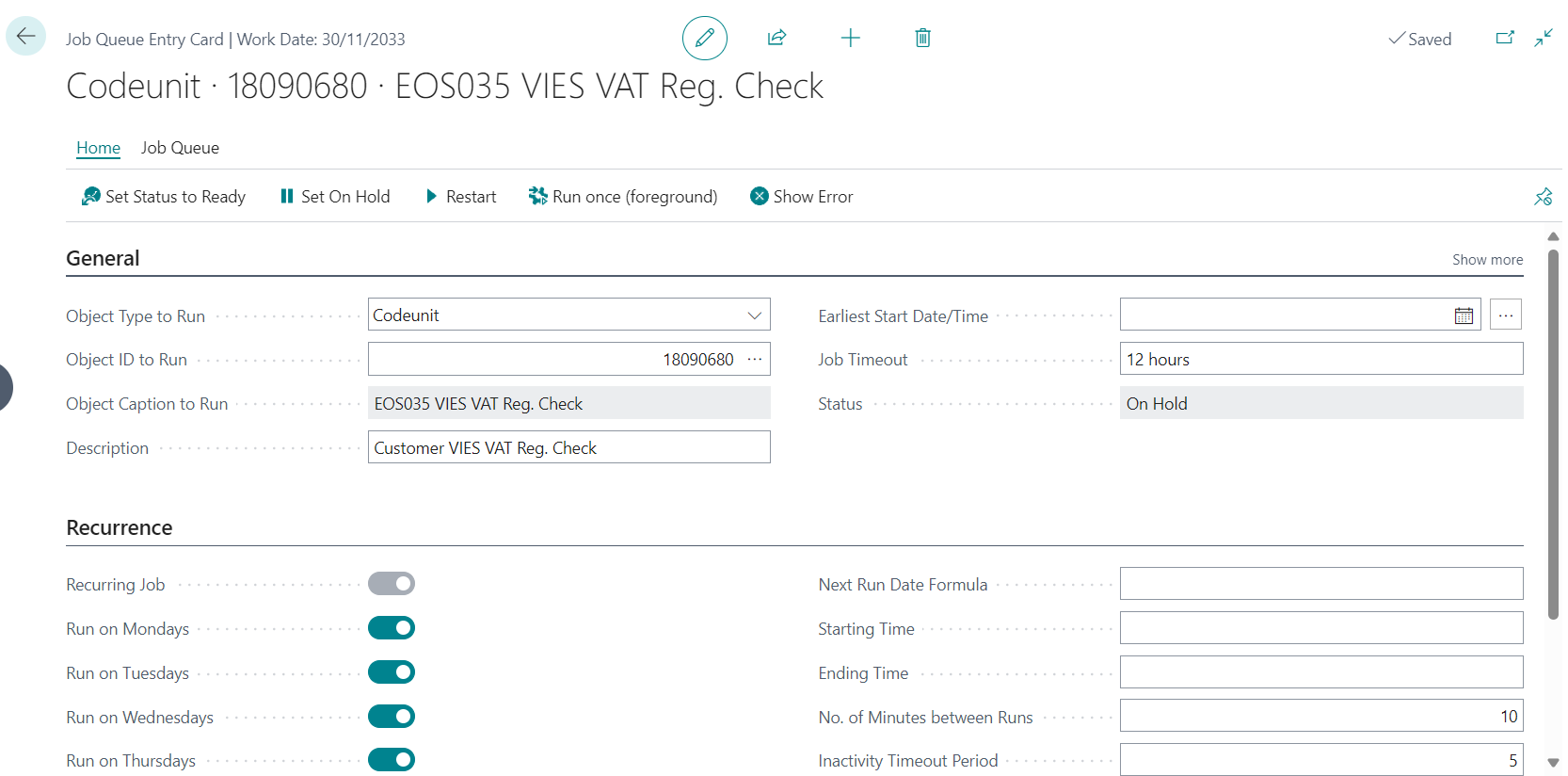

Job queue entries

From Job Queue - Customer, Job Queue - Vendor, Job Queue - Contacts it’s possible to schedule the check, once table at time.

Nome file Link

>

| N.B. |

|---|

| In Parameter String you must specify the table ID to process. |

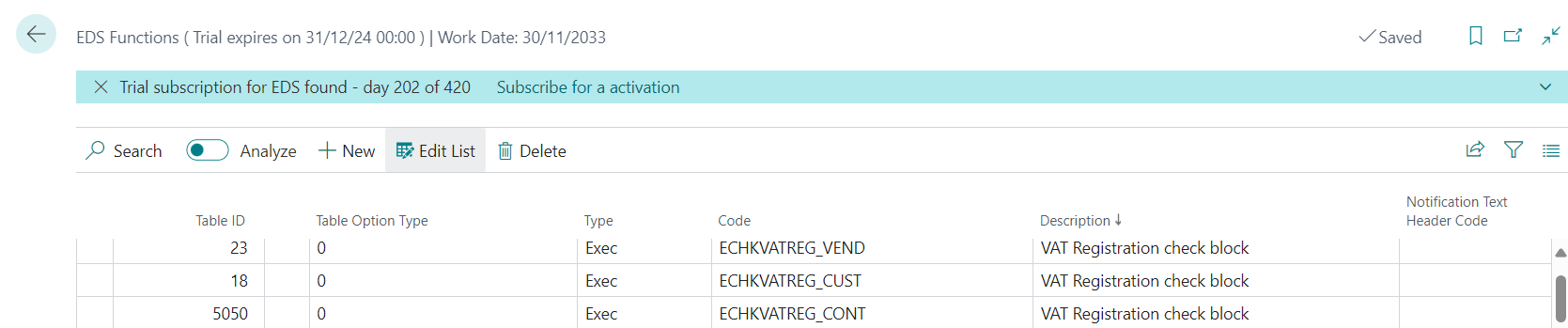

Data Security functions for block or warning message

In EDS Functions of Data Security app there are specific functions that allow to block/alert against the result about the VAT number check.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.