Invoice discounting bill - Insert

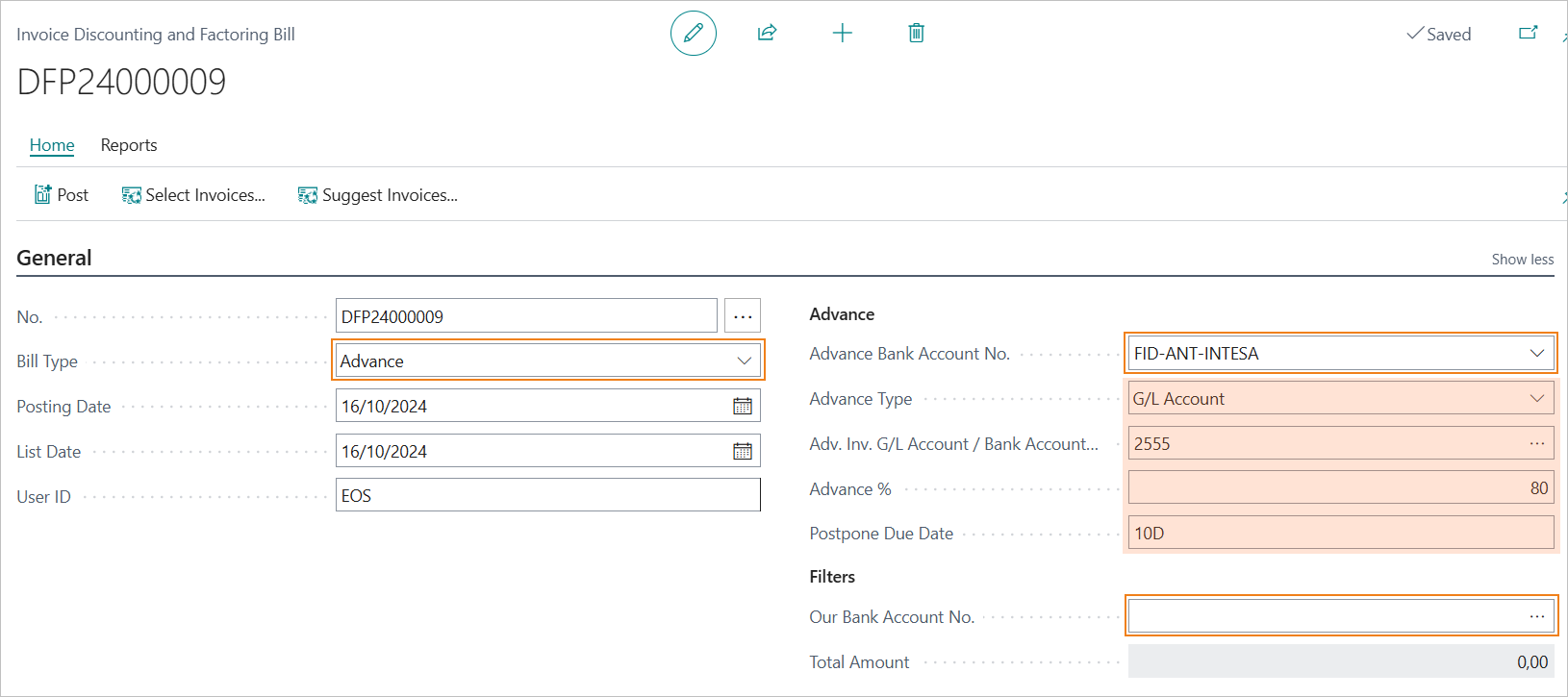

For the advance invoice discounting bill, it is necessary to set the «Advance Bank Account No.» and, if applicable, the filter for «Our Bank Account No.».

By selecting the advance bank account no., the «Advance Type», «Advance Inv. G/L Account / Bank Account No.», the «Advance %» and the «Postpone Due Date» will be proposed (data present on the bank account card).

Invoice discounting bill - Documents selection

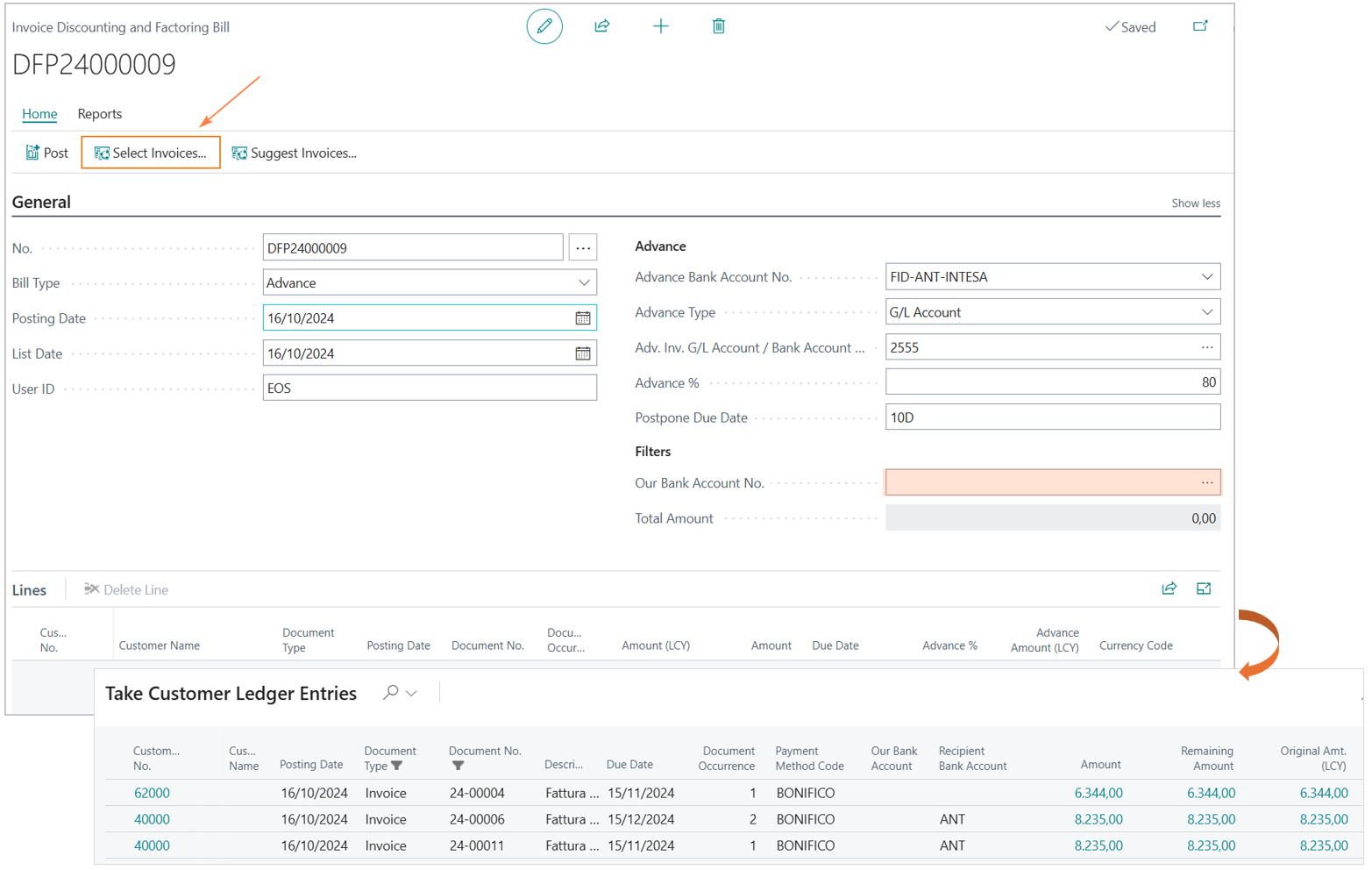

The selection of documents to be advanced is usually done through the «Select Invoices» action.

Only open invoices with a payment method other than Riba and not factored (Factor Code = blank) will be visible in the selection window.

The filter for «Our Bank Account No.» will also be applied if set.

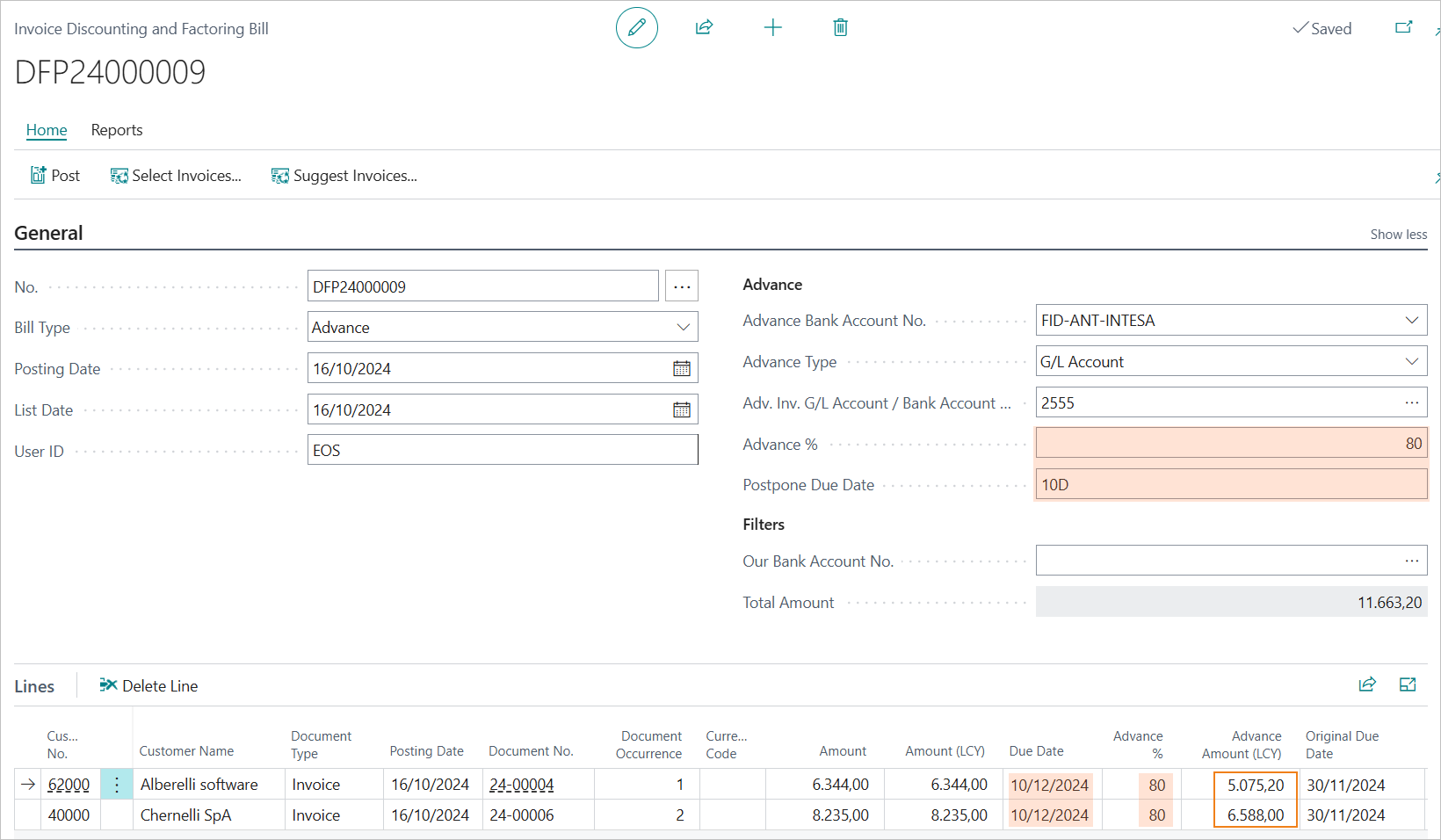

In the case of an invoice discounting bill, the «Advance %» will be displayed on the lines and the «Advance amount (LCY)» and the «Due date» will be calculated (to be communicated to the bank), based on the parameters set in the header (proposed by the advance bank account entered in the bill header).

These values can be modified by the user. The Advance amount (LCY) will be the one detected during registration.

Invoice discounting bill - Posting and G/L entries

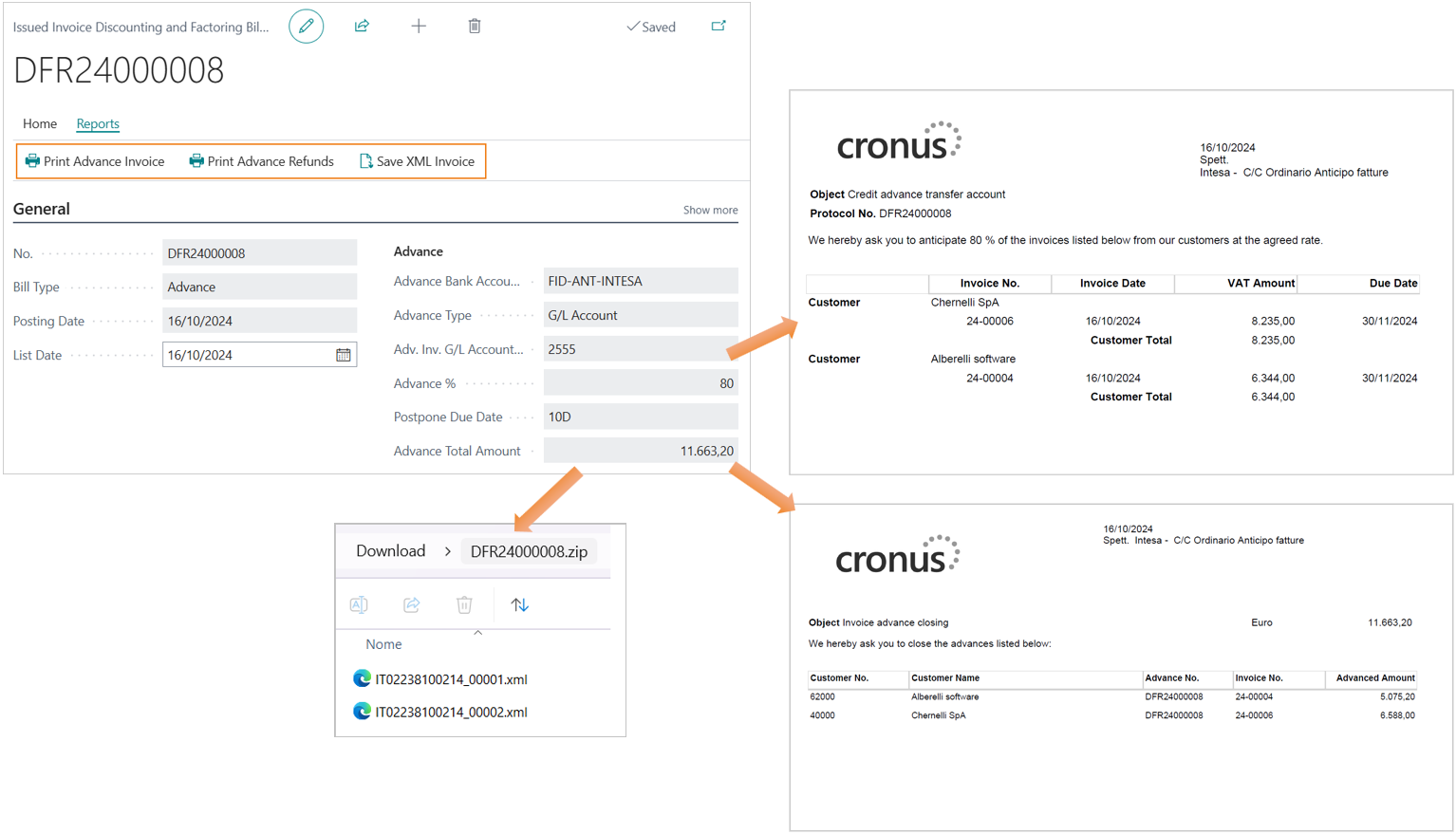

With the posting, the bill is issued and stored in the archive «Issued Invoice Discounting and Factoring Bills».

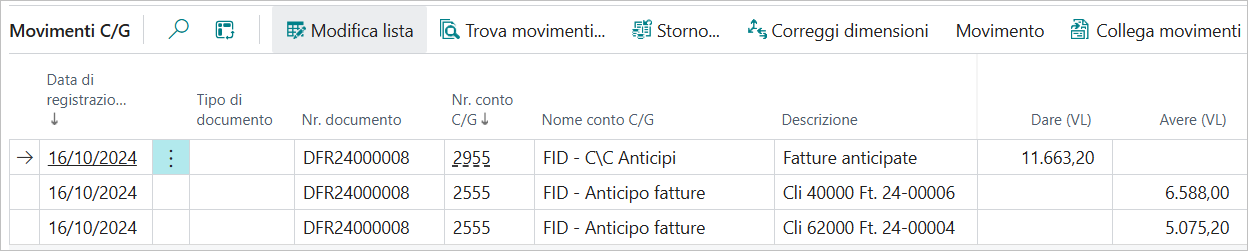

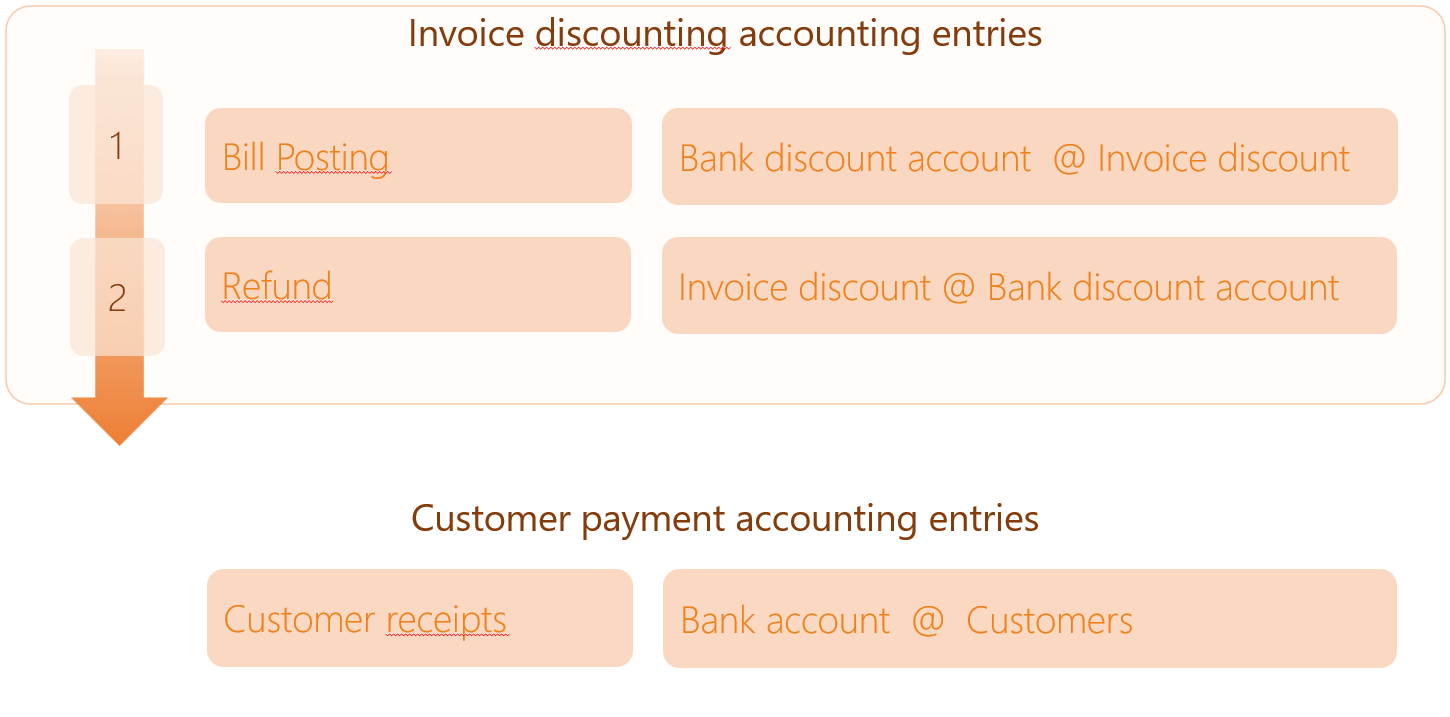

The posting of the invoice discounting bill will make the following general ledger entries:

Bank C\C Discount @ Invoice Discount

The customer ledger is not valued and the discount invoices, therefore, are not paid.

Invoice discounting bill - Refund

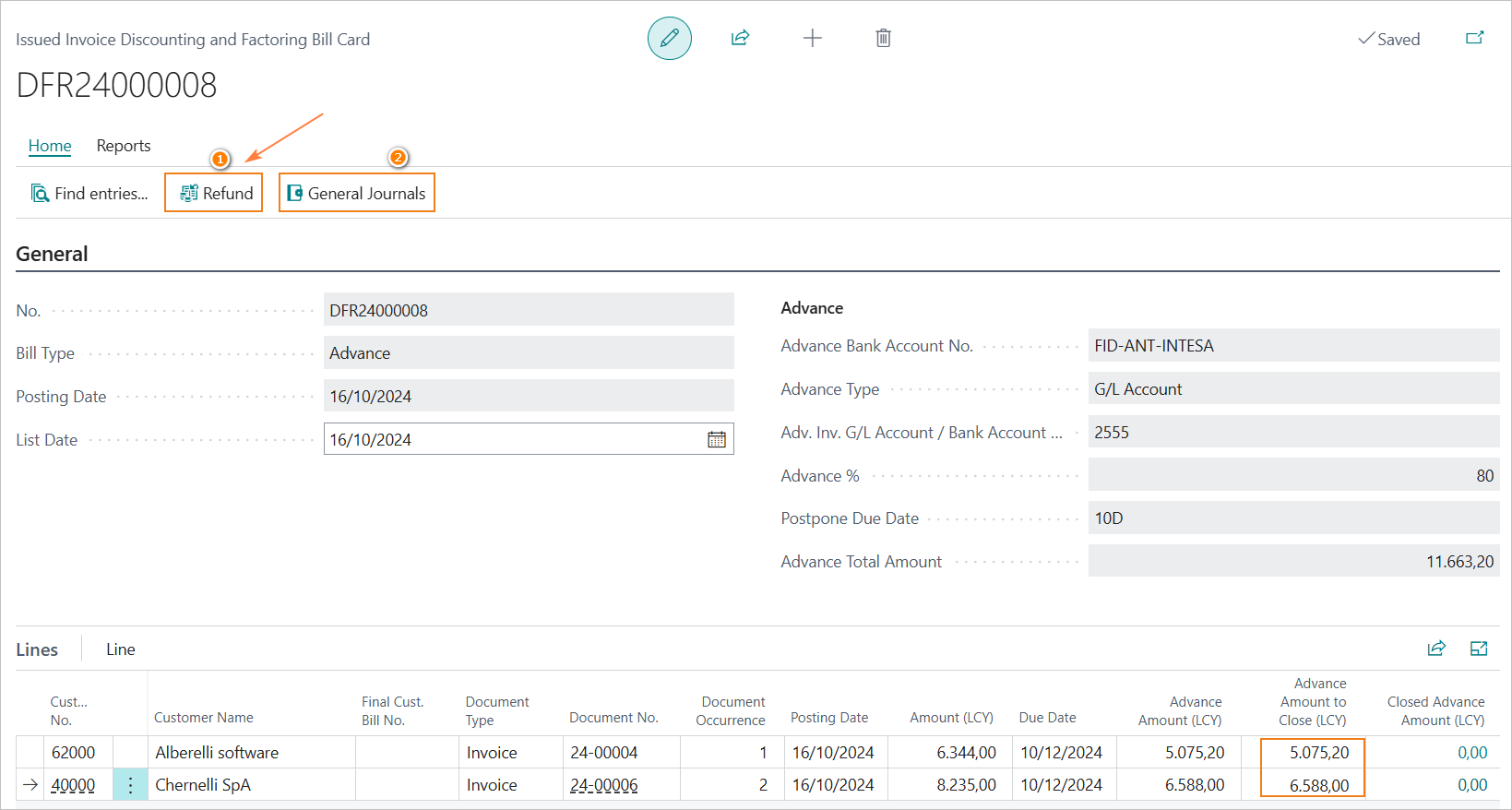

From the Issued invoice discounting bill, it is possible, upon expiry, to proceed with the refund of the amounts advanced through the specific procedure.

Once the records have been selected, through the line action «Calculate amount to be refunded», it will be possible to enhance the field «Advance Amount to Close (LCY)» and proceed with the refund with the action «Refund».

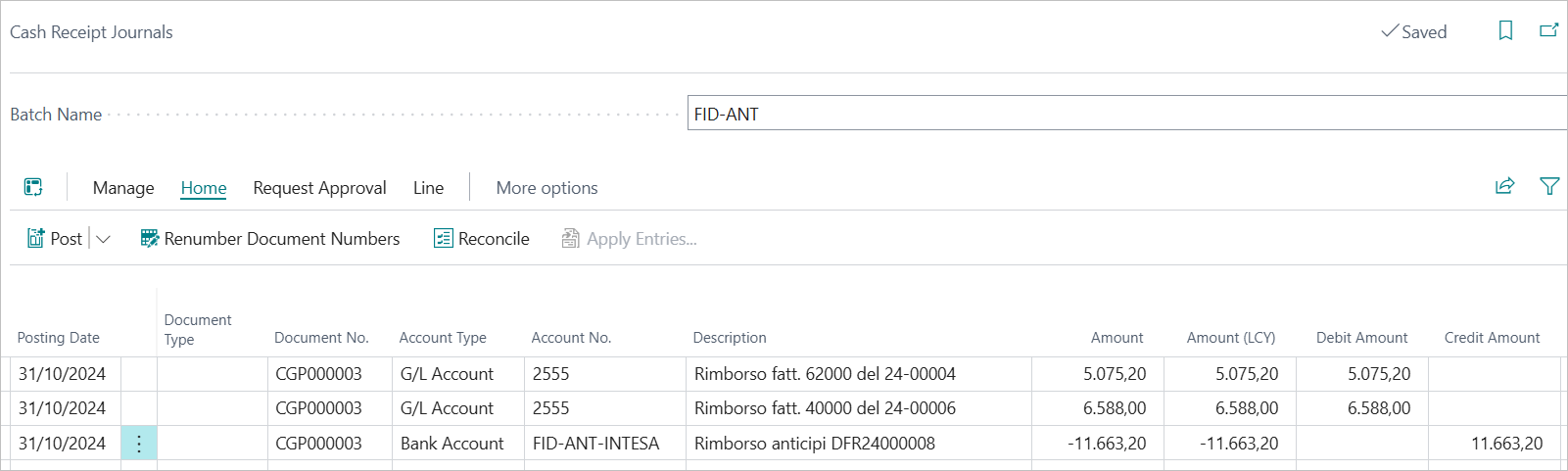

By selecting the «Refund» action, the posting lines will be created in the Batch indicated in setup.

Through the «General Journals» action, it will be possible to access the provisional posting lines.

From the posting batch it will be possible to verify / integrate the records and post.

The posting of the refund records will make the following accounting entry:

Advance invoices @ Bank C/C advances

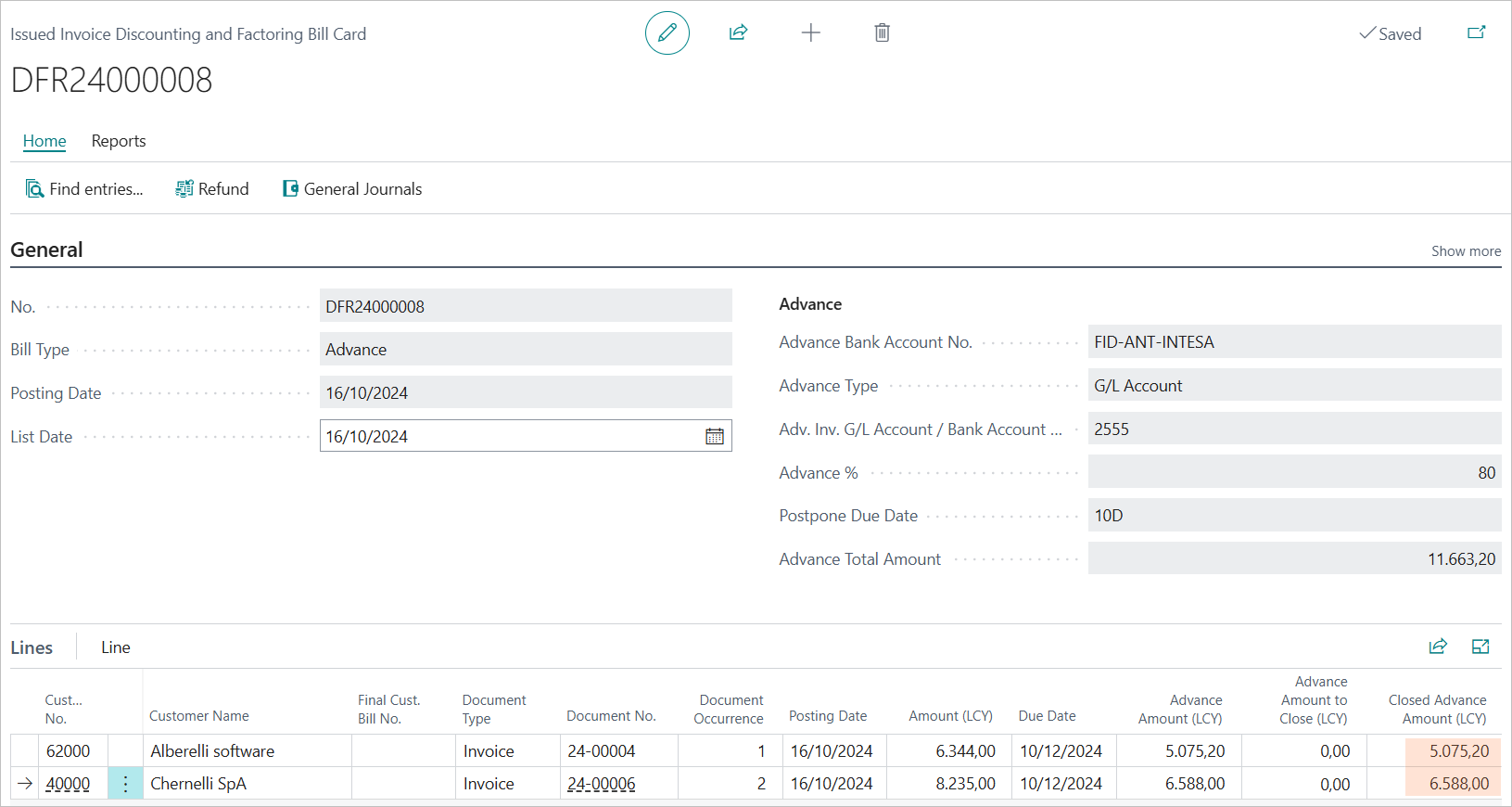

Posting refund records will update the «Closed Advance Amount (LCY)» in the lines of the bill.

Invoice discounting bill - G/L entries summary

The accounting records relating to the invoice discount management process are, therefore, the following:

Invoice discounting bill - Reporting

From the issued invoice discount bill it is possible to:

- print the communication to the bank of the advances to be credited;

- print the communication of the refunds to be debited;

- produce a zip file with the XML files of the invoices contained in the bill.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.