Calculation Logic

Calculation logics for various types of costs

Unlike the BC standard, the costs are calculated by calculating only the input movements with the movement type “Purchase” or “Output”. If the initial stocks have been loaded with Movement Type “Positive adjustment”, it is therefore necessary to set the initial quantities and values in the “Pre-departure Item Costs” table.

Average Cost Calculation: Total purchase and product amount / Total quantity purchased and produced

Setup at DiBa/Standard Cycles: The average cost is calculated with the following logic: consumption from Diba * cost defined in Item cost setup (average cost, weighted average cost or standard cost) + times from Cycle * cost defined in Setup item costs (movement cost, standard cost or budget cost) + C/Labor cost (recovered according to the setup hierarchy).

Setup with Actual Movements: The average cost is calculated with the following logic: actual consumption declared * cost defined in the Item Costs Setup (average cost, weighted average cost or standard cost) + actual times declared * cost defined in the Costs Setup items (movement cost, standard cost or budget cost) + C/Labor cost (recovered according to the setup hierarchy).

NB

- An item should only be managed with Purchase or Production replenishment system. In the event that the same item is both purchased and produced, the following situations may occur:

- Item with “Purchase” replenishment system: the cost will be calculated considering only Purchase type movements;

- Item with “Production order” or “Assembly” replenishment system: the calculated cost will correspond to the average of the costs of the two processes; however, if the calculation is performed with Standard Cycle/DiBa, it will not be possible to view the cost breakdown in the different components (material cost, capacity and c/labor) since the entire cost will be highlighted as a material component.

- In the case of actual movements calculation: the cost of a production movement, unlike the BC standard, is determined by considering the consumption and times declared, regardless of the status of the PO, and of the fact that the order has a phase of C/work, etc.

Calculation of weighted average cost

The weighted average cost is calculated based on the “Weighted average cost calculation method” defined in the Item Cost Setup.

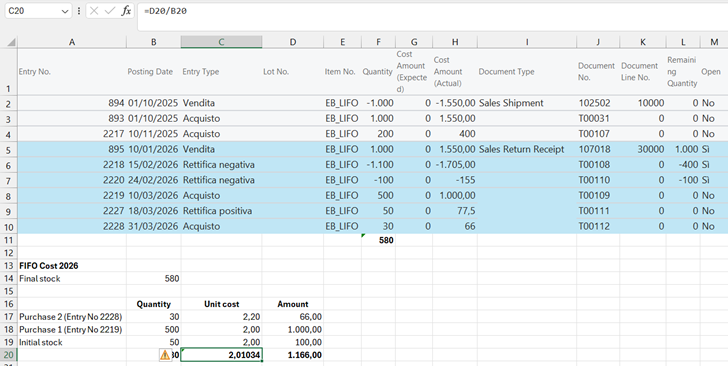

FIFO Cost Calculation

The FIFO cost is calculated with the following logic: the stock at the end of the period is determined, then the last Purchase/Output/Assembly Output movements sufficient to cover the final stock are recovered (Total cost amount / Total quantity).

In the event that the movements present in the calculation period are not sufficient to cover the final stock, the remaining quantity is recovered from the initial stock, valued at the FIFO Cost recovered from the last previous “Final” period (with the same Cost Setup Code items).

Example:

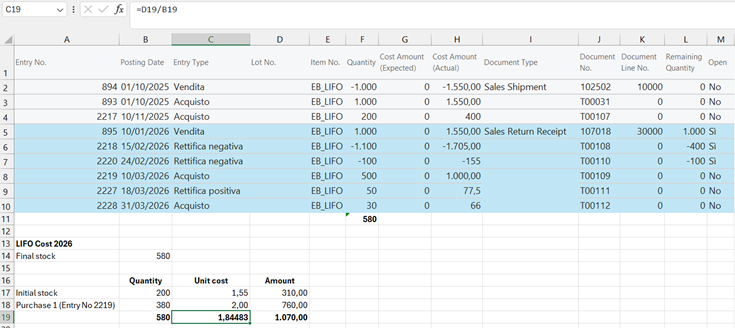

LIFO Cost Calculation

The LIFO cost is calculated with the following logic: initial stock valued at the LIFO Cost recovered from the last previous “Final” period (with the same Item Cost Setup Code) + sum from the Purchase/Output/Assembly Output movements present in the period calculation, which serve to cover the final stock (Total cost amount / Total quantity).

Example:

Last Direct Cost Calculation

- Purchase type item:

the procedure sorts the movements by Registration Date and Movement No. and identifies the last (most recent) movement for which to calculate the cost. The final cost is determined with the following logic: the procedure recovers the last item accounting entry of the Purchase type (invoiced or not invoiced), accesses the valorisation transactions by filtering them by Entry type = Direct cost and applies the following formula: (Purchase amount Actual + Estimated Purchase Amount) / Quantity.

- Production type item: the procedure sorts the movements by Registration Date and Movement No. and identifies the last (most recent) movement for which to calculate the cost. The Ultimate Cost is determined with the following logic: the procedure recovers the Ultimate Cost of the components (consumption) used for the specific Work Order, then adds the direct and general costs of the related capacity movements, then divides the total of the two costs by the quantity of OdP output. In both cases, if there are no movements in the calculation period, the final cost is recovered as follows:

- The system searches for the last Cost in the Item Cost History of the previous period (Previous Period End Date < Period End Date) with the same Item Cost Setup Code, ordering the periods by Period Code; then recover the value of the Last cost field and mark the “Forcing last cost” field with the Previous last cost option.

- If the previous search was also unsuccessful (remote case: probably in the go-live phase with positive adjustments and pre-departure costs or in cases of previous periods filtered for certain items), the Last Cost is inherited from the Average Cost field of the History item costs of the same period and the “Forcing last cost” field is marked = CMP or Standard (i.e. the same forcing option present in the “Forcing average cost” field is inherited).

Points of attention regarding the Roll up calculation logic and the correct definition of the Low-level code:

Rework: Production orders that load and consume the same item): the types of rework managed in the standard of the IVC app are indicated in the file contained at the following link: https://docs.eos-solutions.it/Images/PR000391-0/IVC_Rilavorazioni_ed_Autoconsumi.pptx

Recursiveness: Example: production orders that load item A by consuming item B, subsequent production orders that load item B by consuming item A): in these cases, it is not possible to correctly calculate production costs.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.