Sales Free Goods (SFG) - Free gift self-invoice

Setup

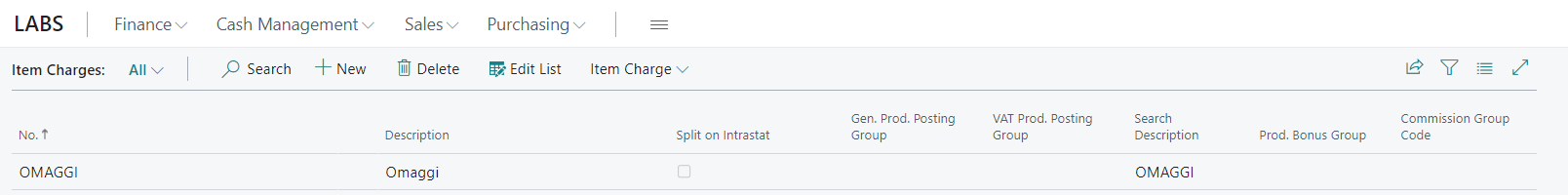

Item Charges

You need to create the item charge codes linked to the management of gifts.

Note Leaving blank the two fields “Gen. Prod. Posting GroupDescending / VAT Prod. Posting Group”, in the invoice line entered as Gift (revenue reversal), these two fields are inherited from the linked Item line.

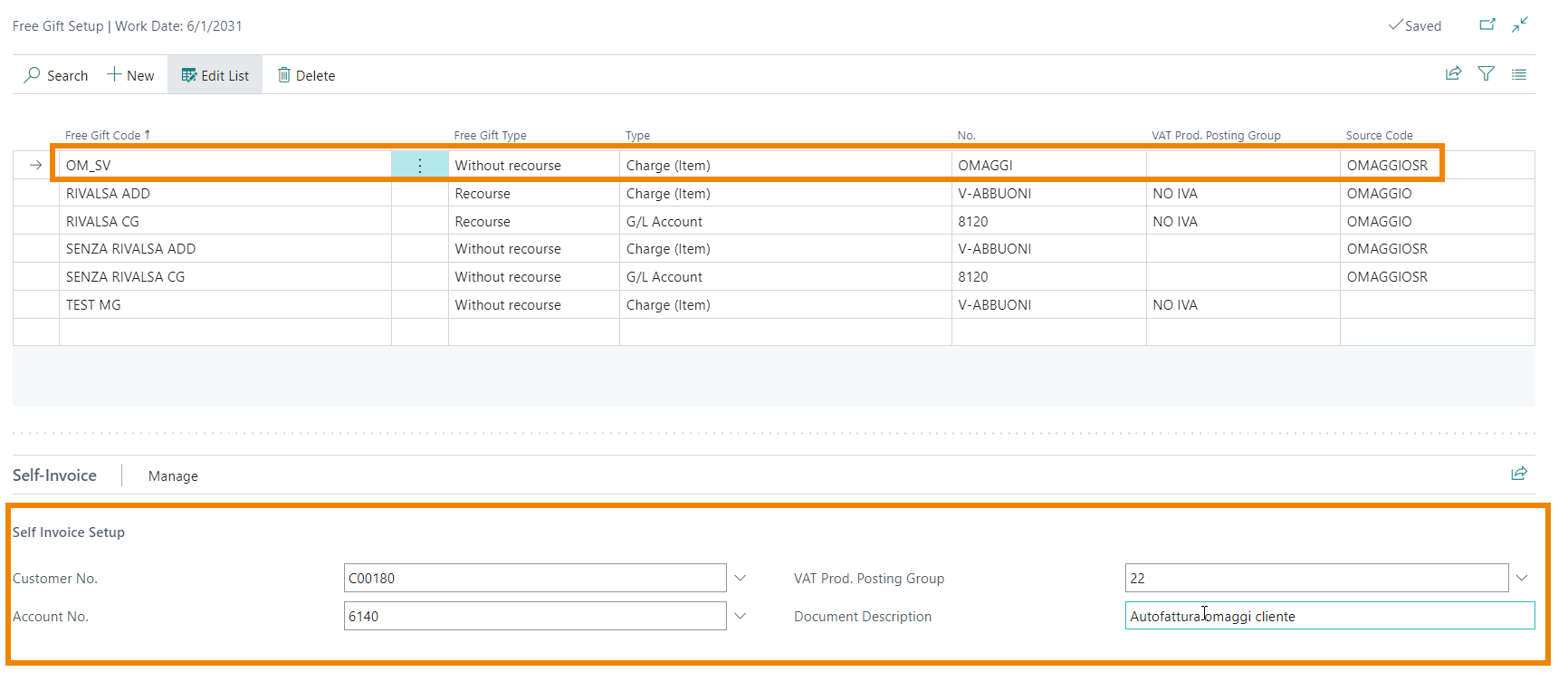

Free Gift Setup (SFG)

In this setup, it is necessary to fill in the free codes to be managed by the system.

| Field | Description |

|---|---|

| Customer No. | fictitious customer (company) holder of the self-invoice document |

| Account No. | account to be handled in the lines of the self-invoice document |

| VAT Prod. Posting Group | VAT category set in the lines of the self-invoice document |

| Document Description | if filled in, it feeds the standard field “Posting Description ”of the self-invoice document header |

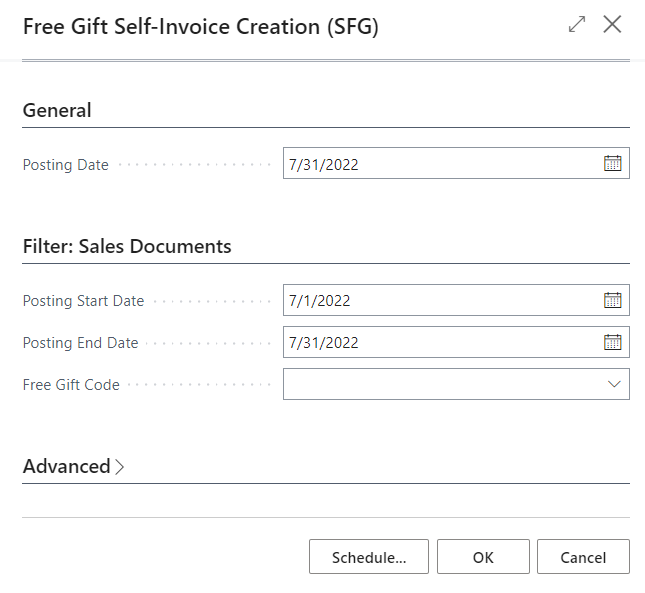

Free gift self-invoice - Procedure

The procedure analyzes the sales Invoice / Credit memo lines, posted in the period, which present a gift with a free gift type “Without recourse”, in order to insert them as lines of the self-invoice document.

| Field | Description |

|---|---|

| Posting Date | indicates the Posting Date with which the self-invoice document will be generated |

| Posting Start / End Date | indicate the period for which to analyze the posted Invoice / Credit memo lines containing lines of free gifts with the type of gift “Without recourse” |

| Free Gift Code | allows you to set filters on free codes with the type of gift “Without recourse” |

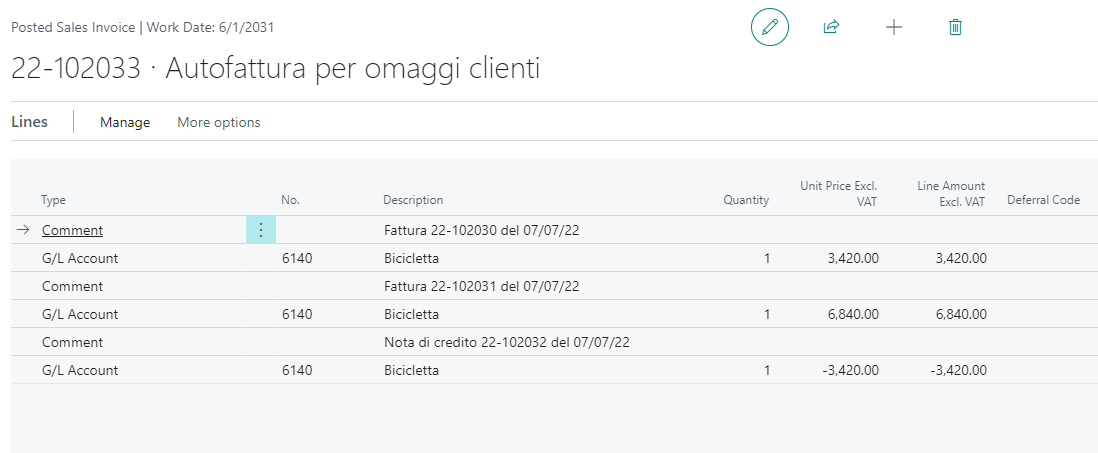

Free gift self-invoice - Example

The self-invoice present a line for each Invoice / Credit memo line included in the calculation: the “Quantity” is forced equal to 1 and the “Unit Price Excl. VAT” coincides with the value of the “Amount” field of the free line (of the Item type). The “Amount” field corresponds to the taxable amount of the line, net of commercial discounts (line discounts and invoice discounts).

A description line is also inserted for each sales document processed.

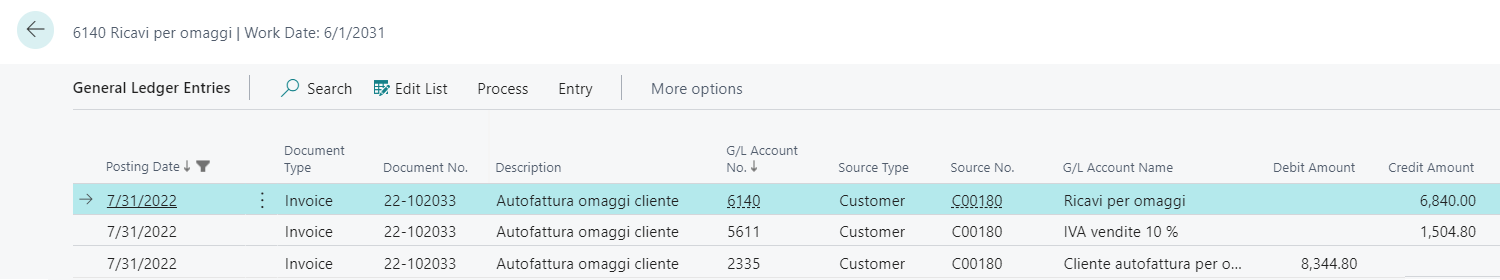

The accounting entry generated by the accounting of the self-invoice is as follows:

Following the accounting of the self-invoice, the following prime entry must be posted aiming at reversing the receivable from the self-invoice customer and the revenue for gifts and to post the non-deductible cost relating to VAT:

Revenues for Gifts (€ 6,840.00) @ Customer for self-invoice gifts (€ 8,334.80)

Non-deductible costs (€ 1,504.80)

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.