Sales Free Goods (SFG)) - Gifts with / without VAT recourse

Free Gifts with VAT recourse

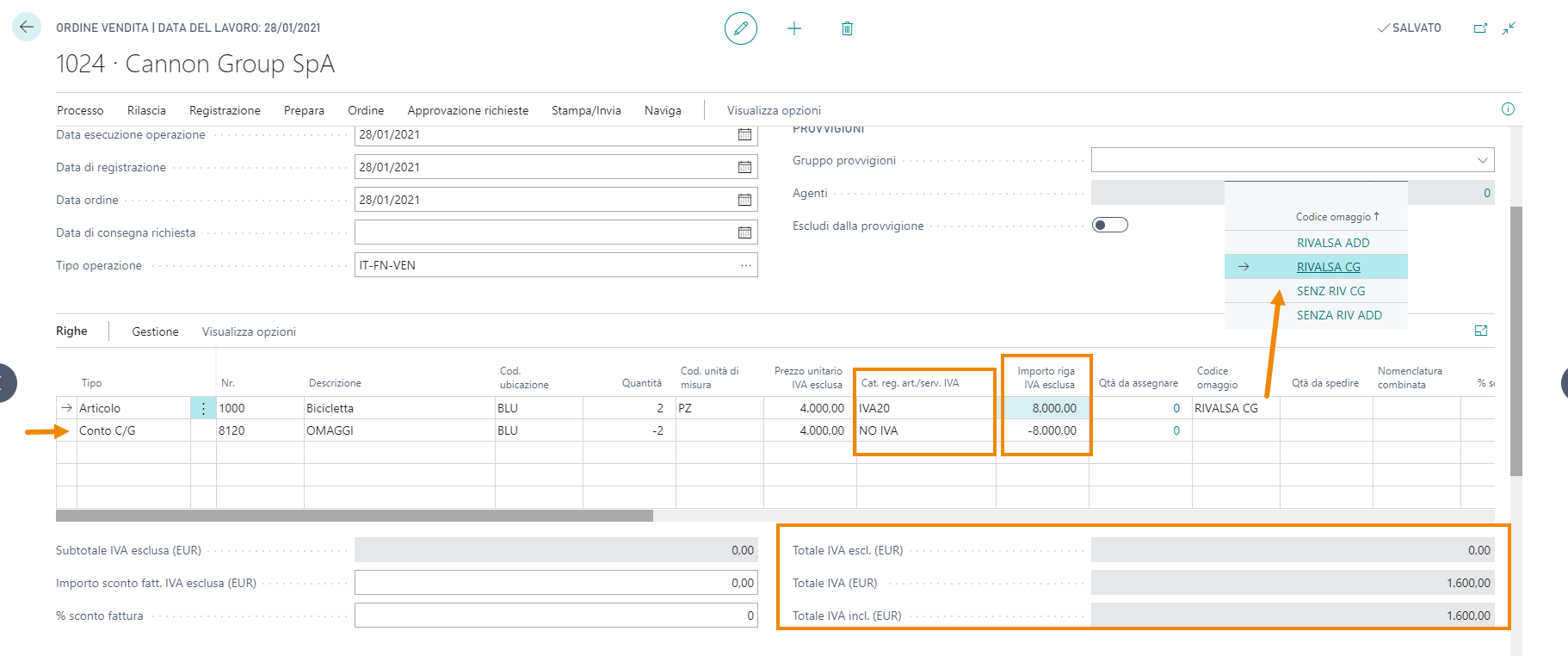

We create a sales order with a line type “Item”.

For the item we choose Recourse as Free Gift Type:

Releasing the system creates a second reverse line with equal quantity and amount, but of opposite sign and different VAT Prod. Posting Group:

The order total is the VAT, which will be paid by the customer.

Recap

If you select a Free Gift Type with recourse the VAT Product Posting Group will be different from the source item line, because the line must show the VAT amount

Free Gifts without VAT recourse

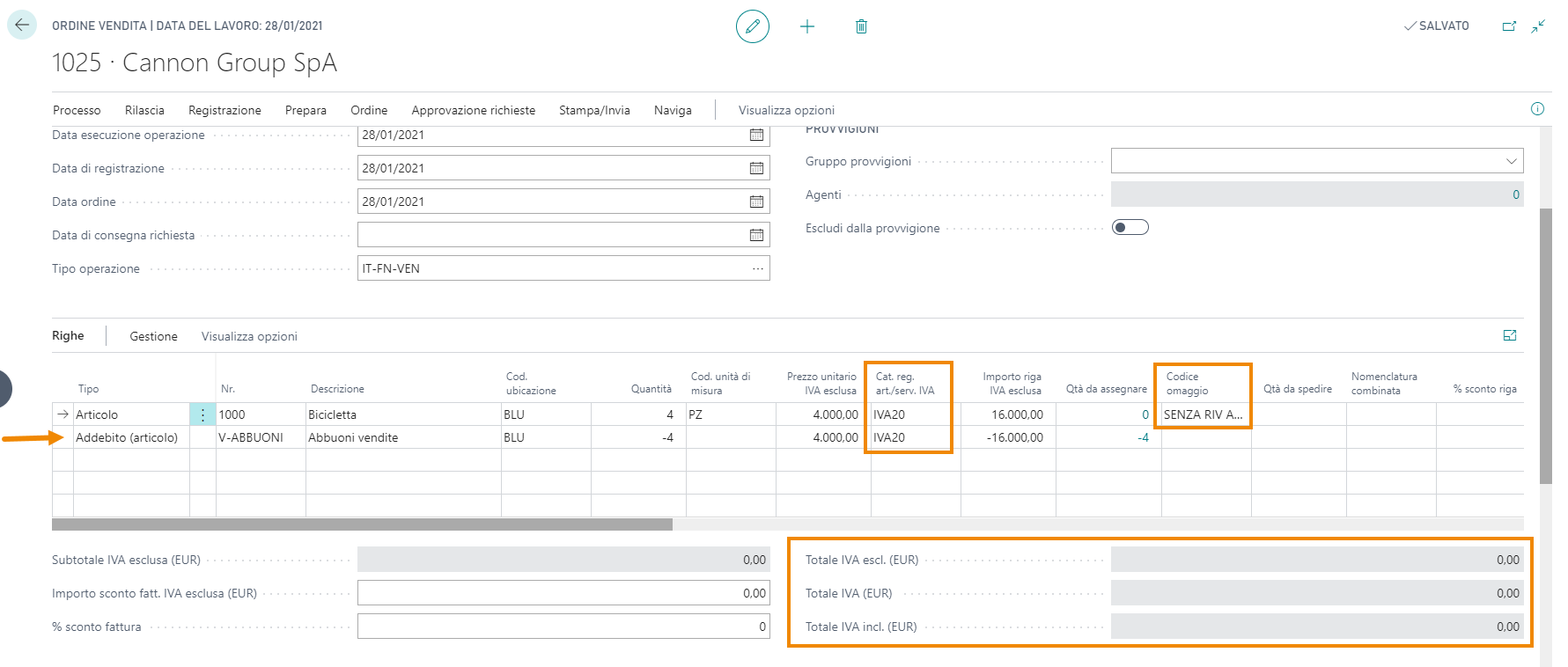

We create a sales order with a line type “Item”.

For the item we choose Without recourse as Free Gift Type and with item charge:

Releasing the system will create a second reverse line with equal quatity and amount, but with opposite sign. The VAT Product Posting Group is the same.

The document total is zero.

Recap

If you select a Free Gift Type without recourse the VAT Product Posting Group will be equal to the source item line, because the total must be zero.

Invoicing

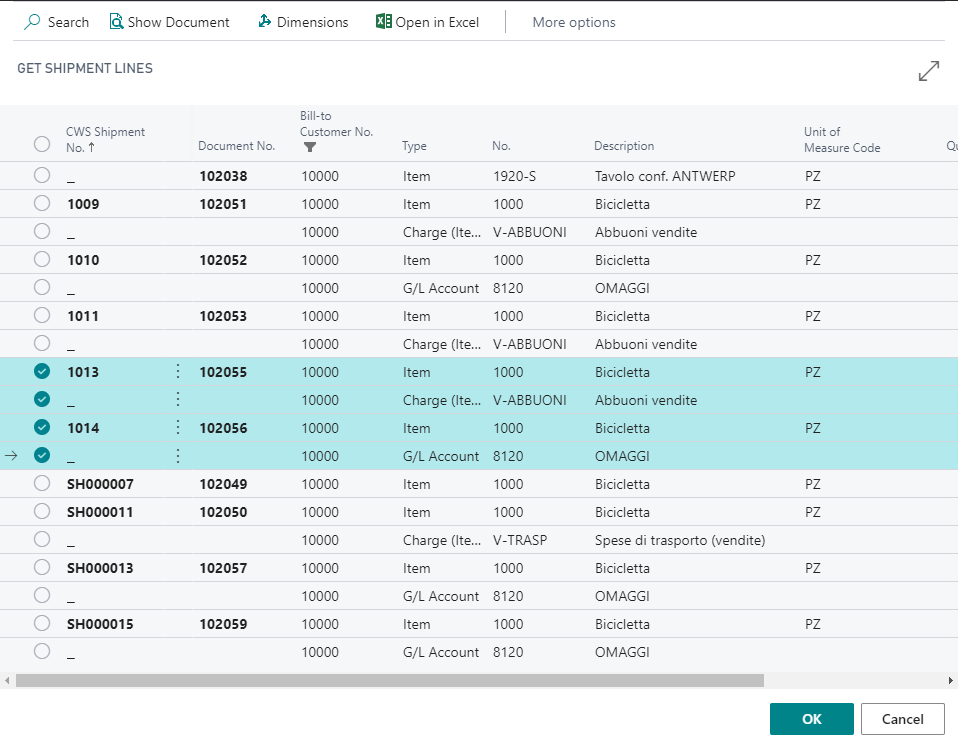

After posting the shipments related to the two created orders, we generate the invoice. We open a NEW document and from Line-> Functions-> Get shipment lines we choose the shipments:

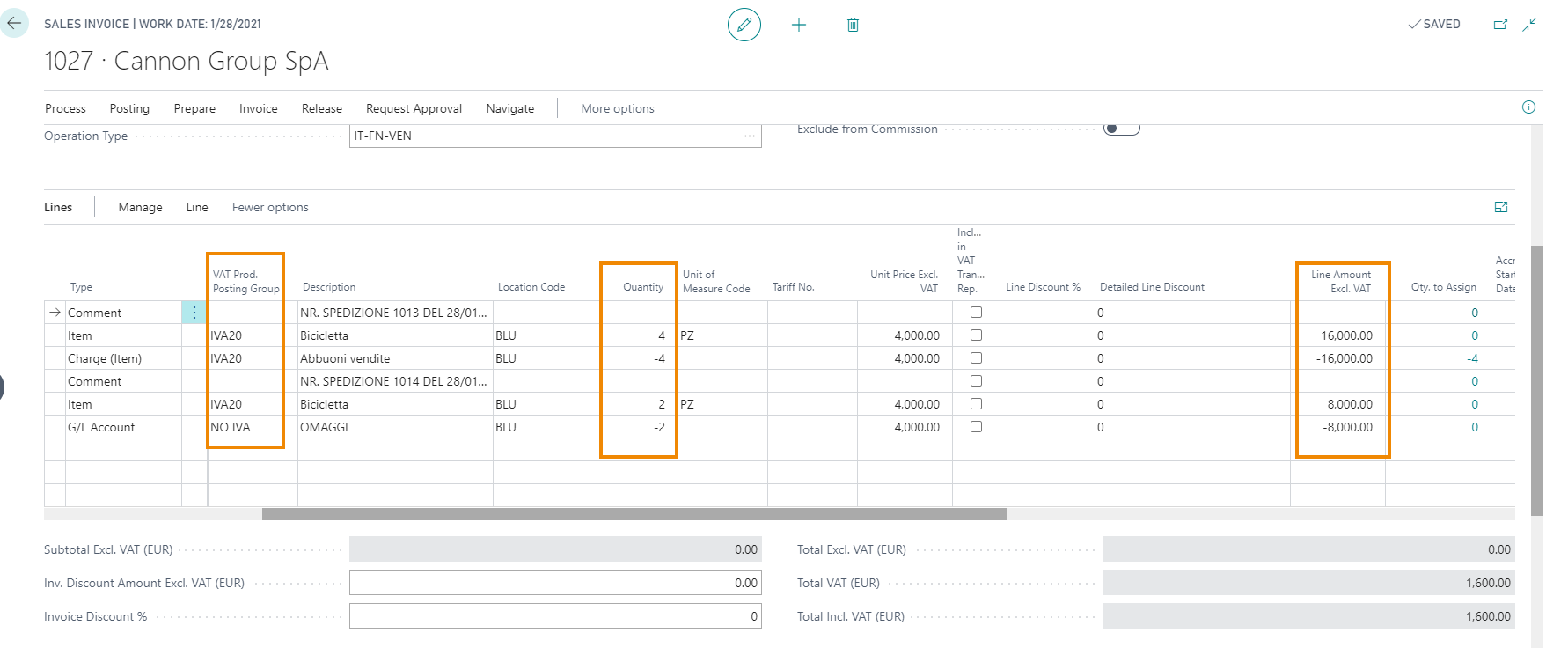

For each shipment the amounts and quantities must be zero:

- The VAT is zero for the first shipment.

- In the second the amount of VAT is equal to 1600 euro, which is the invoice total.

NB. The operation is the same also posting the Invoice directly from the Order or by using the cumulative invoicing.

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.