Settlement

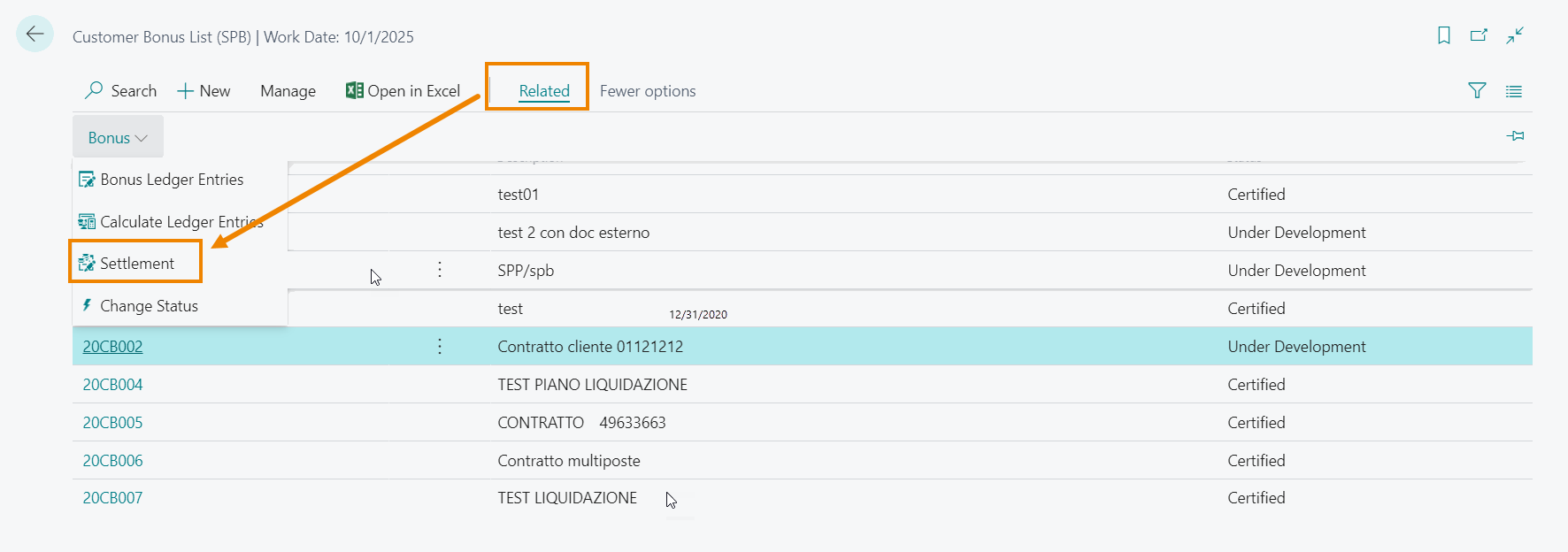

Settlement can be carried out either massively, or by single contract or by single contract line.

We need to enter:

- Starting / Ending Date: posting date range of entries to be settled

- Settlement Type:

- From setup: bonus are settled on the G/L accounts or item charge indicated in setup.

- G/L Account / Item Charge: you must enter the G/L account number or item charge code in the “Settlement No.” field

- Settle Temporary Entries: original movements in the liquidation plan, temporary entries represent “provisional” bonuses, usually dependent on additional conditions.

- Group by Document: defines the logic of combining bonus entries, the maximum detail is the value The settlement populates its journal and the “Amount on Settl. Entries (LCY)” field and consequently of contracts, generating provisional settlement documents (sales credit memos or purchase invoices).

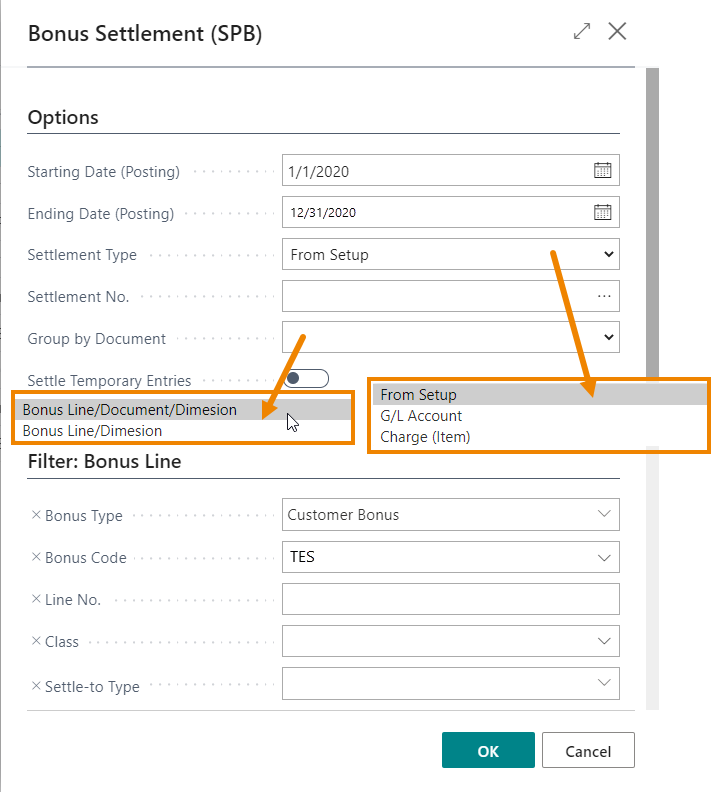

The journal (Customer Bonus Matching (SPB)) is the tool for checking accrued bonuses, from here you can post the temporary documents generated by the settlement procedure (Settle Temporary Entries).

It is also possible to manually match an accrued bonus resulting from a bonus calculated on the basis of documents outside the system or documents wrongly posted without any connection with the respective bonus entries.

Modify amounts

From the journal you can change the amount of the bonuses, the change automatically updates the temporary settlement document. Deleting a bonus line deletes the reference document.

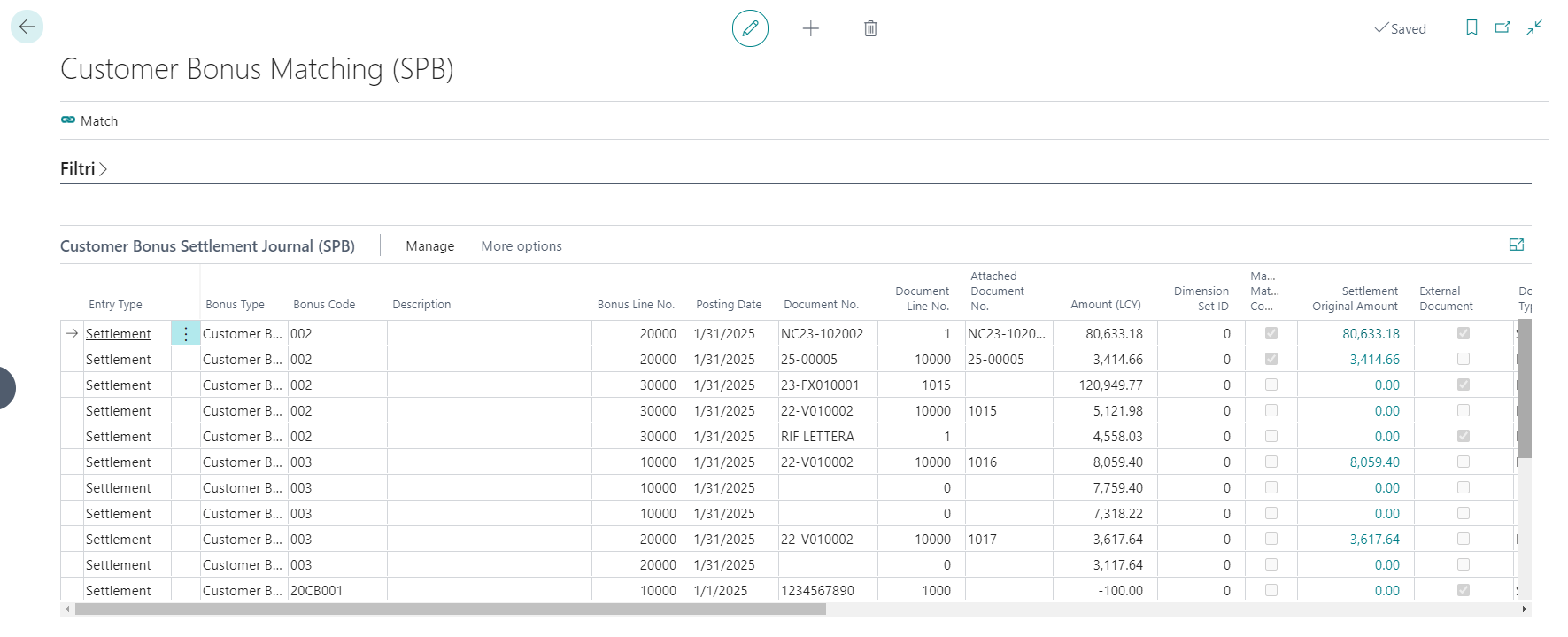

Reverse Settlement to be Accrued

Activation of Surplus Settlement Reverse:

In the Bonus Setup (SPB), it is possible to enable the management of surplus write-offs directly from settlement without generating an accounting write-off document:

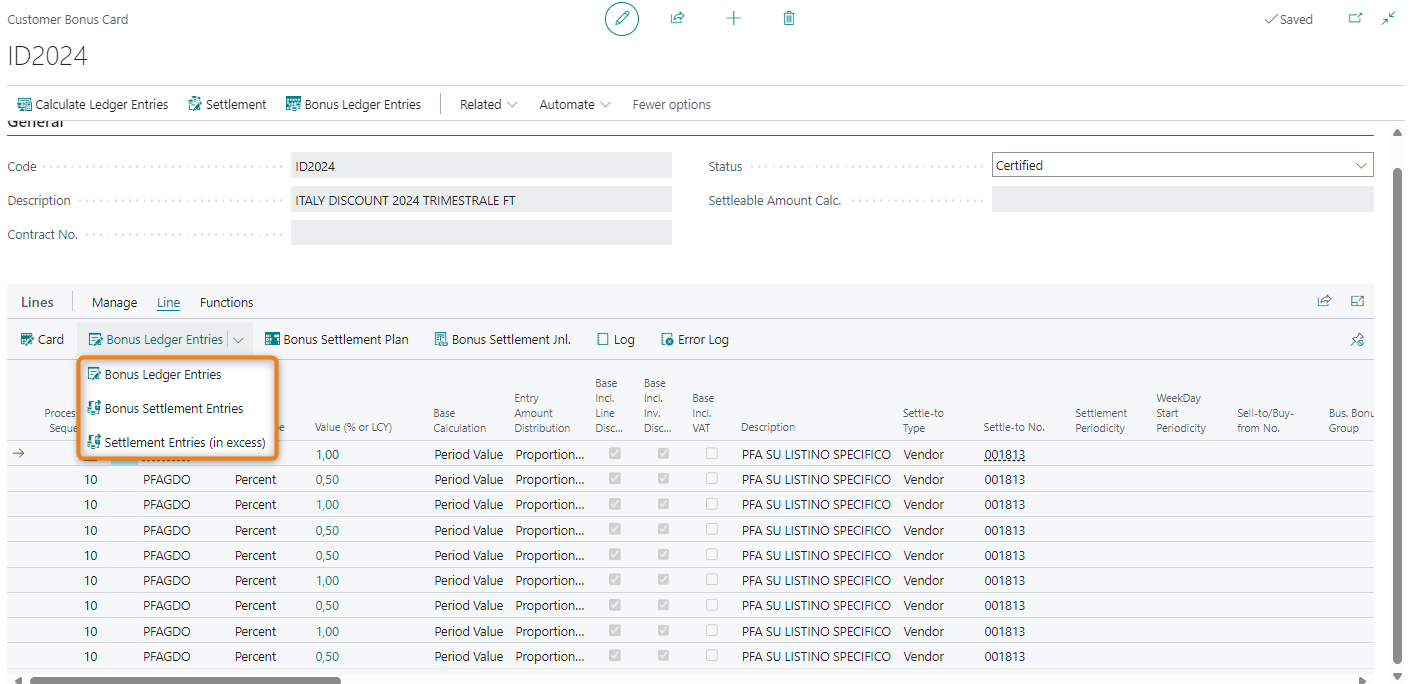

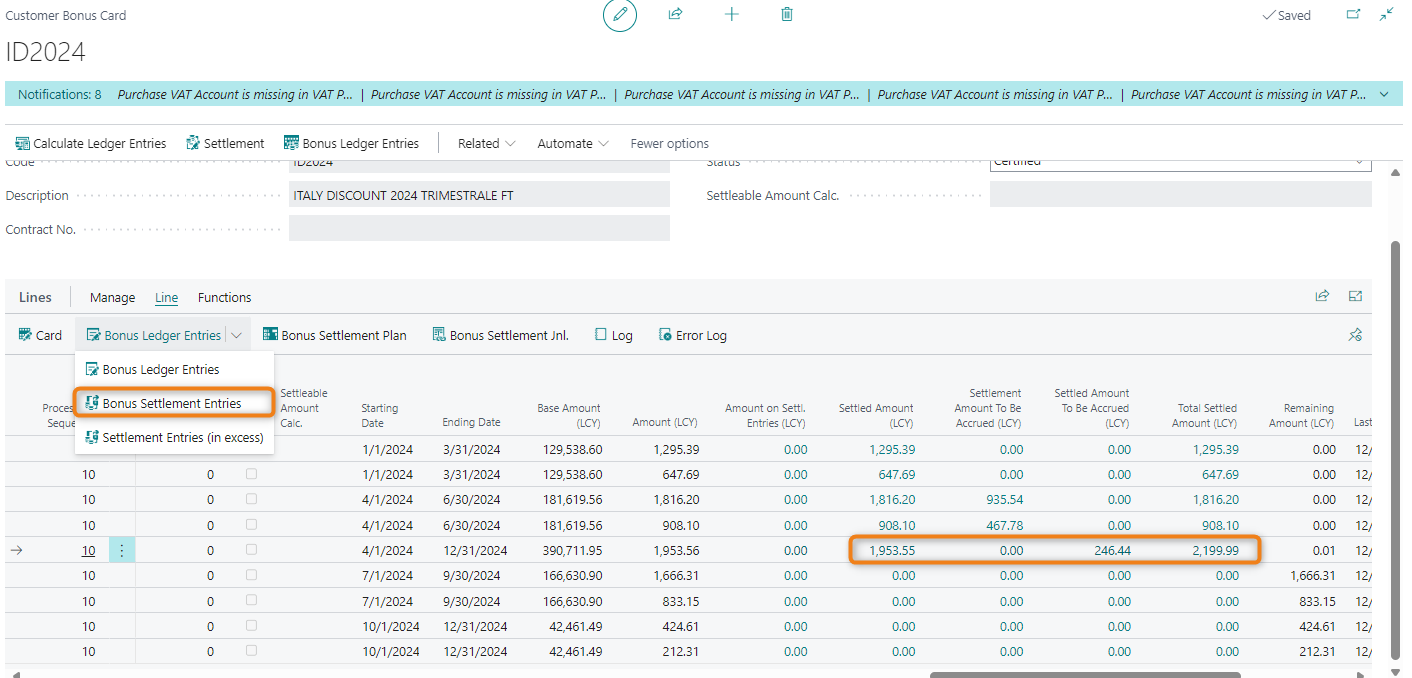

On the contract lines, there are functions to view the following:

- Bonus accounting movements

- Settlement movements

- Surplus settlement movements (to be accrued)

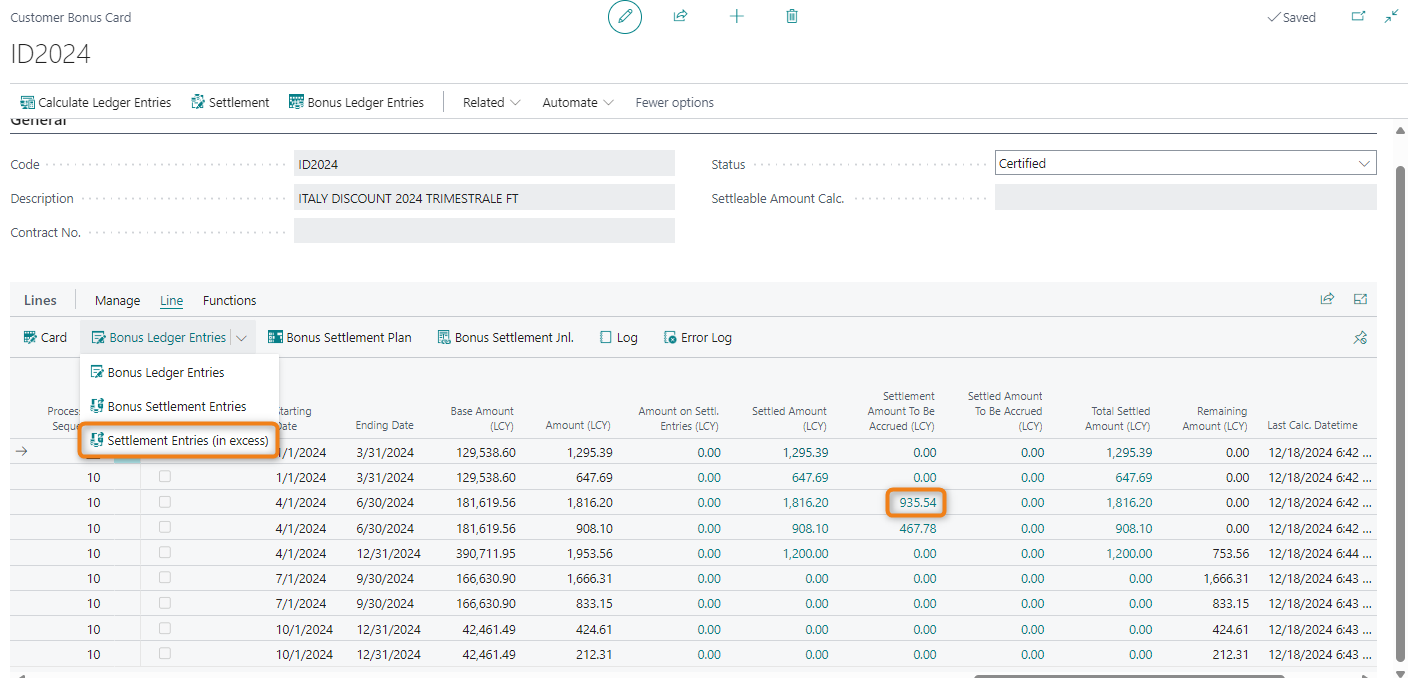

When a settled amount includes a surplus (to be accrued), there are two options:

Option 1: Write-off of the surplus only, followed by the full settlement write-off

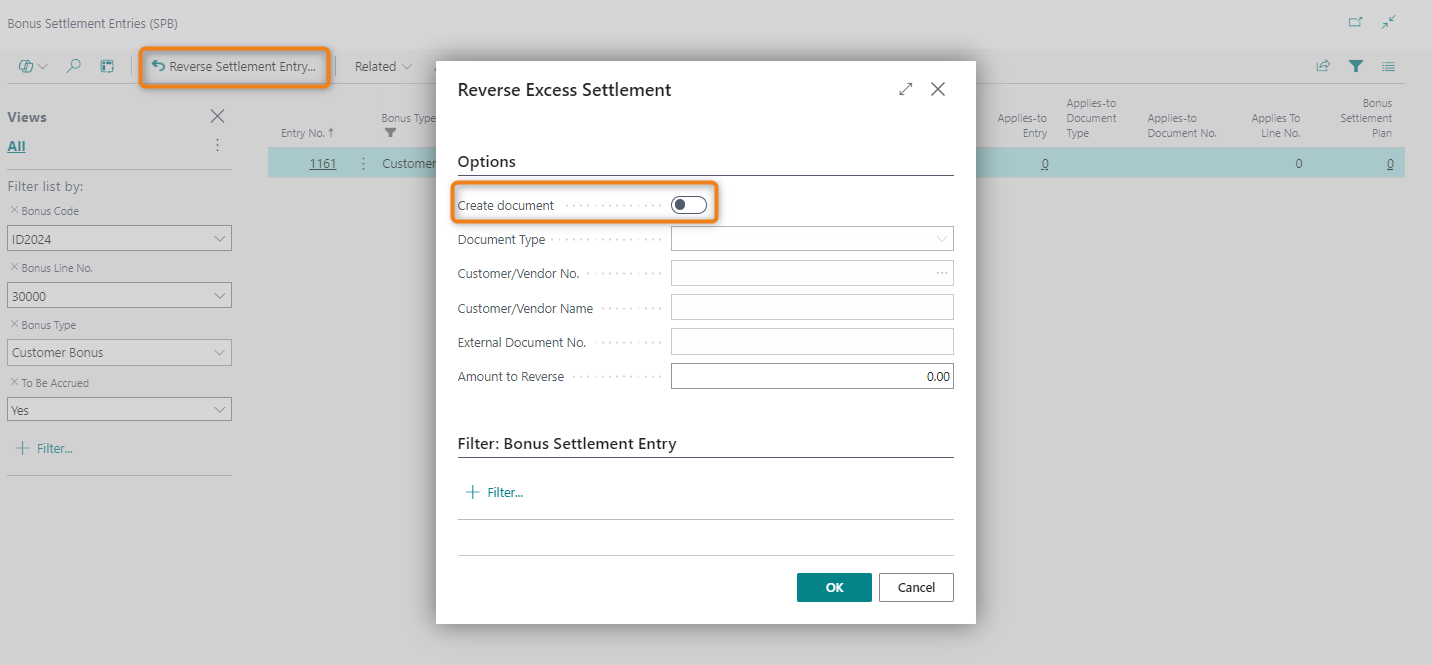

- With the “write off surplus settlement” flag set to true in the bonus setup, the surplus write-off function in the “surplus movements” allows you to reverse the movement without generating an accounting document by unchecking the “Create document” flag in the write-off report:

- Setting the “Create document” flag to false allows you to reverse the surplus without generating an accounting write-off document.

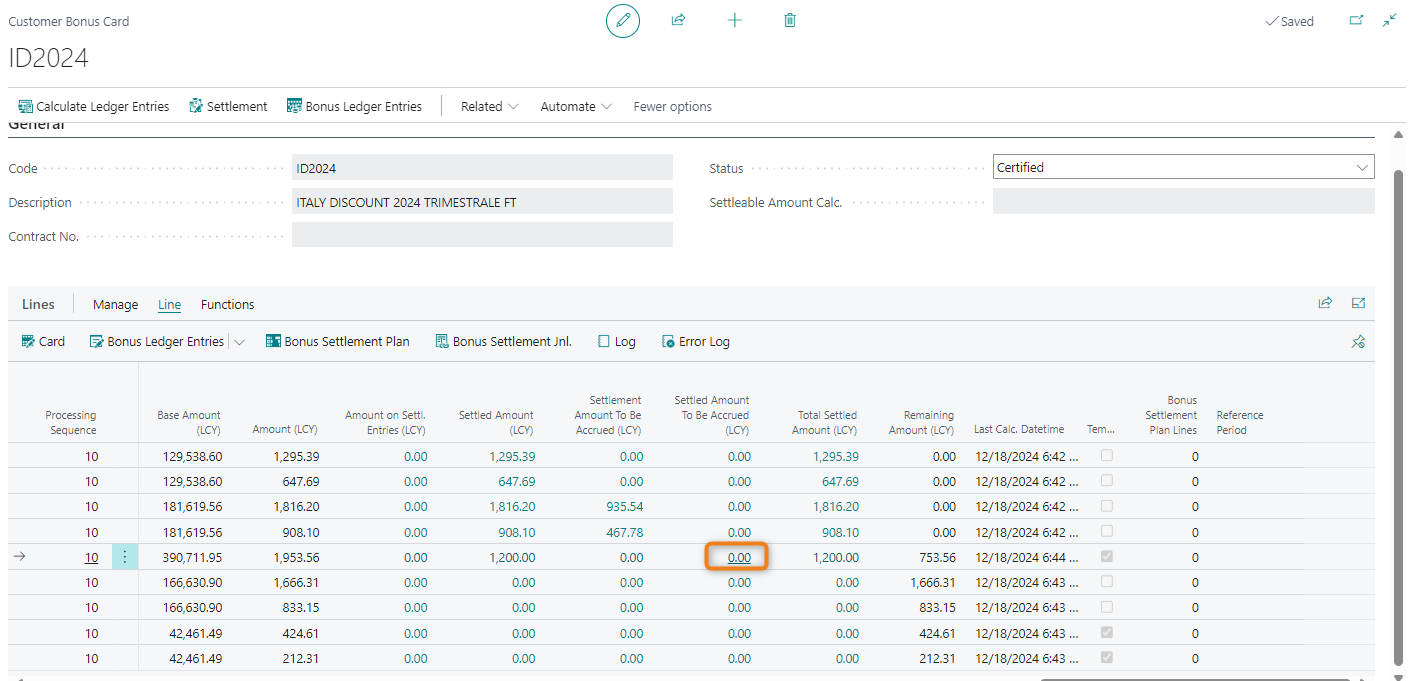

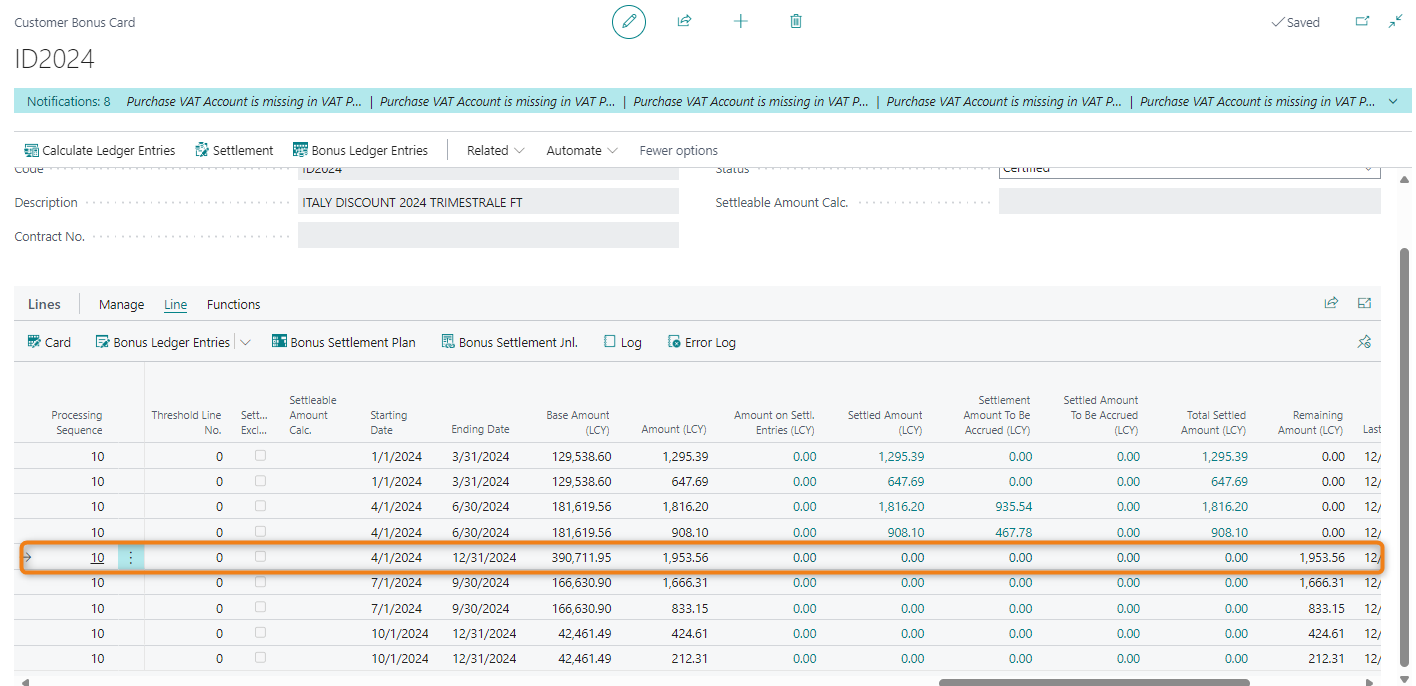

- The system will close the surplus, restoring the settlement to its original value:

Option 2: Write-off of the full settlement (including surplus):

- Starting with a settlement that includes a surplus, you can access the settlement movements (NOT surplus movements).

- Using the write-off function, reverse the movements related to the invoice you want to settle (it is not necessary to select all movements; selecting just one linked to that document number is sufficient):

- With a single action, both the settlement and the surplus (to be accrued) will be reversed:

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.