Transport cost allocation

The “Transport Cost Allocation (ETC)” procedure generates the accounting entries for Transport Costs @ Invoices to be Received related to transport costs calculated through the ETC app. The calculation process includes costs that have not yet been settled or those settled with a Posting Date later than the date of generating the accounting entry.

Processed Movements:

The report processes the records found on the “Transport Costs by Document (ETC)” page, applying the following conditions:

- Lines related to the following document types: Shipment, Purchase Receipt, Return Inbound, Return Shipment, Transfer Shipment;

- Documents posted within the period specified in the Start Date and End Date fields;

- Lines with either estimated or actual transport costs that are Not settled or Settled with a Posting Date later than the End Date specified in the procedure’s Request Page (for example a purchase invoice posted with a Posting Date after the procedure’s End Date for cost allocation).

The accounts to be used are retrieved from the specific record in the “Transport Cost Settlement Setup (ETC)”:

- “Invoices to be Received”: determined via the Vendor Posting Group of the vendor specified in the Settle to No. field;

- “Transport Costs”: determined via the fields “Purchase Line Code”, “Sales Line Code” or “Transfer Line Code”.

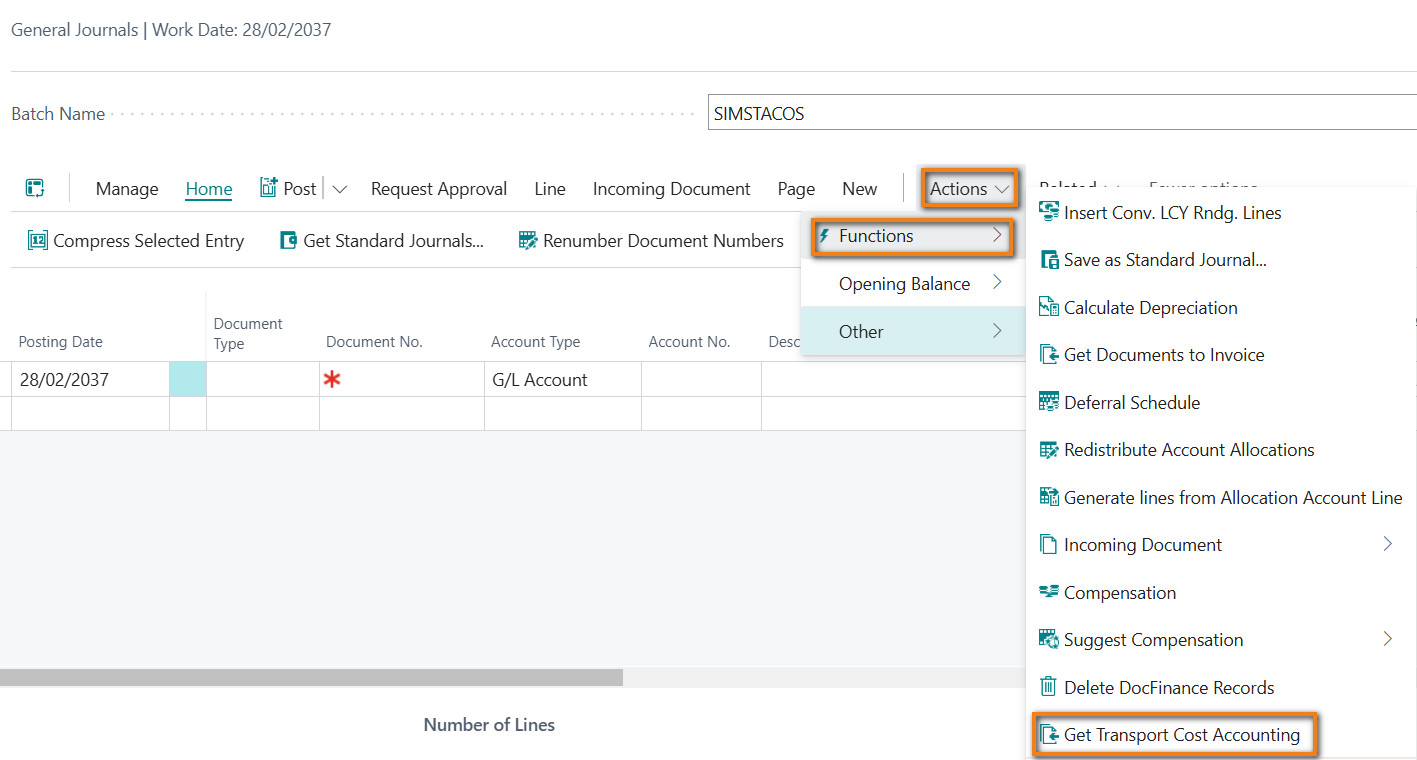

Procedure execution:

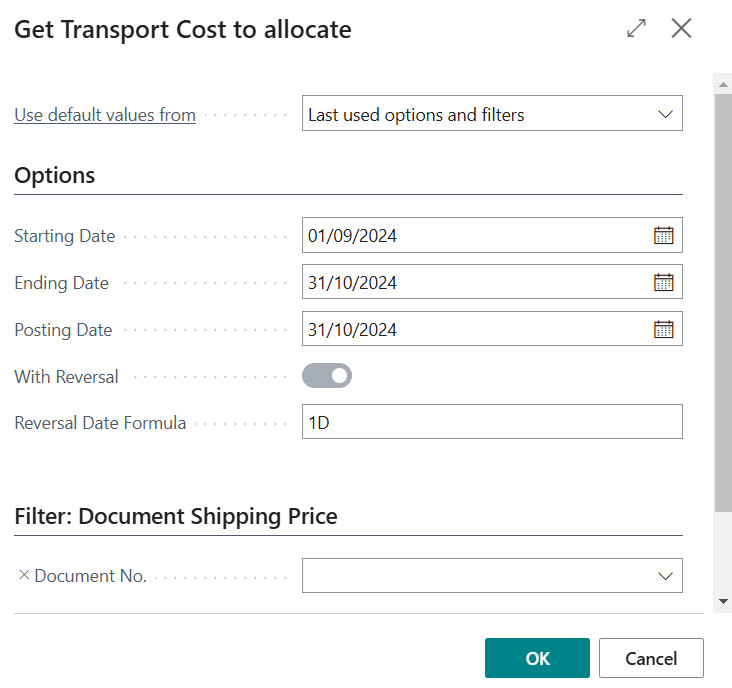

The request page presents the following fields:

- Starting date: the posting date from which movements with a calculated transportation cost should be considered.

- Ending date: the posting date until which movements with a calculated transportation cost should be considered.

- Posting date: the posting date with which accounting entries are generated.

- With Reversal: if selected, the corresponding self-reversing entries will also be generated, on Posting date + “Reversal date formula”.

- Reversal Date formula: formula that defines the posting date of the reversal entries.

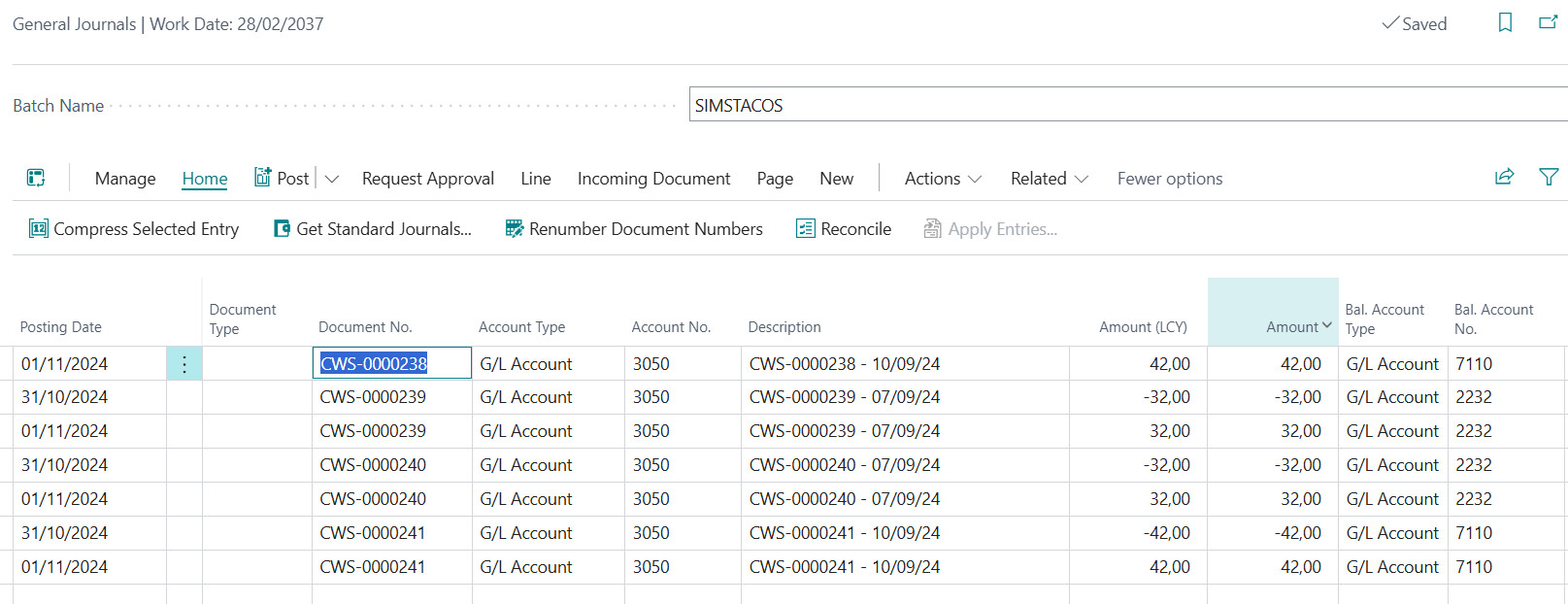

The system generates the entries in the batch from which the “Transportation cost provisioning” function is executed.

In case of simulated entries, the records are created on the selected Posting date and automatically reversed the following day; if they are generated in the General Ledger (COGE), the reversal entry is automatically created when the related invoice is posted (in the following fiscal year).

To facilitate the navigability of movements, by default, the records are generated with the same document number as the load/shipment from which they originated.

NOTE

To use the cost allocation feature, you must install the app: EX038.01 Transport Costs for Simulated GL entries

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.