Examples

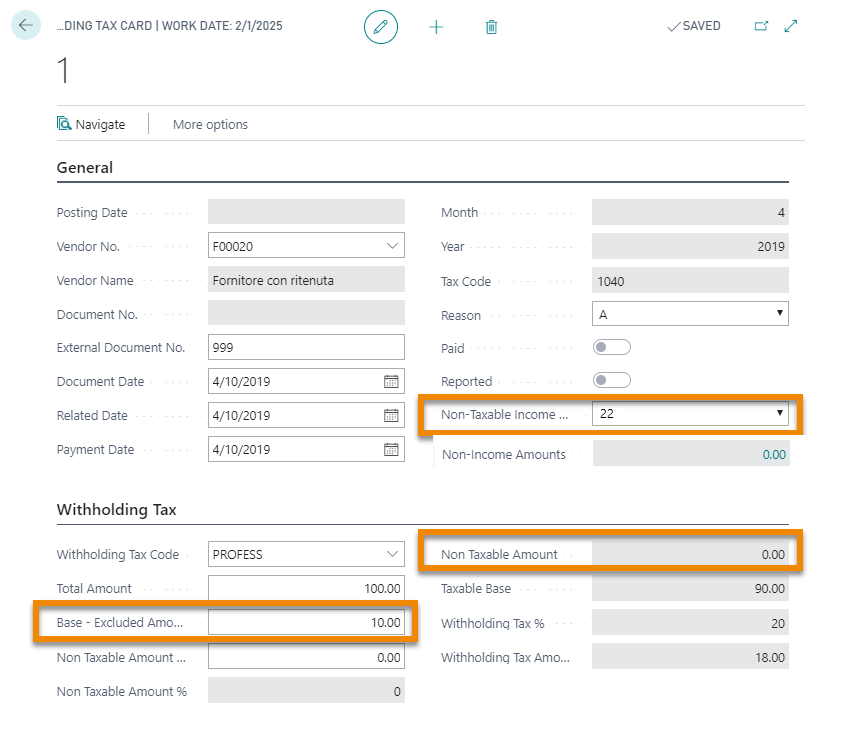

Example 1 - 100% deductible rate

| Field | Description |

|---|---|

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount | Specifies the amount of the original purchase that is excluded from the withholding tax calculation, based on exclusions allowed by law. In the example: 10,00 € (expenses) |

| Non Taxable Amount | Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal to zero (100% deductible rate) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate “22” (22 in case of “Non-Taxable Income”) |

| Withholding Tax Amount | 18,00 €: 20% of the taxable base |

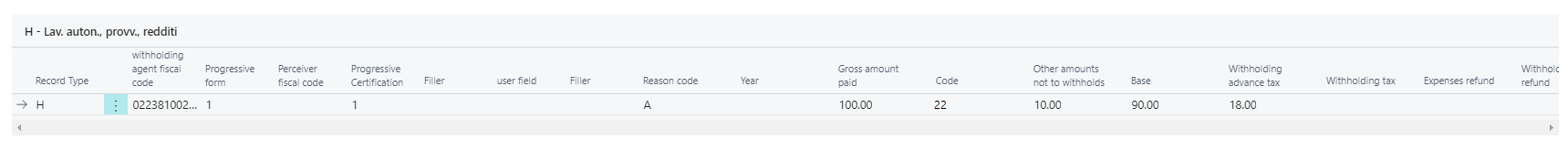

And the PDF preview is:

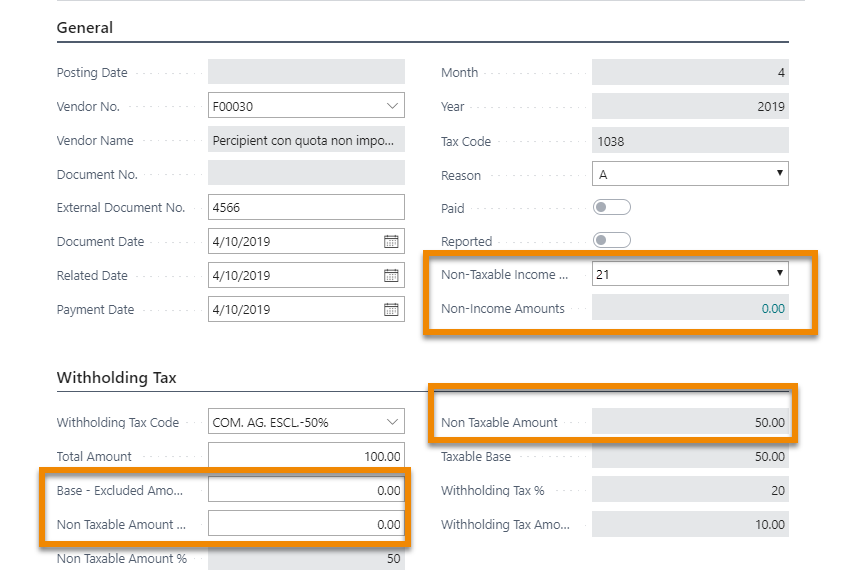

Example 2 - 50% deductible rate (and no expenses refund)

| Field | Description |

|---|---|

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount | Specifies the amount of the original purchase that is excluded from the withholding tax calculation, based on exclusions allowed by law. In the example: 0,00 € (no expenses refund) |

| Non Taxable Amount | Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal 50,00 € (50% deductible rate) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate “21” and fill in the related table in the field below |

| Withholding Tax Amount | 10,00 €: 20% of the taxable base |

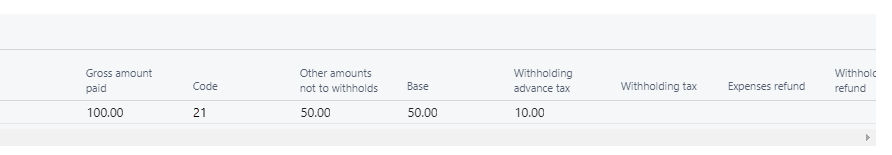

And the PDF preview is:

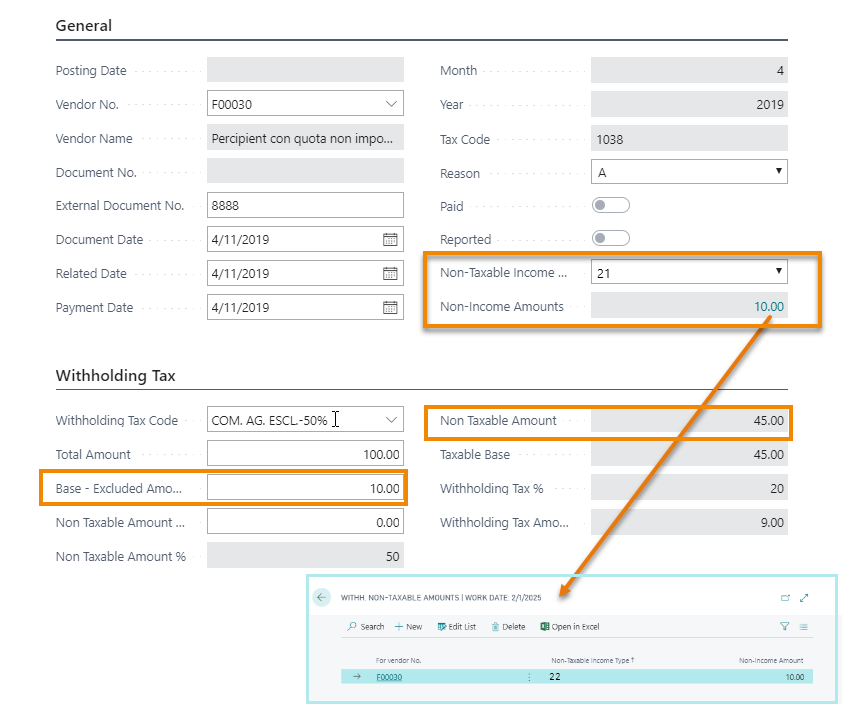

Example 3 - 50% deductible rate (with expenses refund)

| Field | Description |

|---|---|

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount | Specifies the amount of the original purchase that is excluded from the withholding tax calculation, based on exclusions allowed by law. In the example: 10,00 € (expenses refund) |

| Non Taxable Amount | Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal 45,00 € (50% deductible rate with the expenses refund of 10,00 €) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate “21” and fill in the related table in the field below |

| Withholding Tax Amount | 9,00 €: 20% of the taxable base |

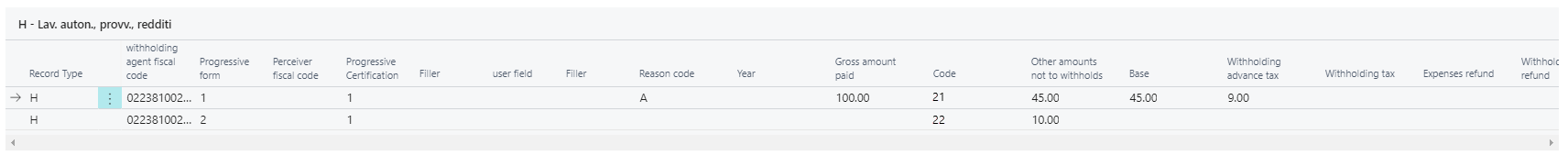

And the PDF preview is:

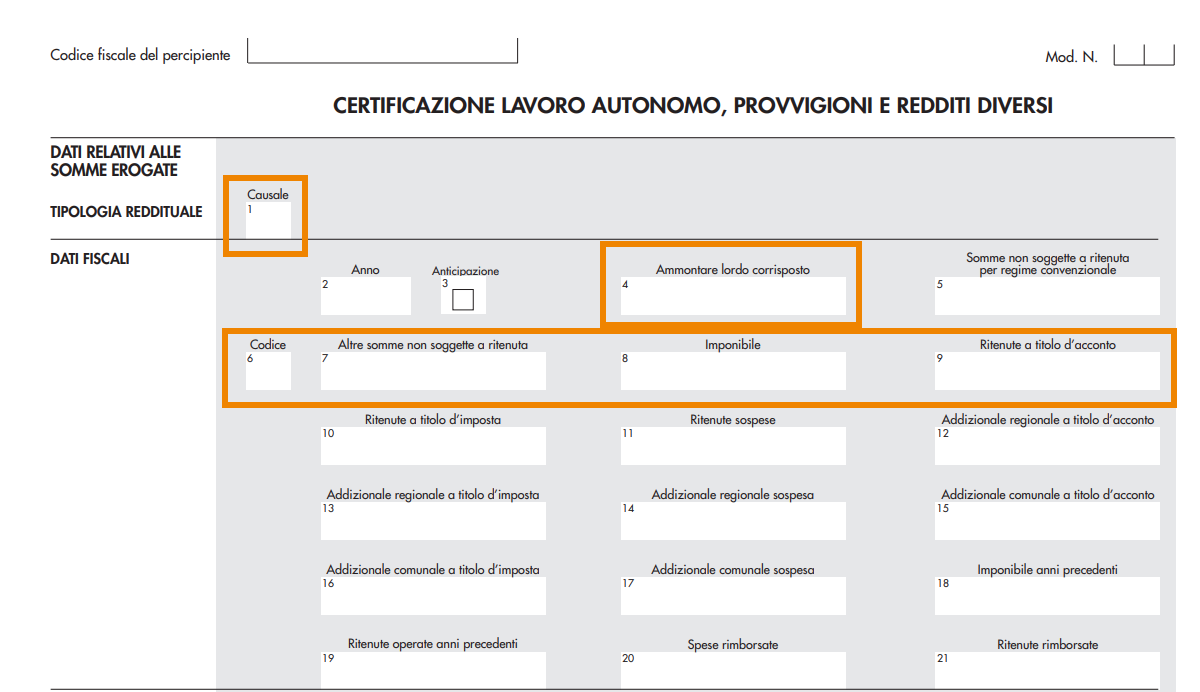

Print example

The ECU App allows the system management of the cases relating to the following types of income, limited to the advance withholdings paid and pertaining to the financial year in the declaration including any non-subject sums identified in point 6 and indicated in point 7:

A – self-employed work included in the practice of a habitual art or profession;

Q – commissions paid to a single-firm agent or sales representative;

R – commissions paid to a multi-firm agent or sales representative;

S – commissions paid to commission agent;

T – commissions paid to mediator;

U – commissions paid to business agent;

V – commissions paid to a person responsible for home sales.

| Important |

|---|

| Substitute declarations or declarations to be canceled are not managed. |

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.